Retail and Distribution Industry Report

Market Trends

- The total market size of the retail industry in India reached USD 672 Bn in 2017 and is forecasted to increase to USD 1,200 Bn by 2021 and 1,750 Bn by 2026 (CAGR of ~10.97%) without taking into impact the effects of Covid-19

- The sector contributes ~10% to India’s GDP and accounts for 8% of employment. India is currently the 5th largest global destination.

- While traditional format dominates the retail market in India, the share of organized segments is rapidly growing.

- Food and grocery accounts for the majority share of the retail market in India followed by apparel and footwear, and consumer durables & IT segments

- India’s retail sector is highly fragmented, with about 152,800 active companies at the end of FY 2018

- Retail sector is expected to recover ~80% of pre-covid revenue (USD 780 Bn) by 2020 end.

Regulations

- FDI is not permitted in the inventory-based model of e-commerce.

- GOI 2021 budget: Focus on ‘AtmaNirbhar Bharat’ initiative and “Make in

- India” programme

- Increased outlay on capital expenditure, infrastructure, affordable housing which will boost rural spending,

- Rationalization of duties

- Product linked incentive (‘PLI’) launched to create manufacturing global champions across 13 sectors

- Incentives proposed for ‘start ups’ likely to aid new entrepreneurs including in retail and e-commerce sectors

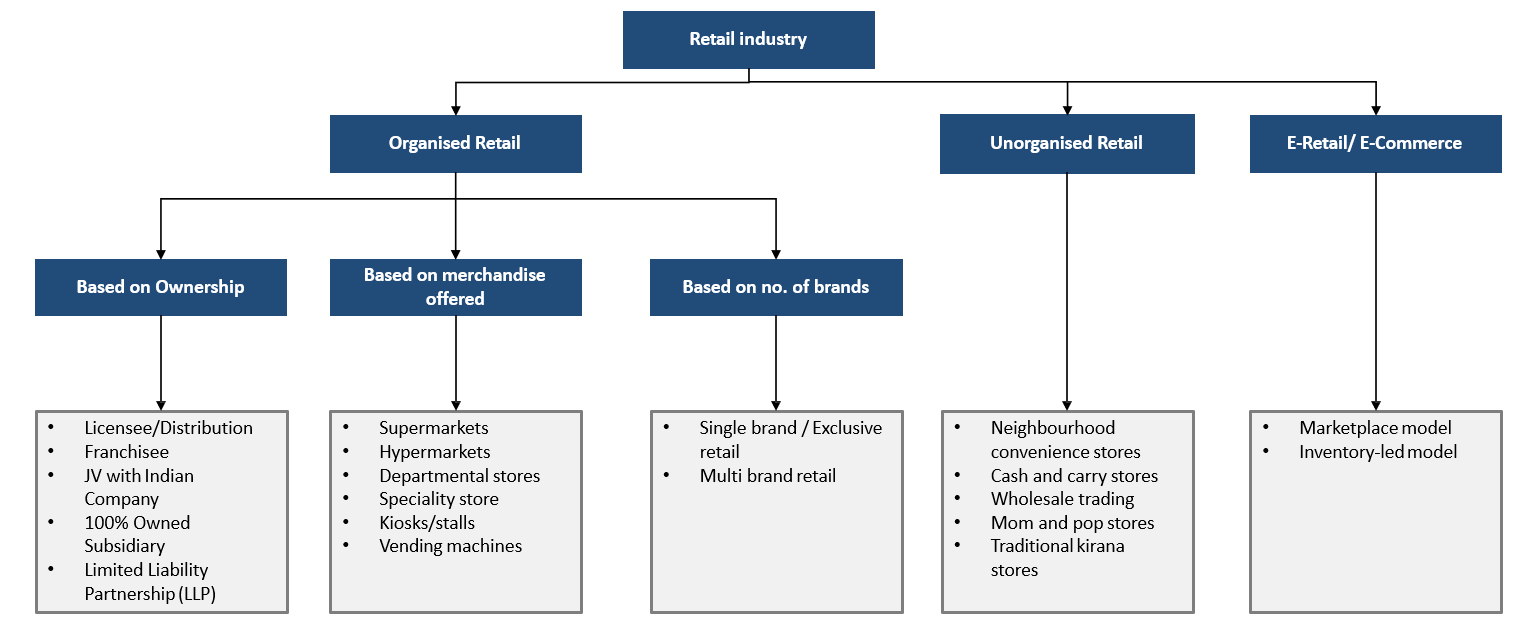

Retail Operating Models

Major Players

|

Retailer |

No. of store s |

Private Labels & owned/licensed brands |

|

Reliance Retail |

11,784 |

Reliance Fresh, Reliance Smart, Reliance Digital, Reliance Mall, JIO Store, Reliance Trends, Reliance Footprint, Reliance Jewels, AJIO |

|

Aditya Birla Fashion Retail Ltd |

3,031 |

Madura Business Lifestyle Brands - Louis Phillipe, Van Heusen, Allen Solly, Peter England Fast Fashion - Forever 21 and People, POLO Ralph Lauren, Ted Baker, The Collective etc Pantaloons - over 200 licensed and international brands, including 24 exclusive brands |

|

Future Retail |

2,000 |

Big Bazaar, FBB, Foodhall, Heritage Fresh, Easyday, WH Smith |

|

Shoppers Stop |

293. |

|

|

Vmart |

214 |

- |

|

Avenue Supermarts Ltd. |

196 |

D Mart, D Mart Minimax, D Mart Premia, D Homes, Dutch Harbour |

|

Trent Ltd |

162 |

Westside, Star Bazaar, Landmark |

|

Spencer Retail |

156 |

Spencers Smart Choice, Tasty Wonders, Clean Home, Maroon, Island Monks, Island Monks kids, Asankhya, La Bonita, Mark Nicolas, Scorez |

|

V2 Retail |

77 |

God-speed, Herrlich, Glamora, Ebellia, Honey Brats |

Major Players - E-Retail/E-Commerce

|

E-Retailers / E-Commerce |

|

|

Amazon India |

Brainbees Solutions Pvt Ltd (Firstcry.) |

|

Flipkart Internet Pvt Ltd |

FSN Ecommerce Ventures Pvt Ltd ( Nykaa.com) |

|

Jasper Infotech Pvt Ltd (Snapdeal) |

One97 Communications Ltd (Paytm Mall) |

|

Indiamart InterMESHLtd |

eBay India |

|

Myntra |

ShopClues |

Facts and Figures

Some fascinating statistics of the Retail and Distribution industry:

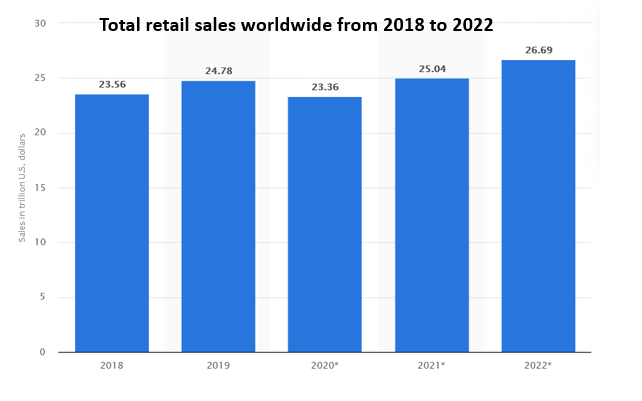

The total retail sales in the world saw a decrease of 5.73% in 2020 from 2019. The major reason being the outbreak of the pandemic. However, there has been an increase of 7.19% in 2021 as compared to 2020.

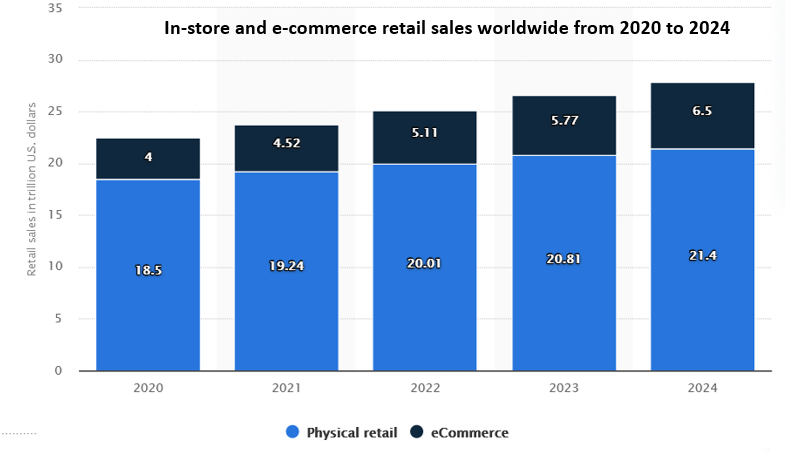

There has been a constant increase in e-commerce retail sales worldwide due to the increasing penetration of internet users. However, the proportion of physical retail is still more than that of e-commerce.

It is expected that Alibaba Group will take the top position among the global retailers with an expected sales value of USD 1,231 Bn with Amazon and Walmart taking the second and third positions respectively.

Online retail sales in India is growing continuously with USD 55.35 Bn of revenue in 2020 and expected revenue of USD 124.35 Bn in 2024. Source: Statista

Broad Competitive Focus

We saw that millennials constitute 34% of India’s total population offering tremendous growth potential for markets.

QCDF analysis of customers preferences in the retail industry are given below hierarchically:

- Convenience/Delivery (D)- As per Deloitte reports, convenience is an important consideration for millennials on account of their hectic lifestyle. The dearth of time is one of the key reasons for the growth in online shopping and growth in ‘ready to eat’ at the rate of over 28 % p.a. over the last 5 years. As per BCG reports, Convenience on the rise with time compression, the expectation to access whenever and wherever: 57% use time-saving products or services.

- Personalization/Flexibility(F)- Millennials aim at differentiating themselves from the rest of the crowd and in lieu of the same, prefer personalized product and service categories. They attach more importance to aesthetic aspects than to core functional aspects. As per BCG reports, 56% seek individualization choices and opt for personalization

- Value/Quality (Q)- Millennials view brands through a holistic lens and place greater reliance on the ethos and the value system of the brand. As per BCG reports, 37% trading down on possessions and shifting towards shopping experiences or indulgences

- Cost (C)- Customers in India are price sensitive and are attracted by discounts and offers. Although, fair price is no longer the final differentiator and does not drive consumer loyalty.

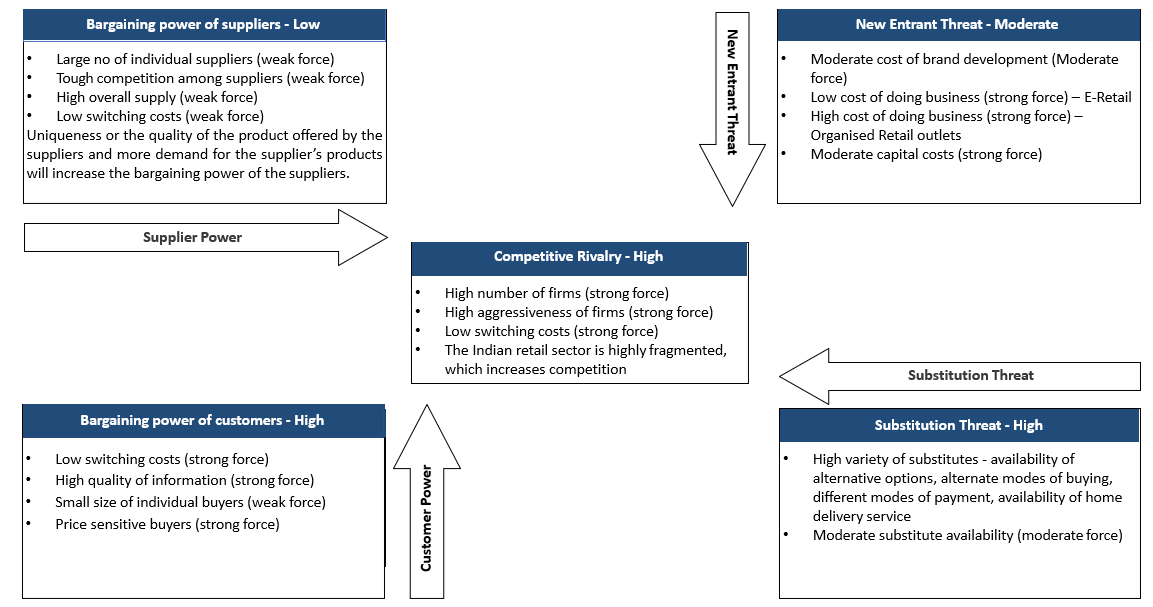

Porter’s Five Force Analysis

Current Trends

- Changing consumer preferences – Retailing in India is impacted by the rapid pace of customer behavior. Value-for-money is a critical factor while making purchase decisions. Many urban dwellers prefer to make their monthly purchases in modern grocery retailers instead of traditional grocery retailers. Introduction of wallet-based payment systems is on rise even in retail outlets. Example - Future Group launched its payment wallet Future Pay, which can be used in all its retail outlets.

- Start-ups gaining prominence – Startups rely on innovation and differentiate themselves. They are posing a challenge to the incumbent players in the industry. During the period 2012-17, eight of India’s top 12 brands ceded ~0.4-2% market share to new entrants in-home care, packaged foods and beverages categories. Online retail increased by 44% during the Covid-19 pandemic.

- Growing Integration of E-commerce and Bricks and Mortar Stores – There is an increase in deployment of multi-channel presence by leading store-based retailers and they are investing heavily in developing e-commerce platforms that are also smartphone- and tablet-compatible to drive e-commerce sales.

- Informal retail – Large rural population live in poor economic conditions and prefer informal retail due to lower prices. Middle-income and affluent customers do not prefer informal retailing due to low-quality products.

- Standard operating hours – In metropolitan cities, retail outlets operate between 8:00 hours and 22:00 hours and in another tier 2 and tier 3 cities they generally operate between 8:00 hours and 20:00 hours. In rural areas, the operating hours are lesser. Also, they may operate for lesser hours during weekends and may not operate during national holidays and festivals. 24 hours retailing is allowed only for pharmacies and are prevalent in major cities and metropolitan cities.

- Personalized products – There is an increasing trend of choosing personalized products that match individual values like health consciousness or sustainability among Indian consumers. Also, they are more in sync with the global trends due to social media influence. As per an EY report, 80% of the consumers would pay 25% higher prices if they receive the desired value.

- Payment – Cash is the major mode of payment in both rural and urban areas. Major retailers in rural areas do not accept card payments. There was however a significant increase in use of wallets and card payments post demonetization, but the trend reversed after the economy returned to normal.

- Seasonality – The major sale seasons include Diwali in November and End of Season Sales (more frequently in the e-commerce space). Heavy expenditure on advertisements, discounts and cashbacks can be seen during these periods.

Emerging Trends

Technology

According to a recent Nielsen global survey, nearly two-thirds (64%) of respondents feel their lives are getting busier and 51% listed A/VR as the top technology they’re seeking out to assist, amplify and augment their daily lives. A/VR technology will transform brand engagement and is clearly a disruptor.

- Augmented Reality - Virtual try before you buy for smarter decision-making. Navigation apps or Electronic shelf beacons ramping up retail experiences

- Advertisements - Intelligent data interpretation, allowing businesses to personalize, predict and recommend products

- Personalized offerings - Personalized digital displays in-store to show personalized messages to approaching consumers based on their smartphone data.

- Digital assistants - Conversational commerce through voice-activated assistance. Currently, the tech-enabled devices are used majorly for playing music, setting alarms, searching for information, ordering cabs etc.

- Inventory Management - RFID for tracking inventory

- Advanced Manufacturing - FMCG companies optimize the production process by use of 3D printers that can easily print food items or other goods and offer more customization as well.

- On-demand delivery - Some advancements in this area include incorporating clients and couriers in one app, on-bike delivery, shops that autonomously arrive at a specific destination on request.

Innovation

- Changing customer trends in urban households – Behavioral changes due to adoption of modern lifestyles in urban households.

- Alliances and Ecosystems - Partnerships with small neighborhood stores started, led by e-commerce, B2B, B2C. This is likely to evolve, scale and lead to ecosystems over time

- Smaller store formats - B2C retailers starting smaller store formats to provide convenience/ ease of access. This is likely to become more mainstream and play out across markets

- Leveraging Gig - Gig workers are on-call and contract workers who provide services to the company on-demand basis. Start-ups in ride-sharing and eating out have started using a flexible workforce. This is likely to extend to other retailers e.g. physical retailers with high variability in footfall

- Private Labels - Private labels have gained prominence in a few categories, both offline and online. It is likely to extend to other categories, as retailers build new capabilities. Amazon offers more than 120 private label brands.

- Social Commerce - Social commerce is the use of networking websites such as Facebook, Instagram, and Twitter as vehicles to promote and sell products and services. Right platform for user-generated content, peer- network advocacy form an integral part of shopping journeys.

- Cross-industry play - Cross-industry players entering retail by extending offerings/ business models

Login to continue reading

And access exclusive content, personalized recommendations, and career-boosting opportunities.

Comments

Add comment