Login to continue reading

And access exclusive content, personalized recommendations, and career-boosting opportunities.

Don't have an account? Sign up

Blogs you need to hog!

Organize Hackathons: The Ultimate Playbook With Past Case Studies

Shivani Goyal

What is Campus Recruitment? How To Tap The Untapped Talent?

Shivangi Vatsal

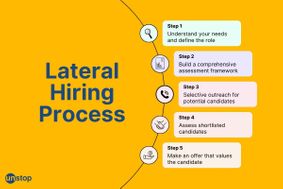

Lateral Hiring: A Complete Guide To The Process, Its Benefits, Challenges & Best Practices

Srishti Magan

Step-By-Step Approach To Building A Winning Campus Recruitment Strategy

Srishti Magan

Comments

Add comment