- Sales Executive Job Description Template

- Sales Executive Roles & Responsibilities

- Essential Skills and Qualifications for Sales Executives

- Tips for Crafting an Effective Sales Executive Job Description

- Sales Executive Job Description Samples

- Frequently Asked Questions

- Business Analyst Job Description Template

- Overview of Business Analyst Role and Responsibilities

- Key Skills and Qualifications for Business Analysts

- Sample Job Descriptions for Business Analysts

- Tips to Write a Business Analyst Job Description

- Closing Thoughts

- Frequently Asked Questions (FAQs)

- Data Analyst Job Description Template

- Key Responsibilities of a Data Analyst

- Essential Skills & Qualifications for Data Analysts

- Data Analyst Job Description Samples

- Closing Thoughts

- Frequently Asked Questions (FAQs)

- Role of a Business Development Executive: Overview

- Business Development Executive Job Description Template

- BDE Roles & Responsibilities

- Key Requirements for a Business Development Executive

- BDE Job Description Samples

- Tips for Writing an Effective BDE Job Description

- Closing Thoughts

- Frequently Asked Questions (FAQs)

- Content Writer Job Description Template

- Understanding Content Writer's Role

- Skills and Qualifications of a Content Writer

- Sample Job Descriptions for Content Writer

- Quick Tips for Creating The Perfect Content Writer Job Description

- Closing Thoughts

- Frequently Asked Questions

- Accountant Job Description Template

- What’s the Role of an Accountant?

- Essential Skills and Abilities for Successful Accountants

- Education and Experience Requirements for Accountants

- Accountant Job Description Samples

- Closing Thoughts

- Frequently Asked Questions (FAQs)

- Understanding the Account Executive Role

- How is the role of an Account Executive different from other related roles?

- Writing an Effective Account Executive Job Description

- Sample Account Executive Job Description

- Final Remarks

- Frequently Asked Questions

- HR Recruiter Job Description Template

- HR Recruiter Role: Responsibilities, Skills & Qualification

- HR Recruiter Job Description Samples

- Closing Thoughts

- Frequently Asked Questions

- Marketing Executive: Responsibilities & Skills

- Template for Marketing Executive Job Description

- Marketing Executive Job Description Samples

- Tips to make marketing executive job description engaging

- Frequently Asked Questions

- HR Executive Key Responsibilities

- Skills and Requirements

- HR Executive vs HR Manager

- HR Executive Job Description Template

- HR Executive Job Description Samples

- Conclusion

- Frequently Asked Questions

- Role of HR Managers in 2024

- HR Manager Job Description Template

- HR Manager Responsibilities: Overview

- Essential Skills and Qualifications for HR Managers

- HR Manager Job Description Samples

- Final Remarks

- Frequently Asked Questions

- Assistant Manager Job Description: Responsibilities

- Assistant Manager Job Description: Required Skills and Qualifications

- Assistant Manager Job Description Template

- Samples for Assistant Manager Job Description

- Summing Up

- Frequently Asked Questions

- Project Coordinator Job Description: Duties, Skills & Qualifications

- Project Coordinator Job Description Template

- Project Coordinator Job Description Samples

- Final Remarks

- Frequently Asked Questions

- Sales Manager: Job Brief

- Sales Manager Job Description Template

- Key Responsibilities of a Sales Manager

- Essential Skills and Qualifications

- Sales Manager Job Description Samples

- Attracting and Hiring Top Sales Manager Talent

- Frequently Asked Questions

- Executive Assistant Job Description Overview

- Executive Assistant Job Description Template

- Executive Assistant Responsibilities

- Essential Skills and Qualifications for Executive Assistants

- Executive Assistant Job Description Samples

- Administrative vs Executive Assistant Roles

- Conclusion

- Frequently Asked Questions

- Job Overview for Sales Coordinator Position

- Sales Coordinator Job Description Template

- Sales Coordinator Roles and Responsibilities

- Administrative Support Provided by Sales Coordinators

- Sales Coordinator Skills & Qualifications

- Sales Coordinator Job Description Samples

- How to Use a Sales Coordinator Job Description Template

- Final Remarks

- Frequently Asked Questions

- Financial Analyst Job Description Overview

- Financial Analyst Job Description Template

- Financial Analyst Roles and Responsibilities

- Educational Requirements and Skills Needed

- Financial Analyst Job Description Samples

- Final Remarks

- Frequently Asked Questions

- Product Manager Job Description: Understanding the Role

- Template For Product Manager Job Description

- Product Manager Job Description Samples

- Summary

- Frequently Asked Questions

- Operations Executive Job Description: Understanding the Role

- Template for Operation Executive Job Description

- Operation Executive Job Description For Entry Level and Experienced Candidates

- Closing Thoughts

- Frequently Asked Questions

- Relationship Manager Job Role Overview

- Template For Effective Relationship Manager Job Description

- Relationship Manager Job Description Samples

- Summary

- Frequently Asked Questions

- What’s the Role of Office Administrator?

- Office Administrator Job Description Template

- Office Administrator Duties

- Essential Skills and Requirements

- Crafting an Office Administrator Job Description

- Office Administrative Job Description Samples

- Office Administrator Job Description: Sample 2

- Closing Thoughts

- Frequently Asked Questions

- Quality Analyst Job Description Template

- Quality Analyst: Responsibilities, Skills & Qualification

- Quality Analyst Job Description Samples

- Frequently Asked Questions

- Java Developer Job Description Template

- Java Developer Role: Responsibilities, Skills, Qualifications

- Java Developer Job Description Samples

- Summing up

- Accounts Payable: What Does It Do?

- Accounts Payable Job Description Template

- Skills and Qualifications For An AP Role

- Steps To Write An Accounts Payable Job Description

- Accounts Payable Job Description Samples

- Summary

- Frequently Asked Questions

- Role Overview

- HR Operations Manager Job Description Template

- Key Responsibilities

- Required Skills and Competencies

- Qualifications Needed

- Job Description: Things To Include

- HR Operations Manager Job Description Samples

- Closing Thoughts

- Frequently Asked Questions

Accountant Job Description Templates For Different Experience Levels

As recruiters seeking to hire accountants, it is essential to understand the responsibilities, skills, and qualifications that come with the role. This article delves into the core responsibilities of accountants, the necessary skills and education required for the job, and provides samples and templates for crafting a comprehensive accountant job description.

Whether it's financial data analysis or tax preparation, this guide will help you identify the key aspects to look for when crafting an accountant job description for your organization. Let’s get started.

Accountant Job Description Template

When crafting an accountant job description, ensure to specify the position's title prominently. Clearly outline the duties and responsibilities expected from the candidate. Here’s an accountant job description template that can be customized as per the industry and role specifications:

Job Summary: We are seeking a detail-oriented and experienced Accountant to join our team. The ideal candidate will be responsible for managing financial transactions, preparing financial reports, and ensuring compliance with regulations.

Responsibilities:

- Manage all accounting transactions

- Prepare budget forecasts

- Publish financial statements on time

- Handle monthly, quarterly, and annual closings

- Reconcile accounts payable and receivable

- Ensure timely payments

- Conduct detailed analysis of financial data

Requirements:

- Bachelor's degree in Accounting or Finance

- Proven work experience as an Accountant

- Advanced knowledge of accounting software

- Strong analytical skills

- Excellent communication and interpersonal abilities

- CPA certification is a plus

Call to Action: If you meet the requirements and are interested in joining our team, please send your resume and cover letter to [email address]. We look forward to hearing from you!

Tailoring Accountant Job Description to Specific Needs

Tailor an accountant job description by customizing it to match your company's unique requirements. Include specific details about the organization’s industry or size for better alignment.

To suit your needs, incorporate specialized skills or software proficiencies essential for the role in question. Highlight any particular certifications or licenses required for the position.

For example, a junior accountant job description might require limited work experience, but for a senior accountant, recruiters need to specify the additional work experience or certifications required for the role.

Don’t just dream about your ideal career—make it a reality! Explore accounts jobs in Delhi here.

What’s the Role of an Accountant?

Primary Responsibilities

An accountant is integral to any organization, responsible for managing financial records, preparing financial statements, analyzing financial data, and ensuring compliance with tax regulations.

Accountants provide valuable insights into a company's financial health and share recommendations to help the organization make informed financial decisions and maintain financial stability.

Additionally, accountants may also be involved in budgeting, forecasting, and auditing processes to support the overall financial health of the organization. Consequently, accuracy is vital in their work to ensure that all numbers add up correctly. A small mistake can have significant repercussions on a company's finances.

Supervisory Responsibilities for Sr. Accountant

Accountants often have supervisory responsibilities where they oversee junior staff members. They may guide and support the team, ensuring tasks are completed accurately and on time. For instance, a senior accountant might review the work of junior accountants to guarantee compliance with regulations.

Having supervisory duties means being accountable for the team's performance. Accountants must provide guidance to junior staff members, answer their questions, and ensure they understand their roles within the organization. Senior accountants must communicate effectively with their team to achieve common goals.

Looking to hire for this role? Post your accountant job description on Unstop and recruit top talent.

Essential Skills and Abilities for Successful Accountants

Analytical Thinking

Successful accountants must possess analytical thinking skills to accurately interpret complex financial data. This skill helps in identifying trends, discrepancies, and potential issues within financial statements.

For instance, when reviewing balance sheets, they need to analyze each entry meticulously to ensure accuracy. This skill is crucial for detecting errors and fraud that may impact the company's financial health.

Organizational and Time Management Skills

Accountants often work on various projects simultaneously, requiring them to prioritize assignments based on deadlines and importance. Effective time management ensures that tasks are completed promptly without compromising quality.

Additionally, accountants with excellent organizational abilities can maintain orderly financial records and easily access necessary information when needed. Moreover, proper time management enables them to meet reporting deadlines consistently while handling day-to-day responsibilities effectively.

The right opportunity can change everything. Explore accounts jobs listed on Unstop now!

Attention to Detail

In the world of accounting, precision is paramount. Accountants need to pay close attention to detail when recording transactions or preparing reports. Even the smallest errors in financial statements or calculations can have significant consequences.

For example, a misplaced decimal point or a simple typo can lead to inaccurate financial reporting, which can result in legal issues, financial losses, or damage to a company's reputation. By carefully reviewing and double-checking their work, accountants can ensure the accuracy and integrity of the financial information they provide, ultimately helping to maintain the trust and confidence of stakeholders.

Importance of Leadership Skills

Leadership skills play a significant role in managing a team within an accounting department. Sr. accountants need strong leadership qualities like communication, problem-solving abilities, and decision-making skills. By demonstrating effective leadership, accountants can motivate their team members towards success.

Assess candidates’ soft skills and technical competence using comprehensive tests to make sure you find the right fit for your company. Find a host of assessments on Unstop.

Education and Experience Requirements for Accountants

Educational Qualifications

To become an accountant, a degree in accounting or a related field is typically required. This educational background provides the necessary knowledge in areas like financial analysis, auditing, and taxation. Some employers may also prefer candidates with advanced degrees such as a Master's in Accounting.

Having a strong foundation in accounting principles is crucial for accountants to perform their duties effectively. Courses covering topics like financial reporting, cost accounting, and business law are essential components of an accounting degree program. Staying updated on industry regulations and standards through continuing education can further enhance an accountant's skills.

Your skills deserve the perfect stage—explore job opportunities that align with your goals!

Certifications

Some of the most common certifications that are preferred when hiring accountants include:

- Certified Public Accountant (CPA)

- Chartered Accountant (CA)

- Certified Management Accountant (CMA)

- Chartered Financial Analyst (CFA)

Apart from these, specific certifications like the following may be required for certain roles or industries:

- Certified Information Systems Auditor (CISA)

- Certified Internal Auditor (CIA)

- Certified Fraud Examiner (CFE)

- Certified Government Financial Manager (CGFM)

Importance of Work Experience

Experience plays a vital role in securing an accounting position. Employers often seek candidates with relevant work experience to ensure they can handle the responsibilities of the role efficiently. Internships or part-time jobs during studies can provide valuable practical experience that complements theoretical knowledge gained through education.

Gaining experience in areas such as tax preparation, financial analysis, or auditing can significantly boost one's resume when applying for accounting positions. Practical exposure to real-world scenarios helps accountants develop problem-solving skills and adaptability in various financial situations.

Accountant Job Description Samples

Junior Accountant Job Description Sample

Do you have a passion for numbers and a desire to learn from the best?

Job Summary: We're seeking a motivated and detail-oriented Junior Accountant to join our vibrant team at [Company Name], a leading financial consulting firm. In this exciting role, you'll gain valuable experience working alongside experienced professionals, contributing to client projects, and developing your accounting expertise.

What You'll Do:

- Become a master of financial statements: Learn the ropes of preparing and consolidating financial statements for diverse clients, and assist with processing financial documents like balance sheets, income statements, and cash flow statements.

- Ensure accuracy and compliance: Review and analyze account payables and receivables, safeguarding accuracy and adherence to regulations.

- Manage complexities of taxation: Assist with managing client taxes like TDS, Sales Tax, ESI, and other related responsibilities.

- Stay organized and meticulous: Maintain accurate records, manage data efficiently, and ensure timely completion of tasks.

- Embrace collaboration: Work effectively with senior accountants, partners, and clients, learning from their expertise.

You're a Perfect Fit if You:

- Hold a Bachelor of Commerce (BCom) or Master of Business Administration (MBA) in Accounting (required).

- Possess strong knowledge of MS Office applications and accounting software like Tally ERP, GST, and waybills.

- Demonstrate analytical thinking and problem-solving skills, tackling challenges with confidence.

- Excel in communication, both written and verbal, clearly conveying information and collaborating effectively.

- Possess a strong work ethic, commitment to accuracy, and a willingness to learn and grow.

- Eager to contribute to a fast-paced environment and become a valuable member of our team.

Why Choose Us?

- Gain invaluable experience: Learn from top-tier professionals and work on diverse client projects, enhancing your resume and opening doors for future opportunities.

- Develop your skills: Participate in training programs and mentorship opportunities, continuously improving your accounting expertise and industry knowledge.

- Join a supportive team: Work in a collaborative and encouraging environment, where your contributions are valued and your potential is nurtured.

- Competitive salary and benefits: Enjoy a rewarding compensation package and benefits that support your professional growth.

Ready to Launch Your Accounting Journey?

Qualified candidates can send their resume and cover letter to [Email address or application portal link]. We look forward to hearing from you!

Senior Accountant Job Description

Job Summary: We're searching for a driven and experienced Senior Accountant to join our dynamic team. In this crucial role, you'll manage core accounting functions and mentor and supervise a team of junior accountants, shaping their development and ensuring seamless financial operations.

Your Impact:

- Prepare accurate and timely financial reports, ensuring adherence to accounting standards and internal controls.

- Prepare tax returns with accuracy and efficiency, minimizing tax liabilities. This includes managing GST, TDS, and other tax obligations, ensuring compliance and minimizing risks.

- Perform thorough account reconciliations to maintain the integrity of our financial records and ensure the general ledger is accurate, updated, and reflects all financial transactions effectively.

- Provide mentorship and guidance to a team of 2 junior accountants, fostering their growth and expertise.

- Address unexpected challenges and implement process improvements for enhanced efficiency.

You Shine Because:

- You possess a Bachelor's degree in Accounting or Finance (required).

- You have 3+ years of proven experience in a manufacturing or similar industry (preferred).

- Strong time management and organizational skills are second nature to you.

- You leverage MS Office Suite like a pro, particularly advanced Excel and Tally.

- Your analytical mind thrives on accuracy and attention to detail.

- You excel at communication, both written and verbal, collaborating effectively with diverse teams.

- Leadership potential simmers within you, ready to guide and mentor junior staff.

We Offer:

- Competitive salary and benefits package to reward your expertise and leadership.

- Opportunity to make a real impact in a growing and dynamic industry.

- Supportive and collaborative work environment where your contributions are valued.

- Continuous learning and development opportunities to enhance your skills and stay ahead of the curve.

Interested candidates who meet the qualifications can send their resumes in PDF format on the [Email address].

Closing Thoughts

In conclusion, it is clear that successful accountants must possess a diverse skill set that includes financial expertise, analytical thinking, and meticulous attention to detail. Education and experience are vital in shaping a competent accountant, while the added responsibility of supervision adds complexity to the role.

For recruiters seeking top talent in the accounting field, it is crucial to look for candidates who continuously strive to enhance their skills, stay abreast of industry trends, and actively seek opportunities for professional growth. By identifying individuals who exhibit these qualities, recruiters can build strong teams of skilled accountants who can navigate the ever-evolving landscape of accounting with confidence and competence.

Frequently Asked Questions (FAQs)

1. What is included in an accountant job description?

An accountant job description typically includes a summary of key responsibilities, required skills, educational qualifications, and any supervisory responsibilities associated with the role. It’s necessary to include specific certifications required for the role, if any.

2. What are some key responsibilities and duties of an accountant?

Accountants are responsible for tasks such as preparing financial statements, analyzing financial data, ensuring compliance with regulations, reconciling accounts, managing budgets, and providing financial reports. They play a crucial role in maintaining accurate financial records and supporting decision-making processes within organizations.

3. What essential skills and abilities contribute to the success of accountants?

Successful accountants possess strong analytical skills, attention to detail, proficiency in accounting software, excellent communication skills, problem-solving abilities, time management skills, and a solid understanding of accounting principles. These attributes enable them to effectively perform their duties and add value to their organizations.

4. What education and experience requirements are necessary for aspiring accountants?

Typically, aspiring accountants need at least a bachelor's degree in accounting or a related field. Some positions may require additional certifications like CPA (Certified Public Accountant). Relevant work experience or internships can also enhance job prospects in the competitive field of accounting.

5. Do accountants have supervisory responsibilities in their roles?

In some cases, senior accountants may have supervisory responsibilities where they oversee junior staff members or collaborate with other departments on financial matters. Supervisory tasks could include reviewing work done by others for accuracy or providing guidance on complex accounting issues while ensuring adherence to established procedures.

You may also be interested in this:

- Content Writer Job Description: Customizable Template + Samples

- Data Analyst Job Description Template [Samples Included]

- Business Analyst Job Description Template & Samples

- Sales Executive Job Description: Get Template, Samples & Top Tips

- Business Development Executive Job Description: Find Examples, Tips & More

I’m a reader first and a writer second, constantly diving into the world of content. If I’m not writing or reading, I like watching movies and dreaming of a life by the beach.

Login to continue reading

And access exclusive content, personalized recommendations, and career-boosting opportunities.

Subscribe

to our newsletter

Blogs you need to hog!

Organize Hackathons: The Ultimate Playbook With Past Case Studies

What is Campus Recruitment? How To Tap The Untapped Talent?

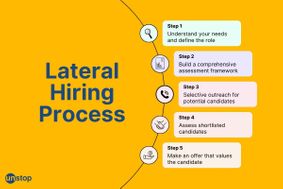

Lateral Hiring: A Complete Guide To The Process, Its Benefits, Challenges & Best Practices

Comments

Add comment