- What Is Walter's Model Of Dividend?

- Key Concepts Of Walter's Model

- Dividend Policies

- Walter's Model Formula And Assumptions

- Model Limitations

- Conclusion

- Frequently Asked Questions

- Exploring Cash And Fund Flow

- Importance Of Cash & Fund Flow Statement

- Components Of Cash & Fund Flow Statement

- Exploring The Key Differences With Examples

- Significance And Application

- Advantages And Disadvantages

- Conclusion

- Frequently Asked Questions

- Definition Of Comparative Statement

- Types Of Comparative Statements

- Formulas For Comparative Statement

- Example Of Comparative Income Statement

- Preparing Comparative Statement

- Steps For Income & Balance Sheets

- Understanding Cash Flow Comparisons

- Practical Examples Explained

- Limitations And Considerations

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Dividend Decision

- Key Factors Influencing Dividend Decision

- Objectives Of Dividend Decision

- Theories And Determinants

- Policies Of Dividend Decision

- Conclusion

- Frequently Asked Questions (FAQs)

- Role of Fund Flow Statement Analysis

- Key Objectives of Preparing a Fund Flow Statement

- Importance of a Fund Flow Statement

- How to Prepare a Fund Flow Statement: A Step-by-Step Guide

- Fund Flow Statement vs. Cash Flow Statement

- How Fund Flow Analysis Empowers Investors and Management

- Limitations of a Fund Flow Statement

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Financing Decision

- Types Of Financial Decisions

- Examples Of Financing Decisions

- Key Factors In Financial Decision-Making

- Theories Of Financial Decision

- Analyzing Costs And Risks

- Evaluating Market & Regulatory Impacts

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Finance Function

- Core Components Of Finance Function

- Functions Of Financial Management

- Importance Of Finance Decision

- Scope Of Finance Function

- Objectives Of Financial Management

- Integrating Decisions Into Business Strategy

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Profit & Wealth Maximization

- Top 5 Key Differences Highlighted

- Calculation Method (Formula)

- Which Approach Is More Sustainable

- How It Impacts Different Stakeholders

- Role Of Decision-Making In Maximization

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Capital Structure

- Top 10 Factors Affecting Capital Structure

- Conclusion

- Frequently Asked Questions (FAQs)

- Defining Working Capital Cycle

- Importance Of Working Capital Cycle

- Components Of Working Capital Cycle

- Steps Of Working Capital Cycle

- Formula Used For Calculation

- Positive vs Negative Working Capital

- Reducing The Cycle

- Conclusion

- Frequently Asked Questions

- What is a Common Size Statement?

- Common Size Statement Format & Formula

- Common Size Statement Analysis

- Importance of Common Size Statement

- Difference Between Common Size and Comparative Statement

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Gordon Growth Model

- Formula & Example Of GGM

- Applications In Investment Valuation

- Gordon Growth Vs. Dividend Discount Model (DDM)

- Pros And Cons Of The Model

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition & Concept Of Maximization

- Importance & Benefits Of Wealth Maximization

- Approaches & Challenges

- Wealth Maximization Vs. Profit Maximization

- Strategies To Implement Wealth Maximization

- Relation Of Psychological Aspects & Wealth

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Investment Decision? (Meaning)

- Key Factors Influencing Investment Decisions

- Importance of Investment Decision

- Exploring Capital Budgeting Methods

- Net Present Value Vs Internal Rate Of Return

- Addressing Inflation Effects

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Discounted Payback Period?

- Understanding The Basic Concept

- Formula & Calculation With Example

- Advantages, Disadvantages And Application

- Payback Vs. Discounted Payback

- Role & Influence Of Decision Rule Explained

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Working Capital Management

- Key Components Of Working Capital

- Importance Of Working Capital Management

- Working Capital Cycle & Formula

- Key Ratios In Working Capital Management

- Factors Influencing Working Capital

- Strategies For Working Capital Management

- Conclusion

- Frequently Asked Questions (FAQs)

- Meaning Of Financial Sources In Business

- Primary And Secondary Sources Of Finance

- Top 7 Sources Of Finance For Business

- Traditional Vs Modern Sources Of Finance

- Classification Of Finance Sources Based On Time Period

- Classification & Impact Based On Ownership

- Strategies For Choosing The Right Sources Of Finance

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Profitability Index?

- Key Features Of PI As A Financial Tool

- Profitability Index Formula

- How To Calculate Profitability Index

- Advantages & Disadvantages Of PI

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Annual Recurring Revenue?

- Importance Of ARR For Business Growth

- Formula And Steps To Calculate ARR

- Differences Between ARR and MRR

- Conclusion

- Frequently Asked Questions

- What Is Capital Budgeting?

- Types & Features Of Capital Budgeting

- Importance Of Capital Budgeting

- Methods Used In Capital Budgeting

- Capital Budgeting Process

- Capital Budgeting Vs. Operational Budgeting

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Financial Statement Analysis?

- Importance & Benefits

- Types Of Financial Statement Analysis

- Methods Of Financial Statement Analysis

- Steps In Financial Statement Analysis

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is The Cost Of Capital?

- Key Components Of Cost Of Capital

- WACC & Formula

- Factors Influencing Cost Of Capital

- Role Of Cost Of Capital In Financial Decisions

- Role In Investment Decisions & Mergers

- Impact On Business Operations & Strategies

- Conclusion

- Frequently Asked Questions

- What Is Internal Rate Of Return (IRR) In Finance?

- Key Concepts Of IRR

- Formula To Calculate Internal Rate Of Return

- Applications Of IRR In Finance

- Limitations & Challenges Of IRR

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Cost of Equity?

- Key Factors Affecting Cost Of Capital

- Role Of Cost Of Equity In Finance

- Methods to Calculate Cost of Equity

- Formula Of Cost Of Equity

- Components Of Cost Of Equity

- Cost Of Equity Vs. Related Financial Concepts

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Ratio Analysis?

- Importance Of Ratio Analysis

- Types Of Financial Ratios Analysis

- Methods Used To Conduct Ratio Analysis

- Applications And Examples

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Net Present Value (NPV)?

- Why Use NPV? Top 5 Benefits

- NPV Formula Explained

- Steps To Calculate NPV With Example

- Positive Vs. Negative NPV

- Advantages And Disadvantages Of NPV

- NPV Vs. Other Financial Metrics

- Conclusion

- Frequently Asked Questions

- What Is The Time Value Of Money?

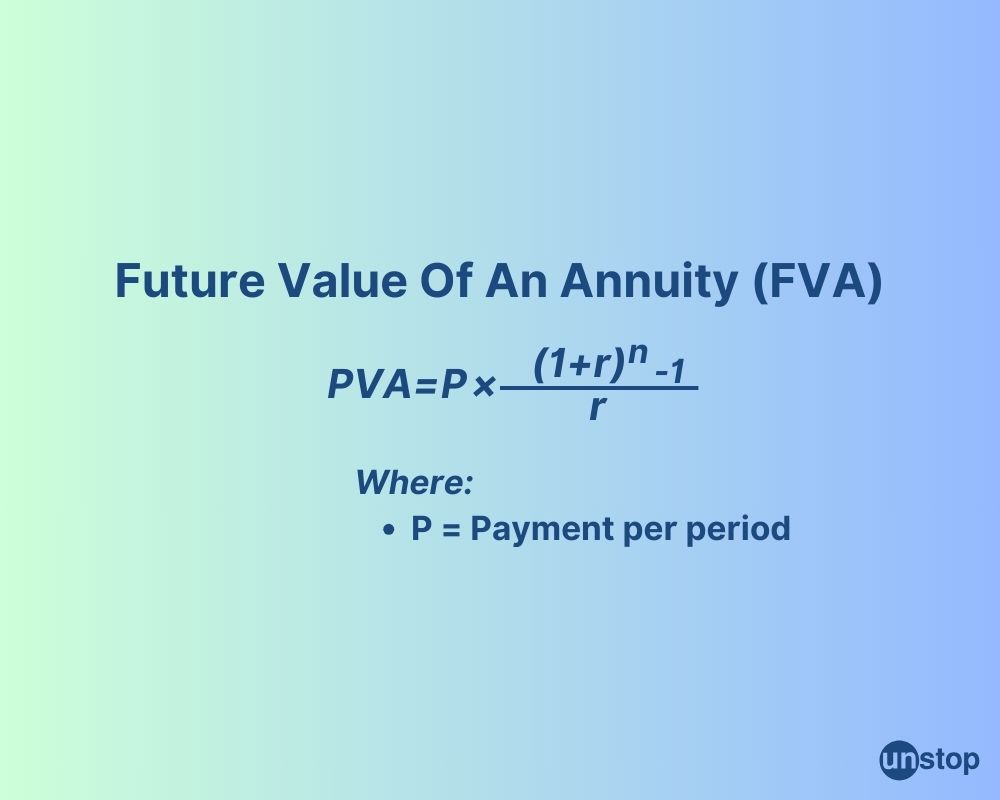

- Time Value Of Money Formula

- Importance Of Time Value Of Money

- Methods & Techniques Of Time Value of Money

- Relationship Between Opportunity Cost And Time Value

- Inflation's Impact on Time Value

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Financial Management?

- Types of Financial Management

- Importance of Financial Management

- Key Functions Of Financial Management

- Best Practices For Financial Management

- Conclusion

- Frequently Asked Questions

- What Is Leverage In Financial Management?

- Types Of Leverage In Financial Management

- Financial Leverage Formula

- Risks & Benefits Of Financial Leverage

- Conclusion

- Frequently Asked Questions

- What Is A Dividend?

- Types Of Dividends

- Dividend In Financial Management

- Examples Of Dividend

- Impacts Of Dividends On Share Prices

- Reasons Companies Pay or Not Pay Dividends

- Conclusion

- Frequently Asked Questions

Time Value Of Money: Definition, Formulas, Importance And Methods

The concept of the time value of money (TVM) explains that having money now is more valuable than having the same amount later because it can earn interest. This idea is essential for making smart choices about investments, saving money, and understanding loans.

Understanding TVM is crucial for anyone looking to make informed financial choices. It empowers you to evaluate opportunities effectively and maximize your wealth over time. Grasping this concept can transform your approach to money management and pave the way for financial success.

What Is The Time Value Of Money?

The time value of money (TVM) is a fundamental financial principle stating that a sum of money has greater value today than it does in the future, given its potential earning capacity. This concept underscores the importance of timing in financial transactions, as money can be invested to earn returns, such as interest or dividends, over time.

TVM explains why financial decisions are sensitive to timing. It provides a framework for understanding that the value of money changes over time due to its earning potential. By considering TVM, individuals and businesses can make more accurate and effective financial decisions.

Concept Of Time Value of Money

The concept of TVM is grounded in three main ideas:

Inflation: Over time, the purchasing power of money erodes due to inflation, making it less valuable in the future than today.

Opportunity Cost: Money can earn returns if invested, so there is a cost associated with not having money available for investment at a given time.

Risk & Uncertainty: Future cash flows are uncertain; thus, a definite amount today is often preferred over a potentially equivalent amount in the future.

Time Value Of Money Formula

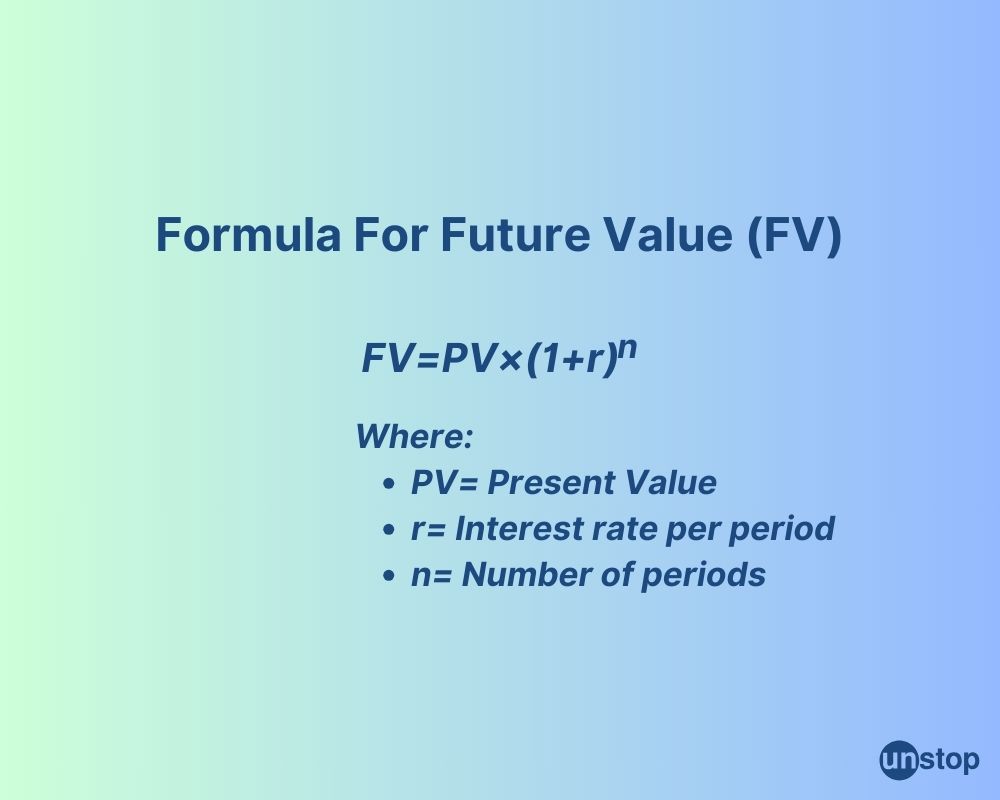

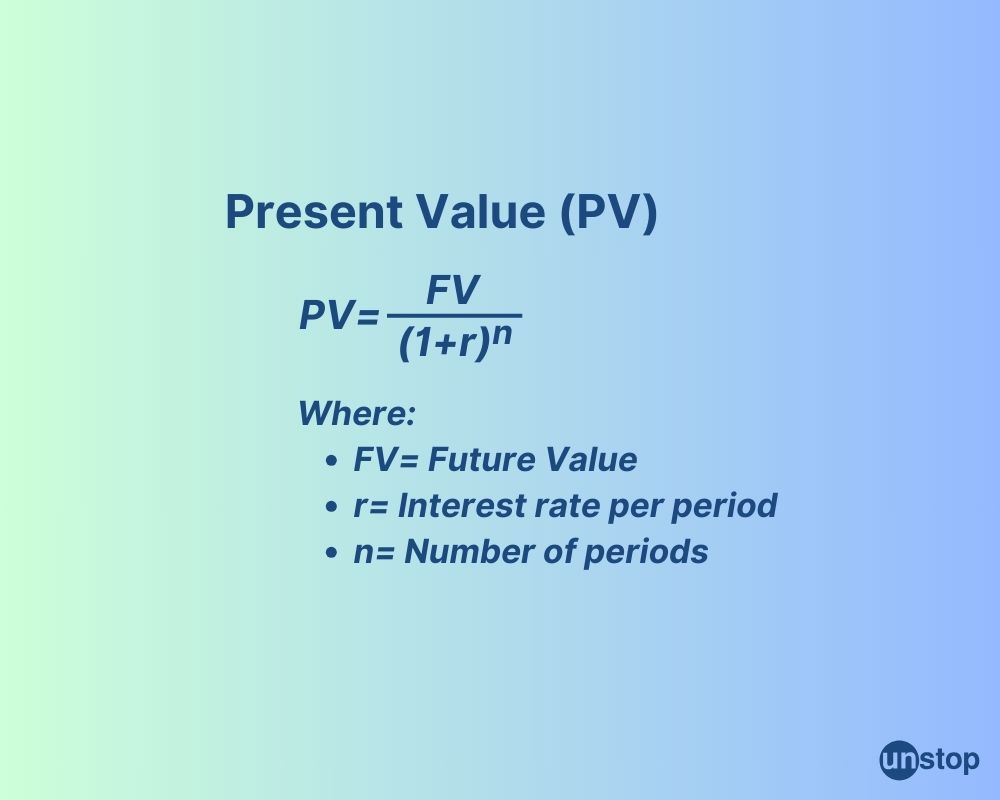

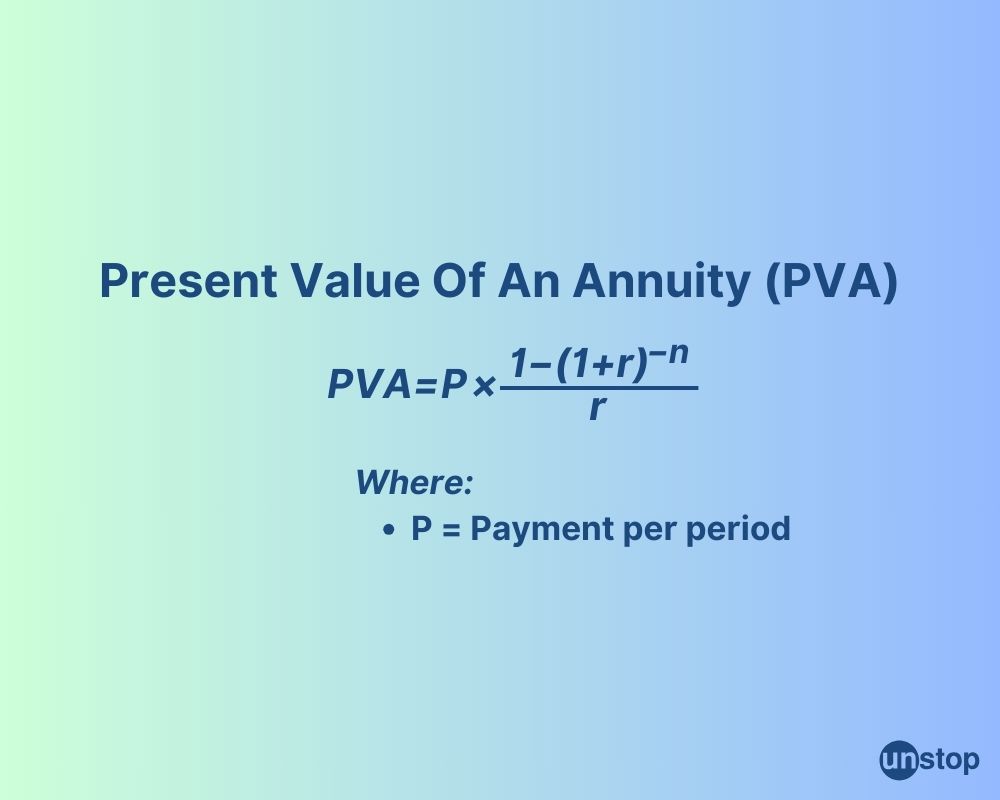

The TVM formula enables the calculation of the present or future value of cash flows, allowing for the assessment of investment opportunities, the cost of loans, and the evaluation of financial plans. Here is the formula:

Future Value (FV)

Present Value (PV)

Present Value of an Annuity (PVA)

Future Value of an Annuity (FVA)

Importance Of Time Value Of Money

In financial management, TVM is pivotal for making informed decisions that maximize value. It is applied in various contexts:

Capital Budgeting

TVM is essential in evaluating the viability of investment projects. By discounting future cash flows to their present value and comparing them with the initial outlay, companies can determine whether a project will yield a satisfactory return.

Investment Decisions

Investors use TVM to compare the present value of future returns from different investment opportunities, helping them choose the most profitable options.

Loan & Debt Management

TVM calculations help determine the actual cost of borrowing and the total interest payable over time, guiding decisions on loans and debt restructuring.

Retirement Planning

Individuals use TVM to estimate the amount they need to save today to reach a desired retirement income, accounting for factors like inflation and expected returns.

Methods & Techniques Of Time Value of Money

The methods and techniques of TVM provide a comprehensive framework for evaluating financial decisions, taking into account the critical factor of time. Let us study some of the important methods and techniques of TVM:

Methods Of TVM

The methods used to calculate TVM include:

Discounting: This method determines the present value of the future value of cash flows by applying a discount rate, accounting for the opportunity cost of capital.

Compounding: Compounding calculates the future value of a present amount by applying an interest rate over time, showing how investments grow.

Annuities: Annuities involve regular payments over time, and TVM methods calculate the present or future value of these payments, considering factors like interest rates and time periods.

Techniques Of TVM

Key techniques include:

Net Present Value (NPV): NPV measures an investment's profitability by subtracting cash outflows from cash inflows.

Internal Rate of Return (IRR): IRR is the rate at which the Net Present Value (NPV) of an investment equals zero. This metric indicates the anticipated yearly return and is useful for evaluating the profitability of different projects.

Payback Period: This technique calculates the time required to recover the initial investment. While simple, it doesn't account for the time value of money beyond the payback period.

Discounted Cash Flow (DCF): DCF is a method used to determine how much future cash flows from an investment are worth today. This approach is crucial for assessing the value of assets, businesses, and various projects.

Relationship Between Opportunity Cost And Time Value

Let us also look at the connection between opportunity cost and the time value of money:

Definition

Opportunity cost is the benefits you miss out on when choosing one option over another. In investment decisions, it's important to think about what you lose by not putting your money into different opportunities. This helps investors see the real cost of their choices.

Delaying Investment

Delaying an investment can significantly impact potential earnings. For example, if someone waits a year to invest INR 1,000, they miss out on interest that could have compounded over time. If that investment returns 5% annually, waiting costs them INR 50 in just one year. The longer the delay, the greater the loss of potential income.

Evaluating Costs

Evaluating opportunity costs is essential for making informed financial choices. Individuals and businesses need to assess different investments and their returns. By doing this, they can identify which options provide the best growth potential. Understanding the difference between immediate consumption and future investment can lead to better decision-making.

Investors should always weigh their options carefully. Each choice carries risks and rewards that can affect overall wealth. Recognizing these factors enhances decision-making power in business and personal finance.

Inflation's Impact on Time Value

Lastly, let us consider the impact of inflation on the time value of money:

Erosion of Purchasing Power

Inflation reduces the purchasing power of money over time. As prices rise, each dollar buys fewer goods and services. This means that money received today is worth more than the same amount in the future. For example, if inflation is at 3% per year, INR 100 today will only have a purchasing power of about INR 97 in a year.

Investment Returns

Understanding how inflation impacts investment returns is essential. When inflation rises, interest rates typically follow suit, which can influence the profitability of investments. If the growth of an investment fails to outpace inflation, its actual value diminishes over time. Therefore, investors need to take this into account when making their financial choices.

Conclusion

Understanding the time value of money is crucial for making smart financial decisions. You've learned its importance, key formulas, and how factors like compounding and inflation affect your money's worth over time. This knowledge empowers you to assess investments, savings, and expenses more effectively.

Now, it's time to put this knowledge into practice. Start calculating present and future values for your financial goals. Explore investment options that leverage the time value of money to maximize your returns. The sooner you act, the more your money can work for you. Don't miss out on the benefits of understanding this fundamental concept.

Time For A Short Quiz

Frequently Asked Questions (FAQs)

1. What is the time value of money?

The time value of money (TVM) is a financial concept stating that a sum of money has greater value now than in the future due to its potential earning capacity. Essentially, money can earn interest, making it more valuable over time.

2. Why is the time value of money important?

Understanding TVM is crucial for effective financial decision-making. It helps individuals and businesses evaluate investments, compare cash flows, and make informed choices about saving and spending.

3. What is the effect of compounding periods on time value?

More frequent compounding periods increase the total amount earned or paid. The more often interest is compounded, the higher the future value due to earning "interest on interest."

4. How does inflation impact the time value of money?

Inflation decreases purchasing power over time. Therefore, when calculating TVM, it's essential to consider inflation rates to accurately assess future cash flows' real value.

Suggested reads:

-

Ratio Analysis: Definition, Importance, Types, And Methodologies

-

Cost Of Equity: Definition, Importance, Calculation And Formula

-

Profitability Index (PI): Definition, Formula, Calculation & More

-

Capital Budgeting: Definition, Types, Importance, Methods & Process

-

Financial Statement Analysis: Definition, Types, Methods And More

Instinctively, I fall for nature, music, humor, reading, writing, listening, traveling, observing, learning, unlearning, friendship, exercise, etc., all these from the cradle to the grave- that's ME! It's my irrefutable belief in the uniqueness of all. I'll vehemently defend your right to be your best while I expect the same from you!

Login to continue reading

And access exclusive content, personalized recommendations, and career-boosting opportunities.

Subscribe

to our newsletter

Comments

Add comment