- What Is Walter's Model Of Dividend?

- Key Concepts Of Walter's Model

- Dividend Policies

- Walter's Model Formula And Assumptions

- Model Limitations

- Conclusion

- Frequently Asked Questions

- Exploring Cash And Fund Flow

- Importance Of Cash & Fund Flow Statement

- Components Of Cash & Fund Flow Statement

- Exploring The Key Differences With Examples

- Significance And Application

- Advantages And Disadvantages

- Conclusion

- Frequently Asked Questions

- Definition Of Comparative Statement

- Types Of Comparative Statements

- Formulas For Comparative Statement

- Example Of Comparative Income Statement

- Preparing Comparative Statement

- Steps For Income & Balance Sheets

- Understanding Cash Flow Comparisons

- Practical Examples Explained

- Limitations And Considerations

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Dividend Decision

- Key Factors Influencing Dividend Decision

- Objectives Of Dividend Decision

- Theories And Determinants

- Policies Of Dividend Decision

- Conclusion

- Frequently Asked Questions (FAQs)

- Role of Fund Flow Statement Analysis

- Key Objectives of Preparing a Fund Flow Statement

- Importance of a Fund Flow Statement

- How to Prepare a Fund Flow Statement: A Step-by-Step Guide

- Fund Flow Statement vs. Cash Flow Statement

- How Fund Flow Analysis Empowers Investors and Management

- Limitations of a Fund Flow Statement

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Financing Decision

- Types Of Financial Decisions

- Examples Of Financing Decisions

- Key Factors In Financial Decision-Making

- Theories Of Financial Decision

- Analyzing Costs And Risks

- Evaluating Market & Regulatory Impacts

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Finance Function

- Core Components Of Finance Function

- Functions Of Financial Management

- Importance Of Finance Decision

- Scope Of Finance Function

- Objectives Of Financial Management

- Integrating Decisions Into Business Strategy

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Profit & Wealth Maximization

- Top 5 Key Differences Highlighted

- Calculation Method (Formula)

- Which Approach Is More Sustainable

- How It Impacts Different Stakeholders

- Role Of Decision-Making In Maximization

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Capital Structure

- Top 10 Factors Affecting Capital Structure

- Conclusion

- Frequently Asked Questions (FAQs)

- Defining Working Capital Cycle

- Importance Of Working Capital Cycle

- Components Of Working Capital Cycle

- Steps Of Working Capital Cycle

- Formula Used For Calculation

- Positive vs Negative Working Capital

- Reducing The Cycle

- Conclusion

- Frequently Asked Questions

- What is a Common Size Statement?

- Common Size Statement Format & Formula

- Common Size Statement Analysis

- Importance of Common Size Statement

- Difference Between Common Size and Comparative Statement

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Gordon Growth Model

- Formula & Example Of GGM

- Applications In Investment Valuation

- Gordon Growth Vs. Dividend Discount Model (DDM)

- Pros And Cons Of The Model

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition & Concept Of Maximization

- Importance & Benefits Of Wealth Maximization

- Approaches & Challenges

- Wealth Maximization Vs. Profit Maximization

- Strategies To Implement Wealth Maximization

- Relation Of Psychological Aspects & Wealth

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Investment Decision? (Meaning)

- Key Factors Influencing Investment Decisions

- Importance of Investment Decision

- Exploring Capital Budgeting Methods

- Net Present Value Vs Internal Rate Of Return

- Addressing Inflation Effects

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Discounted Payback Period?

- Understanding The Basic Concept

- Formula & Calculation With Example

- Advantages, Disadvantages And Application

- Payback Vs. Discounted Payback

- Role & Influence Of Decision Rule Explained

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Working Capital Management

- Key Components Of Working Capital

- Importance Of Working Capital Management

- Working Capital Cycle & Formula

- Key Ratios In Working Capital Management

- Factors Influencing Working Capital

- Strategies For Working Capital Management

- Conclusion

- Frequently Asked Questions (FAQs)

- Meaning Of Financial Sources In Business

- Primary And Secondary Sources Of Finance

- Top 7 Sources Of Finance For Business

- Traditional Vs Modern Sources Of Finance

- Classification Of Finance Sources Based On Time Period

- Classification & Impact Based On Ownership

- Strategies For Choosing The Right Sources Of Finance

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Profitability Index?

- Key Features Of PI As A Financial Tool

- Profitability Index Formula

- How To Calculate Profitability Index

- Advantages & Disadvantages Of PI

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Annual Recurring Revenue?

- Importance Of ARR For Business Growth

- Formula And Steps To Calculate ARR

- Differences Between ARR and MRR

- Conclusion

- Frequently Asked Questions

- What Is Capital Budgeting?

- Types & Features Of Capital Budgeting

- Importance Of Capital Budgeting

- Methods Used In Capital Budgeting

- Capital Budgeting Process

- Capital Budgeting Vs. Operational Budgeting

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Financial Statement Analysis?

- Importance & Benefits

- Types Of Financial Statement Analysis

- Methods Of Financial Statement Analysis

- Steps In Financial Statement Analysis

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is The Cost Of Capital?

- Key Components Of Cost Of Capital

- WACC & Formula

- Factors Influencing Cost Of Capital

- Role Of Cost Of Capital In Financial Decisions

- Role In Investment Decisions & Mergers

- Impact On Business Operations & Strategies

- Conclusion

- Frequently Asked Questions

- What Is Internal Rate Of Return (IRR) In Finance?

- Key Concepts Of IRR

- Formula To Calculate Internal Rate Of Return

- Applications Of IRR In Finance

- Limitations & Challenges Of IRR

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Cost of Equity?

- Key Factors Affecting Cost Of Capital

- Role Of Cost Of Equity In Finance

- Methods to Calculate Cost of Equity

- Formula Of Cost Of Equity

- Components Of Cost Of Equity

- Cost Of Equity Vs. Related Financial Concepts

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Ratio Analysis?

- Importance Of Ratio Analysis

- Types Of Financial Ratios Analysis

- Methods Used To Conduct Ratio Analysis

- Applications And Examples

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Net Present Value (NPV)?

- Why Use NPV? Top 5 Benefits

- NPV Formula Explained

- Steps To Calculate NPV With Example

- Positive Vs. Negative NPV

- Advantages And Disadvantages Of NPV

- NPV Vs. Other Financial Metrics

- Conclusion

- Frequently Asked Questions

- What Is The Time Value Of Money?

- Time Value Of Money Formula

- Importance Of Time Value Of Money

- Methods & Techniques Of Time Value of Money

- Relationship Between Opportunity Cost And Time Value

- Inflation's Impact on Time Value

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Financial Management?

- Types of Financial Management

- Importance of Financial Management

- Key Functions Of Financial Management

- Best Practices For Financial Management

- Conclusion

- Frequently Asked Questions

- What Is Leverage In Financial Management?

- Types Of Leverage In Financial Management

- Financial Leverage Formula

- Risks & Benefits Of Financial Leverage

- Conclusion

- Frequently Asked Questions

- What Is A Dividend?

- Types Of Dividends

- Dividend In Financial Management

- Examples Of Dividend

- Impacts Of Dividends On Share Prices

- Reasons Companies Pay or Not Pay Dividends

- Conclusion

- Frequently Asked Questions

Cost Of Capital: Definition, Components, Factors, Formula And Role

The cost of capital is an essential concept in finance, used to evaluate the feasibility of investments and make decisions regarding capital budgeting. Essentially, it reflects the opportunity cost of investing resources in one project over another and helps determine the minimum acceptable return on investments.

What Is The Cost Of Capital?

The cost of capital is the rate of return required by investors or creditors to provide capital to a business. It is the cost of obtaining funds, whether through equity or debt and includes the returns expected by shareholders and the interest expenses on debt. It ensures that projects cover their costs and generate profits.

Key Components Of Cost Of Capital

Let us study some of the key components of the cost of capital:

Cost of Debt: The effective rate that a company pays on its borrowed funds. It includes interest expenses and any associated fees. The cost of debt can be computed before or after tax, as interest payments are tax-deductible.

Cost of Equity: The return required by equity investors for holding a company's stock. It compensates shareholders for the risk of owning shares in the company.

Cost of Preferred Stock: The return required by preferred shareholders, who receive fixed dividends before common shareholders.

Risk-Free Rate: The return on an investment with zero risk, typically represented by government bonds.

Market Risk Premium: The market risk premium refers to the extra return that investors anticipate when they opt to invest in the stock market instead of a safer, risk-free asset.

Beta: A measure of a stock's volatility and risk relative to the overall market.

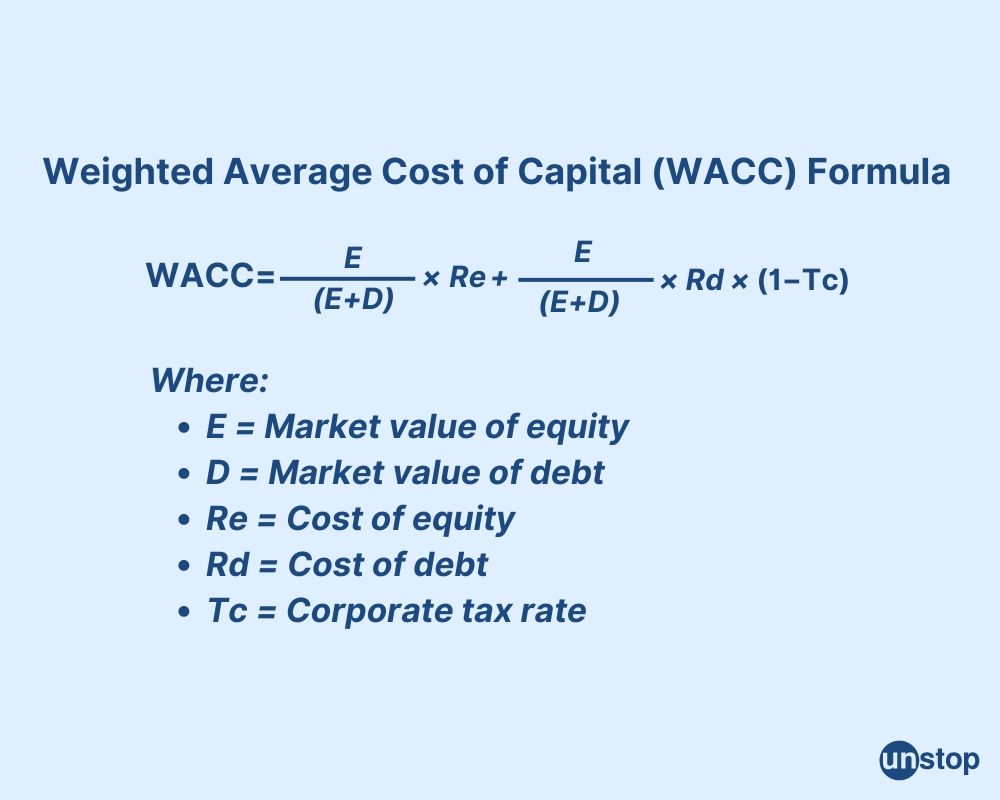

WACC & Formula

Weighted Average Cost of Capital (WACC) serves as a metric that reflects the average cost of capital sources. It combines the costs of equity and debt, weighted by their respective proportions in the overall capital structure. This metric helps businesses understand how much it costs to finance operations through various sources.

The formula is:

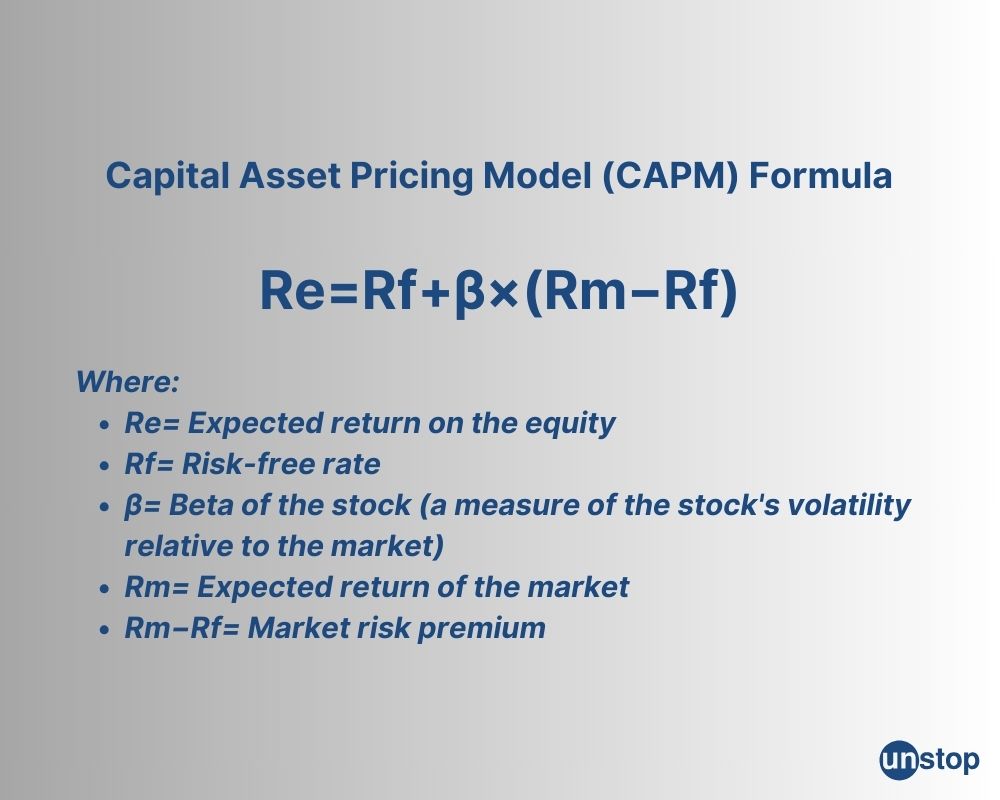

CAPM & Formula

Capital Asset Pricing Model (CAPM) is a common method to estimate the cost of equity. This formula calculates expected returns based on market risk.

The formula is:

Factors Influencing Cost Of Capital

Let us look at some of the factors that influence the cost of capital:

Market Conditions

The cost of capital is heavily influenced by market conditions. Borrowing becomes more expensive if the interest rate shoots up, leading to an increase in debt costs. This shift can change how companies approach their funding and may alter their ideal capital structures.

Economic stability also matters. In uncertain times, lenders may demand higher returns, raising the overall cost.

Credit Rating

A company's credit rating influences its ability to borrow money. Higher ratings typically lead to lower borrowing costs. Lenders view these companies as less risky.

A lower credit rating results in higher interest rates, increasing overall costs. Companies must manage their credit ratings carefully to maintain an optimal capital structure.

Industry-Specific Risks

Each industry carries unique risks that shape the cost of capital. For instance, technology firms may face rapid changes, while utility companies enjoy stable cash flows. These factors affect funding sources and project financing strategies.

Companies in volatile industries often incur higher costs due to increased risk perceptions from investors and lenders. Understanding these industry-specific risks helps businesses make informed decisions about their capital structure choices.

Role Of Cost Of Capital In Financial Decisions

Let us study the role of cost of capital in financial decisions:

Profitability Necessity

Investments must exceed the cost of capital to be profitable. Companies evaluate potential projects based on this metric.

If a project's return is lower than the cost, it will not generate value. This principle applies to all capital investments, from small projects to significant capital investment ventures.

Performance Benchmarks

The cost of capital serves as a performance benchmark for business projects. It helps businesses determine if their returns are adequate.

Companies compare actual project outcomes against their expected returns. This comparison informs whether to proceed with future capital budgeting decisions.

Strategic Planning

Strategic planning relies on understanding the cost of capital. Firms use this knowledge for effective capital management and resource allocation.

By knowing their cost of capital, companies can prioritize projects that offer higher returns. This leads to better capital structure optimization and enhances overall financial health.

Decision-Making Tool

The cost of capital acts as a decision-making tool in corporate finance. It influences how firms approach their capital budgeting processes. Companies assess risks and returns more effectively by considering this figure. It ultimately shapes long-term strategies and growth plans.

Role In Investment Decisions & Mergers

Let us also study the role of the cost of capital in investment decisions and mergers:

Hurdle Rate

The cost of capital acts as a hurdle rate for new investments. Investors use it to evaluate potential investment projects. If the expected return on a project is lower than this cost, the project may not be pursued.

Analysts assess whether the investment can generate returns above this threshold. This assessment helps in deciding which initiatives to fund.

Mergers and Acquisitions

In merger and acquisition evaluations, the cost of capital plays a critical role. Companies must determine if an acquisition will create value for shareholders. They compare the cost of financing the acquisition against expected returns.

A higher cost of capital may lead to a reassessment of the deal's viability. Thus, it influences strategic decisions regarding acquisitions.

Shareholder Value

The cost of capital impacts shareholder value directly. Companies aim to maximize returns on their assets while keeping costs low. When companies successfully manage their cost of capital, they enhance corporate growth strategies.

This management leads to increased share prices over time. Investors are more likely to support firms that effectively balance risk and return.

Impact On Business Operations & Strategies

Lastly, let us study the impact of the cost of capital on business operations and strategies:

Financing Decisions

Businesses often rely on the cost of capital to make financing decisions. This cost affects their choice between debt and equity. A lower cost of capital can lead to more borrowing, while a higher cost may push firms to seek equity financing instead.

For example, if a company's cost of capital increases, it might delay purchasing new equipment.

Strategic Planning

The cost of capital shapes long-term strategic planning. Companies assess this cost when forecasting future projects.

A higher cost can signal increased risk, leading management to reconsider expansion plans. Firms may opt for less risky projects or adjust their capital structure to maintain profitability.

Operational Adjustments

Changes in the cost of capital force businesses to adjust their operations. When costs rise, companies often cut operational expenses.

They may reduce staff or limit spending on software and technology upgrades. This adjustment helps maintain cash flow and aligns with the new financial reality.

Conclusion

The cost of capital influences everything from investment choices to business strategies. By grasping key concepts like WACC, cost of debt, and cost of equity, you can better assess your financial landscape. Recognizing the factors that impact these costs helps you navigate challenges and seize opportunities.

Stay informed and proactive. Regularly evaluate your company's cost of capital to ensure optimal performance. This knowledge empowers you to make strategic moves that align with your goals. Dive deeper into this topic and leverage it for your success. Your financial future depends on it!

Put your learnings to the test!

Frequently Asked Questions

1. What is the cost of capital?

The cost of capital represents the return a company needs to earn to satisfy its investors. It includes costs associated with debt and equity financing.

2. Why is the cost of capital important?

Understanding the cost of capital helps businesses make informed investment decisions. It ensures that projects generate returns exceeding their financing costs.

3. What factors influence the cost of capital?

Factors include interest rates, market conditions, business risk, and investor expectations. Each affects how much return investors demand for their investment.

4. How does the cost of debt differ from the cost of equity?

Debt usually comes with a lower cost compared to equity because lenders face less risk and benefit from tax advantages. In contrast, investors in equity anticipate higher returns since they take on more risks.

5. Can a company reduce its cost of capital?

Yes, companies can reduce their cost of capital by improving credit ratings, optimizing their capital structure, or increasing operational efficiency.

6. What role does the cost of capital play in mergers and acquisitions?

In mergers and acquisitions, understanding the cost of capital helps determine if a deal will create value. It assesses whether expected returns exceed financing costs.

Suggested Reads:

Instinctively, I fall for nature, music, humor, reading, writing, listening, traveling, observing, learning, unlearning, friendship, exercise, etc., all these from the cradle to the grave- that's ME! It's my irrefutable belief in the uniqueness of all. I'll vehemently defend your right to be your best while I expect the same from you!

Login to continue reading

And access exclusive content, personalized recommendations, and career-boosting opportunities.

Subscribe

to our newsletter

Comments

Add comment