H&S Brand Champion Challenge

Pharmaceutical

- Indian pharmaceutical industry supplies over 50% of global demand for various vaccines

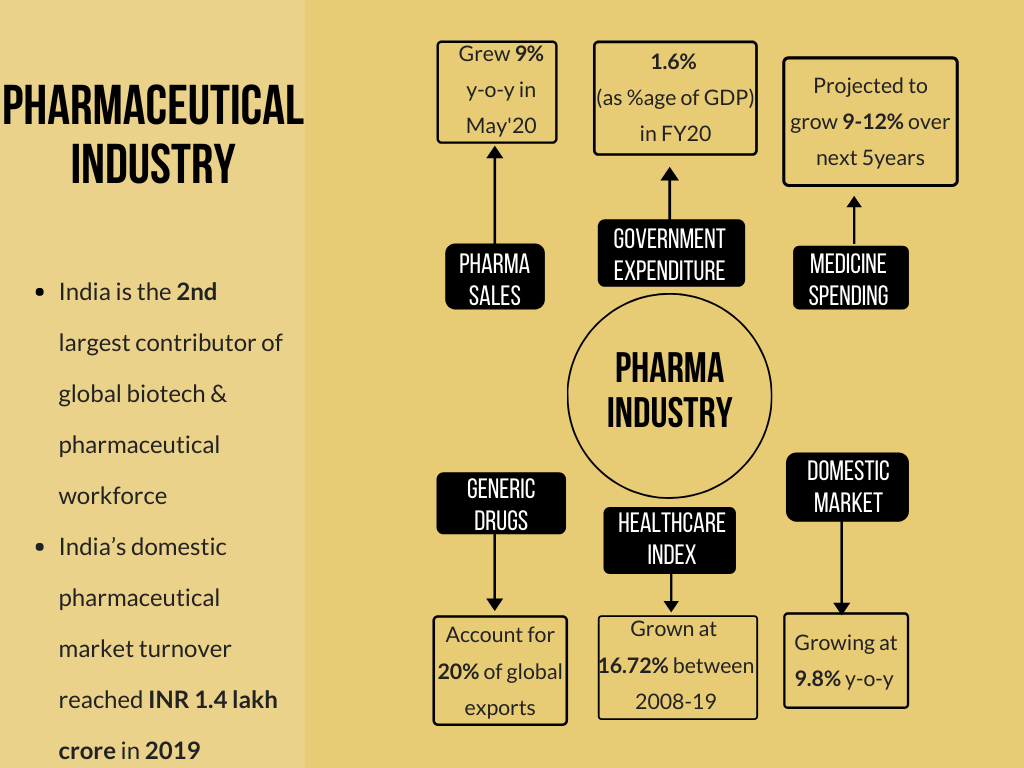

- India is the second-largest contributor of global biotech and pharmaceutical workforce

- Between 2008-19, the S&P BSE Healthcare Index has grown at 16.72%

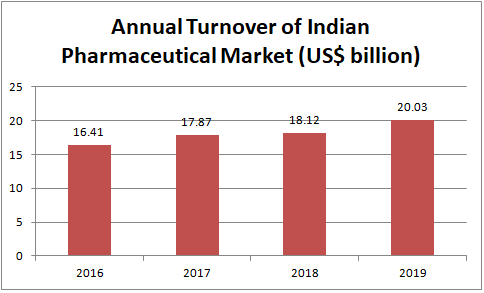

- India’s domestic pharmaceutical market turnover reached INR 1.4 lakh crore in 2019, growing 9.8% y-o-y from INR 129,015 crore in 2018

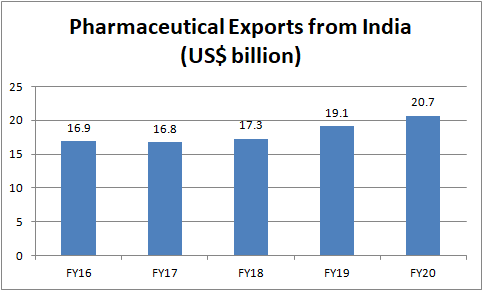

- Indian pharma export reached US$ 20.70 billion in FY20

- India’s pharmaceutical export stood at US$ 20.70 billion in FY20

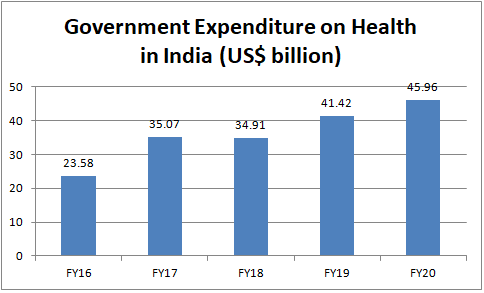

- As per Economic Survey 2019-20, Government expenditure (as a percentage of GDP) increased to 1.6% in FY20 from 1.2% in FY15 for health

Competitive Advantage for India

- Low cost of production and R&D boosts the efficiency of Indian pharma companies, leading to competitive exports

- India’s cost of production is approximately 33 percent lower than that of the US

Government Policies:

- Pharma Vision 2020’ aimed at making India a global leader in end-to-end drug manufacturing

- Under Budget 2020-21, allocation to the Ministry of Health and Family Welfare is INR 65,012 crore

- 100% FDI is allowed under automatic route

- Mega bulk drug parks are to be developed in order to reduce the industry’s dependency on raw material imports

- BIRAC has been established to promote research & innovation capabilities in India’s biotech industry

Investments

- India plans to set up a nearly INR 1 lakh crore fund to provide a boost to companies to manufacture pharmaceutical ingredients domestically

- Indian Drugs & Pharmaceuticals sector has received cumulative FDI worth US$ 16.39 billion between April 2000 and December 2019

Market overview

- Structure of Pharmaceuticals sector: Active Pharmaceutical Ingredients (API) & Formulations

- Over the next 5 years, medicine spending in India is projected to grow 9-12%, leading India to become one of the top 10 countries in terms of medicine spending

- The Ayurveda sector in India reached US$ 4.4 billion by 2018 end and grow at 16% CAGR till 2026

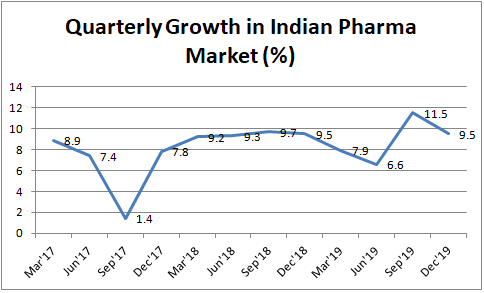

- In May 2020, the Indian pharmaceutical sales grew 9% y-o-y to INR 10,342 crore

- Based on moving annual turnover, Anti-Infectives (13.6%), Cardiac (12.4%), Gastro-Intestinal (11.5%) had the biggest market share in the Indian pharma market in 2018

Strategies updated

- India’s pharmaceutical export market is thriving due to a strong presence in the generics space

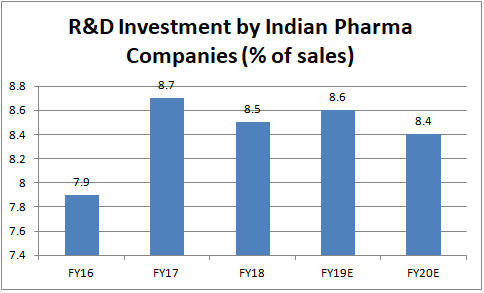

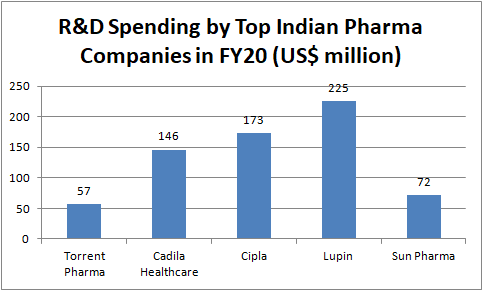

- Players in the sector are trying to strengthen their position in the market and expand themselves by investing heavily in R&D activities

- Players are trying to achieve cost leadership by vertical integration

Growth drivers

- Cost advantage, skilled manpower, increasing penetration of chemists

- India’s generic drugs account for 20% of global exports in terms of volume, making it the largest provider of generic medicines globally

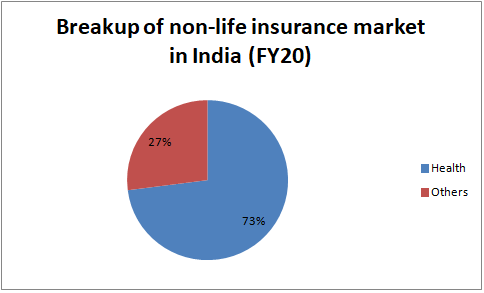

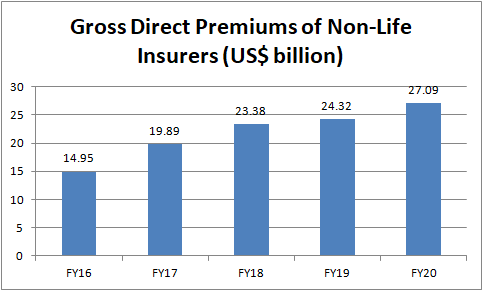

- Accessibility of drugs to greatly improve, increasing penetration of health insurance, Growing number of stress-related diseases due to change in lifestyle & better diagnostic facilities

- Reduction in approval time for new facilities plans to set up new pharmaceutical education and research institutes, exemptions to drugs manufactured through indigenous R&D from price control under NPPP-2012

New Opportunities

- Due to a genetically diverse population and availability of skilled doctors, India has the potential to attract huge investments to its clinical trial market

- As of February 2019, India was engaged in 3,618 trials in last one year

- With 70% of India’s population residing in rural areas, pharma companies have immense opportunities to tap this market

- Growing demand could open up the market for the production of high-end drugs in India

Key Industry Organizations

- Sun Pharmaceutical Industries Limited

- Aurobindo Pharma Limited

- Lupin Limited

- Cipla Limited

- Dr. Reddy’s Laboratories

- Cadila Healthcare Limited

- Intas Pharmaceuticals Limited

- Glenmark Pharma Limited

- Torrent Pharmaceuticals Limited

- ManKind Pharma Limited

- Biocon Limited

- Piramal Enterprises Limited

- Wockhardt Limited

- Divis Laboratories Limited

- Abbott India Limited

Sources

Login to continue reading

And access exclusive content, personalized recommendations, and career-boosting opportunities.

Don't have an account? Sign up

Comments

Add comment