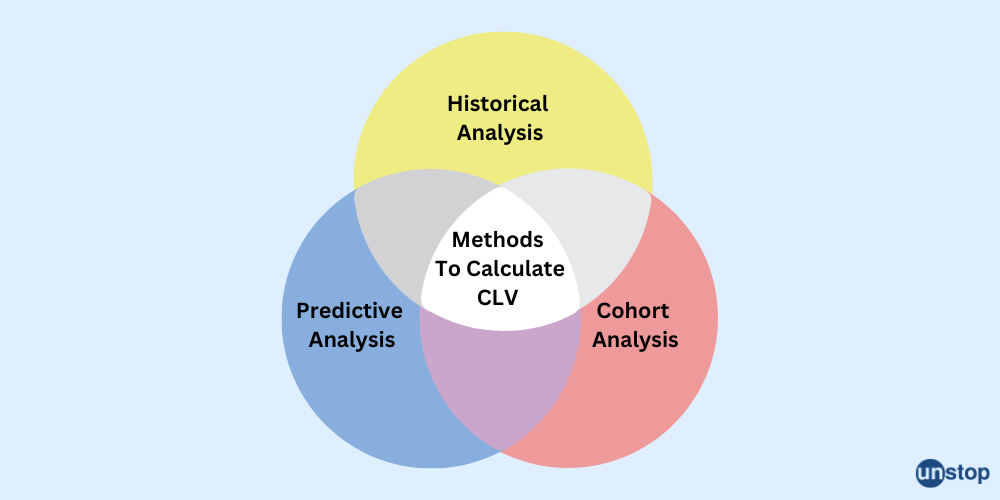

1. Historical Analysis

Historical analysis uses past customer data to estimate the potential revenue each customer generates over their lifetime. It relies on factors like average order value, purchase frequency, and customer lifespan.

Formula:

CLV=(Average Purchase Value)×(Purchase Frequency)×(Customer Lifespan)

Example:

Suppose there is a coffee shop where an average customer spends INR 50 per visit, visiting 3 times a year. Over a span of 5 years, this customer generates a total revenue of INR 750. Therefore, the lifetime value of a typical customer based on historical data is INR 750.

2. Predictive Analysis

Predictive analysis goes beyond past behavior to forecast future trends. This approach uses statistical models to project how customers will behave, taking into account churn rates, retention rates, and transaction sizes.

Formula:

Churn Rate divided by (Average Purchase Value×Purchase Frequency) × Profit Margin

Example:

A retail store estimates that each customer makes 10 purchases annually, spending INR 2,000 per order. However, with a churn rate of 20% (percentage of customers who stop purchasing within a certain period), only 80% of customers remain each year. Taking into account a 30% profit margin, the predicted lifetime value of each customer is INR 30,000.

3. Cohort Analysis

Cohort analysis groups customers based on characteristics like the time of their first purchase. Businesses can track how these groups behave over time, helping them identify trends and improve retention and engagement strategies.

Example:

A retail store groups customers who made their first purchase in January. It tracks these customers' behavior over the next six months, noticing that January customers tend to spend more consistently in the first three months, but their spending drops after.

If January customers spend an average of INR 2,000 in their first month, INR 1,500 in the second, and INR 1,000 in the third, the business can optimize marketing strategies to boost engagement during the drop-off period.

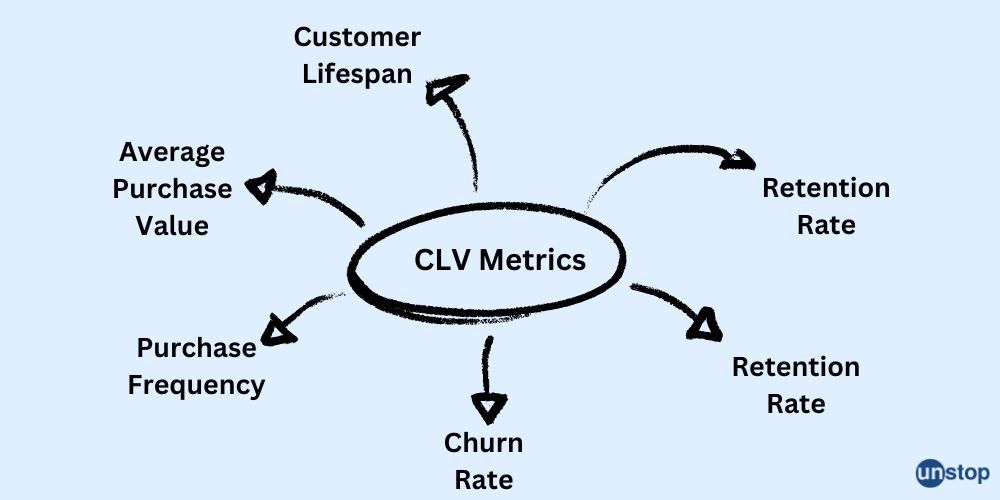

Customer Lifetime Value Metrics

Customer Lifetime Value (CLV) metrics are pivotal in understanding the long-term value a customer brings to a business. These metrics not only encapsulate the total revenue expected from a customer over the entirety of their relationship with a company but also help in strategizing marketing efforts, resource allocation, and customer service enhancements. Some key CLV metrics are:

- Average Purchase Value (APV): This metric calculates the average amount spent by customers per transaction. By understanding APV, businesses can identify trends in spending behavior and adjust their sales strategies accordingly.

- Purchase Frequency (PF): This metric evaluates how often a customer makes a purchase within a given timeframe. A higher frequency indicates a loyal customer base and provides insights into the effectiveness of retention strategies.

- Customer Lifespan (CL): This metric estimates the duration of the relationship between a customer and a business. A longer lifespan suggests successful customer retention efforts and contributes positively to the overall CLV.

- Retention Rate: This measures the percentage of customers a company retains over a specific period. It is crucial for calculating CLV as it directly impacts the predicted longevity of customer relationships.

- Profit Margin Per Customer: This metric assesses the profit generated from each customer, taking into account the costs associated with serving them. It helps in determining the actual value contributed by customers to the business's bottom line.

- Churn Rate: It measures the percentage of customers who stop doing business with a company during a specific period. It is an essential metric for understanding customer retention and directly impacts Customer Lifetime Value (CLV).

Understanding and optimizing CLV metrics enable businesses to make informed decisions regarding customer acquisition costs, marketing strategies, and product development. It encourages a shift from short-term transactions to long-term customer relationships, aligning business operations with the goal of maximizing profitability through sustained customer satisfaction and loyalty.

Comments

Add comment