- What Is Walter's Model Of Dividend?

- Key Concepts Of Walter's Model

- Dividend Policies

- Walter's Model Formula And Assumptions

- Model Limitations

- Conclusion

- Frequently Asked Questions

- Exploring Cash And Fund Flow

- Importance Of Cash & Fund Flow Statement

- Components Of Cash & Fund Flow Statement

- Exploring The Key Differences With Examples

- Significance And Application

- Advantages And Disadvantages

- Conclusion

- Frequently Asked Questions

- Definition Of Comparative Statement

- Types Of Comparative Statements

- Formulas For Comparative Statement

- Example Of Comparative Income Statement

- Preparing Comparative Statement

- Steps For Income & Balance Sheets

- Understanding Cash Flow Comparisons

- Practical Examples Explained

- Limitations And Considerations

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Dividend Decision

- Key Factors Influencing Dividend Decision

- Objectives Of Dividend Decision

- Theories And Determinants

- Policies Of Dividend Decision

- Conclusion

- Frequently Asked Questions (FAQs)

- Role of Fund Flow Statement Analysis

- Key Objectives of Preparing a Fund Flow Statement

- Importance of a Fund Flow Statement

- How to Prepare a Fund Flow Statement: A Step-by-Step Guide

- Fund Flow Statement vs. Cash Flow Statement

- How Fund Flow Analysis Empowers Investors and Management

- Limitations of a Fund Flow Statement

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Financing Decision

- Types Of Financial Decisions

- Examples Of Financing Decisions

- Key Factors In Financial Decision-Making

- Theories Of Financial Decision

- Analyzing Costs And Risks

- Evaluating Market & Regulatory Impacts

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Finance Function

- Core Components Of Finance Function

- Functions Of Financial Management

- Importance Of Finance Decision

- Scope Of Finance Function

- Objectives Of Financial Management

- Integrating Decisions Into Business Strategy

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Profit & Wealth Maximization

- Top 5 Key Differences Highlighted

- Calculation Method (Formula)

- Which Approach Is More Sustainable

- How It Impacts Different Stakeholders

- Role Of Decision-Making In Maximization

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Capital Structure

- Top 10 Factors Affecting Capital Structure

- Conclusion

- Frequently Asked Questions (FAQs)

- Defining Working Capital Cycle

- Importance Of Working Capital Cycle

- Components Of Working Capital Cycle

- Steps Of Working Capital Cycle

- Formula Used For Calculation

- Positive vs Negative Working Capital

- Reducing The Cycle

- Conclusion

- Frequently Asked Questions

- What is a Common Size Statement?

- Common Size Statement Format & Formula

- Common Size Statement Analysis

- Importance of Common Size Statement

- Difference Between Common Size and Comparative Statement

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Gordon Growth Model

- Formula & Example Of GGM

- Applications In Investment Valuation

- Gordon Growth Vs. Dividend Discount Model (DDM)

- Pros And Cons Of The Model

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition & Concept Of Maximization

- Importance & Benefits Of Wealth Maximization

- Approaches & Challenges

- Wealth Maximization Vs. Profit Maximization

- Strategies To Implement Wealth Maximization

- Relation Of Psychological Aspects & Wealth

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Investment Decision? (Meaning)

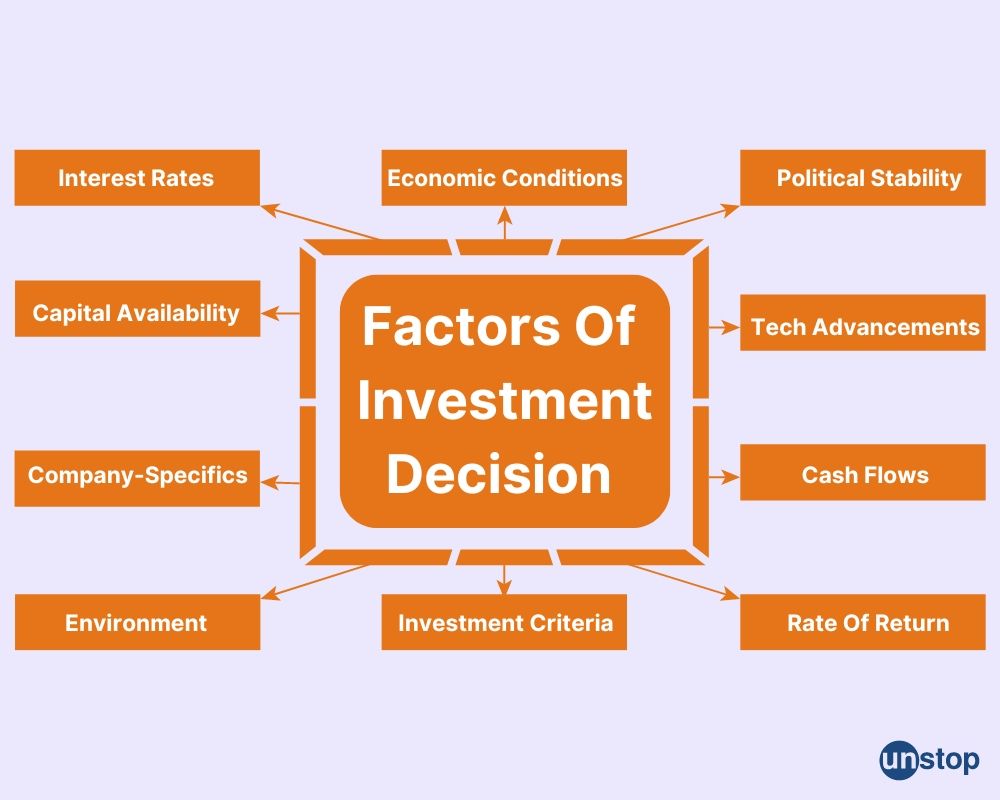

- Key Factors Influencing Investment Decisions

- Importance of Investment Decision

- Exploring Capital Budgeting Methods

- Net Present Value Vs Internal Rate Of Return

- Addressing Inflation Effects

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Discounted Payback Period?

- Understanding The Basic Concept

- Formula & Calculation With Example

- Advantages, Disadvantages And Application

- Payback Vs. Discounted Payback

- Role & Influence Of Decision Rule Explained

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Working Capital Management

- Key Components Of Working Capital

- Importance Of Working Capital Management

- Working Capital Cycle & Formula

- Key Ratios In Working Capital Management

- Factors Influencing Working Capital

- Strategies For Working Capital Management

- Conclusion

- Frequently Asked Questions (FAQs)

- Meaning Of Financial Sources In Business

- Primary And Secondary Sources Of Finance

- Top 7 Sources Of Finance For Business

- Traditional Vs Modern Sources Of Finance

- Classification Of Finance Sources Based On Time Period

- Classification & Impact Based On Ownership

- Strategies For Choosing The Right Sources Of Finance

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Profitability Index?

- Key Features Of PI As A Financial Tool

- Profitability Index Formula

- How To Calculate Profitability Index

- Advantages & Disadvantages Of PI

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Annual Recurring Revenue?

- Importance Of ARR For Business Growth

- Formula And Steps To Calculate ARR

- Differences Between ARR and MRR

- Conclusion

- Frequently Asked Questions

- What Is Capital Budgeting?

- Types & Features Of Capital Budgeting

- Importance Of Capital Budgeting

- Methods Used In Capital Budgeting

- Capital Budgeting Process

- Capital Budgeting Vs. Operational Budgeting

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Financial Statement Analysis?

- Importance & Benefits

- Types Of Financial Statement Analysis

- Methods Of Financial Statement Analysis

- Steps In Financial Statement Analysis

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is The Cost Of Capital?

- Key Components Of Cost Of Capital

- WACC & Formula

- Factors Influencing Cost Of Capital

- Role Of Cost Of Capital In Financial Decisions

- Role In Investment Decisions & Mergers

- Impact On Business Operations & Strategies

- Conclusion

- Frequently Asked Questions

- What Is Internal Rate Of Return (IRR) In Finance?

- Key Concepts Of IRR

- Formula To Calculate Internal Rate Of Return

- Applications Of IRR In Finance

- Limitations & Challenges Of IRR

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Cost of Equity?

- Key Factors Affecting Cost Of Capital

- Role Of Cost Of Equity In Finance

- Methods to Calculate Cost of Equity

- Formula Of Cost Of Equity

- Components Of Cost Of Equity

- Cost Of Equity Vs. Related Financial Concepts

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Ratio Analysis?

- Importance Of Ratio Analysis

- Types Of Financial Ratios Analysis

- Methods Used To Conduct Ratio Analysis

- Applications And Examples

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Net Present Value (NPV)?

- Why Use NPV? Top 5 Benefits

- NPV Formula Explained

- Steps To Calculate NPV With Example

- Positive Vs. Negative NPV

- Advantages And Disadvantages Of NPV

- NPV Vs. Other Financial Metrics

- Conclusion

- Frequently Asked Questions

- What Is The Time Value Of Money?

- Time Value Of Money Formula

- Importance Of Time Value Of Money

- Methods & Techniques Of Time Value of Money

- Relationship Between Opportunity Cost And Time Value

- Inflation's Impact on Time Value

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Financial Management?

- Types of Financial Management

- Importance of Financial Management

- Key Functions Of Financial Management

- Best Practices For Financial Management

- Conclusion

- Frequently Asked Questions

- What Is Leverage In Financial Management?

- Types Of Leverage In Financial Management

- Financial Leverage Formula

- Risks & Benefits Of Financial Leverage

- Conclusion

- Frequently Asked Questions

- What Is A Dividend?

- Types Of Dividends

- Dividend In Financial Management

- Examples Of Dividend

- Impacts Of Dividends On Share Prices

- Reasons Companies Pay or Not Pay Dividends

- Conclusion

- Frequently Asked Questions

Investment Decision: Definition, Factors & Importance In Finance

Making investment choices is crucial for the future growth, profit, and security of both individuals and businesses. By thoroughly assessing potential opportunities, weighing risks, and estimating returns, investors can make smart decisions that match their financial objectives and boost overall value.

In this article, we will delve into the nitty-gritty of making a smart and effective investment decision.

What Is Investment Decision? (Meaning)

An investment decision, also known as a capital budgeting decision, is the process of allocating financial resources to various assets or projects with the goal of generating future returns.

This crucial aspect of financial management involves assessing potential investments to ensure that funds are utilized effectively and strategically.

Types & Examples Of Investment Decision

New Investment Decisions: When a business chooses to grow by establishing a new location in another area, it is committing to a major investment choice.

Term Investment Decision: Opting to invest in long-term projects like research and development for innovative products falls under this category.

Investment Appraisal Decisions: Evaluating the possible profits and dangers linked to investing in a specific project is an essential part of making informed investment choices.

Top 10 Factors Influencing Investment

Let us study some of the key factors that influence investment decisions:

Economic Conditions

Economic conditions are a pivotal factor in investment decisions. The overall economic environment, including inflation rates, economic growth, and market trends, significantly impacts the profitability and risk associated with investments.

A stable economy with positive growth prospects tends to enhance investment opportunities, whereas economic downturns can increase risks and reduce returns.

Interest Rates

Interest rates play a critical role in influencing investment decisions. They affect the cost of borrowing and the return on savings, which in turn influence the cost of capital. When interest rates rise, borrowing costs increase, making it less appealing to invest in some assets while encouraging people to save.

On the other hand, when interest rates are low, borrowing becomes cheaper, which can lead to more investments as the cost of capital decreases.

Capital Availability

Having access to capital is essential for seizing investment opportunities. It's important for investors to confirm that they possess enough funds to dedicate to possible investments.

Limited capital can constrain investment options and force investors to prioritize certain projects over others.

Company-Specific Factors

Company-specific factors, such as financial health, management capabilities, and growth potential, directly influence the expected returns and risks of an investment.

A financially sound company with strong management and growth prospects is generally a more attractive investment. Assessing these factors helps investors gauge the likelihood of achieving their desired returns.

Regulatory Environment

The regulatory environment encompasses the legal and regulatory framework governing investments. Compliance with regulations ensures that investments are legally sound and can protect investors from potential legal issues.

Changes in regulations can also impact the feasibility and attractiveness of certain investments.

Political Stability

A stable political setting plays a crucial role in fostering a favourable investment atmosphere. When there is political uncertainty or instability, it can cause market fluctuations and heightened risks, making it difficult to foresee investment results.

Conversely, countries with stable politics tend to draw in more investments by offering a reliable and safe backdrop for financial activities.

Technological Advancements

Technological advancements are increasingly significant in investment decisions. Innovations and new technologies can create new investment opportunities, enhance efficiency, and influence the competitive landscape.

To make smart investment choices, it's essential for investors to keep up with the latest technology trends. This knowledge helps them seize new opportunities and avoid the dangers linked to using outdated technologies.

Cash Flows

Cash flows play an indispensable role in capital budgeting decisions, guiding investors on the financial health of a project. By analyzing cash inflows and outflows, investors can determine the profitability and sustainability of an investment.

When making investment choices, many investors look for projects that generate positive cash flow. This approach guarantees a reliable income that can cover expenses and yield profits while supporting their long-term business objectives and overall earning potential.

Rate Of Return

The rate of return serves as a key metric in evaluating investment opportunities. Investors seek projects with attractive returns that exceed the cost of capital.

By comparing the expected rate of return with the required rate, investors can assess the feasibility and potential profitability of an investment.

A higher rate of return indicates a more lucrative investment opportunity, while a lower rate may signal risks or inefficiencies in resource allocation. This comparison guides financing decisions and ensures optimal utilization of resources.

Investment Criteria

Before making investment decisions, investors consider various criteria, such as the project's liquidity, assets, and earning capacity. Evaluating factors like the project's cost, management, and business prospects helps investors gauge the potential risks and rewards associated with an investment.

Importance of Investment Decision

The points listed below accurately capture the key importance of investment decisions, which are well-suited for highlighting their significance:

Strategic Direction

Investment decisions determine the long-term strategic direction of an entity. By allocating resources to growth opportunities, businesses can achieve their strategic goals, such as market expansion, product development, or operational efficiency.

Financial Growth

Effective investment decisions are crucial for driving financial growth. They help generate returns, increase profitability, and enhance overall financial performance, which contributes to the long-term success and stability of the organization or individual.

Risk Management

Investment decisions play a key role in managing and mitigating financial risks. By carefully selecting and evaluating investments, investors can diversify their portfolios and reduce exposure to potential losses, thereby protecting their capital.

Capital Allocation

Making sound investment choices is crucial for effective capital distribution. These decisions guide money towards projects or assets that yield the highest returns for the associated risks, enhance resource utilization, and boost overall value generation.

Competitive Advantage

Strategic investments can provide a competitive edge by enabling innovation, enhancing capabilities, and improving operational efficiencies. Investments in technology, research, and development can differentiate a business from its competitors and strengthen its market position.

Shareholder Value

Investment decisions directly impact shareholder value. By making sound investment choices, companies can enhance their profitability and growth prospects, leading to higher stock prices and improved returns for shareholders.

Long-Term Sustainability

Investment decisions are essential for ensuring long-term sustainability. By investing in projects or assets that align with future trends and market demands, businesses and individuals can achieve sustained growth and remain competitive in the long run.

Exploring Capital Budgeting Methods

Let us also study some of the capital budgeting methods related to investment decisions:

Capital Budgeting

Capital budgeting involves making decisions about long-term capital investment projects. It helps determine the right investment process for allocating financial resources effectively.

By utilizing common investment strategies, companies can ensure efficient cash management and maximize profitability.

Working Capital Decisions

Working capital decisions, on the other hand, focus on managing short-term financial resources to meet operational requirements. These decisions are crucial for day-to-day financial management processes and ensuring smooth business operations.

Long-term vs. Short-term Investment Decisions

Long-term investment decisions involve committing funds to projects with a longer payback period, aiming for sustainable growth and expansion. In contrast, short-term investment decisions are focused on immediate returns and liquidity management.

Profitability & Competitiveness

The choices made in capital budgeting and working capital decisions significantly impact a firm's profitability and competitiveness. Efficient cash management through proper capital investment enhances financial stability and growth potential, while effective working capital decisions ensure smooth operations and timely payments, ultimately boosting competitiveness.

Net Present Value Vs Internal Rate Of Return

Let us study the similarities and differences between Net Present Value and Internal Rate Of Return:

Net Present Value (NPV)

Net Present Value (NPV) focuses on determining the profitability of an investment project by calculating the present value of expected cash flows. When assessing investment potential, NPV considers the time value of money, providing a clear picture of the project's worth in today's terms.

NPV assists investors in making smart choices by calculating the present value of future cash flows, allowing them to assess how profitable a project may be.

Internal Rate Of Return (IRR)

Internal Rate of Return (IRR), on the other hand, is another essential tool for decision-making. It represents the rate at which the net present value of cash inflows equals the initial investment cost. IRR indicates the possible return on investment over its lifespan.

Investors often use IRR to gauge the efficiency and attractiveness of projects. However, it comes with limitations. One drawback is that IRR assumes reinvestment at the same rate, which may not always be feasible in practical scenarios.

Addressing Inflation Effects

Lastly, let us study the effects and strategies of inflation in investment decisions:

Inflation Impact

Inflation can lower the real value of investment returns, reducing future cash flow purchasing power. Therefore, investors need to consider inflation when making decisions. Ignoring inflation can result in wrong estimates of expected returns and possible financial losses.

Mitigation Strategies

Investors can take steps to secure their investments from the harmful effects of inflation. One effective method is to spread their investments across various asset classes, which can reduce the risks associated with inflation. Additionally, putting money into assets like real estate or commodities—known for their ability to keep pace with or exceed inflation—can help ensure better returns.

Another effective strategy is to adjust cash flows and discount rates for inflation when calculating metrics like NPV and IRR. By incorporating inflation-adjusted figures, investors can make more accurate assessments of the profitability and feasibility of investment projects.

Conclusion

Investment decisions are pivotal in shaping long-term financial success and strategic direction by directing resources toward assets or projects with the highest potential returns. These decisions influence financial growth, risk management, and optimal capital allocation, while also enhancing competitive advantage and shareholder value.

By evaluating opportunities, assessing risks, and considering market and economic conditions, businesses and individuals can make informed choices that not only drive profitability and growth but also ensure sustainable success and effective use of capital.

Time For A Short Quiz

Frequently Asked Questions (FAQs)

1. What is an investment decision?

An investment decision, also known as a capital budgeting decision, is the process of allocating financial resources to various assets or projects with the goal of generating future returns.

2. What influences investment decisions?

Key factors influencing investment decisions include market conditions, economic outlook, risk tolerance, financial goals, and regulatory environment.

3. How do capital budgeting methods help in investment decision-making?

Capital budgeting methods help in evaluating long-term investment opportunities by analyzing cash flows, risks, and returns associated with different projects.

4. What is the difference between NPV and IRR in investment analysis?

Net Present Value (NPV) calculates the project's value in monetary terms, while Internal Rate of Return (IRR) measures the project's profitability percentage-wise over time.

5. How does inflation impact investment decisions?

Inflation affects investment decisions by eroding the purchasing power of money over time, highlighting the importance of considering inflation rates in financial calculations.

Suggested reads:

Instinctively, I fall for nature, music, humor, reading, writing, listening, traveling, observing, learning, unlearning, friendship, exercise, etc., all these from the cradle to the grave- that's ME! It's my irrefutable belief in the uniqueness of all. I'll vehemently defend your right to be your best while I expect the same from you!

Login to continue reading

And access exclusive content, personalized recommendations, and career-boosting opportunities.

Subscribe

to our newsletter

Comments

Add comment