- What Is Walter's Model Of Dividend?

- Key Concepts Of Walter's Model

- Dividend Policies

- Walter's Model Formula And Assumptions

- Model Limitations

- Conclusion

- Frequently Asked Questions

- Exploring Cash And Fund Flow

- Importance Of Cash & Fund Flow Statement

- Components Of Cash & Fund Flow Statement

- Exploring The Key Differences With Examples

- Significance And Application

- Advantages And Disadvantages

- Conclusion

- Frequently Asked Questions

- Definition Of Comparative Statement

- Types Of Comparative Statements

- Formulas For Comparative Statement

- Example Of Comparative Income Statement

- Preparing Comparative Statement

- Steps For Income & Balance Sheets

- Understanding Cash Flow Comparisons

- Practical Examples Explained

- Limitations And Considerations

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Dividend Decision

- Key Factors Influencing Dividend Decision

- Objectives Of Dividend Decision

- Theories And Determinants

- Policies Of Dividend Decision

- Conclusion

- Frequently Asked Questions (FAQs)

- Role of Fund Flow Statement Analysis

- Key Objectives of Preparing a Fund Flow Statement

- Importance of a Fund Flow Statement

- How to Prepare a Fund Flow Statement: A Step-by-Step Guide

- Fund Flow Statement vs. Cash Flow Statement

- How Fund Flow Analysis Empowers Investors and Management

- Limitations of a Fund Flow Statement

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Financing Decision

- Types Of Financial Decisions

- Examples Of Financing Decisions

- Key Factors In Financial Decision-Making

- Theories Of Financial Decision

- Analyzing Costs And Risks

- Evaluating Market & Regulatory Impacts

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Finance Function

- Core Components Of Finance Function

- Functions Of Financial Management

- Importance Of Finance Decision

- Scope Of Finance Function

- Objectives Of Financial Management

- Integrating Decisions Into Business Strategy

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Profit & Wealth Maximization

- Top 5 Key Differences Highlighted

- Calculation Method (Formula)

- Which Approach Is More Sustainable

- How It Impacts Different Stakeholders

- Role Of Decision-Making In Maximization

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Capital Structure

- Top 10 Factors Affecting Capital Structure

- Conclusion

- Frequently Asked Questions (FAQs)

- Defining Working Capital Cycle

- Importance Of Working Capital Cycle

- Components Of Working Capital Cycle

- Steps Of Working Capital Cycle

- Formula Used For Calculation

- Positive vs Negative Working Capital

- Reducing The Cycle

- Conclusion

- Frequently Asked Questions

- What is a Common Size Statement?

- Common Size Statement Format & Formula

- Common Size Statement Analysis

- Importance of Common Size Statement

- Difference Between Common Size and Comparative Statement

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Gordon Growth Model

- Formula & Example Of GGM

- Applications In Investment Valuation

- Gordon Growth Vs. Dividend Discount Model (DDM)

- Pros And Cons Of The Model

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition & Concept Of Maximization

- Importance & Benefits Of Wealth Maximization

- Approaches & Challenges

- Wealth Maximization Vs. Profit Maximization

- Strategies To Implement Wealth Maximization

- Relation Of Psychological Aspects & Wealth

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Investment Decision? (Meaning)

- Key Factors Influencing Investment Decisions

- Importance of Investment Decision

- Exploring Capital Budgeting Methods

- Net Present Value Vs Internal Rate Of Return

- Addressing Inflation Effects

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Discounted Payback Period?

- Understanding The Basic Concept

- Formula & Calculation With Example

- Advantages, Disadvantages And Application

- Payback Vs. Discounted Payback

- Role & Influence Of Decision Rule Explained

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Working Capital Management

- Key Components Of Working Capital

- Importance Of Working Capital Management

- Working Capital Cycle & Formula

- Key Ratios In Working Capital Management

- Factors Influencing Working Capital

- Strategies For Working Capital Management

- Conclusion

- Frequently Asked Questions (FAQs)

- Meaning Of Financial Sources In Business

- Primary And Secondary Sources Of Finance

- Top 7 Sources Of Finance For Business

- Traditional Vs Modern Sources Of Finance

- Classification Of Finance Sources Based On Time Period

- Classification & Impact Based On Ownership

- Strategies For Choosing The Right Sources Of Finance

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Profitability Index?

- Key Features Of PI As A Financial Tool

- Profitability Index Formula

- How To Calculate Profitability Index

- Advantages & Disadvantages Of PI

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Annual Recurring Revenue?

- Importance Of ARR For Business Growth

- Formula And Steps To Calculate ARR

- Differences Between ARR and MRR

- Conclusion

- Frequently Asked Questions

- What Is Capital Budgeting?

- Types & Features Of Capital Budgeting

- Importance Of Capital Budgeting

- Methods Used In Capital Budgeting

- Capital Budgeting Process

- Capital Budgeting Vs. Operational Budgeting

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Financial Statement Analysis?

- Importance & Benefits

- Types Of Financial Statement Analysis

- Methods Of Financial Statement Analysis

- Steps In Financial Statement Analysis

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is The Cost Of Capital?

- Key Components Of Cost Of Capital

- WACC & Formula

- Factors Influencing Cost Of Capital

- Role Of Cost Of Capital In Financial Decisions

- Role In Investment Decisions & Mergers

- Impact On Business Operations & Strategies

- Conclusion

- Frequently Asked Questions

- What Is Internal Rate Of Return (IRR) In Finance?

- Key Concepts Of IRR

- Formula To Calculate Internal Rate Of Return

- Applications Of IRR In Finance

- Limitations & Challenges Of IRR

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Cost of Equity?

- Key Factors Affecting Cost Of Capital

- Role Of Cost Of Equity In Finance

- Methods to Calculate Cost of Equity

- Formula Of Cost Of Equity

- Components Of Cost Of Equity

- Cost Of Equity Vs. Related Financial Concepts

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Ratio Analysis?

- Importance Of Ratio Analysis

- Types Of Financial Ratios Analysis

- Methods Used To Conduct Ratio Analysis

- Applications And Examples

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Net Present Value (NPV)?

- Why Use NPV? Top 5 Benefits

- NPV Formula Explained

- Steps To Calculate NPV With Example

- Positive Vs. Negative NPV

- Advantages And Disadvantages Of NPV

- NPV Vs. Other Financial Metrics

- Conclusion

- Frequently Asked Questions

- What Is The Time Value Of Money?

- Time Value Of Money Formula

- Importance Of Time Value Of Money

- Methods & Techniques Of Time Value of Money

- Relationship Between Opportunity Cost And Time Value

- Inflation's Impact on Time Value

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Financial Management?

- Types of Financial Management

- Importance of Financial Management

- Key Functions Of Financial Management

- Best Practices For Financial Management

- Conclusion

- Frequently Asked Questions

- What Is Leverage In Financial Management?

- Types Of Leverage In Financial Management

- Financial Leverage Formula

- Risks & Benefits Of Financial Leverage

- Conclusion

- Frequently Asked Questions

- What Is A Dividend?

- Types Of Dividends

- Dividend In Financial Management

- Examples Of Dividend

- Impacts Of Dividends On Share Prices

- Reasons Companies Pay or Not Pay Dividends

- Conclusion

- Frequently Asked Questions

Profitability Index (PI): Definition, Formula, Calculation & More

Profitability Index (PI) is an important financial tool that helps investors and managers prioritize projects, especially in scenarios where resources are limited. It ensures that investments are directed towards opportunities that generate the highest returns relative to their costs.

In this article, we will delve into the varuios aspects of PI including the definition, features, formula, applications etc.

What Is Profitability Index?

The Profitability Index, also referred to as the Profit Investment Ratio or Value Investment Ratio is an essential financial tool used to evaluate the attractiveness and feasibility of an investment or project.

This index is significant in investment decision-making processes. Investors use it to compare multiple projects effectively. A PI greater than one indicates a profitable venture, while a value below one suggests otherwise.

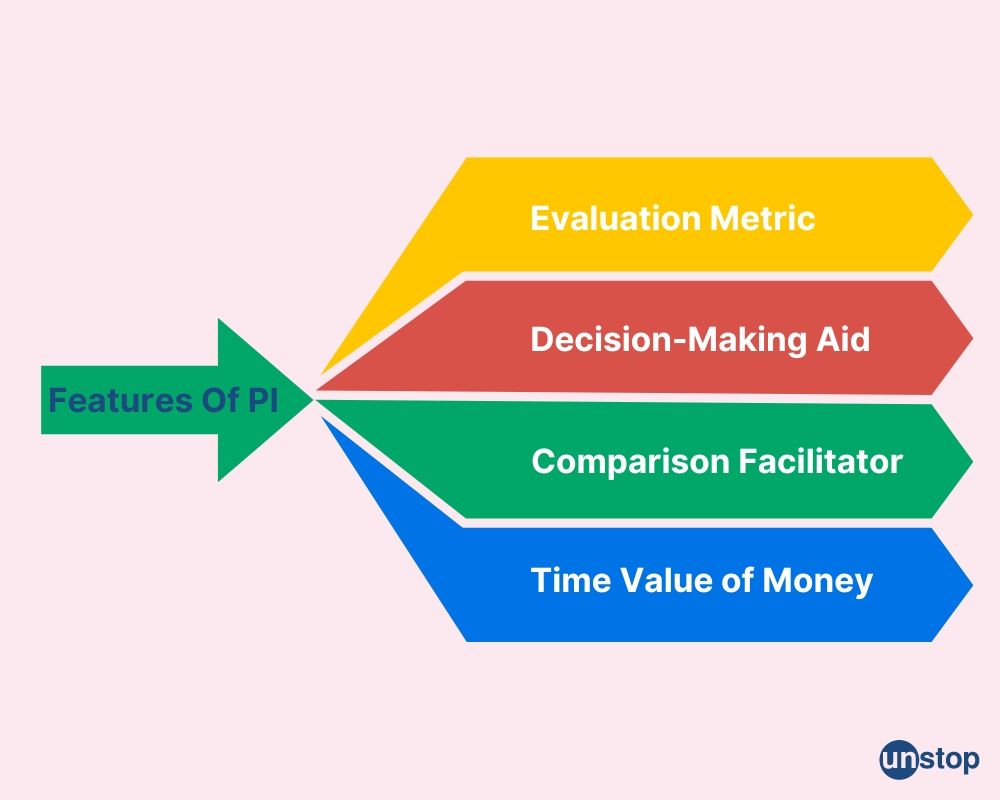

Key Features Of PI As A Financial Tool

Let us study some of the key features of the profitability index as a financial tool:

Evaluation Metric: PI gives a simple ratio that shows how the present value of future cash flows compares to the initial investment, highlighting a project's potential profitability.

Decision-Making Aid: The PI helps prioritize projects by highlighting which ones offer the highest return per unit of investment, making it easier to allocate limited resources effectively.

Comparison Facilitator: By standardizing the measurement of profitability, the PI allows for the comparison of different projects or investment opportunities on an equal footing.

Incorporation of Time Value of Money: The profitability index (PI) takes into account the time value of money by discounting future cash flows, which helps to provide a more accurate assessment of an investment's actual worth.

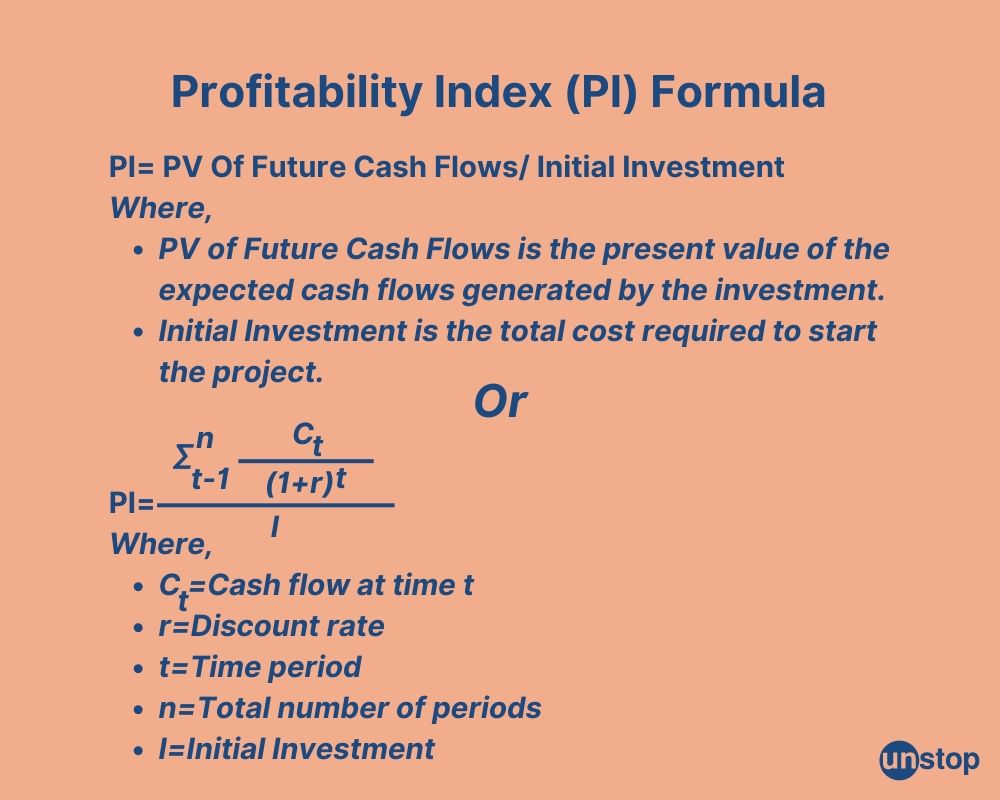

Profitability Index Formula

Interpretation Of PI

-

PI > 1: Indicates that the present value of future cash flows exceeds the initial investment, suggesting the investment is likely to be profitable.

-

PI = 1: Signifies that the present value of future cash flows equals the initial investment, indicating a break-even scenario.

-

PI < 1: This indicates that the future cash flows' present value falls short of the initial investment, which implies that the investment may not yield a profit.

Decision Rule Of PI

-

Accept: Investments with a PI greater than 1 are considered attractive as they are expected to generate value.

-

Reject: Investments with a PI less than 1 are generally avoided as they are expected to destroy value.

-

Rank: When comparing multiple projects, those with higher PIs are more attractive, as they are expected to generate more value per unit of investment.

How To Calculate Profitability Index

Calculating the profitability index involves a few key steps. First, determine future cash flows from the investment. These cash flows need to be estimated for each year of the project. Next, calculate the present value of these cash flows.

After that, find the total present value of all future cash flows. Then, identify the initial investment amount. This amount is crucial for accurate profitability index calculations. Finally, apply the profitability index formula: PI = Total Present Value of Cash Flows / Initial Investment.

Advantages & Disadvantages Of PI

Let us study the advantages and disadvantages of the profitability index:

Advantages Of Profitability Index

Capital Rationing: The PI is particularly beneficial in scenarios of capital rationing, where a company has limited resources and must prioritize multiple projects. It helps identify which projects offer the highest return per unit of investment, ensuring optimal resource allocation.

Simplifies Decision-Making: By providing a clear, quantitative measure of profitability, the PI simplifies the decision-making process, allowing managers to compare and select projects more easily.

Disadvantages Of PI

Scale of Investment: The PI does not consider the absolute size of the investment. A project with a high PI but a small overall return might be less attractive than a project with a slightly lower PI but a much larger overall return.

Assumption of Constant Discount Rate: The calculation assumes a constant discount rate over the project's life, which might not be realistic in a fluctuating economic environment.

Excludes Non-Financial Factors: The PI focuses solely on financial metrics and does not account for qualitative factors such as strategic alignment, market conditions, or regulatory impacts.

Practical Applications

Project Evaluation: Companies use the PI to assess and prioritize projects, especially when funds are limited. It aids in deciding which projects to pursue based on their potential value.

Investment Analysis: The Profitability Index (PI) helps investors evaluate various investment options, allowing them to direct their funds toward projects that promise the greatest returns.

Resource Allocation: The PI aids in the optimal allocation of limited resources by identifying projects that offer the best return per dollar invested.

Capital Budgeting: Companies use PI to evaluate which projects to invest in, especially when facing budget constraints.

Conclusion

In summary, the Profitability Index (PI) is a financial tool that helps assess investment projects by comparing future cash flows to the initial cost. A PI over 1 means the investment is profitable, while a PI under 1 indicates it may not be. PI is especially helpful in choosing which projects to fund first when money is limited, focusing on those with the best returns.

While it provides a clear, quantitative measure of profitability and incorporates the time value of money, it should be used alongside other financial metrics for comprehensive decision-making.

Time For A Short Quiz

Frequently Asked Questions (FAQs)

1. What is the profitability index?

The Profitability Index (PI), also referred to as the Profit Investment Ratio or Value Investment Ratio is an essential financial tool used to evaluate the attractiveness and feasibility of an investment or project.

2. How is the profitability index calculated?

To determine the profitability index (PI), you need to take the present value of expected cash flows and divide it by the amount of the initial investment. The formula is PI = Present Value of Cash Flows / Initial Investment.

3. What does a profitability index greater than 1 indicate?

A PI over 1 means the investment will likely create more value than it costs, making it a good opportunity.

4. Can the profitability index be used to compare projects?

Yes, the profitability index is useful for comparing multiple projects. Higher PI values indicate more attractive investments, helping prioritize resource allocation.

5. What are the limitations of using the profitability index?

The main limitation of PI is that it doesn't account for project size or scale. A high PI on a small project may not yield significant overall returns compared to a larger project with a lower PI.

6. Is the profitability index applicable in all industries?

While applicable in various industries, its effectiveness may vary based on cash flow patterns and investment types. Always consider industry-specific factors when using PI for decision-making.

Suggested reads:

-

Top 7 Sources Of Finance For Businesses And Start-ups Explained

-

Working Capital Management: Definition, Importance, Strategy & More

-

Discounted Payback Period: Definition, Formula, Calculation & More

-

Investment Decision: Definition, Factors & Importance In Finance

-

Common Size Statement: Definition, Types, Formula & Preparation

Instinctively, I fall for nature, music, humor, reading, writing, listening, traveling, observing, learning, unlearning, friendship, exercise, etc., all these from the cradle to the grave- that's ME! It's my irrefutable belief in the uniqueness of all. I'll vehemently defend your right to be your best while I expect the same from you!

Login to continue reading

And access exclusive content, personalized recommendations, and career-boosting opportunities.

Subscribe

to our newsletter

Comments

Add comment