- What Is Walter's Model Of Dividend?

- Key Concepts Of Walter's Model

- Dividend Policies

- Walter's Model Formula And Assumptions

- Model Limitations

- Conclusion

- Frequently Asked Questions

- Exploring Cash And Fund Flow

- Importance Of Cash & Fund Flow Statement

- Components Of Cash & Fund Flow Statement

- Exploring The Key Differences With Examples

- Significance And Application

- Advantages And Disadvantages

- Conclusion

- Frequently Asked Questions

- Definition Of Comparative Statement

- Types Of Comparative Statements

- Formulas For Comparative Statement

- Example Of Comparative Income Statement

- Preparing Comparative Statement

- Steps For Income & Balance Sheets

- Understanding Cash Flow Comparisons

- Practical Examples Explained

- Limitations And Considerations

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Dividend Decision

- Key Factors Influencing Dividend Decision

- Objectives Of Dividend Decision

- Theories And Determinants

- Policies Of Dividend Decision

- Conclusion

- Frequently Asked Questions (FAQs)

- Role of Fund Flow Statement Analysis

- Key Objectives of Preparing a Fund Flow Statement

- Importance of a Fund Flow Statement

- How to Prepare a Fund Flow Statement: A Step-by-Step Guide

- Fund Flow Statement vs. Cash Flow Statement

- How Fund Flow Analysis Empowers Investors and Management

- Limitations of a Fund Flow Statement

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Financing Decision

- Types Of Financial Decisions

- Examples Of Financing Decisions

- Key Factors In Financial Decision-Making

- Theories Of Financial Decision

- Analyzing Costs And Risks

- Evaluating Market & Regulatory Impacts

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Finance Function

- Core Components Of Finance Function

- Functions Of Financial Management

- Importance Of Finance Decision

- Scope Of Finance Function

- Objectives Of Financial Management

- Integrating Decisions Into Business Strategy

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Profit & Wealth Maximization

- Top 5 Key Differences Highlighted

- Calculation Method (Formula)

- Which Approach Is More Sustainable

- How It Impacts Different Stakeholders

- Role Of Decision-Making In Maximization

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Capital Structure

- Top 10 Factors Affecting Capital Structure

- Conclusion

- Frequently Asked Questions (FAQs)

- Defining Working Capital Cycle

- Importance Of Working Capital Cycle

- Components Of Working Capital Cycle

- Steps Of Working Capital Cycle

- Formula Used For Calculation

- Positive vs Negative Working Capital

- Reducing The Cycle

- Conclusion

- Frequently Asked Questions

- What is a Common Size Statement?

- Common Size Statement Format & Formula

- Common Size Statement Analysis

- Importance of Common Size Statement

- Difference Between Common Size and Comparative Statement

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Gordon Growth Model

- Formula & Example Of GGM

- Applications In Investment Valuation

- Gordon Growth Vs. Dividend Discount Model (DDM)

- Pros And Cons Of The Model

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition & Concept Of Maximization

- Importance & Benefits Of Wealth Maximization

- Approaches & Challenges

- Wealth Maximization Vs. Profit Maximization

- Strategies To Implement Wealth Maximization

- Relation Of Psychological Aspects & Wealth

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Investment Decision? (Meaning)

- Key Factors Influencing Investment Decisions

- Importance of Investment Decision

- Exploring Capital Budgeting Methods

- Net Present Value Vs Internal Rate Of Return

- Addressing Inflation Effects

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Discounted Payback Period?

- Understanding The Basic Concept

- Formula & Calculation With Example

- Advantages, Disadvantages And Application

- Payback Vs. Discounted Payback

- Role & Influence Of Decision Rule Explained

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Working Capital Management

- Key Components Of Working Capital

- Importance Of Working Capital Management

- Working Capital Cycle & Formula

- Key Ratios In Working Capital Management

- Factors Influencing Working Capital

- Strategies For Working Capital Management

- Conclusion

- Frequently Asked Questions (FAQs)

- Meaning Of Financial Sources In Business

- Primary And Secondary Sources Of Finance

- Top 7 Sources Of Finance For Business

- Traditional Vs Modern Sources Of Finance

- Classification Of Finance Sources Based On Time Period

- Classification & Impact Based On Ownership

- Strategies For Choosing The Right Sources Of Finance

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Profitability Index?

- Key Features Of PI As A Financial Tool

- Profitability Index Formula

- How To Calculate Profitability Index

- Advantages & Disadvantages Of PI

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Annual Recurring Revenue?

- Importance Of ARR For Business Growth

- Formula And Steps To Calculate ARR

- Differences Between ARR and MRR

- Conclusion

- Frequently Asked Questions

- What Is Capital Budgeting?

- Types & Features Of Capital Budgeting

- Importance Of Capital Budgeting

- Methods Used In Capital Budgeting

- Capital Budgeting Process

- Capital Budgeting Vs. Operational Budgeting

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Financial Statement Analysis?

- Importance & Benefits

- Types Of Financial Statement Analysis

- Methods Of Financial Statement Analysis

- Steps In Financial Statement Analysis

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is The Cost Of Capital?

- Key Components Of Cost Of Capital

- WACC & Formula

- Factors Influencing Cost Of Capital

- Role Of Cost Of Capital In Financial Decisions

- Role In Investment Decisions & Mergers

- Impact On Business Operations & Strategies

- Conclusion

- Frequently Asked Questions

- What Is Internal Rate Of Return (IRR) In Finance?

- Key Concepts Of IRR

- Formula To Calculate Internal Rate Of Return

- Applications Of IRR In Finance

- Limitations & Challenges Of IRR

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Cost of Equity?

- Key Factors Affecting Cost Of Capital

- Role Of Cost Of Equity In Finance

- Methods to Calculate Cost of Equity

- Formula Of Cost Of Equity

- Components Of Cost Of Equity

- Cost Of Equity Vs. Related Financial Concepts

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Ratio Analysis?

- Importance Of Ratio Analysis

- Types Of Financial Ratios Analysis

- Methods Used To Conduct Ratio Analysis

- Applications And Examples

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Net Present Value (NPV)?

- Why Use NPV? Top 5 Benefits

- NPV Formula Explained

- Steps To Calculate NPV With Example

- Positive Vs. Negative NPV

- Advantages And Disadvantages Of NPV

- NPV Vs. Other Financial Metrics

- Conclusion

- Frequently Asked Questions

- What Is The Time Value Of Money?

- Time Value Of Money Formula

- Importance Of Time Value Of Money

- Methods & Techniques Of Time Value of Money

- Relationship Between Opportunity Cost And Time Value

- Inflation's Impact on Time Value

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Financial Management?

- Types of Financial Management

- Importance of Financial Management

- Key Functions Of Financial Management

- Best Practices For Financial Management

- Conclusion

- Frequently Asked Questions

- What Is Leverage In Financial Management?

- Types Of Leverage In Financial Management

- Financial Leverage Formula

- Risks & Benefits Of Financial Leverage

- Conclusion

- Frequently Asked Questions

- What Is A Dividend?

- Types Of Dividends

- Dividend In Financial Management

- Examples Of Dividend

- Impacts Of Dividends On Share Prices

- Reasons Companies Pay or Not Pay Dividends

- Conclusion

- Frequently Asked Questions

Net Present Value (NPV) - Definition, Formula, Calculation & More

Net Present Value (NPV) is an indispensable concept in finance. It helps you understand the value of future cash flows today. By calculating NPV, you can make smarter investment decisions, and knowing how to use NPV can boost your financial skills.

In this article, we'll break down what NPV is and why it matters. Get ready to dive into the world of smart investing and financial planning.

What Is Net Present Value (NPV)?

Net Present Value (NPV) is an important financial metric used to assess an investment's profitability. It compares the value of net cash inflows and outflows over time to determine whether future cash flows from an investment will exceed the initial costs.

Decision-makers use it to evaluate potential projects. A positive NPV shows that a project will likely earn more than it costs. This helps companies decide which investments to make.

Why Use NPV? Top 5 Benefits

Understanding NPV is crucial for several reasons in financial management. Here are the top five reasons why it holds such importance:

Decision-Making Tool

By converting future cash flows into present value terms, NPV allows decision-makers to assess whether the anticipated returns exceed the initial investment cost, thus guiding go/no-go decisions on projects.

Time Value of Money

Net Present Value (NPV) highlights the importance of the time value of money, illustrating that a dollar received now is more valuable than one received later. This financial metric evaluates future cash flows by converting them into their present value, offering a clearer financial picture that takes into account factors like inflation, risk, and potential missed opportunities.

Risk Assessment

NPV incorporates risk into the analysis through the discount rate. The discount rate often reflects the project's risk level. Higher-risk projects use a higher discount rate, reducing the present value of future cash flows and providing a more conservative estimate of potential returns.

Comparison of Projects

NPV allows for straightforward comparison between different projects or investment opportunities. Since NPV provides a single, quantitative measure of an investment's value, it facilitates the ranking and prioritization of projects, enabling companies to allocate capital more efficiently.

Focus on Cash Flows, Not Accounting Profit

NPV focuses on actual cash flows rather than accounting profits, providing a clearer picture of financial viability. By considering cash inflows and outflows, NPV avoids the potential distortions that can arise from accounting practices, non-cash expenses, and one-time items, thereby offering a more realistic view of an investment's financial impact.

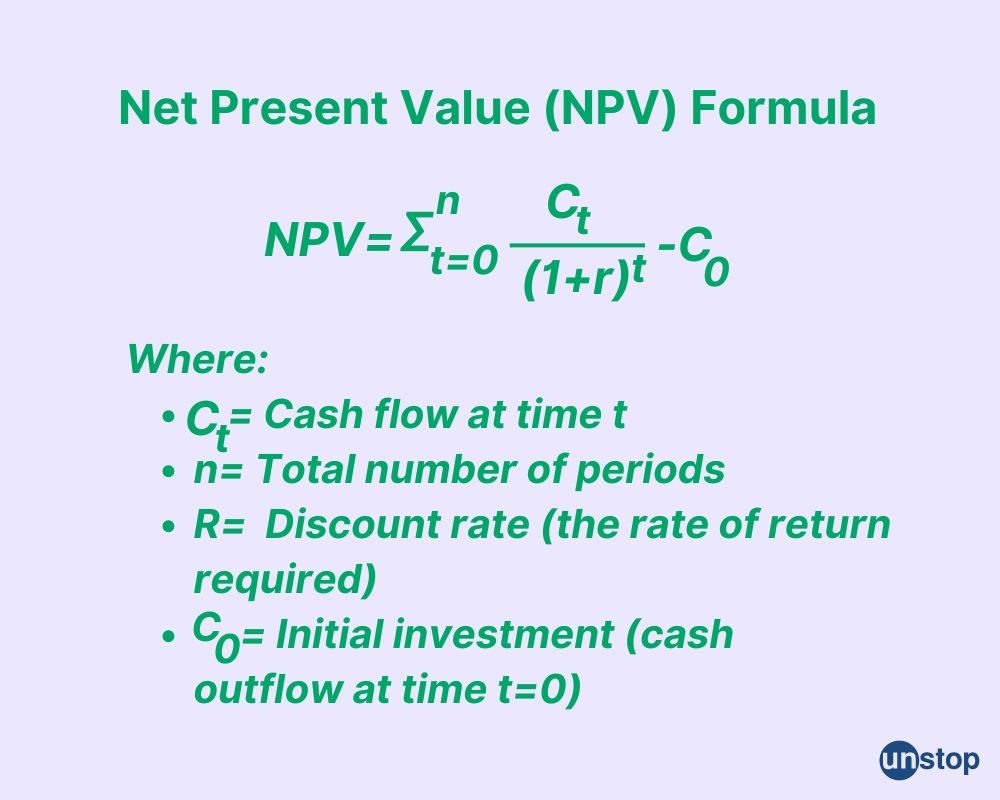

NPV Formula Explained

To calculate NPV, discount each cash flow to its present value using a discount rate and sum them up. Then, subtract the initial investment. A positive NPV indicates that expected earnings exceed costs, making the investment a good option.

The formula for calculating NPV is straightforward. It sums the present value of future cash flows and subtracts the initial investment. The formula looks like this:

Steps To Calculate NPV

Two important steps to keep in mind while determining the NPV of an investment or project:

Identify Cash Flows

Identify the upfront expense of the investment or project, typically a cash outflow occurring at the start. Then, forecast the anticipated cash inflows and outflows for each period, such as annually, throughout the duration of the project.

Select the Discount Rate

Choose an appropriate discount rate to account for the time value of money and the risk associated with the project. This rate could be the company's cost of capital, the required rate of return, or a rate that reflects the project's risk.

Positive Vs. Negative NPV

A positive NPV suggests a worthwhile investment. Conversely, a negative NPV signals caution. Let us consider some of the differences between a positive and a negative NPV:

Positive NPV

A positive NPV means that a project is expected to generate more wealth than it costs. This means the future cash inflows exceed the outflows when discounted at the appropriate interest rate. Investors often see a positive NPV as a green light for project investments.

They view it as an opportunity to enhance their financial position. The potential for profit can lead to further investment and growth.

Negative NPV

A negative NPV suggests that the project's costs outweigh its benefits. In this case, future cash flows do not cover the initial investment and ongoing expenses.

Pursuing projects with negative NPV carries significant risks. Investors may face financial losses or missed opportunities for better alternatives. Interest rate increases can further worsen the situation by raising the cost of capital.

Advantages And Disadvantages Of NPV

Let us also consider some of the advantages and disadvantages of Net Present Value:

Advantages Of NPV

NPV offers several benefits for investment analysis. It incorporates the time value of money, which means it considers how money's value changes over time. This helps investors understand the real worth of future cash flows.

Another advantage is its clarity. NPV provides a straightforward metric for evaluating different projects. Investors can compare NPVs directly to see which project yields better returns.

Disadvantages Of NPV

NPV also has limitations that investors must consider. One significant drawback is its reliance on assumptions. Forecasting future cash flows can be tricky. If these forecasts are inaccurate, the NPV calculation will be flawed.

NPV does not account for opportunity costs effectively. Investors might overlook other potential opportunities while focusing solely on NPV. This could lead to missed chances for better investments.

NPV Vs. Other Financial Metrics

Lastly, let us study how Net present Value stands out compared with other financial metrics:

Profitability Comparison

Net Present Value stands out as a key metric in capital budgeting. It directly measures the added value of an investment. Other metrics, like return on investment, focus on percentage returns without considering the time value of money. NPV accounts for various cash flows over time. This makes it a more robust indicator of financial health.

Investment Evaluation

Investors often compare investment projects using different metrics. While the payback period shows how quickly costs are recouped, it ignores cash flows beyond that point. Net Present Value evaluates all anticipated costs and earnings throughout the project's life. This gives a clearer picture of profitability.

Practical Scenarios

Certain scenarios favour Net Present Value over alternative metrics. For example, when comparing projects with different durations or cash flow patterns, NPV provides better insight. It helps identify which project adds more value to the business. Financial calculators can simplify these calculations, ensuring accurate results.

In summary, NPV offers a comprehensive view of an investment's potential success. Its ability to incorporate various cash flows and account for time makes it essential for effective financial modelling. Other metrics may fall short of providing the same depth of analysis.

Conclusion

Net Present Value (NPV) is a powerful tool for making smart financial decisions. You've learned how to calculate NPV, differentiate between positive and negative values, and weigh its pros and cons against other metrics. These insights empower you to assess investment opportunities more effectively.

Moreover, understanding Net Present Value can help you maximize your returns and minimize risks. Dive deeper into your financial strategy by applying these concepts today. Start evaluating your investments through the lens of NPV to enhance your decision-making process. Take charge of your financial future now!

Time For A Short Quiz

Frequently Asked Questions

1. What is Net Present Value (NPV)?

Net Present Value (NPV) is an important financial metric employed to assess the profitability of an investment. It compares the value of net cash inflows and outflows over time. This calculation helps determine if future cash flows from an investment exceed the initial costs.

2. Why is NPV important in finance?

NPV helps investors assess the potential return on an investment. It provides a clear picture of whether an investment will generate more value than its cost, aiding in better financial decision-making.

3. How do you calculate Net Present Value?

To determine the net present value (NPV), take the total of the cash flows that have been discounted over a specific period and then deduct the initial investment amount from this total.

4. What does a positive Net Present Value mean?

A positive NPV means that the projected earnings (discounted to present Value) exceed the initial investment. This indicates a potentially profitable opportunity worth pursuing.

5. What are the limitations of using NPV?

NPV relies heavily on accurate cash flow projections and discount rates. It may not account for market volatility or unforeseen risks, which can impact investment outcomes.

6. How does Net Present Value compare to other financial metrics?

Unlike ROI or payback period metrics, Net Present Value considers the time value of money, providing a more comprehensive view of an investment's profitability and long-term viability.

Suggested reads:

-

Annual Recurring Revenue (ARR): Definition, Formula & Calculation

-

Profitability Index (PI): Definition, Formula, Calculation & More

-

Top 7 Sources Of Finance For Businesses And Start-ups Explained

-

Working Capital Management: Definition, Importance, Strategy & More

-

Gordon Growth Model (GGM) | Definition, Formula, And Applications

Instinctively, I fall for nature, music, humor, reading, writing, listening, traveling, observing, learning, unlearning, friendship, exercise, etc., all these from the cradle to the grave- that's ME! It's my irrefutable belief in the uniqueness of all. I'll vehemently defend your right to be your best while I expect the same from you!

Login to continue reading

And access exclusive content, personalized recommendations, and career-boosting opportunities.

Subscribe

to our newsletter

Comments

Add comment