- Who is Ernst Engel?

- Engel's Law of Consumption Explained

- Examples of Engel's Law

- The Income Elasticity of Demand for Food: Insights from Engel's Law

- Engel's Law, Curve, and Coefficient

- Engel’s curve example

- Real-World Applications

- Criticisms and Limitations

- Historical Context

- FAQs

Engel's Law, Curve, & Coefficient Explained (How Income Impacts Your Grocery Bill)

Ever wondered why your spending habits change as your income fluctuates? Enter Engel's Law, a concept named after the German statistician Ernst Engel. This law reflects the intricate relationship between income and consumption patterns, shedding light on how people's spending behaviors evolve with their financial circumstances.

By understanding Engel's Law, we gain valuable insights into consumer behavior and economic trends. It provides a lens through which we can comprehend the shifts in expenditure that occur when incomes rise or fall.

Who is Ernst Engel?

Ernst Engel is a 19th-century German statistician and economist. He made significant contributions to the field of economics through his pioneering work in analyzing household expenditure patterns. His research laid the foundation for understanding income distribution and consumption patterns, which continue to be influential in modern economics.

Ernst Engel's Contributions

Engel's law, named after him, states that as income increases, the proportion of income spent on food decreases. This principle forms the basis for understanding how changes in income impact consumer behavior. By studying data on household expenditures, Engel observed that lower-income households tend to allocate a larger percentage of their income towards basic necessities like food and shelter.

Engel's research provided valuable insights into income inequality and poverty levels within societies. It highlighted the fact that individuals with lower incomes face a greater burden. This concept can be instrumental in shaping social policies aimed at alleviating poverty and promoting economic equality.

For example:

-

Governments can implement progressive taxation systems that ensure wealthier individuals contribute a higher percentage of their income towards public services.

-

Social welfare programs can be designed to provide assistance specifically tailored to meet the basic needs of low-income households.

-

Market researchers can use Engel's law to analyze consumer behavior trends and develop marketing strategies that cater to different income segments.

Engel's Law of Consumption Explained

In a nutshell, this law states that as income increases, the proportion of income spent on food decreases. Let's delve into this fascinating economic principle further.

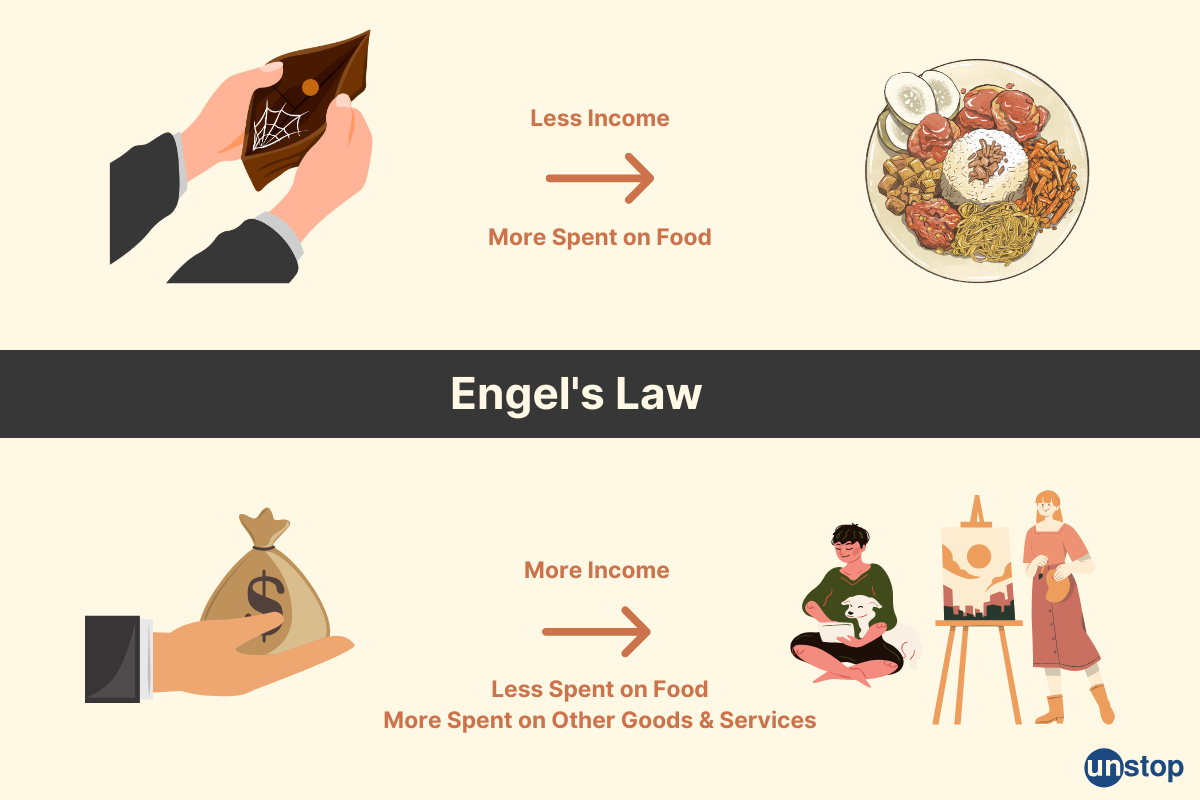

Inverse Relationship: More Income, Less Spent on Food

Engel's Law highlights an inverse relationship between income levels and the proportion spent on food. As household incomes increase, the percentage of income devoted to food decreases. This means that lower-income households tend to spend a larger portion of their budget on food compared to higher-income households.

Disposable Income Leads to Diversified Spending

As people earn more money, they have more disposable income at their disposal. With this increased financial flexibility, individuals can allocate funds toward other goods and services besides food. They often find themselves in a position where they can afford to spend more on non-essential items such as leisure activities or luxury goods. This shift towards discretionary spending is directly linked to the diminishing proportion of income allocated for food.

Examples of Engel's Law

Let's consider some real-life examples that illustrate Engel's Law in action:

-

A low-income family spends a significant portion of their budget on groceries but has limited funds for non-essential items like entertainment or vacations.

-

As a person gets a raise or promotion at work, they may start dining out more frequently or investing in hobbies they couldn't afford before.

-

In countries with rapidly growing economies, rising incomes often lead to increased demand for luxury goods and services.

The Income Elasticity of Demand for Food: Insights from Engel's Law

Engel's Law is a valuable economic theory that sheds light on the income elasticity of demand for food products. This concept helps us understand how sensitive consumer demand for food is to changes in income levels. By examining the relationship between income and food consumption, economists and policymakers can make informed decisions about social welfare programs and develop effective economic policies related to agriculture and nutrition.

What is the Income Elasticity of Demand?

The income elasticity of demand measures the percentage change in the quantity demanded of a particular good or service in response to a one percent increase or decrease in income. In the case of food products, Engel's Law suggests that as incomes rise, the proportionate amount spent on food decreases. This is because as individuals earn more money, they tend to allocate a smaller portion of their budget towards basic necessities like food.

Understanding this relationship has significant implications for policymakers. For example, if there is a decrease in agricultural prices due to increased productivity or market conditions, Engel's Law helps us predict how much consumers will adjust their spending patterns on food items. It also highlights how changes in income can impact the consumption of different types of foods.

Engel's Law also provides insights into inferior goods—products whose demand decreases as incomes rise. Some examples include low-quality processed foods or fast-food meals that people may consume when they have limited financial resources. By analyzing these patterns, policymakers can design strategies to promote healthier eating habits and improve overall nutrition.

Engel's Law, Curve, and Coefficient

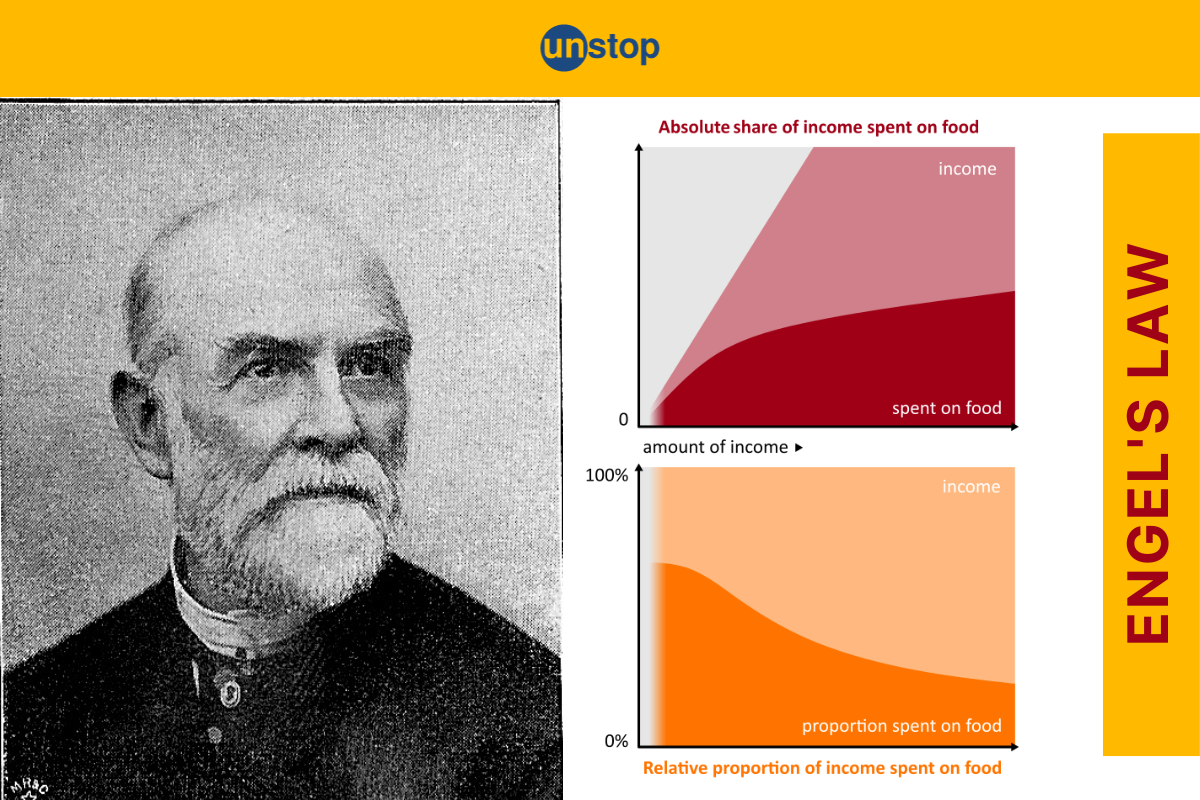

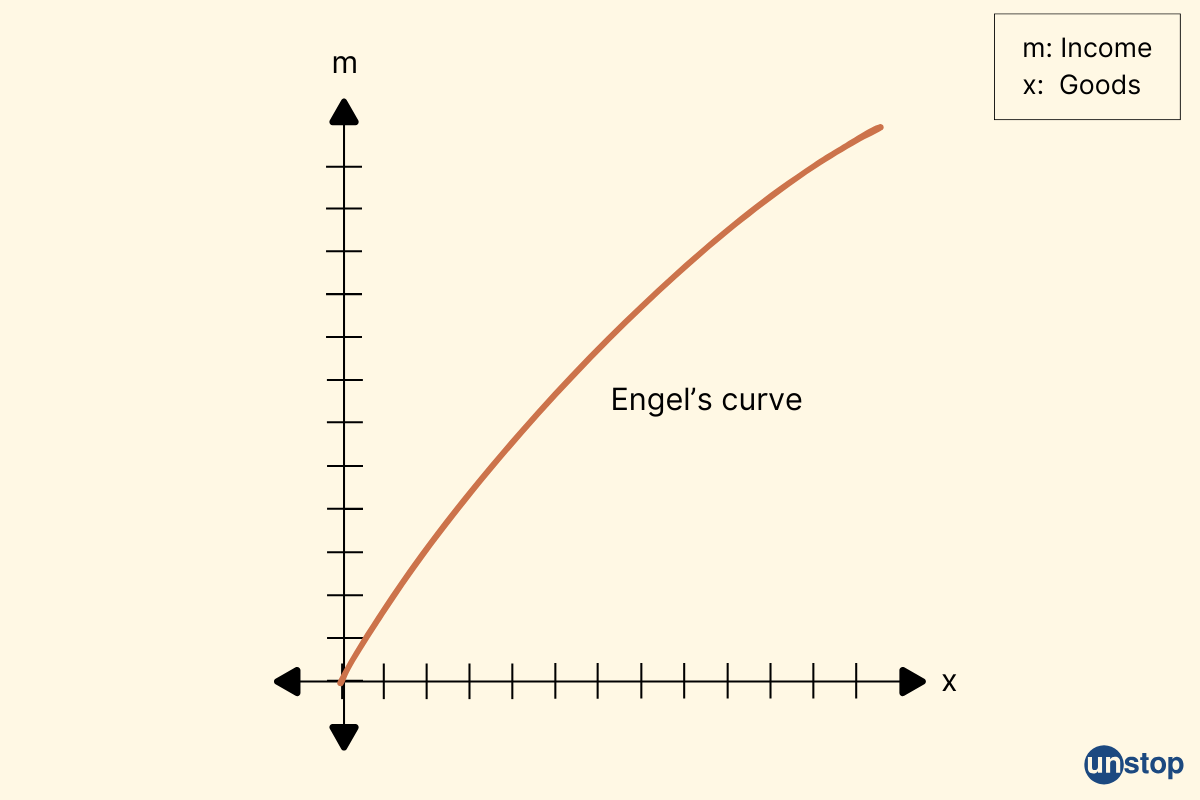

One way to represent Engel's Law graphically is through an Engel curve. This curve shows the relationship between income and the proportion of income spent on food.

The Engel curve typically takes the form of a straight line. As income increases, the proportion of income spent on food decreases. Conversely, as income decreases, the proportion spent on food increases. The slope of this curve represents what we call the Engel coefficient.

The Engel coefficient is a measure that quantifies how much food expenditure changes with each unit change in income. It tells us how sensitive our food spending is to changes in our income level. For example, if the Engel coefficient is 0.6, it means that for every INR 1 increase in income, we spend 60 paise less on food.

Please note: Here the slope represents the coefficient of Engle’s curve.

Analyzing Engel curves and coefficients allows economists to gain insights into consumption patterns across different income groups. By comparing these curves for various demographic segments or regions, we can identify differences in spending behavior based on varying levels of affluence.

Understanding Engel's Law can have practical implications for policymakers and businesses alike. For policymakers, it helps them design targeted social programs or policies to address specific needs based on income groups' consumption patterns. For businesses, it provides insights into consumer behavior and helps them tailor their marketing strategies accordingly.

Engel’s Curve Example

Imagine a low-income Indian household where the total budget is INR 5,000. In this case, they may allocate 40% of their budget (INR 2,000) towards food expenses. However, in contrast, a high-income Indian household with a total budget of INR 25,000 might only allocate 15% (INR 3,750) towards food expenses.

This example clearly highlights the inverse relationship between income and the percentage allocated to food expenses. As households earn more money, they tend to spend a smaller portion of their income on essential items like food.

Real-World Applications

Understanding Engel's Law has practical applications in various fields such as economics, marketing, and public policy.

Policymakers: Targeted Social Welfare Programs

Policymakers can use this knowledge to design targeted social welfare programs that address specific income groups' needs. By analyzing the relationship between real income and spending patterns, policymakers can identify the necessities and luxuries for different income levels. This information helps them allocate resources effectively to support those in need. For example:

-

Policymakers can design progressive tax systems that take into account varying spending patterns at different income levels. This can help address potential disparities in access to basic necessities like food among different socioeconomic groups.

-

In urban areas, where housing costs are higher, policymakers may focus on providing affordable housing options or rental assistance programs.

-

In rural areas with limited access to healthcare services, policymakers may prioritize investing in healthcare infrastructure or subsidizing medical expenses.

Businesses: Effective Marketing Strategies

Businesses can analyze consumer behavior based on income levels to develop effective marketing strategies for different market segments. By understanding how changes in income impact consumer spending habits, businesses can tailor their products and marketing efforts accordingly. For instance:

-

In developed economies where incomes are generally higher, businesses may focus on promoting luxury goods or experiences.

-

In developing economies where incomes are lower, businesses may emphasize affordability and value-for-money offerings.

Economists: Predicting Consumption Patterns

Economists can utilize Engel's Law to study changes in consumption patterns over time and make predictions about future trends. By examining how expenditure on different categories (such as food, housing, recreation) evolves with increasing income levels, economists gain insights into societal development and economic growth. This knowledge aids in forecasting future consumption patterns and informing policy decisions.

Criticisms and Limitations

Critics argue that Engel's Law oversimplifies complex consumer behavior by focusing solely on one aspect: income level. They believe that consumption patterns are influenced by various factors, such as cultural norms, personal preferences, and other variables, which should also be taken into account when studying consumer behavior.

Engel's Law may not hold true in all countries or for all income groups. Cultural and regional differences can significantly influence spending habits, making it difficult to generalize the relationship between income and expenditure. For example, in some cultures, there may be a strong emphasis on saving money regardless of income level, while in others, conspicuous consumption may be more prevalent.

It is important to acknowledge that Engel's Law provides a general trend rather than an absolute rule. While it suggests that as income increases, the proportion spent on food decreases, this may not always be the case for every individual or household. Some people may prioritize other expenses over food even with higher incomes.

Moreover, critics argue that relying solely on Engel's Law for policy decisions or economic forecasting can be risky. It is crucial to consider other economic indicators and conduct thorough research before drawing conclusions about consumer behavior.

Historical Context

During the mid-19th century, when industrialization was transforming societies and economies around the world, Ernst Engel conducted his groundbreaking research. His work provided valuable insights into the changing dynamics of consumption patterns during this period.

Engel's Law, named after him, states that as incomes rise, the proportion of income spent on food decreases. While this may seem like common sense today, it was a revolutionary concept during Engel's time. His research demonstrated a consistent relationship between income levels and spending on food across different demographic variables.

Engel's Law has stood the test of time and remains relevant even in modern times. For example, during periods of economic downturn or recession, individuals tend to allocate a larger portion of their income towards necessities such as food. On the other hand, during times of prosperity or economic growth, people have more disposable income to spend on non-essential items.

The COVID-19 pandemic serves as a recent example that validates Engel's Law. As lockdowns were imposed worldwide and many individuals faced financial difficulties, there was an increased focus on essential goods like groceries. This aligns with Engel's findings that during times of uncertainty or crisis, people prioritize spending on basic needs.

FAQs

Can Engel's Law be applied to non-food items?

Absolutely! While Engel's Law was initially formulated in relation to food consumption, its principles can be extended to other goods and services as well. The key idea behind Engel's Law remains the same: as income increases, the proportion spent on necessities decreases while the share allocated to discretionary items rises.

How can I use Engel's curve in my budgeting?

Engel's curve provides valuable insights into your spending patterns. By analyzing how your expenditure on different categories changes with income variations, you can make informed decisions about budget allocation. It helps identify areas where you may be overspending or underspending relative to your income level.

Is Engel's Law applicable across different countries and cultures?

Yes, indeed! While specific spending patterns may vary across countries and cultures due to factors like preferences, availability of goods, and cultural norms, the underlying principle of Engel's Law holds true universally. As people experience an increase in their incomes, their expenditure on necessities tends to decrease proportionally.

Can I rely solely on Engel's Law for economic forecasting?

Engel's Law is a useful tool for understanding general trends in consumer behavior but should not be used as the sole basis for economic forecasting. Other factors such as inflation rates, changes in demographics, or technology advancements also play crucial roles in shaping consumer spending habits.

Are there any exceptions to Engel's Law?

While Engel's Law provides a reliable framework for understanding consumption patterns, it is important to note that there can be exceptions. Individual preferences, cultural influences, and unique circumstances can lead to variations in spending behavior that may not strictly adhere to the law.

How can businesses benefit from understanding Engel's Law?

Businesses can leverage the insights provided by Engel's Law to develop effective marketing strategies and target specific consumer segments. By understanding how income affects consumer spending patterns, businesses can tailor their products and services to meet the needs of different income groups.

Is there any ongoing research related to Engel's Law?

Engel's Law continues to be an area of interest for researchers studying consumer behavior and economics.

Engel's law, along with Likert Scale, Lorenz curve, Indifference curve, Liquidity trap, and economies of scale, are all important concepts for understanding income, spending pattern, and overall economic behavior. If these terms pique your interest, here are a few suggested reads:

- Law Of Supply Explained In Detail With Examples

- What Is Gig Economy: Understanding The Meaning, Factors, Types And More!

- What is Recession? Delving Deeper Into The Causes With Examples

- What Is A Bear Market?: A Detailed Guide To Navigating It Along With Investing Tips

- Retail Merchandising: The Ultimate Guide With Best Practices & Tips

I am a storyteller by nature. At Unstop, I tell stories ripe with promise and inspiration, and in life, I voice out the stories of our four-legged furry friends. Providing a prospect of a good life filled with equal opportunities to students and our pawsome buddies helps me sleep better at night. And for those rainy evenings, I turn to my colors.

Login to continue reading

And access exclusive content, personalized recommendations, and career-boosting opportunities.

Subscribe

to our newsletter

Comments

Add comment