- What is Inflation in an Economy?

- What are the main Causes of Inflation?

- What are the Impacts of Inflation?

- What is Inflation Rate?

- What is Producer Price Index (PPI)?

- What is Consumer Price Index (CPI)?

- What is Gross Domestic Product (GDP) Deflator?

- Formula to Calculate Inflation

- Control Mechanism to Check Inflation

- Historical Approaches to Control Inflation

- Conclusion

- Frequently Asked Questions (FAQs)

What Is Inflation? Definition, Causes, Impacts & Control Mechanism

Inflation in an economy can have far-reaching implications for consumers and businesses. The impact of inflation on economic stability and growth cannot be underestimated. Understanding this economic phenomenon is of great importance for making informed financial decisions.

In this article, we will delve into the details of inflation, its causes, impact, and control mechanism.

What is Inflation in an Economy?

Inflation refers to the sustained rise in prices over time, resulting in a decrease in the purchasing power of money. When we say "sustained rise," we mean that prices are increasing consistently over a period of time. It's not just a one-time thing where prices go up and then come back down. Nope! Inflation likes to stick around for a while.

Inflation, simply put, is when prices keep going up and up over time. It's like a never-ending roller coaster ride for your wallet! This means that the money you have in your pocket today won't be able to buy as much in the future. So, it's important to understand what inflation is all about.

Image credit: Freepik

Let us take a simple example to explain inflation: Imagine you have ₹10 today, and you can buy five candy bars with it. But if inflation kicks in and prices start rising, maybe next year, those same five candy bars will cost ₹15 instead of 10. That means your ₹10 won't be able to buy as much as before because everything has become more expensive!

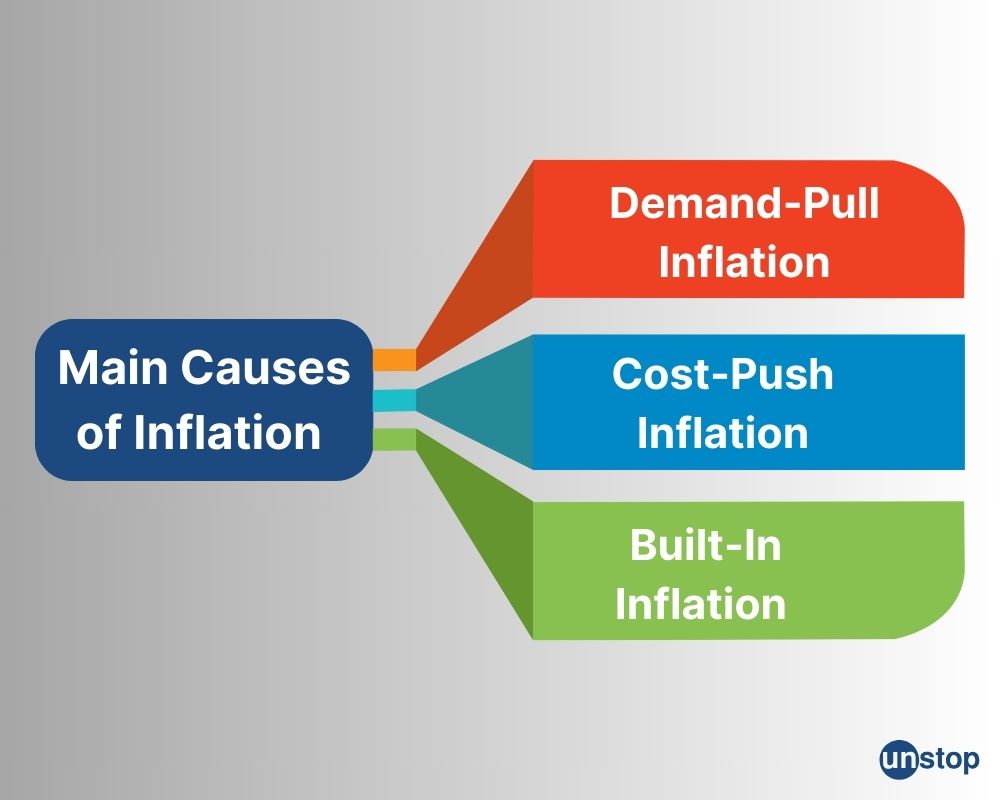

What are the main Causes of Inflation?

What causes inflation? Well, there are three main causes of inflation. Let us study each of them in detail:

Demand-Pull Inflation

Demand-pull inflation occurs when there is a surge in aggregate demand that outpaces the available supply. This leads to upward pressure on prices as consumers compete for limited goods and services.

When more money circulates in the economy, and people have higher purchasing power, they tend to buy more, driving up demand. As a result, businesses may struggle to meet this increased demand, leading to price increases.

Some causes of demand-pull inflation include:

-

Increased consumer spending: When people have more money to spend, they tend to purchase more goods and services, creating a higher demand. This can occur due to factors like tax cuts or increased wages.

-

Expansionary monetary policy: Central banks sometimes adopt expansionary monetary policies by lowering interest rates or increasing the money supply. This stimulates borrowing and spending, further boosting aggregate demand.

-

Government spending: When governments increase their expenditure on public projects such as infrastructure development or social welfare programs, it can lead to an increase in overall demand.

Cost-Push Inflation

Cost-push inflation arises from increased production costs faced by businesses. These cost increases are then passed on to consumers through higher prices for goods and services.

Various factors contribute to cost-push inflation:

-

Rising wages: If workers' wages increase significantly, businesses may need to raise prices in order to maintain profitability.

-

Higher raw material costs: When the prices of essential inputs like oil or metals rise, it becomes more expensive for companies to produce goods. As a result, they may adjust their prices accordingly.

-

Taxes and regulations: Changes in tax policies or new regulations can impose additional costs on businesses. To compensate for these expenses, companies often raise prices.

Built-In Inflation

Also known as wage-price inflation, built-in inflation occurs when businesses increase prices to maintain profit margins in response to higher wages, leading to a cycle where rising wages and rising prices feed into each other.

Key factors of built-in inflation:

- Expectations of Future Inflation: If workers expect higher inflation, they demand higher wages, which in turn drives prices up as companies pass on those costs to consumers.

- Inflationary Spiral: As prices rise, workers seek higher wages, which leads to further price increases.

Other Factors Contributing to Inflation

Monetary Expansion: When a central bank increases the money supply too quickly, it can devalue the currency, leading to inflation.

Supply Shocks: External shocks like oil crises or natural disasters can create sudden shortages, pushing prices up.

Currency Depreciation: If a country's currency loses value, imports become more expensive, contributing to domestic inflation.

What are the Impacts of Inflation?

There are some notable effects of inflation on the overall economy. Let's find out!

Erosion Of Purchasing Power

One major effect of inflation is that it erodes the purchasing power of money. As prices increase, the value of your hard-earned money decreases. This can be problematic for individuals and businesses alike.

For example, if you have savings or fixed-income investments, their value will decrease over time due to inflation. So, it becomes harder to save money for future needs or retirement.

Income Redistribution

Another impact of inflation is income redistribution. Rising prices can affect different groups in society differently. For instance, people with fixed incomes or those who rely heavily on wages may struggle more when prices go up. On the other hand, individuals with assets like real estate or stocks may benefit from inflation as their investments increase in value. This creates an imbalance in wealth distribution within society.

Hampering Long-Term Planning

High or unpredictable levels of inflation can hamper long-term planning for both businesses and individuals. When prices are constantly rising or fluctuating significantly, it becomes difficult to make accurate financial forecasts and set realistic goals for the future. This uncertainty can hinder investment decisions and lead to a lack of confidence in the economy.

Stimulating Spending & Investment

Interestingly, moderate levels of inflation can actually stimulate spending and investment in an economy when properly managed. When people anticipate rising prices in the future, they tend to spend their money rather than hold onto it. This increased spending boosts aggregate demand and encourages economic growth.

However, managing inflation carefully is essential. If inflation rises too rapidly or becomes uncontrollable, it can have negative consequences. For instance, high inflation can lead to hyperinflation, where prices skyrocket and the value of money collapses. This can cause economic instability and social unrest.

What is Inflation Rate?

The inflation rate is the percentage increase in the general price level of goods and services in an economy over a specific period, usually measured annually. It quantifies how much the prices have increased over time.

Key Points to remember:

Measurement Period: Typically measured on a yearly basis.

Percentage Change: This represents the rate of change in prices from one period to another.

Economic Impact: Affects interest rates, wages, and purchasing power.

What is Producer Price Index (PPI)?

The PPI is like a sneak peek into the world of wholesale prices. It measures changes in average selling prices received by domestic producers for their goods or services over time. In simpler terms, it tells us how much producers are charging for the stuff they make.

Now you might be wondering why this matters. Well, changes in producer prices can have a ripple effect on the rest of the economy. If producers start charging more for their goods or services, it could lead to higher prices down the line for consumers like you and me.

What is Consumer Price Index (CPI)?

Unlike the PPI, which focuses on wholesale prices, the CPI looks at retail prices paid by consumers. It tracks changes in prices for a basket of goods and services commonly purchased over time. This means it gives us an idea of how much things cost for everyday people.

Think about it this way: if you go to the grocery store and notice that your favorite snacks are getting more expensive, that's something the CPI would pick up on. It helps us understand how much our money can buy and whether our wages are keeping up with rising costs.

What is Gross Domestic Product (GDP) Deflator?

The Gross Domestic Product (GDP) Deflator is a measure of the overall change in prices for all goods and services produced within an economy over a specific period. It reflects the inflation or deflation in an economy by comparing the nominal GDP (total value of goods and services at current prices) to the real GDP (total value of goods and services at constant prices).

It is considered a broad measure of inflation since it includes all goods and services in an economy, unlike the Consumer Price Index (CPI), which focuses on a fixed basket of consumer goods.

Formula to Calculate Inflation

The formula to calculate the inflation rate is:

Inflation Rate=CPICurrent Period−CPIPrevious Period /CPIPrevious Period×100

- CPI is the Consumer Price Index, which measures the average price change of a basket of goods and services over time.

- Current Period refers to the latest time frame (e.g., this year).

- Previous Period refers to the earlier time frame (e.g., last year).

Example

If the CPI in the current year is 250 and the CPI in the previous year was 200:

Inflation Rate=250−200/200×100=25%

This means the inflation rate is 25%.

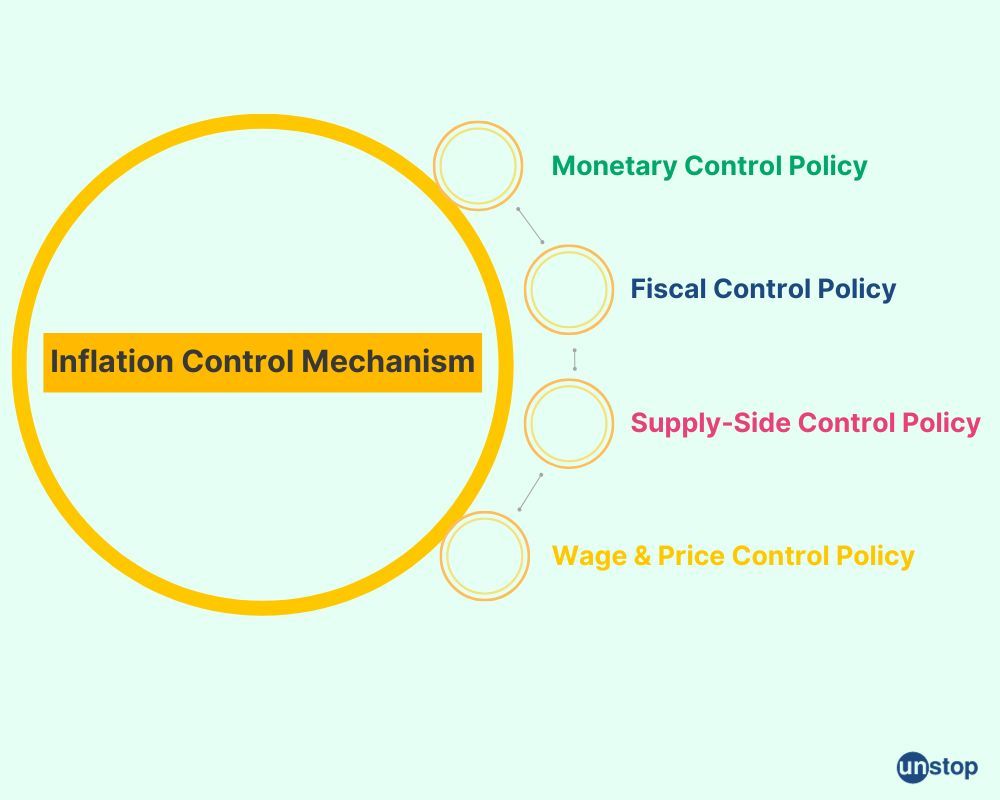

Control Mechanism to Check Inflation

In order to control or beat inflation, central banks and governments employ various strategies and policies. These measures aim to manage the impact of rising prices on the economy and maintain stability.

Monetary Policy Tools

To mitigate the negative impact of inflation on the economy, central banks often aim for moderate inflation rates that strike a balance between maintaining price stability and fostering economic activity. Central banks play a vital role in managing inflationary pressures through monetary policy tools. One such tool is adjusting interest rates.

When inflation rises, central banks may increase interest rates to reduce borrowing and spending, which can help curb demand and slow down price increases. Conversely, during periods of low inflation or economic downturns, central banks may lower interest rates to stimulate borrowing, investment, and consumption.

Fiscal Policies

Governments also have the power to influence inflation through fiscal policies involving taxation and government spending. By adjusting tax rates and government expenditure levels, authorities can impact aggregate demand in the economy.

During times of high inflation, governments may increase taxes or reduce spending to reduce overall demand for goods and services, thereby mitigating price increases.

Supply-Side Policies

Supply-side policies focus on improving productivity, reducing production costs, and increasing efficiency in order to combat inflationary forces. By enhancing productivity levels within an economy, businesses can produce more goods at lower costs. This increased supply helps meet growing demand without driving up prices significantly.

Supply-side policies often involve investments in infrastructure development, education and training programs for workers, deregulation efforts aimed at reducing red tape for businesses, and incentives for innovation.

Wage & Price Controls

Historically, wage and price controls have been used as a means to control inflation; however, their effectiveness remains a subject of debate among economists. Wage controls limit the amount by which wages can increase over a certain period of time while price controls restrict how much prices can rise for specific goods or services.

While these measures may provide temporary relief from rising prices in certain sectors of the economy, they can also lead to unintended consequences such as reduced supply, black market activities, and distortions in resource allocation.

Historical Approaches to Control Inflation

Throughout history, different countries have implemented various strategies to combat inflation. Let's take a look at some of the approaches that have been used:

Volcker Shock of United States

During the 1980s, the United States faced a significant inflation problem. To address this issue, policymakers implemented what became known as the "Volcker Shock." This approach involved tight monetary policy measures aimed at curbing inflationary pressures.

Inflation Targeting Frameworks

In contrast to the Volcker Shock, some nations have adopted inflation-targeting frameworks as a policy objective. Under this approach, central banks or monetary authorities set specific targets for inflation rates and adjust their policies accordingly.

The goal is to maintain price stability by keeping inflation within a predetermined range. By having a clear target, policymakers can make informed decisions about interest rates and other monetary tools to control inflation effectively.

International Cooperation through IMF

Given that inflation can be a global challenge, international cooperation plays an essential role in addressing it effectively. Organizations like the International Monetary Fund (IMF) facilitate collaboration among nations to tackle issues related to inflation. Through discussions and policy coordination, countries can share experiences and knowledge on how best to manage their economies and control inflationary pressures. This cooperation helps foster stability in global financial markets.

While these historical approaches have been utilized over time, it's important to note that there is no one-size-fits-all solution. Each country faces unique circumstances and must tailor its policies accordingly.

Role of Reserve Bank of India (RBI)

In India, the Reserve Bank of India (RBI) plays an important role in monitoring and managing inflation. The RBI implements various monetary policy measures to control inflation and ensure price stability in the economy.

To control inflation within targeted ranges, the RBI employs various tools and strategies. One such tool is adjusting the repo rate—the rate at which banks borrow funds from the central bank.

Image credit: Online source

By increasing or decreasing this rate, the RBI influences borrowing costs for commercial banks and subsequently affects lending rates for businesses and consumers. Open market operations are another method used by the RBI to manage liquidity conditions in the economy effectively.

Through buying or selling government securities in financial markets, the central bank regulates the money supply, which helps control inflationary pressures.

Factors Driving Inflation in India

Several factors drive inflation in India, and food prices are one of them. Fluctuations in agricultural output and supply chain disruptions can lead to changes in food prices, which directly impact the overall inflation rate. The next factor is fuel costs, which also contribute significantly to inflation. As fuel prices rise or fall, it affect transportation costs and has a cascading effect on various sectors of the economy, leading to changes in overall price levels.

Global commodity price fluctuations also have an impact on domestic inflation levels. Changes in international prices for commodities like oil, metals, and agricultural products can affect input costs for Indian industries, influencing overall price levels.

Conclusion

In conclusion, it is important to recognize that while moderate levels of inflation can stimulate economic growth and encourage spending, high or uncontrollable inflation can lead to instability and erode purchasing power. Therefore, individuals, businesses, and policymakers must carefully manage inflation rates to strike a balance between stimulating economic activity and maintaining stability.

By staying informed about the causes, impacts, and control measures associated with inflation, you can make more informed decisions regarding your personal finances or business strategies.

Frequently Asked Questions (FAQs)

1. What are some common strategies used to control or beat inflation?

There are several strategies employed by central banks or governments to control or beat inflation. These include tightening monetary policy by raising interest rates or reducing money supply through open market operations. Governments may also implement fiscal policies like reducing government spending or increasing taxes to curb excessive demand that contributes to rising prices.

2. How does high inflation affect consumers?

High levels of inflation can significantly impact consumers' purchasing power. As prices rise rapidly over time, consumers may find it challenging to afford essential goods and services. Fixed-income individuals such as retirees may face particular difficulties as their income remains stagnant while expenses increase.

3. What are some historical examples of extreme hyperinflation?

Historically notable cases of hyperinflation include Germany's Weimar Republic in the 1920s when people needed wheelbarrows full of cash to buy basic necessities. Another example is Zimbabwe in the late 2000s, where hyperinflation reached staggering levels, resulting in the printing of billion-dollar banknotes.

4. How does inflation affect investments?

Inflation can impact investments in various ways. While it erodes the purchasing power of money, it can also lead to increased asset prices, benefiting investors holding assets like real estate or stocks. However, it is essential to consider how inflation affects specific investment types and adjust strategies accordingly.

5. What role does inflation play in monetary policy decisions?

Central banks often use inflation as a key indicator when making monetary policy decisions. They aim to maintain price stability by targeting a specific inflation rate. If inflation exceeds the target level, central banks may take measures such as raising interest rates to curb excessive borrowing and spending that contribute to rising prices.

Suggested reads:

- What Is Glocalization? A Detailed Explanation With Examples

- Experience Curve: An Effective Guide For Strategic Success

- J-Curve: Usages & Effects On Economics And Private Equity

- Electronic Money: All You Need To Know & Be Secured Using It

- Economies Of Scope: Definition, Benefits, Strategies & Examples

Instinctively, I fall for nature, music, humor, reading, writing, listening, traveling, observing, learning, unlearning, friendship, exercise, etc., all these from the cradle to the grave- that's ME! It's my irrefutable belief in the uniqueness of all. I'll vehemently defend your right to be your best while I expect the same from you!

Login to continue reading

And access exclusive content, personalized recommendations, and career-boosting opportunities.

Subscribe

to our newsletter

Comments

Add comment