- What Is Walter's Model Of Dividend?

- Key Concepts Of Walter's Model

- Dividend Policies

- Walter's Model Formula And Assumptions

- Model Limitations

- Conclusion

- Frequently Asked Questions

- Exploring Cash And Fund Flow

- Importance Of Cash & Fund Flow Statement

- Components Of Cash & Fund Flow Statement

- Exploring The Key Differences With Examples

- Significance And Application

- Advantages And Disadvantages

- Conclusion

- Frequently Asked Questions

- Definition Of Comparative Statement

- Types Of Comparative Statements

- Formulas For Comparative Statement

- Example Of Comparative Income Statement

- Preparing Comparative Statement

- Steps For Income & Balance Sheets

- Understanding Cash Flow Comparisons

- Practical Examples Explained

- Limitations And Considerations

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Dividend Decision

- Key Factors Influencing Dividend Decision

- Objectives Of Dividend Decision

- Theories And Determinants

- Policies Of Dividend Decision

- Conclusion

- Frequently Asked Questions (FAQs)

- Role of Fund Flow Statement Analysis

- Key Objectives of Preparing a Fund Flow Statement

- Importance of a Fund Flow Statement

- How to Prepare a Fund Flow Statement: A Step-by-Step Guide

- Fund Flow Statement vs. Cash Flow Statement

- How Fund Flow Analysis Empowers Investors and Management

- Limitations of a Fund Flow Statement

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Financing Decision

- Types Of Financial Decisions

- Examples Of Financing Decisions

- Key Factors In Financial Decision-Making

- Theories Of Financial Decision

- Analyzing Costs And Risks

- Evaluating Market & Regulatory Impacts

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Finance Function

- Core Components Of Finance Function

- Functions Of Financial Management

- Importance Of Finance Decision

- Scope Of Finance Function

- Objectives Of Financial Management

- Integrating Decisions Into Business Strategy

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Profit & Wealth Maximization

- Top 5 Key Differences Highlighted

- Calculation Method (Formula)

- Which Approach Is More Sustainable

- How It Impacts Different Stakeholders

- Role Of Decision-Making In Maximization

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Capital Structure

- Top 10 Factors Affecting Capital Structure

- Conclusion

- Frequently Asked Questions (FAQs)

- Defining Working Capital Cycle

- Importance Of Working Capital Cycle

- Components Of Working Capital Cycle

- Steps Of Working Capital Cycle

- Formula Used For Calculation

- Positive vs Negative Working Capital

- Reducing The Cycle

- Conclusion

- Frequently Asked Questions

- What is a Common Size Statement?

- Common Size Statement Format & Formula

- Common Size Statement Analysis

- Importance of Common Size Statement

- Difference Between Common Size and Comparative Statement

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Gordon Growth Model

- Formula & Example Of GGM

- Applications In Investment Valuation

- Gordon Growth Vs. Dividend Discount Model (DDM)

- Pros And Cons Of The Model

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition & Concept Of Maximization

- Importance & Benefits Of Wealth Maximization

- Approaches & Challenges

- Wealth Maximization Vs. Profit Maximization

- Strategies To Implement Wealth Maximization

- Relation Of Psychological Aspects & Wealth

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Investment Decision? (Meaning)

- Key Factors Influencing Investment Decisions

- Importance of Investment Decision

- Exploring Capital Budgeting Methods

- Net Present Value Vs Internal Rate Of Return

- Addressing Inflation Effects

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Discounted Payback Period?

- Understanding The Basic Concept

- Formula & Calculation With Example

- Advantages, Disadvantages And Application

- Payback Vs. Discounted Payback

- Role & Influence Of Decision Rule Explained

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Working Capital Management

- Key Components Of Working Capital

- Importance Of Working Capital Management

- Working Capital Cycle & Formula

- Key Ratios In Working Capital Management

- Factors Influencing Working Capital

- Strategies For Working Capital Management

- Conclusion

- Frequently Asked Questions (FAQs)

- Meaning Of Financial Sources In Business

- Primary And Secondary Sources Of Finance

- Top 7 Sources Of Finance For Business

- Traditional Vs Modern Sources Of Finance

- Classification Of Finance Sources Based On Time Period

- Classification & Impact Based On Ownership

- Strategies For Choosing The Right Sources Of Finance

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Profitability Index?

- Key Features Of PI As A Financial Tool

- Profitability Index Formula

- How To Calculate Profitability Index

- Advantages & Disadvantages Of PI

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Annual Recurring Revenue?

- Importance Of ARR For Business Growth

- Formula And Steps To Calculate ARR

- Differences Between ARR and MRR

- Conclusion

- Frequently Asked Questions

- What Is Capital Budgeting?

- Types & Features Of Capital Budgeting

- Importance Of Capital Budgeting

- Methods Used In Capital Budgeting

- Capital Budgeting Process

- Capital Budgeting Vs. Operational Budgeting

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Financial Statement Analysis?

- Importance & Benefits

- Types Of Financial Statement Analysis

- Methods Of Financial Statement Analysis

- Steps In Financial Statement Analysis

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is The Cost Of Capital?

- Key Components Of Cost Of Capital

- WACC & Formula

- Factors Influencing Cost Of Capital

- Role Of Cost Of Capital In Financial Decisions

- Role In Investment Decisions & Mergers

- Impact On Business Operations & Strategies

- Conclusion

- Frequently Asked Questions

- What Is Internal Rate Of Return (IRR) In Finance?

- Key Concepts Of IRR

- Formula To Calculate Internal Rate Of Return

- Applications Of IRR In Finance

- Limitations & Challenges Of IRR

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Cost of Equity?

- Key Factors Affecting Cost Of Capital

- Role Of Cost Of Equity In Finance

- Methods to Calculate Cost of Equity

- Formula Of Cost Of Equity

- Components Of Cost Of Equity

- Cost Of Equity Vs. Related Financial Concepts

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Ratio Analysis?

- Importance Of Ratio Analysis

- Types Of Financial Ratios Analysis

- Methods Used To Conduct Ratio Analysis

- Applications And Examples

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Net Present Value (NPV)?

- Why Use NPV? Top 5 Benefits

- NPV Formula Explained

- Steps To Calculate NPV With Example

- Positive Vs. Negative NPV

- Advantages And Disadvantages Of NPV

- NPV Vs. Other Financial Metrics

- Conclusion

- Frequently Asked Questions

- What Is The Time Value Of Money?

- Time Value Of Money Formula

- Importance Of Time Value Of Money

- Methods & Techniques Of Time Value of Money

- Relationship Between Opportunity Cost And Time Value

- Inflation's Impact on Time Value

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Financial Management?

- Types of Financial Management

- Importance of Financial Management

- Key Functions Of Financial Management

- Best Practices For Financial Management

- Conclusion

- Frequently Asked Questions

- What Is Leverage In Financial Management?

- Types Of Leverage In Financial Management

- Financial Leverage Formula

- Risks & Benefits Of Financial Leverage

- Conclusion

- Frequently Asked Questions

- What Is A Dividend?

- Types Of Dividends

- Dividend In Financial Management

- Examples Of Dividend

- Impacts Of Dividends On Share Prices

- Reasons Companies Pay or Not Pay Dividends

- Conclusion

- Frequently Asked Questions

Walter's Model Of Dividend: Formula, Assumptions And Limitations

James E. Walter's Model of Dividend Policy delves into the relationship between a company's dividend choices, its valuation, and its cost of capital. It is especially insightful for companies that depend largely on retained earnings to finance their investments.

What Is Walter's Model Of Dividend?

Walter's Model focuses on the relationship between dividends and share prices. It suggests that the choice of dividend policy can affect a company's value. According to this Model, dividends are reinvested in profitable investments, leading to higher future earnings.

The Model assumes that all earnings are either distributed as dividends or reinvested.

Key Concepts Of Walter's Model

Let us study the key concepts of Walter's Model:

Internal Financing

Walter's Model assumes that all financing is done through retained earnings, meaning the company does not rely on external financing sources such as debt or new equity.

Relationship Between Dividends & Investment

The Model establishes a direct correlation between a company's dividend policy and its investment opportunities, asserting that the return on investments (r) and the cost of capital (k) are critical determinants in shaping the most effective dividend policy.

Rate of Return (r) vs. Cost of Capital (k)

The Model hinges on comparing the internal rate of return (r) with the cost of capital (k). This comparison dictates whether a firm should retain earnings or distribute them as dividends.

If r > k: The firm should retain earnings as it can reinvest them at a rate higher than the cost of capital, leading to an increase in the firm's value.

If r < k: The firm should distribute earnings as dividends since reinvestment would yield a return lower than the cost of capital, which would decrease the firm's value.

If r = k: The firm's value is unaffected by its dividend policy, as the return on reinvested earnings equals the cost of capital.

Comparison With Other Models

Other models like the Gordon Growth Model, also link dividends to share prices. However, they differ in assumptions. Gordon's Model assumes a constant growth rate of dividends.

In contrast, Walter's Model emphasizes the dividend payout ratio and its impact on shareholder wealth. The infinite dividend approach considers long-term growth without focusing on immediate returns.

Importance In Financial Strategy

Dividend decisions are crucial in financial management. Walter's Model highlights how these decisions influence investment opportunities and overall financial health. Companies must balance between paying dividends and reinvesting earnings.

This balance affects their ability to fund profitable projects and impacts future earnings flows.

Integration With Share Prices

Walter's Model integrates dividends with share prices by showing how dividend policies can alter investor perceptions. Higher dividends may attract investors seeking immediate returns.

On the other hand, lower dividends might signal more reinvestment in growth opportunities. This dynamic influences market performance and shareholder satisfaction.

Dividend Policies

The relationship between the internal rate of return and the cost of capital influences dividend policies. When the internal rate of return surpasses the cost of capital, firms prefer retaining earnings rather than paying out dividends. This reinvestment leads to higher future returns.

If the internal rate matches the cost of capital, firms might adopt a balanced approach. They may pay out some dividends while retaining part of their earnings.

This ensures steady growth without compromising financial security.

When the internal rate falls below the cost of capital, firms should prioritize paying dividends over reinvestment. This strategy minimizes losses and maintains investor confidence.

Balancing Act

Balancing the rate of return with the cost of capital maximizes shareholder wealth. Firms must continuously evaluate their investment opportunities and financing costs. By doing so, they can make informed decisions on dividend payouts and reinvestments.

This balance ensures that firms achieve constant earnings growth and maintain financial stability. Proper management of these factors enhances equity value and provides long-term rewards to investors.

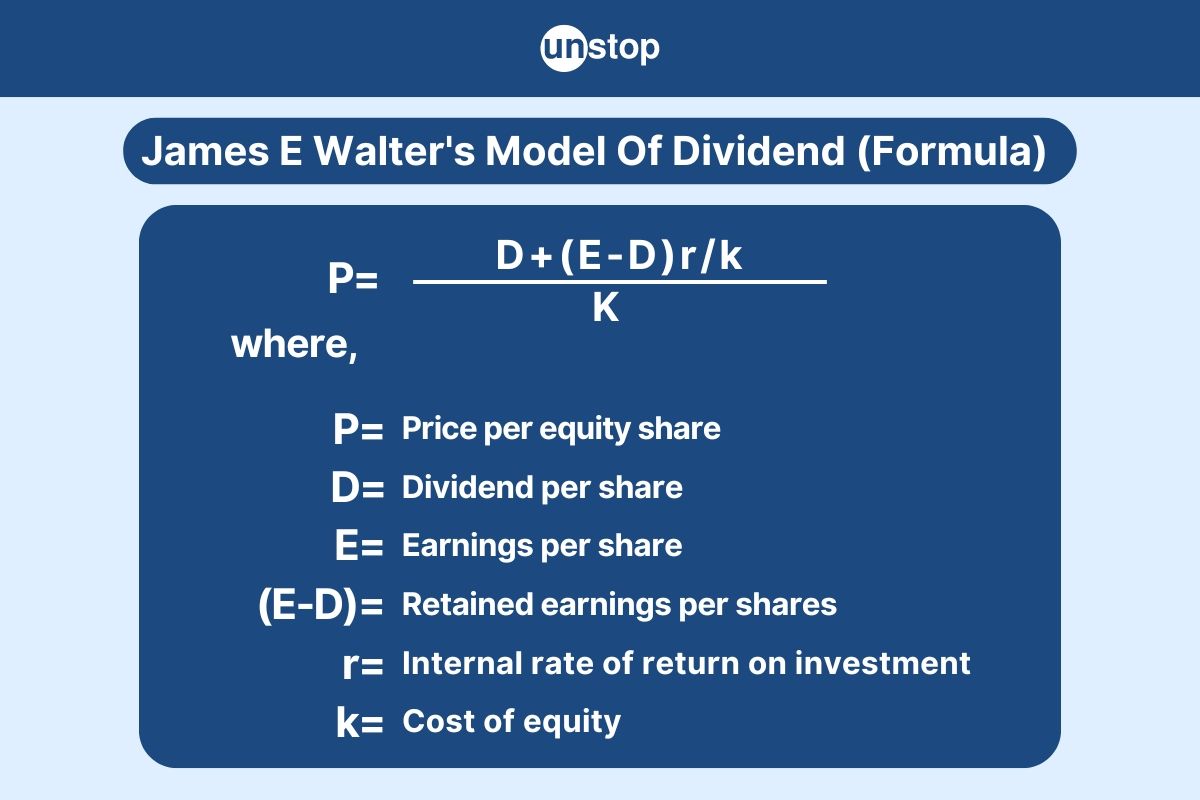

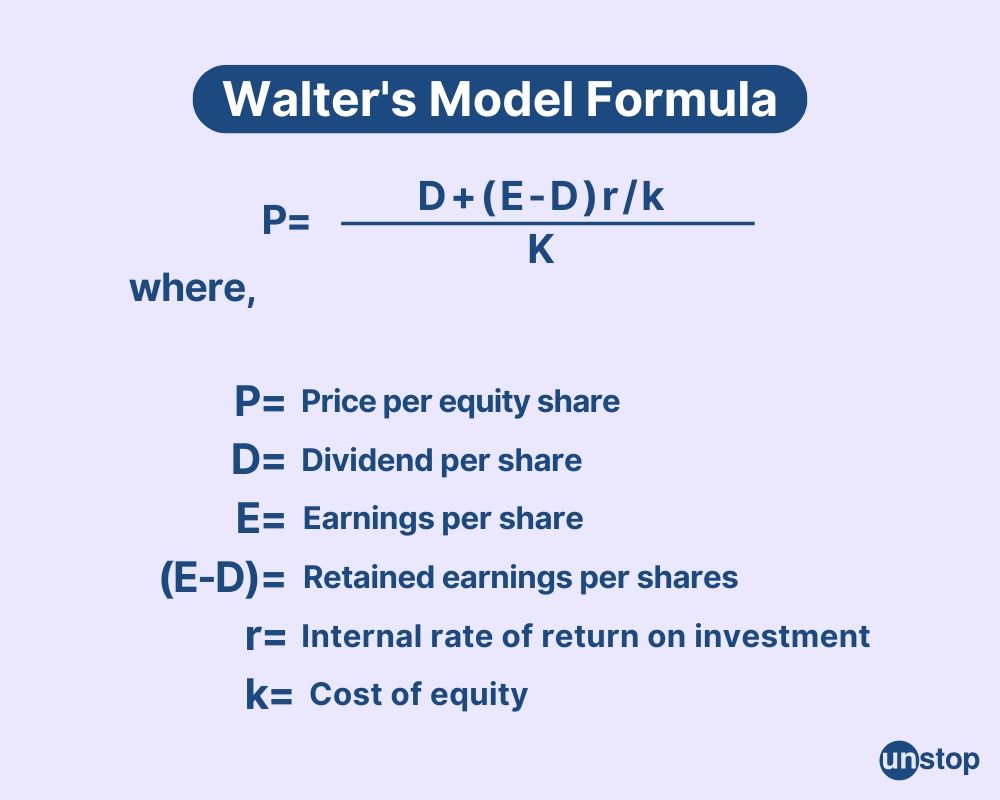

Walter's Model Formula And Assumptions

Walter's Model formula calculates the market value of a share. It uses dividends, earnings, and cost of equity. This formula shows how dividends and retained earnings impact the market value:

Constant Rates Assumption

Walter's Model assumes constant rates of return and cost of capital. This means the internal rate of return (r) and cost of equity (k) do not change over time. Such assumptions simplify calculations but may not reflect real market conditions. In reality, these rates can vary due to economic changes.

All Earnings as Dividends

The Model also assumes all earnings are either distributed as dividends or reinvested at the firm's internal rate of return. This assumption impacts long-term growth prospects. If all earnings are paid out as dividends, there is no retained profit for reinvestment. This could hinder future growth.

Model Limitations

Let us study some of the limitations of Walter’s Model:

No External Financing

Walter's Model assumes no external financing. This limits the Model's applicability to firms that rely solely on internal funds. Organizations often need external investments for growth. Without these, expanding operations becomes challenging.

The Model's assumption restricts its use for businesses aiming for rapid growth.

Equity-Based Focus

The Model applies only to equity-based organizations. This narrow focus ignores firms with debt financing. Many companies use a mix of equity and debt to fund their operations.

Adjusting the Model to include debt could make it more relevant. This would provide a broader view of the firm's financial health.

Constant Cost of Capital

Walter's Model operates under the assumption of a consistent cost of capital. However, in reality, financial markets are dynamic, characterized by fluctuating interest rates and changing market conditions over time. These variations directly influence a firm's cost of capital.

By assuming a static rate, the Model may inadequately capture the complexities of real-world scenarios, potentially leading to misleading evaluations of a firm's true value.

Limited Growth Strategies

The Model does not account for new investment opportunities. Firms often encounter new markets or technologies that require investment. Ignoring these opportunities can hinder growth strategies.

The Model's limitations make it less useful for dynamic business environments.

Real-World Implications

Assuming no external financing and constant costs can misguide strategic decisions. Firms may overlook potential risks and opportunities in the market. This can impact long-term returns and market share.

Conclusion

Walter's Model of Dividend Policy provides valuable insights into the relationship between dividend policy, internal financing, and firm valuation. It emphasizes the importance of aligning dividend decisions with the firm's investment opportunities and the comparative rates of return and cost of capital.

However, its practical application is limited by its assumptions and the complexities of real-world financial environments.

Time For A Short Quiz

Frequently Asked Questions

1. What is the Walter Model in dividend models?

The Walter Model is a method for valuing stocks based on the relationship between dividends and internal rate of return.

2. How does the Walter Model relate to dividends?

It connects a firm's dividend policy to its profitability and growth, helping investors evaluate stock value.

3. What assumptions does the Walter Model make?

It assumes constant return on investment and cost of equity and that all earnings are either distributed as dividends or reinvested immediately.

4. What are the limitations of the Walter Model?

It oversimplifies by assuming constant rates and ignores external market factors, making it less applicable in real-world scenarios.

5. How does the rate and cost relationship affect the Model?

The Model relies on comparing the firm's internal rate of return to its cost of equity to determine optimal dividend distribution.

6. Why should investors consider model limitations?

Understanding limitations helps investors avoid over-reliance on simplified models and encourages a more comprehensive analysis.

7. Can the Walter Model be used for all types of companies?

No, it's best suited for firms with stable earnings and predictable growth, not for companies with fluctuating profits.

Suggested reads:

-

Managerial Grid | A Guide For Effective Leadership & Management

-

Beyond Resumes: 9 Soft Skills Every Recruiter Must Look Out For In 2024

-

Skills Taxonomy: Understanding Its Importance And Benefits (+ Example)

-

The Great Reshuffle 2.0: Strategies For Thriving In The New Era

-

Productivity Paradox At Work: The Concept, Causes & Solutions Explained

Instinctively, I fall for nature, music, humor, reading, writing, listening, traveling, observing, learning, unlearning, friendship, exercise, etc., all these from the cradle to the grave- that's ME! It's my irrefutable belief in the uniqueness of all. I'll vehemently defend your right to be your best while I expect the same from you!

Login to continue reading

And access exclusive content, personalized recommendations, and career-boosting opportunities.

Subscribe

to our newsletter

Comments

Add comment