- What Is Walter's Model Of Dividend?

- Key Concepts Of Walter's Model

- Dividend Policies

- Walter's Model Formula And Assumptions

- Model Limitations

- Conclusion

- Frequently Asked Questions

- Exploring Cash And Fund Flow

- Importance Of Cash & Fund Flow Statement

- Components Of Cash & Fund Flow Statement

- Exploring The Key Differences With Examples

- Significance And Application

- Advantages And Disadvantages

- Conclusion

- Frequently Asked Questions

- Definition Of Comparative Statement

- Types Of Comparative Statements

- Formulas For Comparative Statement

- Example Of Comparative Income Statement

- Preparing Comparative Statement

- Steps For Income & Balance Sheets

- Understanding Cash Flow Comparisons

- Practical Examples Explained

- Limitations And Considerations

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Dividend Decision

- Key Factors Influencing Dividend Decision

- Objectives Of Dividend Decision

- Theories And Determinants

- Policies Of Dividend Decision

- Conclusion

- Frequently Asked Questions (FAQs)

- Role of Fund Flow Statement Analysis

- Key Objectives of Preparing a Fund Flow Statement

- Importance of a Fund Flow Statement

- How to Prepare a Fund Flow Statement: A Step-by-Step Guide

- Fund Flow Statement vs. Cash Flow Statement

- How Fund Flow Analysis Empowers Investors and Management

- Limitations of a Fund Flow Statement

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Financing Decision

- Types Of Financial Decisions

- Examples Of Financing Decisions

- Key Factors In Financial Decision-Making

- Theories Of Financial Decision

- Analyzing Costs And Risks

- Evaluating Market & Regulatory Impacts

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Finance Function

- Core Components Of Finance Function

- Functions Of Financial Management

- Importance Of Finance Decision

- Scope Of Finance Function

- Objectives Of Financial Management

- Integrating Decisions Into Business Strategy

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Profit & Wealth Maximization

- Top 5 Key Differences Highlighted

- Calculation Method (Formula)

- Which Approach Is More Sustainable

- How It Impacts Different Stakeholders

- Role Of Decision-Making In Maximization

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Capital Structure

- Top 10 Factors Affecting Capital Structure

- Conclusion

- Frequently Asked Questions (FAQs)

- Defining Working Capital Cycle

- Importance Of Working Capital Cycle

- Components Of Working Capital Cycle

- Steps Of Working Capital Cycle

- Formula Used For Calculation

- Positive vs Negative Working Capital

- Reducing The Cycle

- Conclusion

- Frequently Asked Questions

- What is a Common Size Statement?

- Common Size Statement Format & Formula

- Common Size Statement Analysis

- Importance of Common Size Statement

- Difference Between Common Size and Comparative Statement

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Gordon Growth Model

- Formula & Example Of GGM

- Applications In Investment Valuation

- Gordon Growth Vs. Dividend Discount Model (DDM)

- Pros And Cons Of The Model

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition & Concept Of Maximization

- Importance & Benefits Of Wealth Maximization

- Approaches & Challenges

- Wealth Maximization Vs. Profit Maximization

- Strategies To Implement Wealth Maximization

- Relation Of Psychological Aspects & Wealth

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Investment Decision? (Meaning)

- Key Factors Influencing Investment Decisions

- Importance of Investment Decision

- Exploring Capital Budgeting Methods

- Net Present Value Vs Internal Rate Of Return

- Addressing Inflation Effects

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Discounted Payback Period?

- Understanding The Basic Concept

- Formula & Calculation With Example

- Advantages, Disadvantages And Application

- Payback Vs. Discounted Payback

- Role & Influence Of Decision Rule Explained

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Working Capital Management

- Key Components Of Working Capital

- Importance Of Working Capital Management

- Working Capital Cycle & Formula

- Key Ratios In Working Capital Management

- Factors Influencing Working Capital

- Strategies For Working Capital Management

- Conclusion

- Frequently Asked Questions (FAQs)

- Meaning Of Financial Sources In Business

- Primary And Secondary Sources Of Finance

- Top 7 Sources Of Finance For Business

- Traditional Vs Modern Sources Of Finance

- Classification Of Finance Sources Based On Time Period

- Classification & Impact Based On Ownership

- Strategies For Choosing The Right Sources Of Finance

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Profitability Index?

- Key Features Of PI As A Financial Tool

- Profitability Index Formula

- How To Calculate Profitability Index

- Advantages & Disadvantages Of PI

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Annual Recurring Revenue?

- Importance Of ARR For Business Growth

- Formula And Steps To Calculate ARR

- Differences Between ARR and MRR

- Conclusion

- Frequently Asked Questions

- What Is Capital Budgeting?

- Types & Features Of Capital Budgeting

- Importance Of Capital Budgeting

- Methods Used In Capital Budgeting

- Capital Budgeting Process

- Capital Budgeting Vs. Operational Budgeting

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Financial Statement Analysis?

- Importance & Benefits

- Types Of Financial Statement Analysis

- Methods Of Financial Statement Analysis

- Steps In Financial Statement Analysis

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is The Cost Of Capital?

- Key Components Of Cost Of Capital

- WACC & Formula

- Factors Influencing Cost Of Capital

- Role Of Cost Of Capital In Financial Decisions

- Role In Investment Decisions & Mergers

- Impact On Business Operations & Strategies

- Conclusion

- Frequently Asked Questions

- What Is Internal Rate Of Return (IRR) In Finance?

- Key Concepts Of IRR

- Formula To Calculate Internal Rate Of Return

- Applications Of IRR In Finance

- Limitations & Challenges Of IRR

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Cost of Equity?

- Key Factors Affecting Cost Of Capital

- Role Of Cost Of Equity In Finance

- Methods to Calculate Cost of Equity

- Formula Of Cost Of Equity

- Components Of Cost Of Equity

- Cost Of Equity Vs. Related Financial Concepts

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Ratio Analysis?

- Importance Of Ratio Analysis

- Types Of Financial Ratios Analysis

- Methods Used To Conduct Ratio Analysis

- Applications And Examples

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Net Present Value (NPV)?

- Why Use NPV? Top 5 Benefits

- NPV Formula Explained

- Steps To Calculate NPV With Example

- Positive Vs. Negative NPV

- Advantages And Disadvantages Of NPV

- NPV Vs. Other Financial Metrics

- Conclusion

- Frequently Asked Questions

- What Is The Time Value Of Money?

- Time Value Of Money Formula

- Importance Of Time Value Of Money

- Methods & Techniques Of Time Value of Money

- Relationship Between Opportunity Cost And Time Value

- Inflation's Impact on Time Value

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Financial Management?

- Types of Financial Management

- Importance of Financial Management

- Key Functions Of Financial Management

- Best Practices For Financial Management

- Conclusion

- Frequently Asked Questions

- What Is Leverage In Financial Management?

- Types Of Leverage In Financial Management

- Financial Leverage Formula

- Risks & Benefits Of Financial Leverage

- Conclusion

- Frequently Asked Questions

- What Is A Dividend?

- Types Of Dividends

- Dividend In Financial Management

- Examples Of Dividend

- Impacts Of Dividends On Share Prices

- Reasons Companies Pay or Not Pay Dividends

- Conclusion

- Frequently Asked Questions

Profit Maximization Vs Wealth Maximization- Differences Explained

Ever wondered about the best approach for financial decision-making: profit maximization or wealth maximization? Delving into these two strategies can shed light on how businesses balance short-term gains with long-term prosperity.

Let's explore the nuances of profit maximization vs wealth maximization to uncover which path leads to sustained success and growth. Which strategy will emerge as the ultimate champion in the quest for financial excellence?

Definition Of Profit & Wealth Maximization

To begin, let us study the definition of profit maximization and wealth maximation:

Profit Maximization

Profit maximization is a financial management strategy aimed at increasing a company's earnings to the highest possible level. This involves optimizing revenue while minimizing costs, ensuring that the difference between total revenue and total costs is at its maximum.

Businesses use strategies like boosting sales, cutting costs, and enhancing efficiency to reach their main goal of maximizing profits. This is crucial for increasing shareholder value and keeping the company financially strong.

Wealth Maximization

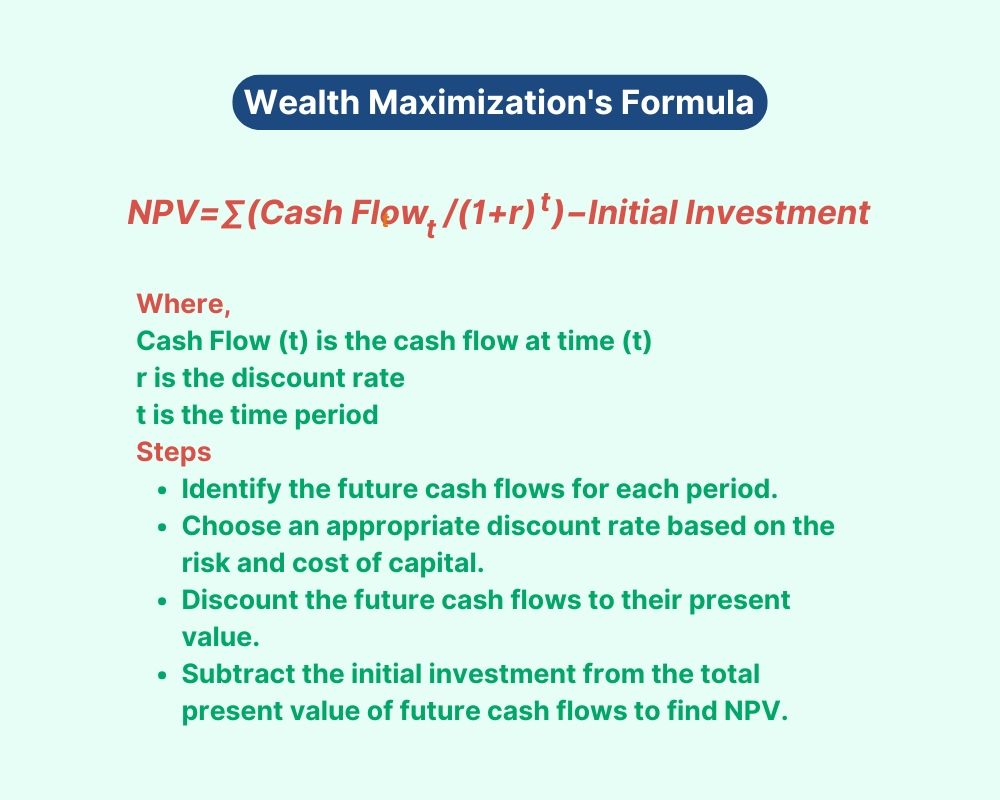

Wealth maximization, also referred to as value maximization or maximizing net present value (NPV), is a financial strategy in managing money that aims to boost the total worth of a company for its shareholders. This method focuses on long-term growth and durability by assessing and executing investments and choices that improve the firm's market value.

Unlike profit maximization, which emphasizes short-term earnings, wealth maximization considers the time value of money, risk factors, and potential future cash flows, ensuring that the firm's value is maximized over time and ultimately leading to increased shareholder wealth.

Importance of Profit Maximization

-

Efficiency Determination: Profit maximization is crucial for determining a company's efficiency in resource allocation and operations.

-

Financial Health: It helps in evaluating the financial health of a business by assessing its ability to generate profits consistently.

-

Investor Confidence: By prioritizing profit maximization, companies can attract investors' confidence through a track record of profitability and sound financial management.

Top 5 Key Differences Highlighted

Let us study the top five (5) core differences between profit maximization and wealth maximization:

Time Horizon

Profit Maximization: Focuses on short-term earnings and immediate profits, often prioritizing quick gains.

Wealth Maximization: Emphasizes long-term growth and sustainability, considering future cash flows and overall value creation.

Risk Consideration

Profit Maximization: Often overlooks the risk and uncertainty associated with business decisions.

Wealth Maximization: Takes into account risk and uncertainty, aiming to achieve the best possible return for a given level of risk.

Measurement Focus

Profit Maximization: Measures success by the level of profits generated within a specific period.

Wealth Maximization: Measures success by the increase in the company's market value and shareholder wealth over time.

Decision Criteria

Profit Maximization: Decisions are based on maximizing immediate profits, sometimes at the expense of long-term benefits.

Wealth Maximization: Decisions are based on net present value (NPV) and the potential for future cash flows, ensuring long-term benefits and value creation.

Stakeholder Consideration

Profit Maximization: Primarily considers the interests of the company's owners or shareholders with a narrow focus on profit.

Wealth Maximization: Considers a broader range of stakeholders, including shareholders, employees, customers, and the community, aiming for sustainable and balanced growth.

These differences highlight the broader and more comprehensive approach to wealth maximization compared to the narrower focus on profit maximization.

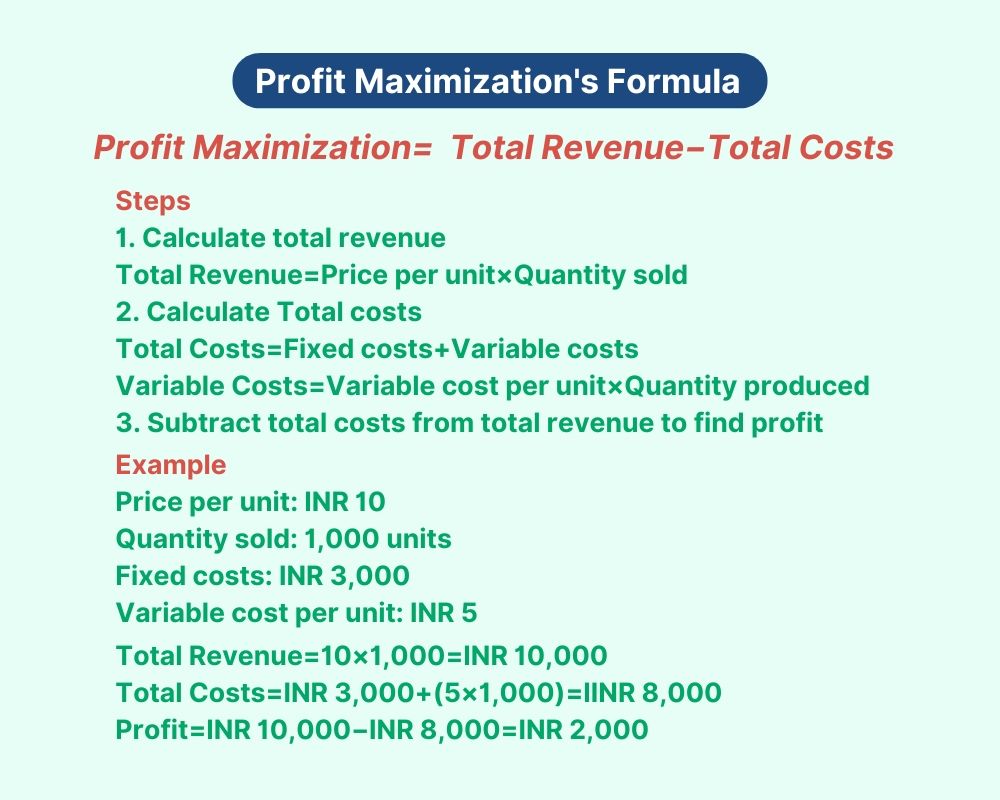

Calculation Method (Formula)

Let us understand the calculation method or formula for profit maximization and wealth maximization:

Formula For Profit Maximization

Profit maximization focuses on increasing the difference between total revenue and total costs. The basic calculation involves:

Formula For Wealth Maximization

Wealth maximization, or Net Present Value (NPV) maximization, focuses on the present value of future cash flows. The basic calculation involves:

Which Approach Is More Sustainable

Let us study the sustainability of these two approaches used in maximization:

-

Profit Maximization focuses on short-term gains by increasing revenue and minimizing costs. However, this approach may not be sustainable in the long run as it can compromise quality or ethical standards.

-

Wealth Maximization, on the other hand, aims for long-term growth and value creation. By focusing on increasing the overall wealth of shareholders, it ensures sustained success and stability over time.

How It Impacts Different Stakeholders

-

Profit maximization primarily benefits shareholders through increased dividends and stock prices. It can, however, lead to negative consequences for employees, customers, and the community if achieved at the expense of fair wages, product quality, or social responsibility.

-

Wealth maximization considers the interests of all stakeholders, including employees, customers, suppliers, and the environment. This approach fosters a more holistic view of success by balancing financial gains with social and environmental responsibilities.

Role Of Decision-Making In Maximization

-

Effective financial decision-making is crucial for both profit maximization and wealth maximization. It involves a careful study of various factors such as market conditions, competition, risks, and opportunities to optimize profits or create sustainable wealth.

-

Seasoned finance professionals often rely on their expertise in financial analysis, risk assessment, and resource allocation to make informed decisions that align with the firm's objectives.

Conclusion

Understanding the difference between profit maximization and wealth maximization is crucial for making informed financial decisions that support your goals. By grasping the key distinctions between these two approaches, you can enhance your understanding and stay ahead in your financial pursuits. Explore additional resources to deepen your knowledge in this area.

Explore further to expand your knowledge and apply these principles effectively in your financial strategies. Keep learning and adapting to optimize your financial outcomes. Stay informed, stay proactive, and continue exploring the nuances of profit maximization and wealth maximization to secure a prosperous future.

Time For A Short Quiz

Frequently Asked Questions (FAQs)

1. What is profit maximization?

Profit maximization is a financial management strategy aimed at increasing a company's earnings to the highest possible level. This involves optimizing revenue while minimizing costs, ensuring that the difference between total revenue and total costs is at its maximum.

2. How does wealth maximization differ from profit maximization?

Wealth maximization focuses on increasing the long-term value of a business for its shareholders, whereas profit maximization concentrates on short-term gains and maximizing profits at a specific point in time.

3. Which approach is more sustainable for a business, profit maximization or wealth maximization?

Wealth maximization is considered more sustainable as it emphasizes long-term growth and value creation. By focusing on increasing overall wealth, businesses can ensure stability and growth over an extended period, benefiting both shareholders and stakeholders.

4. How do profit maximization and wealth maximization impact decision-making within a company?

Profit maximization tends to lead to decisions that prioritize short-term gains, such as cost-cutting measures that may affect product quality. In contrast, wealth maximization encourages strategic decisions that consider long-term implications on financial health and sustainability.

5. Can a company pursue both profit maximization and wealth maximization simultaneously?

While companies often aim to maximize both profit and wealth, conflicts may arise between short-term profitability and long-term value creation. Balancing these objectives requires careful planning and decision-making to ensure sustainable growth and profitability over time.

Suggested reads:

-

Financing Decision: Definition, Types, Factors & Theories Explained

-

Fund Flow Statement | Definition, Importance, Format And More

-

Difference Between Cash Flow Statement And Fund Flow Statement

-

Finance Function: Definition, Components, Functions, Scope & More

-

Walter's Model Of Dividend | Formula, Assumptions And Limitations

Instinctively, I fall for nature, music, humor, reading, writing, listening, traveling, observing, learning, unlearning, friendship, exercise, etc., all these from the cradle to the grave- that's ME! It's my irrefutable belief in the uniqueness of all. I'll vehemently defend your right to be your best while I expect the same from you!

Login to continue reading

And access exclusive content, personalized recommendations, and career-boosting opportunities.

Subscribe

to our newsletter

Comments

Add comment