Oil and Gas

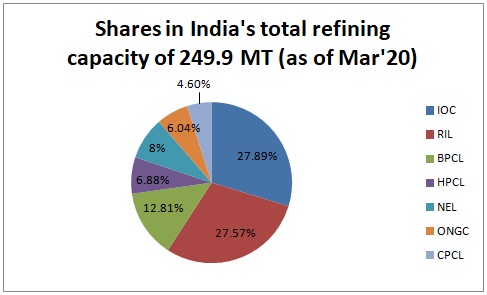

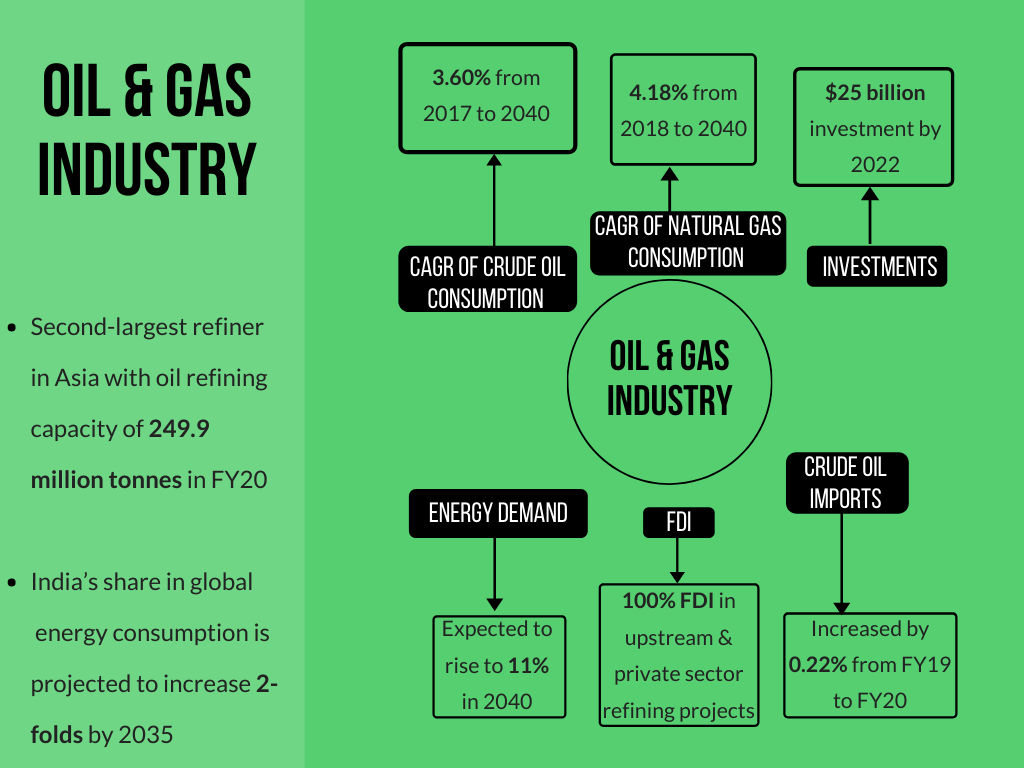

Oil & Gas industry involves the exploration, extraction, refining, transporting, and marketing of petroleum products. India is the 2nd largest refiner in Asia with 21 refineries and with its oil refining capacity at 249.9 million tonnes in FY20.

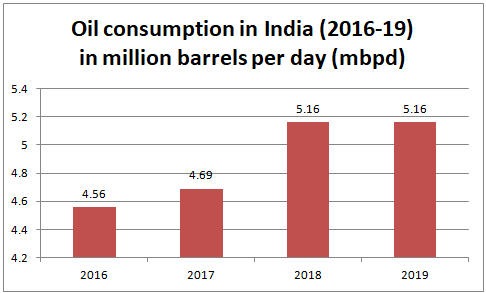

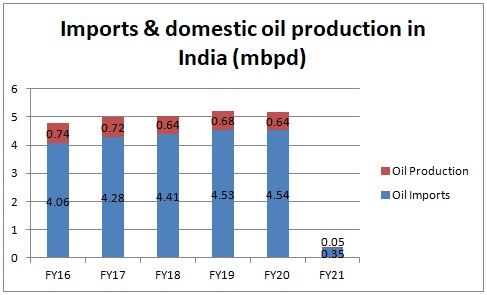

India’s consumption of petroleum products grew 4.5% to 213.69 MMT during FY20 from 213.22 MMT in FY19 and is the 3rd largest consumer of oil in the world. Oil demand increased by 3.21% to 4.88 mbpd in 2019 from 4.73 mbpd during the previous year. In FY20, crude oil imports increased to 4.54 mbpd from 4.53 mbpd in FY19.

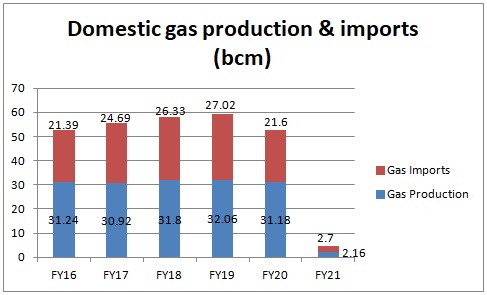

LNG import stood at 33.68 billion cubic meters (bcm) during FY20; India is the 4th largest LNG importer in the world. India’s share in global primary energy consumption is projected to increase 2 folds by 2035.

Competitive Advantage for India

- India is the world’s third-largest energy consumer globally

- Diesel demand is expected to double and consumption of natural gas in India will increase by more than three-folds in next 10 years

Government Policies

- The Government has allowed 100% foreign direct investment (FDI) in upstream and private sector refining projects

- Government has enacted various policies such as OALP and CBM to encourage investments

- Government-approved fiscal incentives to attract investment and technology to improve recovery from oil fields

Investments

- The industry is expected to attract $25 billion investment in exploration and production by 2022

Market Overview

- The Oil & Gas sector is divided into 3 segments: Upstream, Midstream & Downstream segment

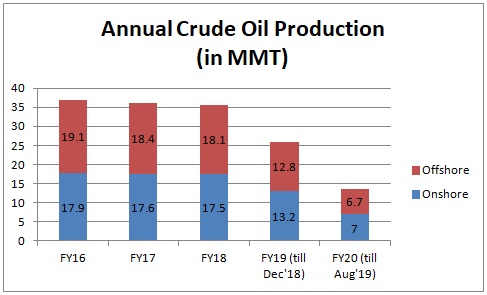

- India’s crude oil production in FY20 stood at 32.2 MMT

- Private companies own about 35.36% of the total refining capacity in FY20

- Onshore production accounted for 50.68% of total production, while offshore contributed the remaining 49.32%

- Crude oil consumption is expected to grow at a CAGR of 3.60% to 500 million tonnes by 2040 from 221.56 million tonnes in 2017

- Natural Gas consumption is forecast to increase at a CAGR of 4.18% to 143.08 million tonnes by 2040 from 58.10 million tonnes in 2018

Oil demand & supply in India

- Oil demand is expected to rise by 5.8 mbpd by 2040 from 5.18 mbpd in 2019

- Oil production is expected to rise and reach 36 bcm^ by 2021

Gas demand & supply in India

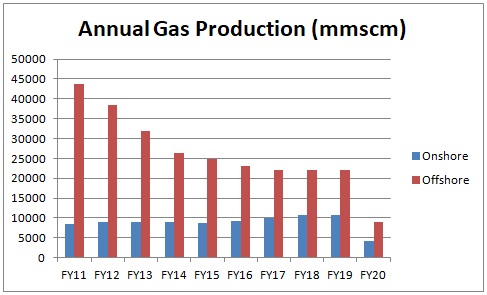

- India’s natural gas imports increased at a CAGR of 12% during FY16–FY20

- Gas consumption is projected to reach 143.08 bcm by 2040

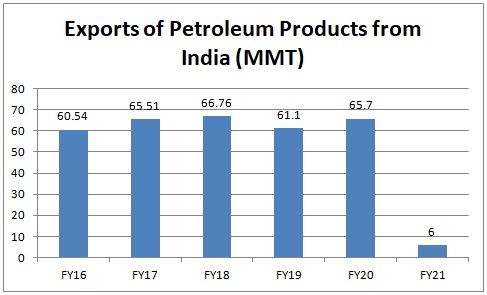

Exports of petroleum products

- Exports from India increased from 60.54 MMT in FY16 to 65.7 MMT in FY20

- HSD was the major export item among petroleum products, followed by MS, ATF, and Naptha

Pipelines

- As of May 01, 2020, India had a network of 10,419 km of crude pipeline, having a capacity of 147.9 mmtpa

- Top three companies IOCL, HPCL, and BPCL contribute more than 80% of the total length of the product pipeline network in India

Strategies updated

- During FY19P, 1,228,000 meters of wells were explored and developed and 545 wells were drilled in the country

- State-owned oil companies undertake most of the upstream drilling and exploration work

- Coal Bed Methane (CBM) policy was designed to be liberal and investor-friendly

- Underground Coal Gasification (UCG) technology is being implemented which reduces capital outlay, operating costs and output gas expenses by 25–50% vis-a-vis surface gasification

- Oil companies are focusing on diversification and hence on vertical integration for the next stage of growth

- Companies are looking forward to developing JVs and technical partnership with foreign companies to improve capabilities to develop shale reserves

Growth Drivers

- Robust growth in the domestic market; India’s energy demand as a percentage of global energy demand is expected to rise to 11% in 2040 from nearly 6% in 2017

- Favourable business condition of abundant raw materials and skilled labour

- Government support in forms of favourable policies and allowance of 100% FDI investment

New Opportunities

- Refining capacity in the country is expected to increase to 667 MTPA by 2040

- Opportunities for secondary/tertiary oil-producing techniques

- Development of unconventional resources: CBM fields in the deep sea

- A huge opportunity lies for LNG terminal operation, engineering, procurement and construction services

- Expansion is planned for tapping foreign investment in export-oriented infrastructure, including product pipelines and export terminals

- India has technically recoverable shale gas resource of nearly 96 tcf

Key Industry Organizations

- Indian Oil Corporation of India (IOC) - 56.98% state-owned

- Bharat Petroleum Corporation Limited (BPCL) - 54.31% state-owned

- Oil and Natural Gas Corporation (ONGC) - 68.07% state-owned

- Reliance Petroleum Limited

- Gail India Limited - 53.59% state-owned

- Essar Oil Limited

- Gas Authority of India

- Hindustan Petroleum Corporation Limited (HPCL) - 51.11% state-owned (through ONGC)

- Oil India Limited - 66.13% state-owned

- Tata Petrodyne

Sources:

Login to continue reading

And access exclusive content, personalized recommendations, and career-boosting opportunities.

Comments

Add comment