H&S Brand Champion Challenge

Telecommunications

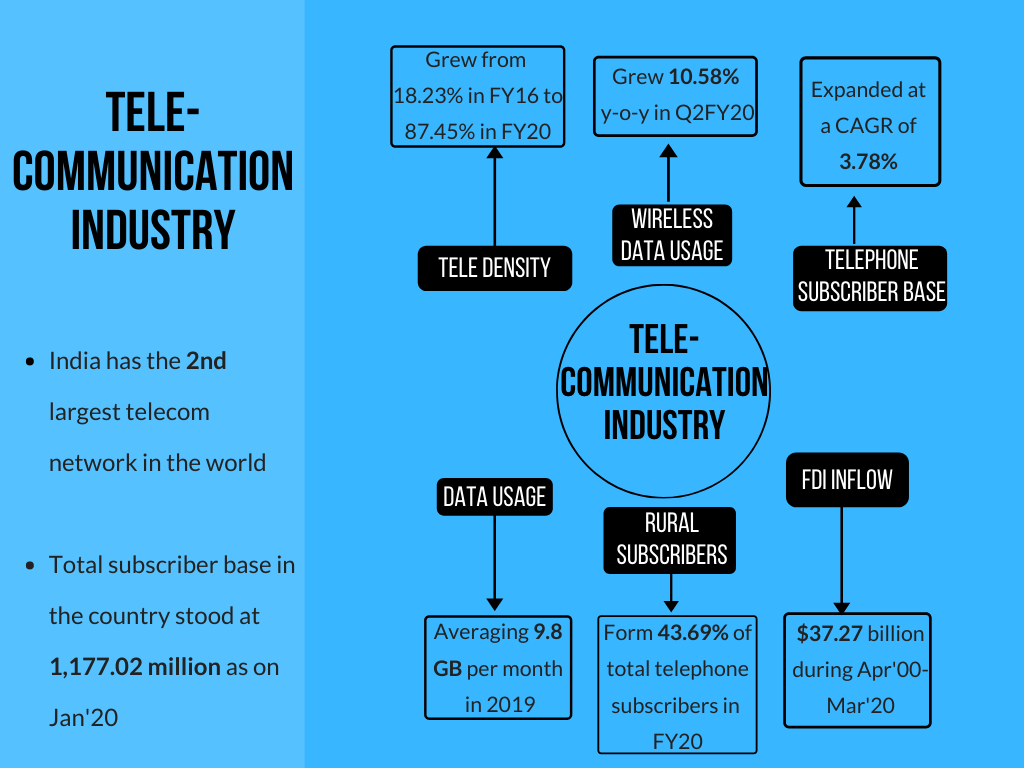

- India has the 2nd largest telecom network in the world.

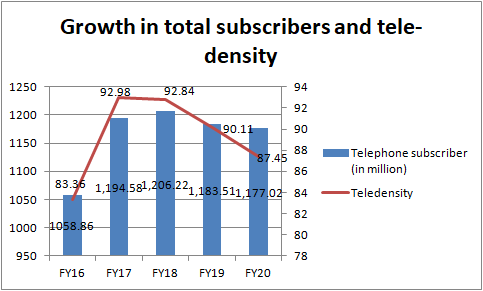

- The total subscriber base in the country stood at 1,177.02 million as on January 2020.

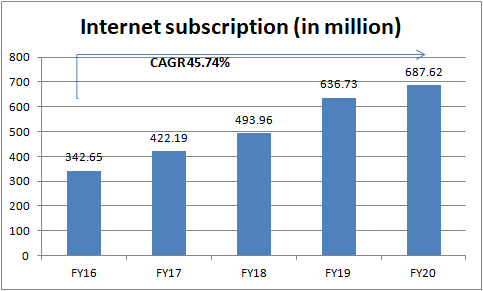

- India’s active internet subscription reached 530 million in 2018 at a run rate of 65 million users per year in the last two years

- India had the world’s highest data usage per smartphone, averaging 9.8 GB per month in 2019

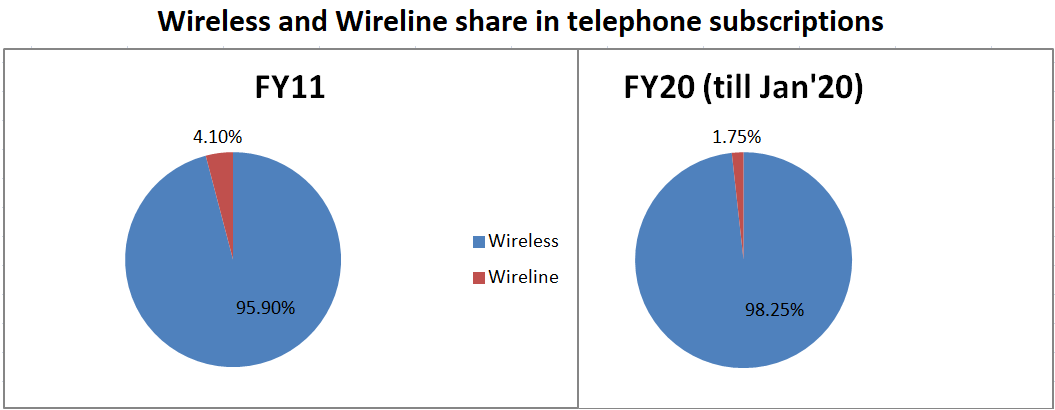

- The wireless segment accounted for 98.25% of the total telephone subscriptions as of January 2020

- As of May 2020, India had over 500 million active internet users

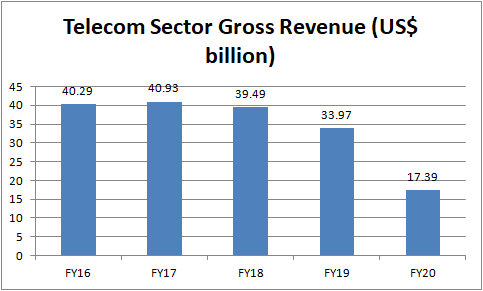

- Indian telecom sector’s gross revenue declined from US$ 40.29 billion in FY16 to US$ 33.97 billion in FY19

Competitive Advantage for India

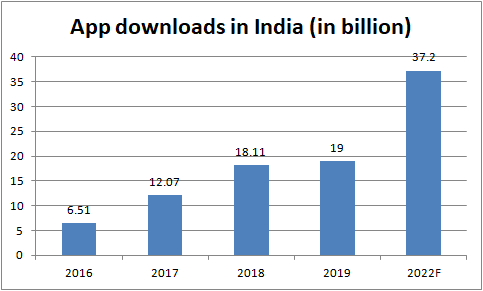

- India ranks second in terms of number of telecommunication subscriptions, internet subscribers and app downloads globally

- A young growing population is aiding this trend (especially the demand for smartphones)

- Rural subscribers form 43.69% of the total telephone subscribers in FY20 (till January 2020) compared to 33.35% in FY11

Government Policies:

- National Digital Communications Policy 2018 meant to attract US$ 100 billion worth of investment and generate 4 million jobs in the sector by 2022

- The Government of India’s National Digital Communication Policy, which released in September 2018, envisaged strengthening of mobile tower industry by promoting and incentivizing deployment of solar and green energy for telecom towers

- FDI in the telecom sector has been increased to 100% from 74%. Out this, 49% will be done through automatic route and the rest will be done through the FIPB approval route

- In January 2020, Government of India allowed 100% FDI in Bharti Airtel

- Government of India announced the Phased Manufacturing Programme (PMP) to promote domestic production of mobile handsets

Investments

- As of January 2019, expenditure on telecom infrastructure and services by Government of India grew six-fold to Rs 60,000 crore (US$ 8.31 billion) between 2014-19

- FDI inflow in telecom sector stood at US$ 37.27 billion during April 2000-March 2020

Market overview

- 3 segments of Telecom Market: Mobile (Wireless), Fixed-line (wireline) & Internet services

- Tele-density grew from 18.23% in FY16 to 87.45% in FY20 (till January 2020)

- In the era of 5G, telecom will earn 70% of its revenue from core beneficiaries of 5G. Currently, it is earning 30% from enterprises

- India’s telephone subscriber base expanded at a CAGR of 3.78%, reaching 1,183.51 million in FY19

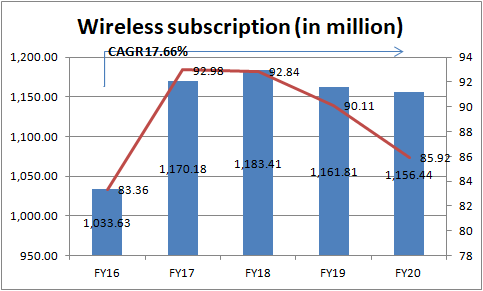

- In FY20 (till January 2020), wireless subscription stood at 1,156.44 million, whereas, wireless tele-density reached 85.92%

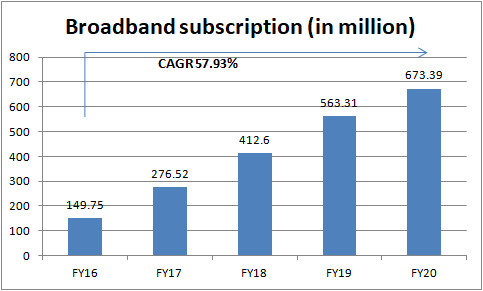

- Total broadband subscription in the country grew from 149.75 million in FY16 to 563.32 in FY19

- The number of internet subscribers in the country is expected to double by 2021 to 829 million

- Overall IP traffic is expected to grow four-fold at a CAGR of 30% by 2021

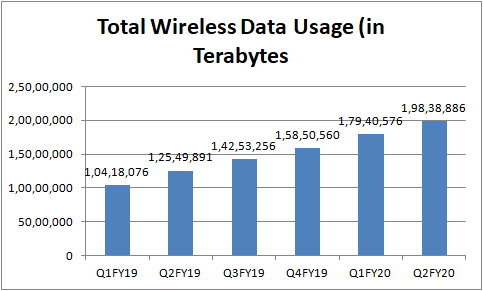

- Total wireless data usage in India grew 10.58% y-o-y to 19,838,886 TB in Q2FY20

- App downloads in the country increased from 12.07 billion in 2017 to 19.00 billion in 2019 and is expected to reach 37.21 billion in 2022F

Strategies updated

- To curb cost and focus on core operations, telecom companies have been segregating their tower assets into separate companies

- The green telecom concept is aimed at reducing carbon footprint of the telecom industry through lower energy consumption

- As of January 2020, more than 542 banks have been permitted to provide mobile banking services in India

- Players have reduced the number of plans on offer and now offer a limited number of simple tariff plans along with marquee plans

- Players price their products very carefully due to the price sensitive nature of customers and high competition in the sector

Growth drivers

- Higher real income and changing lifestyles, Growing young population, Increasing MoU and data usage

- Reduction in license fee & Relaxed FDI norms

- Higher FDI inflow & Increasing M&A activity

- The emergence of an affluent middle class is triggering demand for the mobile and internet segments

New Opportunities

- Internet penetration is expected to grow steadily and is likely to be bolstered by Government policy

- BWA technologies, such as WiMAX and LTE, is among the most recent and significant developments in wireless communication

- The Indian Government is planning to develop 100 smart city projects where IoT will play a vital role in development of those cities

- Reliance Jio Infocomm is going to expand its optical fibre network to over 1,100 cities under its Jio GigaFiber brand

- By January 2020, rural tele-density reached 58.03%

- Value of Unified Payments Interface (UPI) transactions crossed 1 billion-mark

Key Industry Organizations

- Mahanagar Telephone Nigam Ltd (MTNL)

- Bharat Sanchar Nigam Ltd (BSNL)

- Bharti Airtel

- Reliance Jio Infocomm

- Vodafone Idea Limited

- Tata Indicom

- Virgin Mobile

- Uninor

Sources

Login to continue reading

And access exclusive content, personalized recommendations, and career-boosting opportunities.

Don't have an account? Sign up

Comments

Add comment