- What Is Walter's Model Of Dividend?

- Key Concepts Of Walter's Model

- Dividend Policies

- Walter's Model Formula And Assumptions

- Model Limitations

- Conclusion

- Frequently Asked Questions

- Exploring Cash And Fund Flow

- Importance Of Cash & Fund Flow Statement

- Components Of Cash & Fund Flow Statement

- Exploring The Key Differences With Examples

- Significance And Application

- Advantages And Disadvantages

- Conclusion

- Frequently Asked Questions

- Definition Of Comparative Statement

- Types Of Comparative Statements

- Formulas For Comparative Statement

- Example Of Comparative Income Statement

- Preparing Comparative Statement

- Steps For Income & Balance Sheets

- Understanding Cash Flow Comparisons

- Practical Examples Explained

- Limitations And Considerations

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Dividend Decision

- Key Factors Influencing Dividend Decision

- Objectives Of Dividend Decision

- Theories And Determinants

- Policies Of Dividend Decision

- Conclusion

- Frequently Asked Questions (FAQs)

- Role of Fund Flow Statement Analysis

- Key Objectives of Preparing a Fund Flow Statement

- Importance of a Fund Flow Statement

- How to Prepare a Fund Flow Statement: A Step-by-Step Guide

- Fund Flow Statement vs. Cash Flow Statement

- How Fund Flow Analysis Empowers Investors and Management

- Limitations of a Fund Flow Statement

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Financing Decision

- Types Of Financial Decisions

- Examples Of Financing Decisions

- Key Factors In Financial Decision-Making

- Theories Of Financial Decision

- Analyzing Costs And Risks

- Evaluating Market & Regulatory Impacts

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Finance Function

- Core Components Of Finance Function

- Functions Of Financial Management

- Importance Of Finance Decision

- Scope Of Finance Function

- Objectives Of Financial Management

- Integrating Decisions Into Business Strategy

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Profit & Wealth Maximization

- Top 5 Key Differences Highlighted

- Calculation Method (Formula)

- Which Approach Is More Sustainable

- How It Impacts Different Stakeholders

- Role Of Decision-Making In Maximization

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Capital Structure

- Top 10 Factors Affecting Capital Structure

- Conclusion

- Frequently Asked Questions (FAQs)

- Defining Working Capital Cycle

- Importance Of Working Capital Cycle

- Components Of Working Capital Cycle

- Steps Of Working Capital Cycle

- Formula Used For Calculation

- Positive vs Negative Working Capital

- Reducing The Cycle

- Conclusion

- Frequently Asked Questions

- What is a Common Size Statement?

- Common Size Statement Format & Formula

- Common Size Statement Analysis

- Importance of Common Size Statement

- Difference Between Common Size and Comparative Statement

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Gordon Growth Model

- Formula & Example Of GGM

- Applications In Investment Valuation

- Gordon Growth Vs. Dividend Discount Model (DDM)

- Pros And Cons Of The Model

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition & Concept Of Maximization

- Importance & Benefits Of Wealth Maximization

- Approaches & Challenges

- Wealth Maximization Vs. Profit Maximization

- Strategies To Implement Wealth Maximization

- Relation Of Psychological Aspects & Wealth

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Investment Decision? (Meaning)

- Key Factors Influencing Investment Decisions

- Importance of Investment Decision

- Exploring Capital Budgeting Methods

- Net Present Value Vs Internal Rate Of Return

- Addressing Inflation Effects

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Discounted Payback Period?

- Understanding The Basic Concept

- Formula & Calculation With Example

- Advantages, Disadvantages And Application

- Payback Vs. Discounted Payback

- Role & Influence Of Decision Rule Explained

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Working Capital Management

- Key Components Of Working Capital

- Importance Of Working Capital Management

- Working Capital Cycle & Formula

- Key Ratios In Working Capital Management

- Factors Influencing Working Capital

- Strategies For Working Capital Management

- Conclusion

- Frequently Asked Questions (FAQs)

- Meaning Of Financial Sources In Business

- Primary And Secondary Sources Of Finance

- Top 7 Sources Of Finance For Business

- Traditional Vs Modern Sources Of Finance

- Classification Of Finance Sources Based On Time Period

- Classification & Impact Based On Ownership

- Strategies For Choosing The Right Sources Of Finance

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Profitability Index?

- Key Features Of PI As A Financial Tool

- Profitability Index Formula

- How To Calculate Profitability Index

- Advantages & Disadvantages Of PI

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Annual Recurring Revenue?

- Importance Of ARR For Business Growth

- Formula And Steps To Calculate ARR

- Differences Between ARR and MRR

- Conclusion

- Frequently Asked Questions

- What Is Capital Budgeting?

- Types & Features Of Capital Budgeting

- Importance Of Capital Budgeting

- Methods Used In Capital Budgeting

- Capital Budgeting Process

- Capital Budgeting Vs. Operational Budgeting

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Financial Statement Analysis?

- Importance & Benefits

- Types Of Financial Statement Analysis

- Methods Of Financial Statement Analysis

- Steps In Financial Statement Analysis

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is The Cost Of Capital?

- Key Components Of Cost Of Capital

- WACC & Formula

- Factors Influencing Cost Of Capital

- Role Of Cost Of Capital In Financial Decisions

- Role In Investment Decisions & Mergers

- Impact On Business Operations & Strategies

- Conclusion

- Frequently Asked Questions

- What Is Internal Rate Of Return (IRR) In Finance?

- Key Concepts Of IRR

- Formula To Calculate Internal Rate Of Return

- Applications Of IRR In Finance

- Limitations & Challenges Of IRR

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Cost of Equity?

- Key Factors Affecting Cost Of Capital

- Role Of Cost Of Equity In Finance

- Methods to Calculate Cost of Equity

- Formula Of Cost Of Equity

- Components Of Cost Of Equity

- Cost Of Equity Vs. Related Financial Concepts

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Ratio Analysis?

- Importance Of Ratio Analysis

- Types Of Financial Ratios Analysis

- Methods Used To Conduct Ratio Analysis

- Applications And Examples

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Net Present Value (NPV)?

- Why Use NPV? Top 5 Benefits

- NPV Formula Explained

- Steps To Calculate NPV With Example

- Positive Vs. Negative NPV

- Advantages And Disadvantages Of NPV

- NPV Vs. Other Financial Metrics

- Conclusion

- Frequently Asked Questions

- What Is The Time Value Of Money?

- Time Value Of Money Formula

- Importance Of Time Value Of Money

- Methods & Techniques Of Time Value of Money

- Relationship Between Opportunity Cost And Time Value

- Inflation's Impact on Time Value

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Financial Management?

- Types of Financial Management

- Importance of Financial Management

- Key Functions Of Financial Management

- Best Practices For Financial Management

- Conclusion

- Frequently Asked Questions

- What Is Leverage In Financial Management?

- Types Of Leverage In Financial Management

- Financial Leverage Formula

- Risks & Benefits Of Financial Leverage

- Conclusion

- Frequently Asked Questions

- What Is A Dividend?

- Types Of Dividends

- Dividend In Financial Management

- Examples Of Dividend

- Impacts Of Dividends On Share Prices

- Reasons Companies Pay or Not Pay Dividends

- Conclusion

- Frequently Asked Questions

Gordon Growth Model (GGM) | Definition, Formula, And Applications

Are you curious about how to predict a company's future dividends? Dive into the world of finance with the Gordon Growth Model and unlock the potential to enhance your investment strategies.

Discover how this formula can help you estimate the value of a stock based on its expected dividends and growth rate. Elevate your financial knowledge and take charge of your investment portfolio today.

Definition Of Gordon Growth Model

The Gordon Growth Model, also known as GGM, is a technique for determining the value of a company's stock by considering the current worth of its upcoming dividend payouts. This model is especially handy for evaluating firms that have consistent increases in dividends over time.

Intrinsic Value

The Gordon Growth Model aims to calculate a stock's true value by looking at predicted future dividend payments.

This model works under the assumption that dividends will continue growing at a steady rate without end.

Constant Dividend Growth

The constant dividend growth assumption in the Gordon Growth Model is crucial for accurately predicting future cash flows. It reflects a scenario in which a company's dividends increase at a stable rate over time.

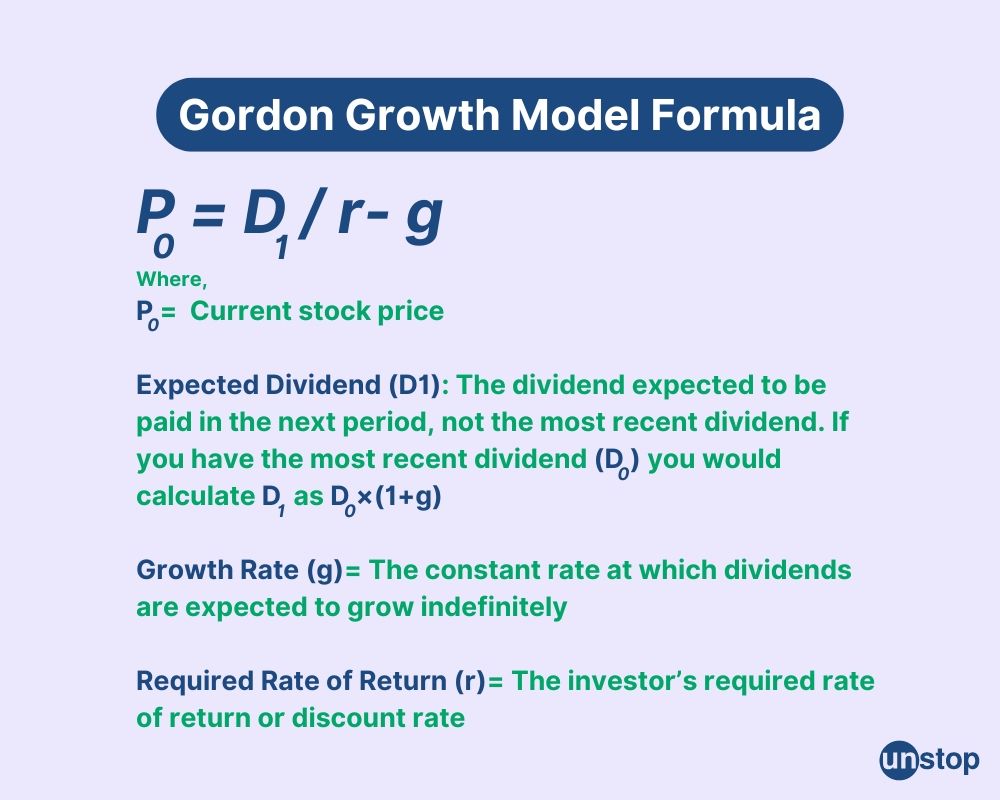

Formula & Example Of GGM

Let us study the formula of the Gordon Growth Model with an example for better clarity:

If a company has just paid a dividend of INR 3 per share, expects dividends to grow at 5% annually, and the required rate of return is 8%, the stock price would be calculated as follows:

Calculate the expected dividend for the next period: D1=D0×(1+g)=3×(1+0.05)=3×1.05=3.15

Apply the GGM formula: P0=D1/r−g=3.15/0.08−0.05=3.15/0.03=105

So, the estimated stock price would be INR 105.

Applications In Investment Valuation

Let us understand the application of the GGM in detail:

Undervalued Stocks

Investors can utilize the Gordon Growth Model as a useful tool for evaluating stocks and pinpointing those that may be undervalued. This method involves calculating a stock's intrinsic value by considering its anticipated dividend growth rate alongside the required rate of return.

This enables investors to pinpoint stocks that are trading below their fair value, presenting an opportunity for capital appreciation.

Role Of Dividends Per Share

Dividends per share play a crucial role in determining the fair value of a stock when applying the Gordon growth model. The model focuses on the dividend discount models, specifically the dividend discount model or dividend capitalization model, which emphasizes the significance of dividends in estimating a stock's worth.

By analyzing a company's dividend yield and dividend strategy, investors can gauge the attractiveness of a stock for long-term investment.

Influence Of Market Conditions

Market conditions significantly impact the application of the Gordon growth model in investment decision-making. Market conditions such as economic outlook, interest rates, and industry trends can affect the stability of dividend stocks and their dividend growth rates.

In times of economic instability or market fluctuations, investors should tweak their predictions and factors in the model for precise stock valuation.

Gordon Growth Vs. Dividend Discount Model (DDM)

Let us study the key differences between the Gordon Growth Model (GGM) and the Dividend Discount Model (DDM):

Dividend Growth Assumptions

GGM: Assumes dividends grow at a constant rate indefinitely.

DDM: Can accommodate multiple growth rates over different periods, allowing for variable or multi-stage growth rates.

Complexity

GGM: Simpler and easier to apply because it uses a single, constant growth rate.

DDM: More complex as it can involve forecasting dividends for multiple periods with different growth rates, making it adaptable to various scenarios.

Applicability

GGM: Best suited for companies with stable, predictable dividend growth.

DDM: Suitable for a broader range of companies, including those with irregular or changing dividend patterns.

Dividend Forecasting

GGM: Requires only the most recent dividend and the growth rate for future dividends.

DDM: Requires detailed forecasting of dividends for each period, especially if there are multiple growth stages.

Use Case Flexibility

GGM: Limited to scenarios where the growth rate of dividends is constant and less than the required rate of return.

DDM: This can be adapted for companies experiencing different growth phases, making it more flexible for various dividend policies and growth expectations.

Pros And Cons Of The Model

Let us study the pros and cons of the Gordon Growth Model:

Pros (Advantages)

-

The Gordon growth model provides a straightforward method for valuing stocks based on expected future dividends.

-

Investors can quickly assess the attractiveness of an investment by considering the relationship between the required rate of return (ROR) and the dividend per share (DPS).

-

Businesses that have consistent dividend payouts and can forecast their growth rates find the Gordon Growth Model especially beneficial.

Cons (Limitations)

-

One main limitation of the Gordon growth model is its assumption of perpetual growth in dividends.

-

This assumption may not hold true in real-world scenarios where companies face financial difficulties or operate in volatile business cycles.

-

Market fluctuations and unforeseen circumstances may hinder a firm's capacity to maintain consistent dividend growth, resulting in errors in assessing stock value.

Conclusion

You have now grasped the essence of the Gordon Growth Model, learned how to calculate it, explored its practical applications in investment valuation, and analyzed its pros and cons. By understanding this model, you can make more informed decisions in assessing the value of investments and guiding your financial strategies effectively.

Take this knowledge and apply it to your investment analyses. Consider the growth rate, required rate of return, and dividends to make sound investment choices. Keep evaluating the model's strengths and weaknesses to refine your decision-making process. Empower yourself with the Gordon Growth Model to navigate the complexities of investment valuation successfully.

Time For A Short Quiz

Frequently Asked Questions (FAQs)

1. How can I apply the Gordon Growth Model in investment valuation?

To apply the Gordon Growth Model in investment valuation, you need to forecast the expected dividend per share, determine the required rate of return, and calculate the present value of future dividends. This model helps estimate the intrinsic value of a stock for investment decisions.

2. List some of the advantages of using the Gordon Growth Model?

The Gordon Growth Model provides a simple and effective way to estimate the intrinsic value of a stock based on its dividends. It is particularly useful for stable companies with consistent dividend payments and can help investors make informed decisions regarding stock investments.

3. Can you explain the formula and calculation involved in the Gordon Growth Model?

To find the intrinsic value of a stock using the Gordon Growth Model, you can use the formula V = D / (r - g). Here, V represents the stock's value, D stands for the expected dividend per share, r is the required rate of return, and g denotes the dividend growth rate. Simply input these values into the equation to determine the stock's estimated value.

4. What are some limitations or drawbacks of using the Gordon Growth Model?

One drawback of the Gordon Growth Model is its assumption of a steady growth rate indefinitely, which may not be applicable to all businesses. It depends significantly on precise forecasts of future dividends and necessitates a consistent track record of dividend payments for effectiveness.

5. How does understanding the Gordon Growth Model benefit investors?

Investors can make better investment decisions by grasping the Gordon Growth Model. It helps in determining a stock's true value through its dividends, enabling investors to gauge if a stock is undervalued or overvalued, thus enhancing their investment strategies.

Suggested reads:

-

Working Capital Cycle | Definition, Importance, Formula And More

-

Factors Affecting Capital Structure | Top 10 Factors Explained

-

Profit Maximization Vs Wealth Maximization- Differences Explained

-

Finance Function: Definition, Components, Functions, Scope & More

-

Fund Flow Statement | Definition, Importance, Format And More

Instinctively, I fall for nature, music, humor, reading, writing, listening, traveling, observing, learning, unlearning, friendship, exercise, etc., all these from the cradle to the grave- that's ME! It's my irrefutable belief in the uniqueness of all. I'll vehemently defend your right to be your best while I expect the same from you!

Login to continue reading

And access exclusive content, personalized recommendations, and career-boosting opportunities.

Subscribe

to our newsletter

Comments

Add comment