- What Is Walter's Model Of Dividend?

- Key Concepts Of Walter's Model

- Dividend Policies

- Walter's Model Formula And Assumptions

- Model Limitations

- Conclusion

- Frequently Asked Questions

- Exploring Cash And Fund Flow

- Importance Of Cash & Fund Flow Statement

- Components Of Cash & Fund Flow Statement

- Exploring The Key Differences With Examples

- Significance And Application

- Advantages And Disadvantages

- Conclusion

- Frequently Asked Questions

- Definition Of Comparative Statement

- Types Of Comparative Statements

- Formulas For Comparative Statement

- Example Of Comparative Income Statement

- Preparing Comparative Statement

- Steps For Income & Balance Sheets

- Understanding Cash Flow Comparisons

- Practical Examples Explained

- Limitations And Considerations

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Dividend Decision

- Key Factors Influencing Dividend Decision

- Objectives Of Dividend Decision

- Theories And Determinants

- Policies Of Dividend Decision

- Conclusion

- Frequently Asked Questions (FAQs)

- Role of Fund Flow Statement Analysis

- Key Objectives of Preparing a Fund Flow Statement

- Importance of a Fund Flow Statement

- How to Prepare a Fund Flow Statement: A Step-by-Step Guide

- Fund Flow Statement vs. Cash Flow Statement

- How Fund Flow Analysis Empowers Investors and Management

- Limitations of a Fund Flow Statement

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Financing Decision

- Types Of Financial Decisions

- Examples Of Financing Decisions

- Key Factors In Financial Decision-Making

- Theories Of Financial Decision

- Analyzing Costs And Risks

- Evaluating Market & Regulatory Impacts

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Finance Function

- Core Components Of Finance Function

- Functions Of Financial Management

- Importance Of Finance Decision

- Scope Of Finance Function

- Objectives Of Financial Management

- Integrating Decisions Into Business Strategy

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Profit & Wealth Maximization

- Top 5 Key Differences Highlighted

- Calculation Method (Formula)

- Which Approach Is More Sustainable

- How It Impacts Different Stakeholders

- Role Of Decision-Making In Maximization

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Capital Structure

- Top 10 Factors Affecting Capital Structure

- Conclusion

- Frequently Asked Questions (FAQs)

- Defining Working Capital Cycle

- Importance Of Working Capital Cycle

- Components Of Working Capital Cycle

- Steps Of Working Capital Cycle

- Formula Used For Calculation

- Positive vs Negative Working Capital

- Reducing The Cycle

- Conclusion

- Frequently Asked Questions

- What is a Common Size Statement?

- Common Size Statement Format & Formula

- Common Size Statement Analysis

- Importance of Common Size Statement

- Difference Between Common Size and Comparative Statement

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Gordon Growth Model

- Formula & Example Of GGM

- Applications In Investment Valuation

- Gordon Growth Vs. Dividend Discount Model (DDM)

- Pros And Cons Of The Model

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition & Concept Of Maximization

- Importance & Benefits Of Wealth Maximization

- Approaches & Challenges

- Wealth Maximization Vs. Profit Maximization

- Strategies To Implement Wealth Maximization

- Relation Of Psychological Aspects & Wealth

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Investment Decision? (Meaning)

- Key Factors Influencing Investment Decisions

- Importance of Investment Decision

- Exploring Capital Budgeting Methods

- Net Present Value Vs Internal Rate Of Return

- Addressing Inflation Effects

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Discounted Payback Period?

- Understanding The Basic Concept

- Formula & Calculation With Example

- Advantages, Disadvantages And Application

- Payback Vs. Discounted Payback

- Role & Influence Of Decision Rule Explained

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Working Capital Management

- Key Components Of Working Capital

- Importance Of Working Capital Management

- Working Capital Cycle & Formula

- Key Ratios In Working Capital Management

- Factors Influencing Working Capital

- Strategies For Working Capital Management

- Conclusion

- Frequently Asked Questions (FAQs)

- Meaning Of Financial Sources In Business

- Primary And Secondary Sources Of Finance

- Top 7 Sources Of Finance For Business

- Traditional Vs Modern Sources Of Finance

- Classification Of Finance Sources Based On Time Period

- Classification & Impact Based On Ownership

- Strategies For Choosing The Right Sources Of Finance

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Profitability Index?

- Key Features Of PI As A Financial Tool

- Profitability Index Formula

- How To Calculate Profitability Index

- Advantages & Disadvantages Of PI

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Annual Recurring Revenue?

- Importance Of ARR For Business Growth

- Formula And Steps To Calculate ARR

- Differences Between ARR and MRR

- Conclusion

- Frequently Asked Questions

- What Is Capital Budgeting?

- Types & Features Of Capital Budgeting

- Importance Of Capital Budgeting

- Methods Used In Capital Budgeting

- Capital Budgeting Process

- Capital Budgeting Vs. Operational Budgeting

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Financial Statement Analysis?

- Importance & Benefits

- Types Of Financial Statement Analysis

- Methods Of Financial Statement Analysis

- Steps In Financial Statement Analysis

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is The Cost Of Capital?

- Key Components Of Cost Of Capital

- WACC & Formula

- Factors Influencing Cost Of Capital

- Role Of Cost Of Capital In Financial Decisions

- Role In Investment Decisions & Mergers

- Impact On Business Operations & Strategies

- Conclusion

- Frequently Asked Questions

- What Is Internal Rate Of Return (IRR) In Finance?

- Key Concepts Of IRR

- Formula To Calculate Internal Rate Of Return

- Applications Of IRR In Finance

- Limitations & Challenges Of IRR

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Cost of Equity?

- Key Factors Affecting Cost Of Capital

- Role Of Cost Of Equity In Finance

- Methods to Calculate Cost of Equity

- Formula Of Cost Of Equity

- Components Of Cost Of Equity

- Cost Of Equity Vs. Related Financial Concepts

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Ratio Analysis?

- Importance Of Ratio Analysis

- Types Of Financial Ratios Analysis

- Methods Used To Conduct Ratio Analysis

- Applications And Examples

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Net Present Value (NPV)?

- Why Use NPV? Top 5 Benefits

- NPV Formula Explained

- Steps To Calculate NPV With Example

- Positive Vs. Negative NPV

- Advantages And Disadvantages Of NPV

- NPV Vs. Other Financial Metrics

- Conclusion

- Frequently Asked Questions

- What Is The Time Value Of Money?

- Time Value Of Money Formula

- Importance Of Time Value Of Money

- Methods & Techniques Of Time Value of Money

- Relationship Between Opportunity Cost And Time Value

- Inflation's Impact on Time Value

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is Financial Management?

- Types of Financial Management

- Importance of Financial Management

- Key Functions Of Financial Management

- Best Practices For Financial Management

- Conclusion

- Frequently Asked Questions

- What Is Leverage In Financial Management?

- Types Of Leverage In Financial Management

- Financial Leverage Formula

- Risks & Benefits Of Financial Leverage

- Conclusion

- Frequently Asked Questions

- What Is A Dividend?

- Types Of Dividends

- Dividend In Financial Management

- Examples Of Dividend

- Impacts Of Dividends On Share Prices

- Reasons Companies Pay or Not Pay Dividends

- Conclusion

- Frequently Asked Questions

Comparative Statement : Definition, Types, Formula [With Examples]

![Comparative Statement : Definition, Types, Formula [With Examples]](https://d8it4huxumps7.cloudfront.net/bites/wp-content/banners/2024/7/668fa4267294f_feature_image_of_comparative_statement.jpg?d=1200x800)

A comparative statement helps people like investors and managers see trends and make smart choices. It usually includes income and balance sheets next to each other for easy comparison.

These statements can help understand how well the company is doing financially and operationally. In this article, we will explore the impact of comparative statements in detail.

Definition Of Comparative Statement

To begin, let us understand the definition and importance of a comparative statement:

Definition

A comparative statement is a financial document used to compare the financial performance of a company over multiple periods. This analysis is crucial for stakeholders, including investors, management, and analysts, to assess trends, growth, and areas needing improvement.

Importance Of Comparative Statement In Financial Analysis

When companies present comparative statements, they demonstrate a commitment to providing comprehensive, meaningful financial information while ensuring accuracy and reliability in financial reporting.

Let us look at some of the importance of the comparative statement in financial analysis:

Evaluating Performance

Comparing numbers in financial analysis helps businesses see how well they've done over time. It lets them spot where they're doing well and where they need to do better by looking at data from different periods.

Facilitating Decision-Making

When making decisions on resource allocation, analysts and investors heavily depend on comparative statements. By observing changes in financial metrics over time, stakeholders can assess the firm's performance and make strategic decisions that support the company's long-term objectives.

Identifying Trends

Comparative statements help companies spot trends in their financial data by comparing present and past performance. This comparison allows organizations to identify areas of growth or decline, empowering them to improve financial performance proactively.

Assessing Progress

Comparative statements help companies track their financial goals. By comparing different factors' changes over time, businesses can understand how well they are performing and where they are headed financially.

Improves Transparency

Presenting prior period figures alongside current data enhances the transparency of financial reporting, instilling trust among stakeholders.

Types Of Comparative Statements

Comparative Income Statement: Compares the income and expenses over multiple periods. Useful for analyzing trends in revenue, expenses, and profitability.

Comparative Balance Sheet: Compares the assets, liabilities, and equity over multiple periods. Useful for assessing changes in financial position and stability.

Comparative Cash Flow Statement: Compares cash inflows and outflows over multiple periods. Useful for evaluating cash management and liquidity.

Formulas For Comparative Statement

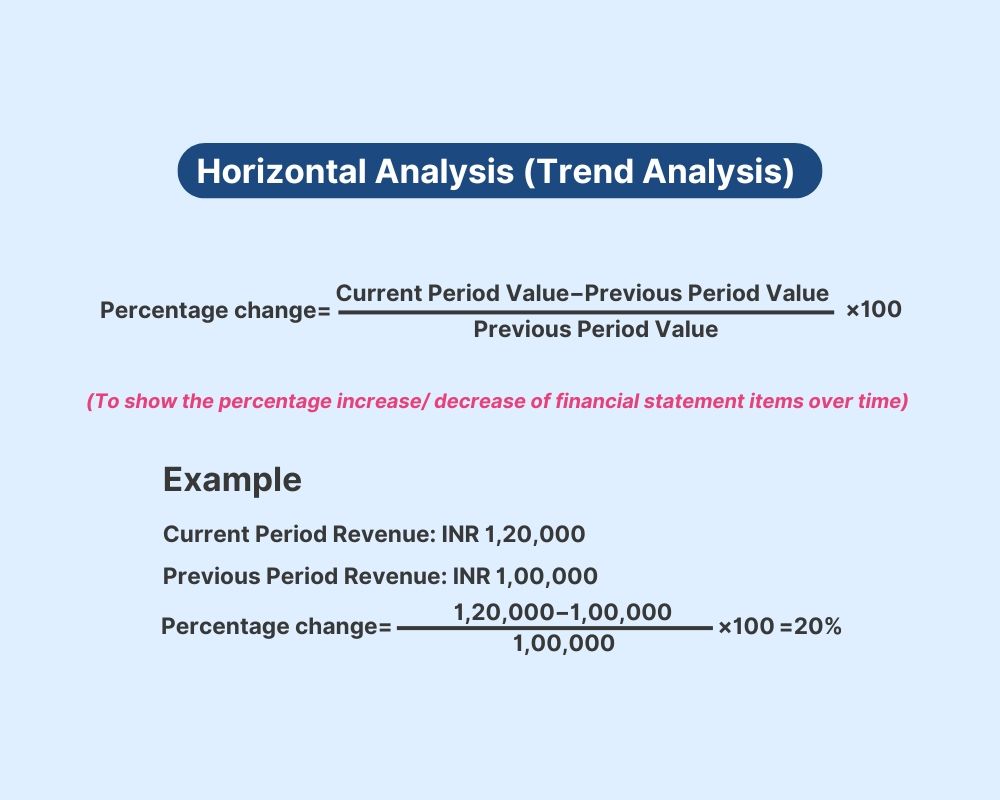

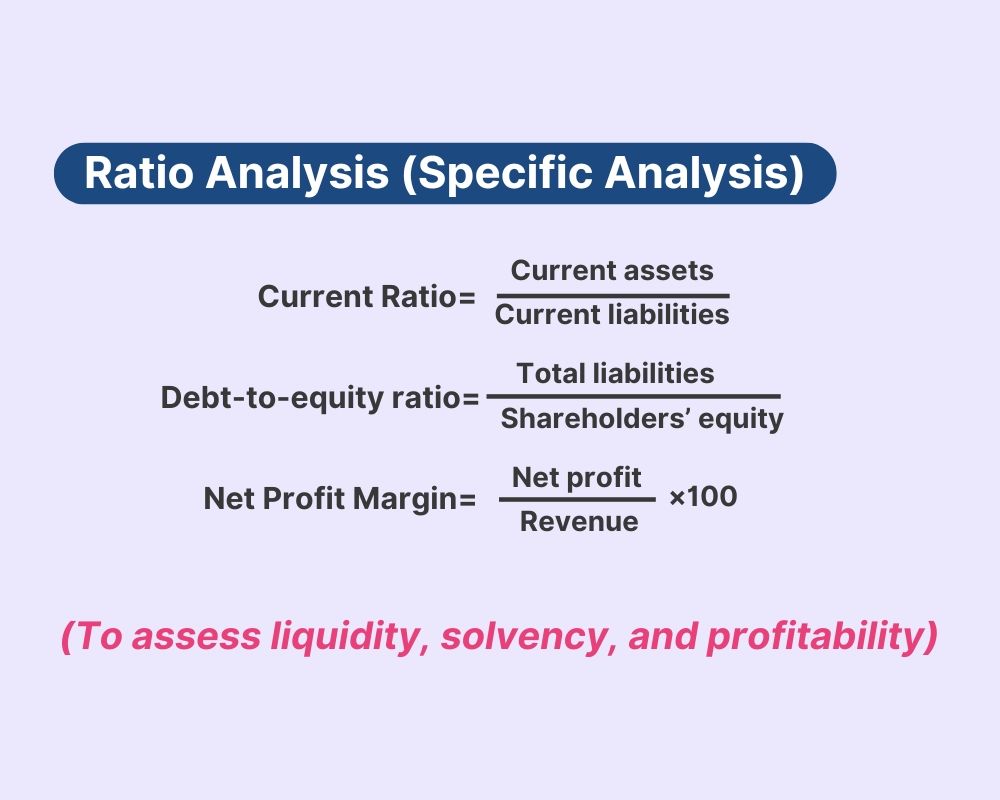

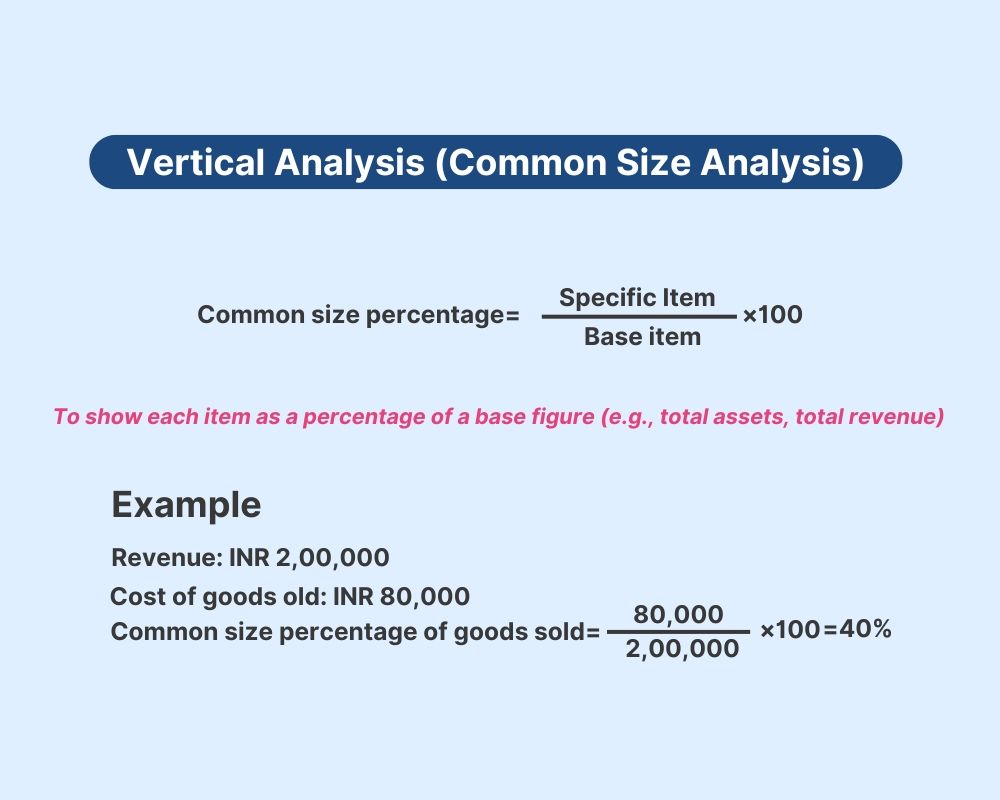

A comparative statement formula analyzes financial data over multiple periods by comparing figures from one period to the next. The basic formula calculates the percentage change between the periods for each financial item.

Some of the important formulas of comparative statements are provided below:

1. Formula for horizontal analysis

2. Formula for vertical analysis

3. Formula for ratio analysis

Example Of Comparative Income Statement

Provided below is a sample of the comparative income statement:

| Item | 2023 (INR) | 2024 (INR) | Change (INR) | Change (%) |

|---|---|---|---|---|

| Revenue | 5,00,000 | 5,50,000 | 50,000 | 10% |

| Cost of Goods Sold | 3,00,000 | 3,20,000 | 20,000 | 6.67% |

| Gross Profit | 2,00,000 | 2,30,000 | 30,000 | 15% |

| Operating Expenses | 1,00,000 | 1,10,000 | 10,000 | 10% |

| Net Income | 1,00,000 | 1,20,000 | 20,000 | 20% |

This table compares the income statements for the two periods, showing the absolute change and the percentage change for each item.

Preparing Comparative Statement

When preparing comparative financial statements, start by selecting the comparative statement format suitable for the analysis. Then, the financial data for the periods to be compared will be gathered.

Next, organize the information into columns for each period, ensuring consistency in the arrangement of accounts across periods. Calculate the comparative expense statements or comparative income statements based on the data collected.

Importance

Accuracy and consistency are crucial in data presentation to allow for meaningful comparative analysis. Inaccurate data can lead to misleading conclusions, impacting decision-making processes.

Consistent presentation ensures that trends and changes are accurately reflected, aiding in identifying areas of growth or concern within the organization. This reliability enhances the usefulness of comparative financial statements for stakeholders.

Role Of Accounting Principles

Adhering to accounting principles is crucial for reliable and honest comparative statements. These principles ensure that financial position and performance are accurately reflected over time, maintaining the entity's credibility.

Steps For Income & Balance Sheets

Let us study the steps for income and balance sheets:

Comparative Income Statements

To prepare comparative income statements, start by gathering the income statements for the different periods. Then, list the revenues and expenses for each period side by side. Calculate the variance between the periods to identify trends and fluctuations in income.

Comparing Balance Sheets

When comparing balance sheets across periods, ensure that the accounting principles used are consistent. Look for any changes in cash balance, assets, liabilities, and equity. Analyze the differences to understand how the company's financial position has evolved over time.

Understanding Changes In Financial Information

It is crucial to grasp the changes in income and balance sheet items to unleash financial insights. By analyzing these variations, you can gain a deeper understanding of the company's performance and financial health. Pay attention to accounting ratios and trends in revenue to make informed decisions.

Understanding Cash Flow Comparisons

Let us study the importance and aspects of cash flow comparisons:

Importance

Cash flow statements are essential for comparing a company's financial performance over time. They offer valuable insights by analyzing cash flows from operating, investing, and financing activities, allowing analysts to assess the financial well-being and sustainability of a business.

Interpreting Changes

Analyzing changes in cash flow from different activities offers valuable information regarding a company's operational efficiency and investment strategies. Operating activities reflect the core business functions while investing activities involve capital expenditures and asset acquisitions. Financing activities, on the other hand, focus on how the company raises capital.

Role In Assessment

Comparing cash flows between different periods aids in assessing a company's liquidity position and ability to meet its financial obligations. A positive trend in operating cash flows indicates healthy business operations, while negative trends may signal underlying issues that need attention.

Moreover, comparing cash flows with industry benchmarks provides a broader perspective on the company's financial standing.

Practical Examples Explained

Let us study some of the practical applications of comparative statements:

Financial Analysis

Comparative statements play a crucial role in financial analysis by providing a snapshot of a company's performance over multiple years. By looking at profits and losses over time, experts can see patterns and make smart choices.

One practical example is comparing a company's revenue from the current year to the previous year. If the revenue has increased, it indicates growth and positive performance. On the other hand, a decrease may signal underlying issues that need attention.

Industry Benchmarking

Another application of comparative statements is industry benchmarking. Companies can compare their financial data with industry averages to assess their competitiveness and identify areas for improvement. This comparison helps in setting realistic goals and strategies for future growth.

Case Studies

In a case study involving Company A, comparative statements revealed a consistent upward trend in profits over the past five years. This analysis allowed the company to allocate resources effectively and capitalize on areas driving profitability.

Another case study focused on Company B showed a decline in profits despite increasing revenue. By analyzing comparative statements, the company identified inefficiencies in cost management and implemented corrective measures to improve profitability.

Limitations And Considerations

Lastly, let us study the limitations and considerations of the comparative statement:

Interpretation

Comparative statements in business scenarios have limitations, especially when assessing costs and performance. The challenge lies in accurately capturing the nuances of changes over time and across different periods. For managers and investors, understanding these factors is crucial for making informed decisions.

When companies undergo significant transformations, relying solely on comparative statements can be misleading. The dynamic nature of businesses can skew figures, leading to misinterpretations by stakeholders. Managers must consider the broader context and avoid making decisions based solely on historical data.

Financial Data

Interpreting comparative financial data requires a deep understanding of the industry trends and the specific firm's operations. While comparative statements provide valuable insights into a company's performance relative to its peers, they may not always capture the full picture. Investors should also consider qualitative factors impacting a company's sales and overall success.

Conclusion

In understanding comparative statements, you've gained insight into their importance in financial analysis, the various types available, and the steps involved in their preparation. By exploring income and balance sheets alongside cash flow comparisons and practical examples, you've equipped yourself with a comprehensive understanding of how to utilize these statements effectively.

However, it's crucial to bear in mind the limitations and considerations that come with their use. As you delve deeper into financial analysis, remember to apply these insights practically. Utilize comparative statements to make informed decisions, identify trends, and assess performance accurately.

Time For A Short Quiz

Frequently Asked Questions (FAQs)

1. What is a comparative statement?

A comparative statement is a financial report that compares financial data from multiple periods, helping stakeholders analyze trends and make informed decisions.

2. What are the types of comparative statements?

The main types include comparative income statements, comparative balance sheets, and comparative cash flow statements.

3. What is the purpose of a comparative statement?

A comparative income statement helps in analyzing changes in revenue, expenses, and profitability over different periods, highlighting trends and performance.

4. What is vertical analysis in comparative statements?

Vertical analysis, also known as common size analysis, represents individual items in a financial statement as a percentage of the total revenue or total assets. This method allows for easy comparison of the relative proportions of each item within the statement.

5. What are some practical examples explained in comparative statements?

Practical examples could include comparing revenue growth year-over-year, analyzing changes in expenses, assessing asset utilization efficiency, and evaluating cash flow trends to make informed business decisions.

Suggested reads:

- KRA Frameworks And Models: Concepts, Importance, And Implementation

- Team Building: Definition, Stages & Objectives (Top 10 Strategies)

- Job Shadowing: How HR Can Cultivate Talent Through Firsthand Experience

- Walter's Model Of Dividend | Formula, Assumptions And Limitations

- Skills Taxonomy: Understanding Its Importance And Benefits (+ Example)

Instinctively, I fall for nature, music, humor, reading, writing, listening, traveling, observing, learning, unlearning, friendship, exercise, etc., all these from the cradle to the grave- that's ME! It's my irrefutable belief in the uniqueness of all. I'll vehemently defend your right to be your best while I expect the same from you!

Login to continue reading

And access exclusive content, personalized recommendations, and career-boosting opportunities.

Subscribe

to our newsletter

Comments

Add comment