Stimulating the Indian economy -By The Economics Club, IMI New Delhi

When a crisis hits, governments most often face the pertinent dilemma of choosing between fiscal discipline and fiscal stimulus. Decision-makers try to balance the need for fiscal discipline in the long run for the financial health of the country without compromising on the need for reviving the economy in the short run through expansionary fiscal policies. With an unprecedented predicament surmounting the Indian economy, the Government and RBI have been working in tandem to come up with necessary fiscal and monetary stimuli to cushion the economy from jolts caused by the adverse effects of the coronavirus pandemic. When the public refrain from spending and businesses hold back from making new investments, it becomes imperative for the government to instill confidence in the people by putting money in their hands through various measures and incentivize them to spend more.

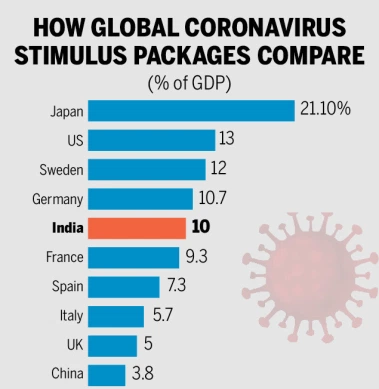

Here is a comparison of stimulus packages across countries:

Source: The Economic Times

Stimulus 1.0

The initial stimulus packages were announced to resist the impact of the losses and damage inflicted on the economy by the spread of the virus. Several measures included in the initial stimulus packages were directed towards the most vulnerable sections of society and also provided for some support to the businesses, with the intent of preventing closure of businesses due to the onslaught of the pandemic. The policy support measures were comparable in size and scale to those offered by other emerging economies of the world and the composition of these packages was similar to that provided by advanced economies.

- Cash transfers to the bottom one-third of India’s population to support them in sustaining their livelihood.

- Free food entitlements under the Food Security Act to ensure that every person has access to requisite food.

- Support to businesses was provided in the form of collateral-free extension of working capital requirements with reduced regulatory burden.

- Deference in tax payments and allowing for loan moratoriums aimed at preventing bankruptcies.

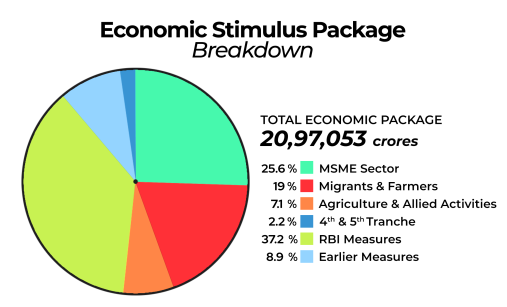

These measures provided support majorly on the supply side but it was necessary to boost demand in order to restore balance and stimulate growth. Here is the breakdown of the stimulus package:

Source: The Peninsula Foundation

Stimulus 2.0

The public was growing risk-averse and was saving large parts of their income as they were anticipating a gloomy period ahead in the economy. This was evident from the fact that bank deposits and particularly Jan Dhan accounts were recording higher than normal savings, which correlated to poor spending by the public. This had affected the demand side, making it difficult to realize the improvements made on the supply side of the economy initiated by restarting businesses. To spur the demand, the Government came up with certain creative measures in its second stimulus package which was worth INR 46,675 crores. This package focused on increasing the spending levels of central government employees.

- Given the travel restrictions in place and the improbability of employees choosing to travel amidst the pandemic, the government decided to let employees claim and encash their Leave To Travel Concession (LTC) incentives, provided they spend it on consumer goods which attract a GST of 12% or more. This provision came with a caveat that the transaction needs to be made in a digital mode from registered vendors.

- As part of the festive season, Government gave incentives in the form of a Special Festival Advance Transfer scheme, where the government employees were given advances of INR 10,000 in the form of prepaid cards, which have to be spent, rather than being saved, as the card expires on 31 March 2021.

Through these initiatives, the Government aims to increase consumer demand in the range of INR 28,000 crores.

Need for Stimulus 3.0

The Economic Affairs Secretary, Govt. of India recently announced that the government is looking forward to Stimulus 3.0 as a relief measure to the pandemic-hit nation. The major setback in aggregate demand in the economy, which saw about 23.9 percent contraction in the April-June quarter calls for another financial stimulus to revive consumer sentiment. Experts believe that for India to enter a positive growth trajectory, it is necessary to take bold and decisive actions and to take them now.

Failing to enforce a major fiscal push on the demand side would result in the economy being trapped in a quagmire of low demand and low income. NITI Aayog has called for diversification in stimulus packages by laying greater emphasis on infrastructure projects rather than merely tweaking incentives. Infrastructure projects with short gestation periods will facilitate quick capital spending creating a multiplier effect in the economy as a whole. Government spending often leads the way in crowding in investments from the private sector, thereby setting in motion the virtuous cycle of investments, consumption, and growth.

Way forward

The positive effects of the measures taken by the government can be seen through improved agricultural growth of 3.4% in the first quarter of FY 20-21, which provided spillover benefits to the secondary and tertiary sectors of the rural economy. GST collections in September have also increased nearing pre-COVID levels owing to high revenues from import of goods and domestic transactions. These signs of revival are green shoots to the Indian economy. However, it is critical that the government keeps in mind long-run economic growth by continuing its measures to provide direct income support to the marginalized sections of society, for whom everyday life has become a battle for survival.

Businesses must also be supported through measures that lead to financial stability in the face of deteriorating financials. This becomes essential for augmenting systemic sentiment in the economy, with banks lending to MSMEs and corporations leading to new investments. There is also a dire need to increase government spending in sectors such as healthcare, education, tourism in addition to infrastructure. The government’s responsibility in providing support is far from over and must be continued into the next financial year as the nation requires a stimulus that injects the economy with sustainable growth beyond quick fix packages.

This article was submitted as a monthly entry to D2C Igniters Club by The Economics Club, IMI New Delhi.

Get your juices flowing and share your story with us!

Login to continue reading

And access exclusive content, personalized recommendations, and career-boosting opportunities.

Blogs you need to hog!

What Innovation Does For Efficiency and Competitiveness in a Corporate Sector?

Online to Offline Commerce- Everything one needs to know

How Do You Work Around Branding Guidelines To Be Guidelines And Not Limitations? | Alekhya, Brand Manager- Vivel, ITC | Dove, Unilever

Comments

Add comment