- What Is Walter's Model Of Dividend?

- Key Concepts Of Walter's Model

- Dividend Policies

- Walter's Model Formula And Assumptions

- Model Limitations

- Conclusion

- Frequently Asked Questions

- Exploring Cash And Fund Flow

- Importance Of Cash & Fund Flow Statement

- Components Of Cash & Fund Flow Statement

- Exploring The Key Differences With Examples

- Significance And Application

- Advantages And Disadvantages

- Conclusion

- Frequently Asked Questions

- Definition Of Comparative Statement

- Types Of Comparative Statements

- Formulas For Comparative Statement

- Example Of Comparative Income Statement

- Preparing Comparative Statement

- Steps For Income & Balance Sheets

- Understanding Cash Flow Comparisons

- Practical Examples Explained

- Limitations And Considerations

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Dividend Decision

- Key Factors Influencing Dividend Decision

- Objectives Of Dividend Decision

- Theories And Determinants

- Policies Of Dividend Decision

- Conclusion

- Frequently Asked Questions (FAQs)

- Role of Fund Flow Statement Analysis

- Key Objectives of Preparing a Fund Flow Statement

- Importance of a Fund Flow Statement

- How to Prepare a Fund Flow Statement: A Step-by-Step Guide

- Fund Flow Statement vs. Cash Flow Statement

- How Fund Flow Analysis Empowers Investors and Management

- Limitations of a Fund Flow Statement

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Financing Decision

- Types Of Financial Decisions

- Examples Of Financing Decisions

- Key Factors In Financial Decision-Making

- Theories Of Financial Decision

- Analyzing Costs And Risks

- Evaluating Market & Regulatory Impacts

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Finance Function

- Core Components Of Finance Function

- Functions Of Financial Management

- Importance Of Finance Decision

- Scope Of Finance Function

- Objectives Of Financial Management

- Integrating Decisions Into Business Strategy

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Profit & Wealth Maximization

- Top 5 Key Differences Highlighted

- Calculation Method (Formula)

- Which Approach Is More Sustainable

- How It Impacts Different Stakeholders

- Role Of Decision-Making In Maximization

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Capital Structure

- Top 10 Factors Affecting Capital Structure

- Conclusion

- Frequently Asked Questions (FAQs)

- Defining Working Capital Cycle

- Importance Of Working Capital Cycle

- Components Of Working Capital Cycle

- Steps Of Working Capital Cycle

- Formula Used For Calculation

- Positive vs Negative Working Capital

- Reducing The Cycle

- Conclusion

- Frequently Asked Questions

- What is a Common Size Statement?

- Common Size Statement Format & Formula

- Common Size Statement Analysis

- Importance of Common Size Statement

- Difference Between Common Size and Comparative Statement

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Gordon Growth Model

- Formula & Example Of GGM

- Applications In Investment Valuation

- Gordon Growth Vs. Dividend Discount Model (DDM)

- Pros And Cons Of The Model

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition & Concept Of Maximization

- Importance & Benefits Of Wealth Maximization

- Approaches & Challenges

- Wealth Maximization Vs. Profit Maximization

- Strategies To Implement Wealth Maximization

- Relation Of Psychological Aspects & Wealth

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Investment Decision? (Meaning)

- Key Factors Influencing Investment Decisions

- Importance of Investment Decision

- Exploring Capital Budgeting Methods

- Net Present Value Vs Internal Rate Of Return

- Addressing Inflation Effects

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Discounted Payback Period?

- Understanding The Basic Concept

- Formula & Calculation With Example

- Advantages, Disadvantages And Application

- Payback Vs. Discounted Payback

- Role & Influence Of Decision Rule Explained

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Working Capital Management

- Key Components Of Working Capital

- Importance Of Working Capital Management

- Working Capital Cycle & Formula

- Key Ratios In Working Capital Management

- Factors Influencing Working Capital

- Strategies For Working Capital Management

- Conclusion

- Frequently Asked Questions (FAQs)

- Meaning Of Financial Sources In Business

- Primary And Secondary Sources Of Finance

- Top 7 Sources Of Finance For Business

- Traditional Vs Modern Sources Of Finance

- Classification Of Finance Sources Based On Time Period

- Classification & Impact Based On Ownership

- Strategies For Choosing The Right Sources Of Finance

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Profitability Index?

- Key Features Of PI As A Financial Tool

- Profitability Index Formula

- How To Calculate Profitability Index

- Advantages & Disadvantages Of PI

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Annual Recurring Revenue?

- Importance Of ARR For Business Growth

- Formula And Steps To Calculate ARR

- Differences Between ARR and MRR

- Conclusion

- Frequently Asked Questions

- What Is Capital Budgeting?

- Types & Features Of Capital Budgeting

- Importance Of Capital Budgeting

- Methods Used In Capital Budgeting

- Capital Budgeting Process

- Capital Budgeting Vs. Operational Budgeting

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Financial Statement Analysis?

- Importance & Benefits

- Types Of Financial Statement Analysis

- Methods Of Financial Statement Analysis

- Steps In Financial Statement Analysis

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is The Cost Of Capital?

- Key Components Of Cost Of Capital

- WACC & Formula

- Factors Influencing Cost Of Capital

- Role Of Cost Of Capital In Financial Decisions

- Role In Investment Decisions & Mergers

- Impact On Business Operations & Strategies

- Conclusion

- Frequently Asked Questions

- What Is Internal Rate Of Return (IRR) In Finance?

- Key Concepts Of IRR

- Formula To Calculate Internal Rate Of Return

- Applications Of IRR In Finance

- Limitations & Challenges Of IRR

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Cost of Equity?

- Key Factors Affecting Cost Of Capital

- Role Of Cost Of Equity In Finance

- Methods to Calculate Cost of Equity

- Formula Of Cost Of Equity

- Components Of Cost Of Equity

- Cost Of Equity Vs. Related Financial Concepts

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Ratio Analysis?

- Importance Of Ratio Analysis

- Types Of Financial Ratios Analysis

- Methods Used To Conduct Ratio Analysis

- Applications And Examples

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Net Present Value (NPV)?

- Why Use NPV? Top 5 Benefits

- NPV Formula Explained

- Steps To Calculate NPV With Example

- Positive Vs. Negative NPV

- Advantages And Disadvantages Of NPV

- NPV Vs. Other Financial Metrics

- Conclusion

- Frequently Asked Questions

- What Is The Time Value Of Money?

- Time Value Of Money Formula

- Importance Of Time Value Of Money

- Methods & Techniques Of Time Value of Money

- Relationship Between Opportunity Cost And Time Value

- Inflation's Impact on Time Value

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Financial Management?

- Types of Financial Management

- Importance of Financial Management

- Key Functions Of Financial Management

- Best Practices For Financial Management

- Conclusion

- Frequently Asked Questions

- What Is Leverage In Financial Management?

- Types Of Leverage In Financial Management

- Financial Leverage Formula

- Risks & Benefits Of Financial Leverage

- Conclusion

- Frequently Asked Questions

- What Is A Dividend?

- Types Of Dividends

- Dividend In Financial Management

- Examples Of Dividend

- Impacts Of Dividends On Share Prices

- Reasons Companies Pay or Not Pay Dividends

- Conclusion

- Frequently Asked Questions

Difference Between Cash Flow Statement And Fund Flow Statement

Often, small businesses fail due to poor cash flow management. Differentiating between a cash flow statement and a fund flow statement is crucial for financial success.

While both documents track the movement of money within a business, they serve distinct purposes. A cash flow statement focuses on operational liquidity, while a fund flow statement emphasizes changes in financial position over time.

Exploring Cash And Fund Flow

To begin, let us understand what exactly is cash and fund flow statements:

Cash Flow Statement

Cash flow statements primarily focus on cash transactions within a specified period. They outline the cash inflows and outflows resulting from operating, investing, and financing activities. These statements provide insights into liquidity and solvency.

Fund Flow Statement

Fund flow statements, on the other hand, cover both cash and non-cash items, offering a broader view of an entity's financial health. They analyze changes in working capital, long-term investments, and equity, reflecting the overall financial position.

Primary Differences

Cash flow statements primarily focus on actual cash transactions, providing insights into liquidity and short-term financial health.

Fund flow statements emphasize changes in a company's financial position over time, including long-term investments and financing activities.

Importance Of Cash & Fund Flow Statement

Let us understand the significance of cash and fund flow statements:

Cash flow statement

It's really important for a company to make sure it has enough cash to pay its bills. The cash flow statement provides a detailed look at the money coming in and going out over a certain time, with a focus on day-to-day operations, investments, and financing activities to handle short-term cash needs effectively.

Fund flow statement

Provide insights into the long-term financial stability and growth prospects of a business. Shows the changes in the financial position of a business between two balance sheet dates by detailing the sources and uses of funds. Long-term financial planning and changes in working capital.

Components Of Cash & Fund Flow Statement

Let us look at the important components of cash and fund flow statements:

Cash Flow Statement

Operating Activities: Money coming in from customers and going out to suppliers and employees are part of the cash flow generated by regular business activities.

Investing Activities: Cash flows from the purchase and sale of long-term assets, like property, plant, and equipment.

Financing Activities: Cash flows from transactions with the company's owners and creditors, such as issuing shares or borrowing funds.

Funds Flow Statement

Sources of Funds: Includes funds from operations, issuance of shares, long-term borrowings, and sale of fixed assets.

Uses of Funds: Includes the purchase of fixed assets, repayment of long-term debt, payment of dividends, and increase in working capital.

Net Change in Working Capital: Reflects the change in current assets minus current liabilities between two periods.

Exploring The Key Differences With Examples

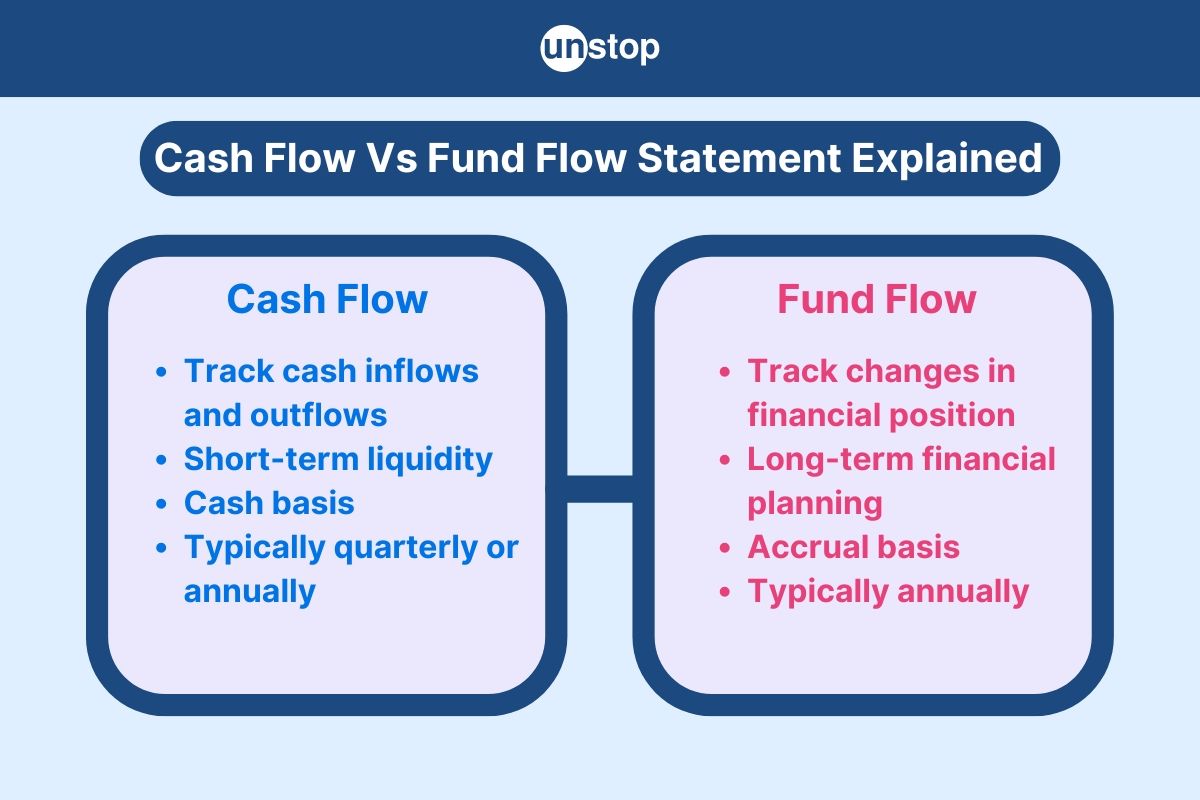

| Aspect | Cash Flow Statement | Funds Flow Statement |

| Objective | Track cash inflows and outflows | Track changes in financial position |

| Focus | Short-term liquidity | Long-term financial planning |

| Accounting Basis | Cash basis | Accrual basis |

| Time Period | Typically quarterly or annually | Typically annually |

| Activities Tracked | Operating, investing, and financing activities | Sources and uses of funds |

| Changes in Working Capital | Indirectly reflected in operating activities | Directly reflected as a change in working capital |

| Inclusion of Non-Cash Items | Excludes non-cash items (like depreciation) | Includes non-cash items (like depreciation and amortization) |

| Main Outputs | Net cash provided by or used in each activity | Net increase or decrease in funds and changes in working capital |

Example Of Cash Flow Statement

| Particulars | Amount (INR) |

| Cash Flows from Operating Activities | |

| Cash received from customers | 5,00,000 |

| Cash paid to suppliers | 3,00,000 |

| Cash paid for operating expenses | 1,00,000 |

| Net Cash from Operating Activities | 1,00,000 |

| Cash Flows from Investing Activities | |

| Purchase of equipment | 50,000 |

| Sale of investments | 20,000 |

| Net Cash from Investing Activities | 30,000 |

| Cash Flows from Financing Activities | |

| Issuance of shares | 60,000 |

| Repayment of long-term debt | 20,000 |

| Net Cash from Financing Activities | 40,000 |

| Net Increase in Cash | 1,10,000 |

| Opening Cash Balance | 50,000 |

| Closing Cash Balance | 1,60,000 |

Example Of Fund Flow Statement

| Particulars | Amount (INR) |

| Sources of Funds | |

| Funds from operations | 1,20,000 |

| Issue of equity shares | 50,000 |

| Long-term borrowings | 80,000 |

| Sale of fixed assets | 30,000 |

| Total Sources of Funds | 2,80,000 |

| Uses of Funds | |

| Purchase of fixed assets | 1,00,000 |

| Repayment of long-term debt | 70,000 |

| Payment of dividends | 30,000 |

| Increase in working capital | 50,000 |

| Total Uses of Funds | 2,50,000 |

| Net Increase/Decrease in Funds | 30,000 |

Significance And Application

Let us also look at the application aspects of cash and fund flow statements:

Cash Flow Statement

Liquidity Management: Helps manage short-term cash needs and ensure there is enough cash to meet obligations.

Investment Decisions: Assists investors in evaluating the company's ability to generate cash and sustain operations.

Operational Efficiency: Provides insights into the operational efficiency of the company by tracking cash generated from operations.

Funds Flow Statement

Financial Planning: Aids in long-term financial planning and resource allocation.

Credit Analysis: Creditors find it beneficial to evaluate a company's capacity to handle financial assets and settle debts by examining the cash flow statement and fund flow statement.

Investment Analysis: Helps in understanding the company's strategy regarding long-term investments and financing.

Advantages And Disadvantages

Let us study the advantages and disadvantages of cash and fund flow statements:

Cash Flow Statements

Advantages

Clear Insights: Cash flow statements provide a clear view of a company's ability to generate cash.

Short-Term Focus: Useful for short-term investment decisions due to their focus on actual cash movements.

Analytical Tool: Essential for business analysis, helping in understanding the liquidity position.

Disadvantages

Limited Scope: This might not reflect the long-term financial health of an organization.

Omission of Non-Cash Activities: Excludes non-cash transactions that affect the overall picture.

Subject to Manipulation: Can be manipulated by companies to present a more favourable view.

Fund Flow Statements

Advantages

Long-Term View: Ideal for strategic long-term investment choices, focusing on the movement of funds over time.

Resource Allocation: Helps in allocating resources efficiently by tracking capital movement.

Regulatory Requirements: Meets regulatory requirements by providing a comprehensive view of fund utilization.

Disadvantages

Complexity: Fund flow statements can be complex to interpret due to their detailed nature.

Historical Data: Historical data, often used in these statements, might not accurately represent today's market conditions.

Conclusion

Understanding the disparities between cash flow and fund flow statements is crucial for making informed financial decisions. By delving into their differences, advantages, disadvantages, and applications, you have gained valuable insights into how these statements can impact your financial analysis.

Leveraging this knowledge can empower you to navigate financial reports more effectively, enhancing your ability to assess the liquidity and solvency of a business accurately. Remember, the key lies in utilizing both statements strategically to gain a comprehensive view of a company's financial health.

Time For A Short Quiz

Frequently Asked Questions

1. What is the main focus of a cash flow statement?

The primary focus of a cash flow statement is to track the actual cash coming in and going out of a business over a specified period. It helps in assessing liquidity, operational efficiency, and financial health.

2. How does a fund flow statement differ from a cash flow statement?

The cash flow statement looks at real cash transactions, while the fund flow statement examines how funds were obtained and spent in a given time frame, encompassing non-cash components.

3. What are the advantages of using a cash flow statement?

The cash flow statement indicates a company's ability to generate cash, settle obligations, and plan for upcoming expenses. Investors can assess risk, evaluate liquid assets, and make informed decisions based on actual cash figures.

4. Explain the significance of understanding the difference between cash flow statement and fund flow statement.

Understanding these differences is crucial for financial analysis and decision-making. It allows stakeholders to gain a comprehensive view of a company's financial performance, assess its solvency, and make strategic investment or financing choices based on accurate data.

5. How can businesses effectively utilize both cash flow and fund flow statements?

Businesses can benefit from examining both cash flow and fund flow statements to gain a full picture of their financial well-being. By studying cash movements and the sources and uses of funds, companies can improve how they manage working capital, pinpoint areas needing enhancement, and make better decisions to boost profits.

Suggested reads:

-

Walter's Model Of Dividend | Formula, Assumptions And Limitations

-

Team Building: Definition, Stages & Objectives (Top 10 Strategies)

-

Job Shadowing: How HR Can Cultivate Talent Through Firsthand Experience

-

Circular Economy: Definition, Implementation & Benefit Explained

-

What Is Gig Economy: Understanding The Meaning, Factors, Types And More!

Instinctively, I fall for nature, music, humor, reading, writing, listening, traveling, observing, learning, unlearning, friendship, exercise, etc., all these from the cradle to the grave- that's ME! It's my irrefutable belief in the uniqueness of all. I'll vehemently defend your right to be your best while I expect the same from you!

Login to continue reading

And access exclusive content, personalized recommendations, and career-boosting opportunities.

Subscribe

to our newsletter

Comments

Add comment