E-Commerce Industry Report

Market Trends

- E-commerce has maintained strong growth in 2020 despite disruption to players’ operations during the COVID-19 lockdown, with consumers moving to this channel to avoid visiting store-based retailers and looking for the best prices

- Revenue is projected to reach INR 3,551,418 Mn in 2021 with a CAGR of 9.58% resulting in a projected market volume of ₹5,121,483 Mn by 2025.

- The average revenue per user (ARPU) would be INR 5,512 in 2025

- The number of E-commerce users will be 948.4 Mn by 2025

- The user penetration is 46.2% in 2021 and will hit 65.6% in 2025

- In 2021, 93% of total e-commerce purchases in the country will be domestic and this will become 91% by 2025. The amount of cross-border revenue will gradually increase.

Revenue Share by Category

|

Category |

2018 |

2019 |

2020 |

|

Consumer Electronics |

25% |

26% |

24% |

|

Apparel and Footwear |

23% |

21% |

18% |

|

Food and Drink |

3% |

5% |

6% |

|

Personal Accessories and Eyewear |

5% |

6% |

5% |

|

Consumer Appliances |

2% |

2% |

3% |

|

Media Products |

3% |

3% |

3% |

|

Beauty and Personal Care |

1% |

1% |

2% |

|

Others |

37% |

36% |

40% |

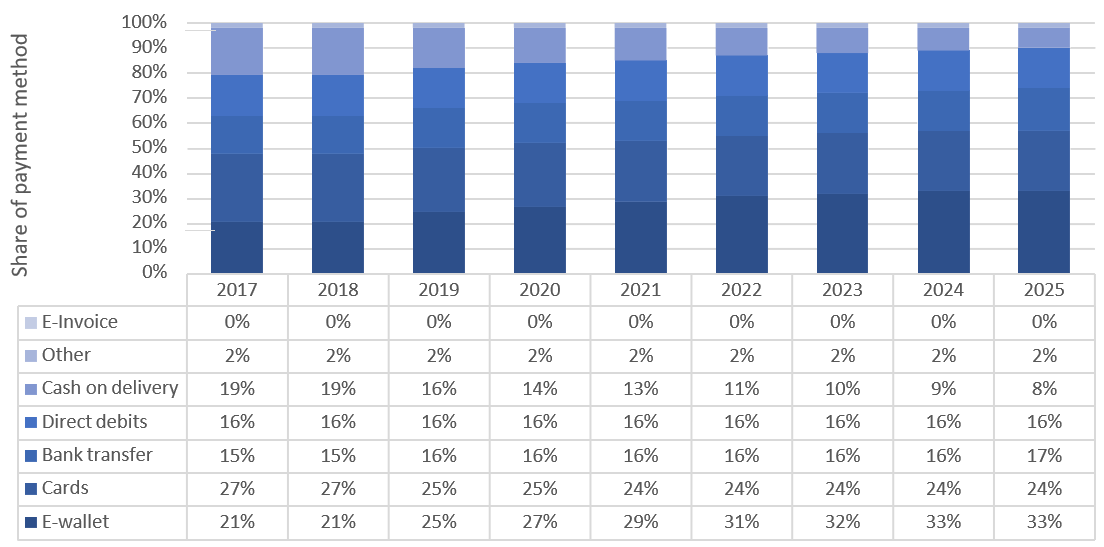

Revenue Share by Payment Method

Demographics

|

Users |

2020 |

|

High income |

34.8% |

|

Low income |

28.2% |

|

Medium income |

36.9% |

|

Users |

2020 |

|

Female |

35.1% |

|

Male |

64.9% |

|

Users |

2020 |

|

18-24 years |

29.4% |

|

25-34 years |

37.1% |

|

35-44 years |

23.6% |

|

45-54 years |

8.6% |

|

55-64 years |

1.4% |

Regulations

The government is embracing e-commerce digital platforms to transform and organize traditional offline markets. It is taking various initiatives to boost the e-commerce sector in the country such as Start-up India, Digital India, Skill India, Innovation Fund and BharatNet (to grow rural broadband penetration). Various regulatory reforms such as the new draft e-commerce policy, the national retail policy and consumer protection rule 2020 showcase the government’s inclination towards building this sector further.

|

Law |

Description |

|

Foreign Direct Investment Policy |

1.Marketplace model - 100% FDI permitted under automatic route 2.Inventory model – FDI not permitted |

|

Consumer Protection (E-Commerce) Rules, 2020 |

Framework to overhaul administration and settlement of consumer disputes. Law around cancellation, refund, display of relevant information, price manipulation and consumer differentiation, etc |

|

Payment and Settlements Systems Act, 2007 |

Set up by the RBI, the Act provides for the regulation and supervision of payment systems in India and designates the apex institution (RBI) as the authority for that purpose and all related matters. The Act also provides the legal basis for ‘netting’ and ‘settlement finality’. |

|

Draft E-commerce policy |

To ensure that network effects do not create digital monopolies, which could misuse their dominant market position •Protection of customers – Algorithms are not biased, genuine products, makes platforms co-owners of liability for counterfeit products •Ensuring fairness – Algorithm should not be biased towards vendors, transparency on discounts, availability of service providers •Government oversight – Formation of Standing Group of Secretaries on e-commerce (SGoS) to recommend e-commerce policy changes •Promoting e-commerce – Bring more offline sellers online, opening Government e-Marketplace (GeM) |

|

Finance Act 2020 |

Scope of Equalization Levy (EL) expanded to cover “e-commerce supplies or services”. Covers digital transactions including B2B transactions, B2C transactions, e-commerce marketplaces and digital services |

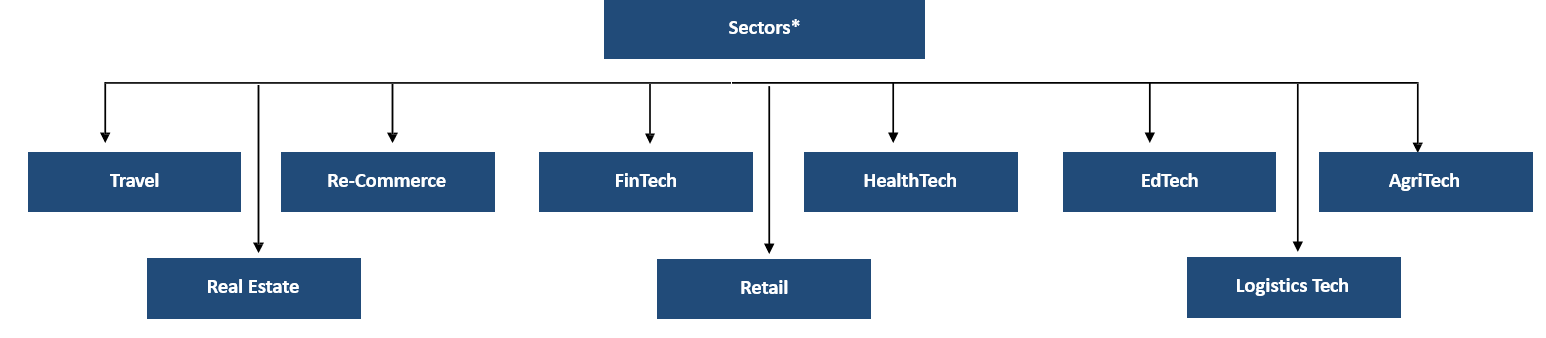

E-Commerce Industries

|

Sector |

Major players |

|

Travel |

MakeMyTrip, Goibibo, Yatra, Cleartrip, Ola, Uber, RedBus |

|

Real estate |

MagicBricks, CommonFloor, 99acres, Housing, Oxfordcaps |

|

Re-Commerce |

Cars24, OLX |

|

FinTech |

PolicyBazaar, Digit Insurance, Cred, Cleartax, Khatabook |

|

Retail |

Amazon, Flipkart, Paytm, Big Basket, Swiggy, Zomato, Udaan, Dunzo, Myntra, Nykaa, Ajio |

|

HealthTech |

Curefit, 1mg, Practo, Medplus, LensKart, HealthKart |

|

EdTech |

EduKart, Byjus, WhiteHatJr., Udacity, Vedantu, Edureka, Toppr, Embibe, Unacademy, Cuemaths |

|

Logistics Tech |

Delhivery, Porter, Grey Orange, Locus, Ecom Express, Ather Energy, Cohort |

|

AgriTech |

Green Agrevolution (Dehaat), Ergos Business Solutions, Krishna Acharya Technologies (Bijak) |

Facts & Figures

Some fascinating statistics of the E-Commerce industry:

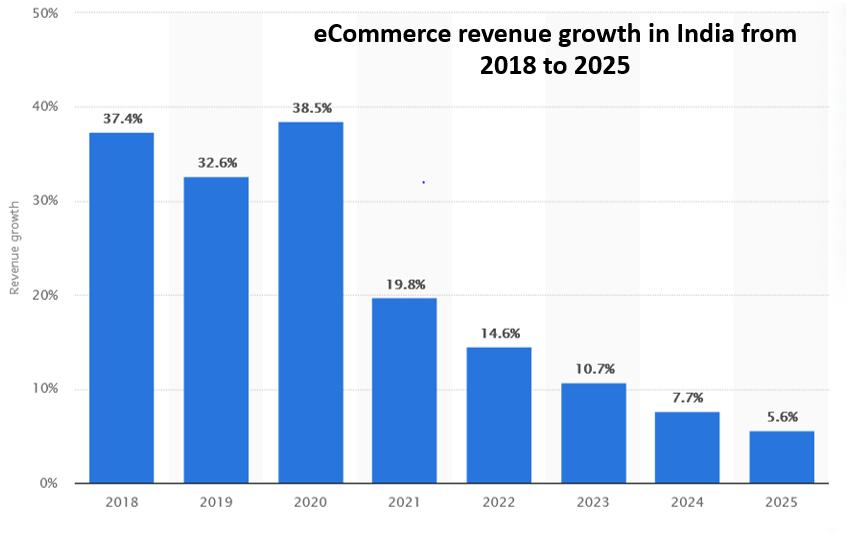

The eCommerce sector in India has seen the highest revenue growth of 38.5% in 2020 since the majority of the brick and mortar stores had been shut due to the lockdown.

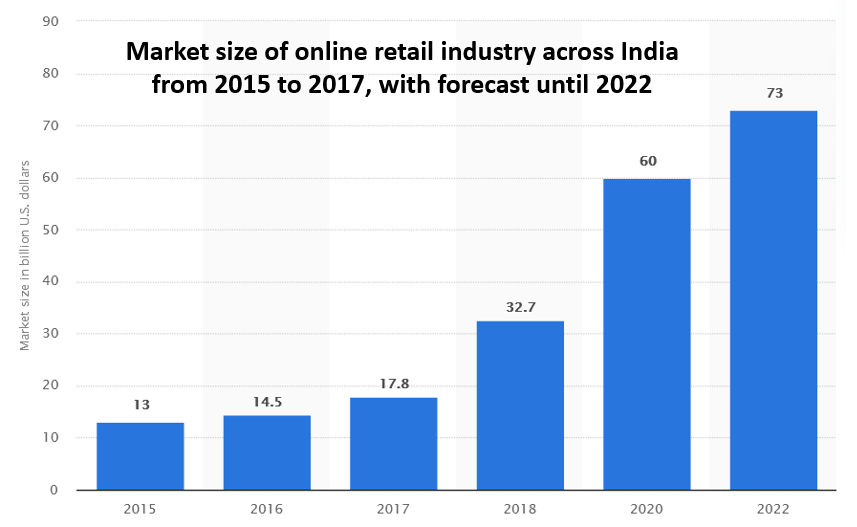

The market size of the online retail industry across India is expected to reach USD 73 Bn in 2022.

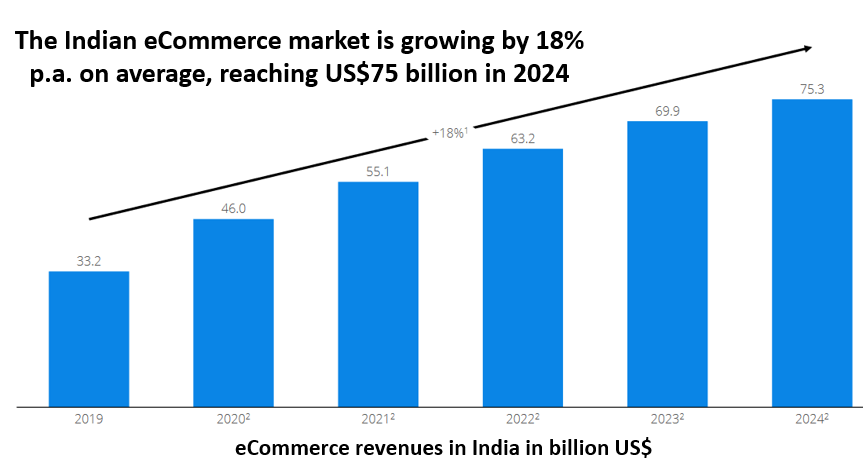

The eCommerce sector in India is growing by 18% per year on average with expected revenue of USD 75.3 Bn in 2024.

Source: Statista

Broad Competitive Focus

In the E-Commerce market, the number of users is expected to amount to 948.4m users by 2025. QCDF analysis of customers preferences in E-Commerce industry are given below hierarchically:

- Convenience/Delivery (D)– As per Deloitte reports, convenience is an important consideration for millennials on account of their hectic lifestyle. Even online grocery shopping tripled during the pandemic. Expanded online assortments, new promotional tactics, convenient returns, etc. have encouraged customers to start their journeys online. As per BCG reports, about 40% of the consumers are trying online grocery for the very first time.

- Personalization/Flexibility(F)– When a customer feels a connection to a brand, sales and loyalty both increase. eCommerce personalization can offer a slew of benefits that energize an existing customer base and increase profitability far more efficiently.

As per McKinsey reports, such personalization also helps the company reduce its marketing cost by 10-20%.

- Value/Quality (Q) – Consumers look for quality and differentiated experiences across categories and platforms. What matters most to them is the convenience, trust and quality of all the products being sold.

- Cost (C) – Customers in India are price sensitive and are attracted by discounts and offers. Although fair price is no longer the final differentiator and does not drive consumer loyalty, spending additional costs for returns or delivery, might affect purchases.

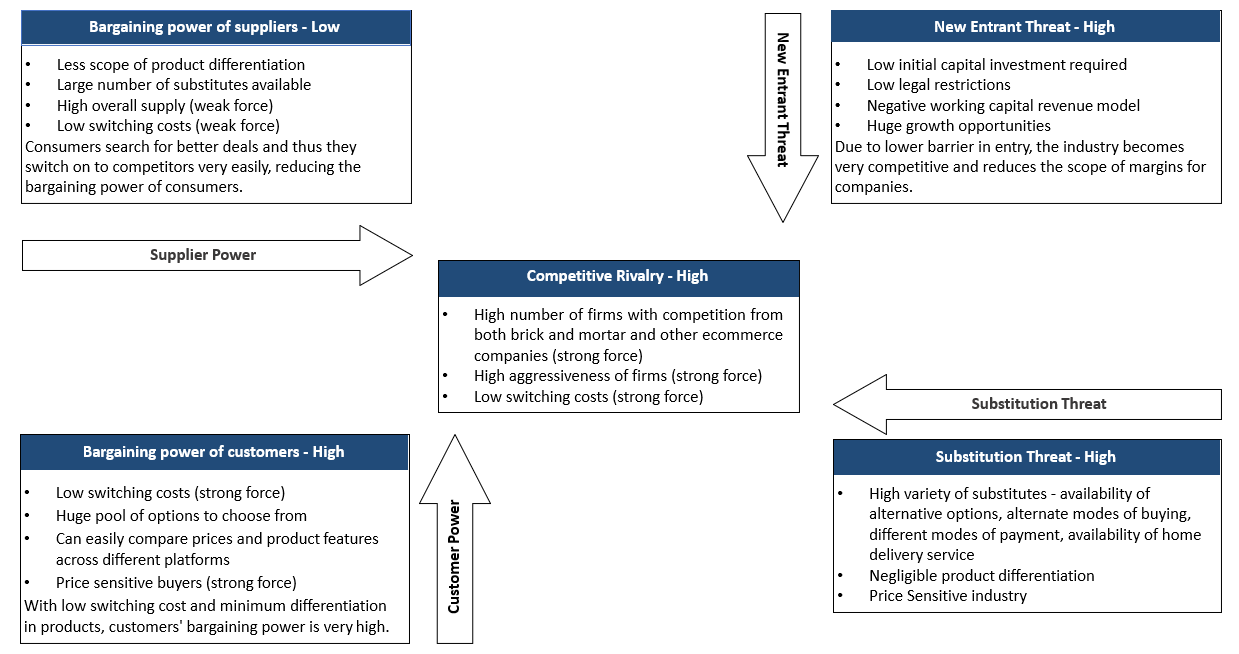

Porter’s Five Forces Analysis

Current Trends (due to Covid-19 impact)

- Pandemic drives shift to the digital channel: There has been a sudden shift favoring e-commerce in almost every industry due to lockdown restrictions and concerns for safety. Foodservice takeaway and delivery posted one of the strongest increases due to dine-in closures, which forced operators and consumers to migrate online. The consumer electronics and appliances category also received a digital boost as shut-in consumers bought products to support working, learning and entertaining at home.

- Virtual try-on features enable brands to mimic in-person fit experience: Ensuring proper fit remains one of the key challenges in selling these products online. Advances in technology, including leveraging augmented reality or 3D capabilities to mimic an in-person fitting session, have made it easier for retailers and brands to more accurately match clothing to consumers of all shapes and sizes.

- Different consumer segments: There is an increase in the usage by the 60 plus age group who recorded the highest percentage increase during the pandemic. commerce. The 60+ age group’s increase in e-commerce outpaced the average for the total consumer group for all industries except beauty. Consumers between the ages of 30 and 44 years were the most frequent users of the digital channel across all five categories – Apparels, Electronics, Beauty, Foodservice and Travel.

- Digitization: In order to adapt strategies and remain competitive in the post-pandemic world, companies will need to explore such shifts in digital shopping behaviors that took place during this period of abrupt change. From faster fulfillment to more efficient last mile delivery and collection services, digitalization is at the core of these efforts because it enables businesses to quickly enhance capabilities and maximize efficiencies across their operations.

- Gaining traction in tier 2 and 3 cities and hinge on local influencers: While social commerce is taking off among mass market and tier 2 and 3 city consumers, adoption is lower among more affluent urban consumers. Unlocking social commerce for this segment is a big opportunity. In order to drive demand aggregation, select resellers are given training to become local influencers. DealShare, for example, plans to pick influencers from its exciting pool of customers and recruit from social commerce and marketing platforms such as Meesho.

- Rise of pay later: In the aftermath of the lockdown, when personal consumption and discretionary expenditure plummeted, affordability has become a central theme. This has led to businesses and consumers welcoming Buy Now Pay Later (BNPL) options in digital payments, injecting speed, flexibility and convenience in paying. The coming year will witness the explosion of mass affordability solutions, triggered by the flexibility and benefits of BNPL options.

- Consumers turned to mobile more for purchases during COVID-19: Across most industries explored in this analysis, a higher percentage of connected consumers turned to smartphones as opposed to computers to execute e-commerce purchases during the COVID 19 pandemic. Given the stationary nature of many consumers during the pandemic, the fact consumers turned even more towards their mobile devices to execute such purchases is especially telling of just how much this device has become the centre of the consumer’s world and commerce activities.

- Last-mile delivery to go electric: Many hyperlocal delivery start-ups like BigBasket, Grofers, Swiggy, Zomato, etc. are seen to slowly yet steadily switch to electric mobility. E-commerce players such as Amazon, Flipkart, etc. who witness a large volume of orders and need larger delivery fleets, are also moving towards an electric-enabled fleet from ICE vehicles. This shift is fueled by the low cost to rent and maintain e-vehicles compared to their ICE counterparts, along with the promotional measures by the government to develop electric mobility.

Emerging Trends

- Omni channel strategy - Traditional offline channels are increasingly adopting online channels to reach their customers. Online channels also look to expand their footprint through experience stores e.g., Nykaa has physical stores.

- Multi-language integration - With the next growth engine poised to be from tier 2 and 3 cities it will be crucial for e-commerce platforms to provide their services in a host of languages in order to gain necessary traction.

- Direct to consumers (D2C) - With the exponential rise in the number of first-time users getting online to meet their shopping requirements, brands and companies will certainly need to have their presence online either through marketplace listings or the more lucrative D2C channel. The online shopping trend will help bring in traction into niche product categories and brand reach.

- Digitization opportunities for businesses - The pandemic proved that a digital ring-fence is required in order to build a resilient enterprise. From traditional conglomerates, enterprise services to humble mom-and-pop stores have taken to digitizing their operations and we will continue to witness increased traction.

- Deep-tech adoption - Many e-commerce companies are deploying deep-tech such as Artificial Intelligence, Machine Learning, Internet of Things, Virtual Reality in a bid to provide improved personalized offerings to their customers.

- Rise of Super Apps - We have been witnessing expansion in portfolio service offerings, as online companies increasingly bid to become a one-stop-shop to meet customer needs. While still in the early stages, this is an interesting trend to look out for.

- Consolidation - Considering the nascent stage of the segment there is yet tremendous value to be unlocked, online companies are grappling to quickly capture market, wallet, and mind share. Growth all around also means players in the space are constantly looking to consolidate their position and ensure long-term and sustainable growth in an increasingly competitive market.

- Focus on cybersecurity and Robotic Process Automation (RPA) - As digital payments go mainstream, financial institutions are straining hard to continuously reduce their exposure to financial crimes. RPA will continue to impact migration activities, data security & governance, and compliance management, especially in the wake of the recent and ensuing PSU bank consolidations. RPAs-led intelligent automation in the field of financial fraud will gain grounds in helping banks and digital payments firms to earn consumer trust.

Login to continue reading

And access exclusive content, personalized recommendations, and career-boosting opportunities.

Comments

Add comment