- What Is Walter's Model Of Dividend?

- Key Concepts Of Walter's Model

- Dividend Policies

- Walter's Model Formula And Assumptions

- Model Limitations

- Conclusion

- Frequently Asked Questions

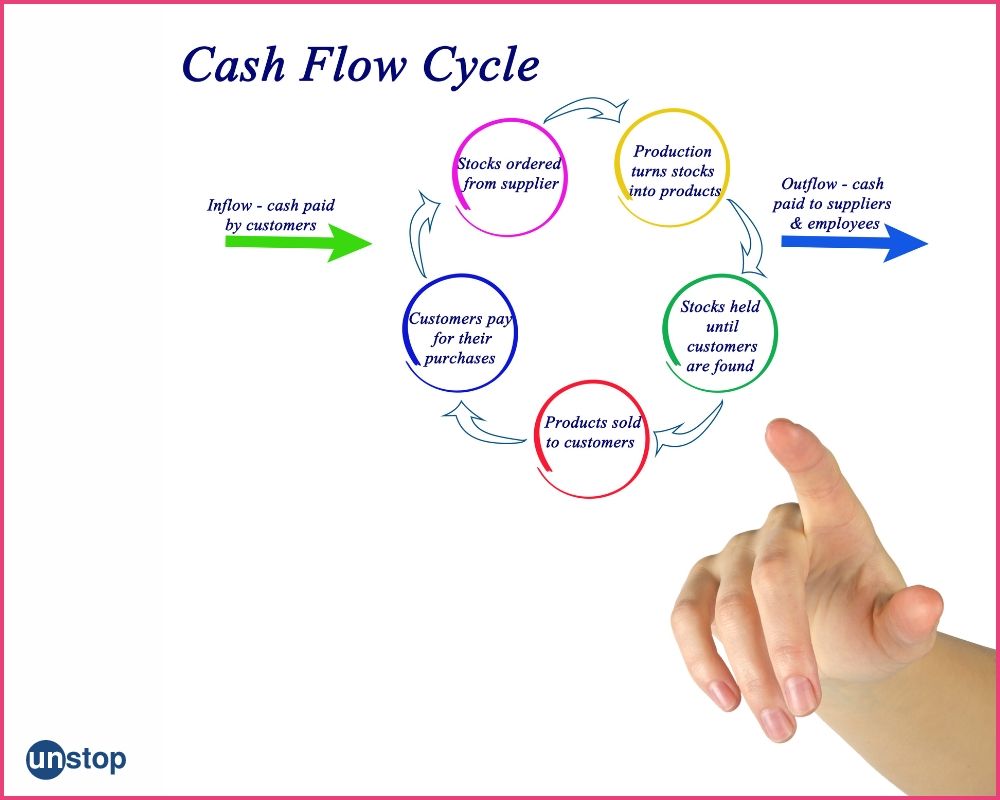

- Exploring Cash And Fund Flow

- Importance Of Cash & Fund Flow Statement

- Components Of Cash & Fund Flow Statement

- Exploring The Key Differences With Examples

- Significance And Application

- Advantages And Disadvantages

- Conclusion

- Frequently Asked Questions

- Definition Of Comparative Statement

- Types Of Comparative Statements

- Formulas For Comparative Statement

- Example Of Comparative Income Statement

- Preparing Comparative Statement

- Steps For Income & Balance Sheets

- Understanding Cash Flow Comparisons

- Practical Examples Explained

- Limitations And Considerations

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Dividend Decision

- Key Factors Influencing Dividend Decision

- Objectives Of Dividend Decision

- Theories And Determinants

- Policies Of Dividend Decision

- Conclusion

- Frequently Asked Questions (FAQs)

- Role of Fund Flow Statement Analysis

- Key Objectives of Preparing a Fund Flow Statement

- Importance of a Fund Flow Statement

- How to Prepare a Fund Flow Statement: A Step-by-Step Guide

- Fund Flow Statement vs. Cash Flow Statement

- How Fund Flow Analysis Empowers Investors and Management

- Limitations of a Fund Flow Statement

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Financing Decision

- Types Of Financial Decisions

- Examples Of Financing Decisions

- Key Factors In Financial Decision-Making

- Theories Of Financial Decision

- Analyzing Costs And Risks

- Evaluating Market & Regulatory Impacts

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Finance Function

- Core Components Of Finance Function

- Functions Of Financial Management

- Importance Of Finance Decision

- Scope Of Finance Function

- Objectives Of Financial Management

- Integrating Decisions Into Business Strategy

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Profit & Wealth Maximization

- Top 5 Key Differences Highlighted

- Calculation Method (Formula)

- Which Approach Is More Sustainable

- How It Impacts Different Stakeholders

- Role Of Decision-Making In Maximization

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Capital Structure

- Top 10 Factors Affecting Capital Structure

- Conclusion

- Frequently Asked Questions (FAQs)

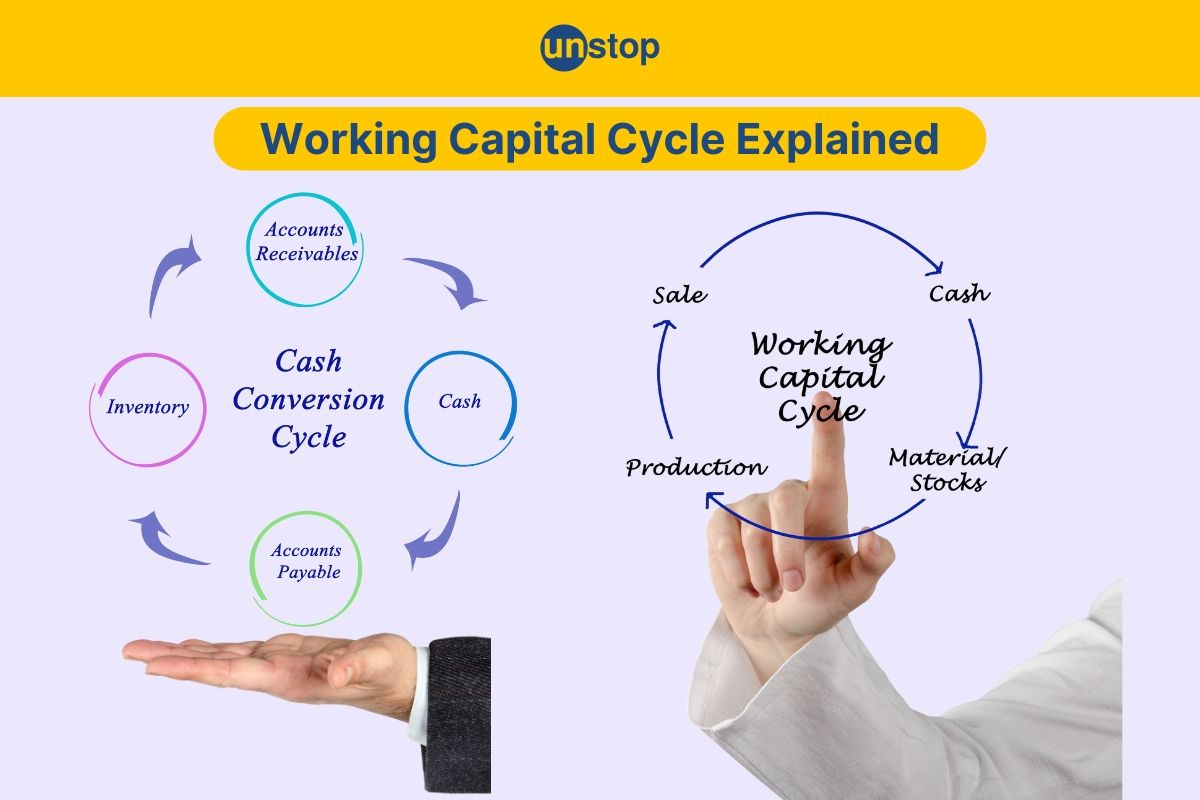

- Defining Working Capital Cycle

- Importance Of Working Capital Cycle

- Components Of Working Capital Cycle

- Steps Of Working Capital Cycle

- Formula Used For Calculation

- Positive vs Negative Working Capital

- Reducing The Cycle

- Conclusion

- Frequently Asked Questions

- What is a Common Size Statement?

- Common Size Statement Format & Formula

- Common Size Statement Analysis

- Importance of Common Size Statement

- Difference Between Common Size and Comparative Statement

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Gordon Growth Model

- Formula & Example Of GGM

- Applications In Investment Valuation

- Gordon Growth Vs. Dividend Discount Model (DDM)

- Pros And Cons Of The Model

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition & Concept Of Maximization

- Importance & Benefits Of Wealth Maximization

- Approaches & Challenges

- Wealth Maximization Vs. Profit Maximization

- Strategies To Implement Wealth Maximization

- Relation Of Psychological Aspects & Wealth

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Investment Decision? (Meaning)

- Key Factors Influencing Investment Decisions

- Importance of Investment Decision

- Exploring Capital Budgeting Methods

- Net Present Value Vs Internal Rate Of Return

- Addressing Inflation Effects

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Discounted Payback Period?

- Understanding The Basic Concept

- Formula & Calculation With Example

- Advantages, Disadvantages And Application

- Payback Vs. Discounted Payback

- Role & Influence Of Decision Rule Explained

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Working Capital Management

- Key Components Of Working Capital

- Importance Of Working Capital Management

- Working Capital Cycle & Formula

- Key Ratios In Working Capital Management

- Factors Influencing Working Capital

- Strategies For Working Capital Management

- Conclusion

- Frequently Asked Questions (FAQs)

- Meaning Of Financial Sources In Business

- Primary And Secondary Sources Of Finance

- Top 7 Sources Of Finance For Business

- Traditional Vs Modern Sources Of Finance

- Classification Of Finance Sources Based On Time Period

- Classification & Impact Based On Ownership

- Strategies For Choosing The Right Sources Of Finance

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Profitability Index?

- Key Features Of PI As A Financial Tool

- Profitability Index Formula

- How To Calculate Profitability Index

- Advantages & Disadvantages Of PI

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Annual Recurring Revenue?

- Importance Of ARR For Business Growth

- Formula And Steps To Calculate ARR

- Differences Between ARR and MRR

- Conclusion

- Frequently Asked Questions

- What Is Capital Budgeting?

- Types & Features Of Capital Budgeting

- Importance Of Capital Budgeting

- Methods Used In Capital Budgeting

- Capital Budgeting Process

- Capital Budgeting Vs. Operational Budgeting

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Financial Statement Analysis?

- Importance & Benefits

- Types Of Financial Statement Analysis

- Methods Of Financial Statement Analysis

- Steps In Financial Statement Analysis

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is The Cost Of Capital?

- Key Components Of Cost Of Capital

- WACC & Formula

- Factors Influencing Cost Of Capital

- Role Of Cost Of Capital In Financial Decisions

- Role In Investment Decisions & Mergers

- Impact On Business Operations & Strategies

- Conclusion

- Frequently Asked Questions

- What Is Internal Rate Of Return (IRR) In Finance?

- Key Concepts Of IRR

- Formula To Calculate Internal Rate Of Return

- Applications Of IRR In Finance

- Limitations & Challenges Of IRR

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Cost of Equity?

- Key Factors Affecting Cost Of Capital

- Role Of Cost Of Equity In Finance

- Methods to Calculate Cost of Equity

- Formula Of Cost Of Equity

- Components Of Cost Of Equity

- Cost Of Equity Vs. Related Financial Concepts

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Ratio Analysis?

- Importance Of Ratio Analysis

- Types Of Financial Ratios Analysis

- Methods Used To Conduct Ratio Analysis

- Applications And Examples

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Net Present Value (NPV)?

- Why Use NPV? Top 5 Benefits

- NPV Formula Explained

- Steps To Calculate NPV With Example

- Positive Vs. Negative NPV

- Advantages And Disadvantages Of NPV

- NPV Vs. Other Financial Metrics

- Conclusion

- Frequently Asked Questions

- What Is The Time Value Of Money?

- Time Value Of Money Formula

- Importance Of Time Value Of Money

- Methods & Techniques Of Time Value of Money

- Relationship Between Opportunity Cost And Time Value

- Inflation's Impact on Time Value

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Financial Management?

- Types of Financial Management

- Importance of Financial Management

- Key Functions Of Financial Management

- Best Practices For Financial Management

- Conclusion

- Frequently Asked Questions

- What Is Leverage In Financial Management?

- Types Of Leverage In Financial Management

- Financial Leverage Formula

- Risks & Benefits Of Financial Leverage

- Conclusion

- Frequently Asked Questions

- What Is A Dividend?

- Types Of Dividends

- Dividend In Financial Management

- Examples Of Dividend

- Impacts Of Dividends On Share Prices

- Reasons Companies Pay or Not Pay Dividends

- Conclusion

- Frequently Asked Questions

Working Capital Cycle | Definition, Importance, Formula And More

Understanding the working capital cycle is essential for businesses to manage their operational efficiency and financial health effectively. By analyzing this process, organizations can optimize inventory levels, streamline accounts receivable and payable, and enhance overall cash flow management.

Exploring this concept provides valuable insights into improving financial performance and sustaining long-term success.

Defining Working Capital Cycle

The working capital cycle is defined as the time it takes for a business to convert its current assets into cash, ensuring smooth operations. It includes the processes of purchasing inventory, selling products, and collecting payments.

By monitoring the working capital cycle, companies can assess their financial health and operational efficiency. This cycle represents the flow of cash and resources within a company, impacting its liquidity and profitability.

Importance Of Working Capital Cycle

Let us study some of the importance of the working capital cycle:

Liquidity Management

The working capital cycle helps businesses manage their short-term liquidity needs by ensuring they have enough cash flow to cover day-to-day operations, pay suppliers, and meet other short-term obligations.

A well-managed cycle ensures that cash is efficiently utilized and readily available when needed.

Operational Efficiency

Efficient management of the working capital cycle improves operational efficiency by optimizing inventory levels, streamlining accounts receivable collections, and effectively managing accounts payable.

This allows businesses to reduce unnecessary costs, minimize idle resources, and improve overall productivity.

Risk Management

By monitoring the working capital cycle, businesses can identify potential cash flow gaps and manage financial risks effectively. This includes assessing credit risks associated with customers and suppliers, implementing appropriate credit policies, and maintaining adequate cash reserves to mitigate unforeseen challenges.

Profitability

An optimized working capital cycle contributes to improved profitability by reducing financing costs and maximizing cash flow.

Efficient management of inventory turnover, timely collection of receivables, and strategic payment of payables help enhance the company's bottom line and profitability margins.

Strategic Decision-Making

The working capital cycle provides valuable insights for strategic decision-making. By analyzing the cycle's components, businesses can identify opportunities to enhance cash flow, optimize working capital levels, and allocate resources effectively.

This enables informed decisions regarding investments, expansion plans, and operational improvements.

Components Of Working Capital Cycle

Let us also study the components of the working capital cycle:

Inventory Conversion Period

The inventory conversion period (ICP) is the time taken to change raw materials into finished goods and sell them to customers. Longer inventory conversion periods tie up cash and increase storage costs, while shorter periods reduce holding costs and improve liquidity.

Accounts Receivable Period

The accountable receivable period (ARP) is the time it takes for a company to collect cash from credit sales made to customers. Longer accounts receivable periods indicate slower cash inflows and potential liquidity traps.

On the other hand, shorter periods enhance cash flow, reducing the risk of bad debts.

Accounts Payable Period

Accounts payable period (APP) is the time frame during which a company pays its suppliers for goods and services purchased on credit. Longer accounts payable periods allow companies to retain cash longer for other uses, but they may strain supplier relationships if extended too far.

Steps Of Working Capital Cycle

Let us study the steps involved in the working capital cycle:

Material Acquisition

Material acquisition is a crucial step in the working capital cycle as it involves purchasing raw materials to initiate production. Efficient material sourcing ensures smooth operations and timely delivery of goods.

Effective material acquisition optimizes costs by securing quality materials at competitive prices. It also minimizes production delays and enhances overall productivity within the organization.

Inventory Management

The role of inventory management is vital in the working capital cycle as it balances the stock levels by ensuring that it meets customer demand while minimizing excess inventory. Maintaining optimal inventory levels is essential for cash flow management.

Proper inventory management helps reduce holding costs associated with excess stock and prevents stockouts that can lead to lost sales opportunities. By closely monitoring inventory turnover rates, companies can improve working capital efficiency.

Receivable Days

Receivable days indicate how long a company typically waits to get paid by its customers. Managing receivable days effectively is crucial for maintaining a healthy cash flow position.

Reducing receivable days accelerates cash inflows, allowing companies to reinvest funds into business operations or reduce debt. Longer receivable days can strain liquidity and impact the overall financial health of the organization.

Formula Used For Calculation

The Working Capital Cycle (WCC) is typically calculated using the Cash Conversion Cycle (CCC), which incorporates three main components:

- Inventory Conversion Period (ICP)

- Accounts Receivable Period (ARP)

- Accounts Payable Period (APP)

Formula

CCC=ICP+ARP−APP

Example

For XYZ Corporation,

ICP = 60 days (Inventory Conversion Period), ARP = 45 days (Accounts Receivable Period), and APP = 30 days (Accounts Payable Period)

CCC= 60 day+45 days−30 days,

CCC=75 days

Interpretation

With a CCC of 75 days, XYZ Corporation typically needs around 75 days to change its investments in inventory and accounts receivable into cash while handling accounts payable.

This figure helps in understanding the company's ability to quickly access funds and effectively manage its working capital flow.

Positive vs Negative Working Capital

Positive working capital signifies that a company's current assets exceed its current liabilities. This situation allows a business to cover its short-term obligations without difficulty. Negative working capital, on the other hand, shows that a company's current liabilities surpass its current assets.

- Positive Working Capital: Ensures smooth operations, ability to invest in growth opportunities, and demonstrates financial stability.

- Negative Working Capital: Signals potential financial strain, inability to cover short-term debts easily, and may lead to increased costs due to rushed payments.

Reducing The Cycle

Let us study the strategies to reduce the working capital cycle:

Inventory Management

Optimizing inventory management is crucial for reducing the working capital cycle. By streamlining inventory levels, companies can minimize excess stock and free up cash that would otherwise be tied up in inventory.

This enables a more efficient use of resources and helps in maintaining a positive working capital cycle.

Payment Acceleration

Accelerating payment cycles with suppliers is another effective strategy for reducing the working capital cycle. By negotiating favourable terms and incentivizing early payments, companies can improve their cash flow management.

This approach not only enhances liquidity but also strengthens relationships with suppliers, leading to potential discounts and improved stability.

Benefits Of Optimization

Optimizing the operating cycle leads to an efficient working capital cycle, enabling businesses to operate with a shorter working capital cycle. This results in sufficient cash flow to meet operational needs and invest in growth opportunities.

A well-managed net operating cycle contributes to overall financial stability and resilience against market fluctuations.

Conclusion

In conclusion, the working capital cycle is an essential aspect of financial management that directly impacts a company's liquidity, profitability, and operational efficiency. By effectively managing the cycle through proactive strategies and continuous monitoring, businesses can enhance their financial health and resilience in dynamic market environments.

Knowing how to calculate, analyze, and optimize your working capital cycle can significantly impact your company's financial health and sustainability. Take charge of your business's liquidity and operational efficiency by applying the insights gained from this comprehensive guide.

Time For A Short Quiz

Frequently Asked Questions

1. What is the working capital cycle?

The working capital cycle is defined as the time it takes for a business to convert its current assets into cash, ensuring smooth operations. It includes the processes of purchasing inventory, selling goods, and collecting payments.

2. How can I calculate the working capital cycle?

Calculating the working capital cycle involves taking the total of the average collection period and the average age of inventory and then subtracting the average payment period from this sum.

Working Capital Cycle = Inventory Days Outstanding + Receivables Days Outstanding - Payables Days Outstanding.

3. Why is it important to understand positive vs negative working capital cycles?

Understanding positive (long) and negative (short) working capital cycles is crucial for managing cash flow effectively. A positive cycle indicates longer periods between paying suppliers and receiving payments, while a negative cycle signifies quicker turnover, impacting liquidity and financial health.

4. What are some techniques to reduce the working capital cycle?

Techniques to reduce the working capital cycle include inventory management optimization, negotiating better payment terms with suppliers, improving billing and collections processes, and enhancing operational efficiency to speed up cash conversion cycles.

5. How does the working capital cycle impact a company's financial health?

The working capital cycle directly affects a company's liquidity, profitability, and overall financial health. Efficient management of this cycle ensures smooth operations, adequate cash flow for day-to-day activities, and improved profitability through reduced financing costs.

Suggested reads:

Instinctively, I fall for nature, music, humor, reading, writing, listening, traveling, observing, learning, unlearning, friendship, exercise, etc., all these from the cradle to the grave- that's ME! It's my irrefutable belief in the uniqueness of all. I'll vehemently defend your right to be your best while I expect the same from you!

Login to continue reading

And access exclusive content, personalized recommendations, and career-boosting opportunities.

Subscribe

to our newsletter

Comments

Add comment