- What is Fiscal Policy in Economics?

- Understanding the Components of Fiscal Policy

- What are the Main Objectives of Fiscal Policy?

- Importance of Fiscal Policy in the Economy

- Types Of Fiscal Policies

- Tools Of Fiscal Policy

- Fiscal Policy Vs Monetary Policy

- Conclusion

- Frequently Asked Questions (FAQs)

Fiscal Policy: Definition, Objectives, Types And Tools Explained

At its core, fiscal policy revolves around how the government collects money (revenue) and how it spends that money (expenditure). By understanding fiscal policy, individuals can gain insights into how governments manage their economies.

In this article, we will explore the nitty-gritty of fiscal policy, including its types, objectives, tools, etc.

What is Fiscal Policy in Economics?

Fiscal policy is the strategic use of taxation and government spending to shape economic conditions, promote growth and stability. It involves the management of government revenue and expenditure to achieve specific economic objectives, such as controlling inflation or reducing unemployment. Depending on the government's objectives, fiscal policy can either stimulate or curb economic activity.

Governments generate revenue through various means, including taxes on individuals and businesses, tariffs on imported goods, fees for public services, and income from state-owned enterprises. On the other hand, government expenditure encompasses a wide range of areas such as infrastructure development, education, healthcare, defence spending, social welfare programs, and more.

Understanding the Components of Fiscal Policy

As discussed earlier, fiscal policy is a central tool of macroeconomic management employed by governments to achieve specific economic objectives such as controlling inflation, reducing unemployment, encouraging economic growth, and managing public debt.

Fiscal policy is grounded in the Keynesian economic theory, which posits that government intervention can help stabilize an economy over the business cycle. To understand fiscal policy, we must first grasp the components of fiscal policy. Listed below are some of the important components of fiscal policy:

Government Spending

Public Services and Infrastructure: This includes spending on education, healthcare, transportation, and public infrastructure projects. Such spending can stimulate economic activity by creating jobs and boosting demand.

Social Welfare Programs: Governments may spend on social safety nets like unemployment benefits, pensions, and subsidies to support vulnerable populations, which can also stabilize consumer demand during economic downturns.

Defence and Security: Spending on national defence and public safety also constitutes a significant part of government expenditure.

Taxation

Direct Taxes: These are taxes on income, wealth, and profits, such as personal income tax and corporate tax. Adjusting these taxes can directly influence disposable income and investment levels.

Indirect Taxes: These include taxes on goods and services, such as value-added tax (VAT) or sales tax. Changes in indirect taxes affect consumer prices and purchasing power.

Tax Incentives and Relief: Governments may offer tax credits, deductions, or exemptions to stimulate certain economic activities, such as investment in renewable energy or research and development.

What are the Main Objectives of Fiscal Policy?

Now, let us categorically study the main or key objectives of fiscal policy:

Economic Growth

Fiscal policies play an important role in fostering economic growth by investing in infrastructure projects or providing tax incentives for businesses. Stimulate and sustain economic growth by increasing demand, encouraging investment, and enhancing productivity. Fiscal policy aims to promote a stable and growing economy.

Employment Generation

High levels of unemployment can be detrimental to both individuals and the overall economy. Governments may implement expansionary fiscal policies that involve increasing public spending or decreasing taxes to stimulate job creation. Reduce unemployment by creating jobs through government spending on public projects and by providing incentives for businesses to hire more workers.

Inflation Control

Manage inflation by regulating demand through changes in government spending and taxation. During high inflation, contractionary fiscal policy is used to cool down the economy. When prices rise too quickly across an economy (inflation), it can erode people's purchasing power. Fiscal policies can be used to curb inflation by reducing government spending or increasing taxes.

Income Redistribution

Reduce income inequality through progressive taxation and social welfare programs, ensuring a fairer distribution of wealth within society.

Economic Stability

Economies go through periods of expansion (boom) followed by contraction (recession). Fiscal policies can help smooth out these cycles by adjusting government spending levels during different phases. Stabilize the economy by smoothing out the business cycle, addressing recessions with expansionary measures, and controlling excessive growth during booms with contractionary policies.

Public Debt Management

Manage the level of government borrowing and debt to ensure that it remains sustainable, avoiding excessive deficits and ensuring fiscal responsibility.

Resource Allocation

Direct resources to essential sectors such as education, healthcare, and infrastructure to enhance long-term economic development and improve the quality of life.

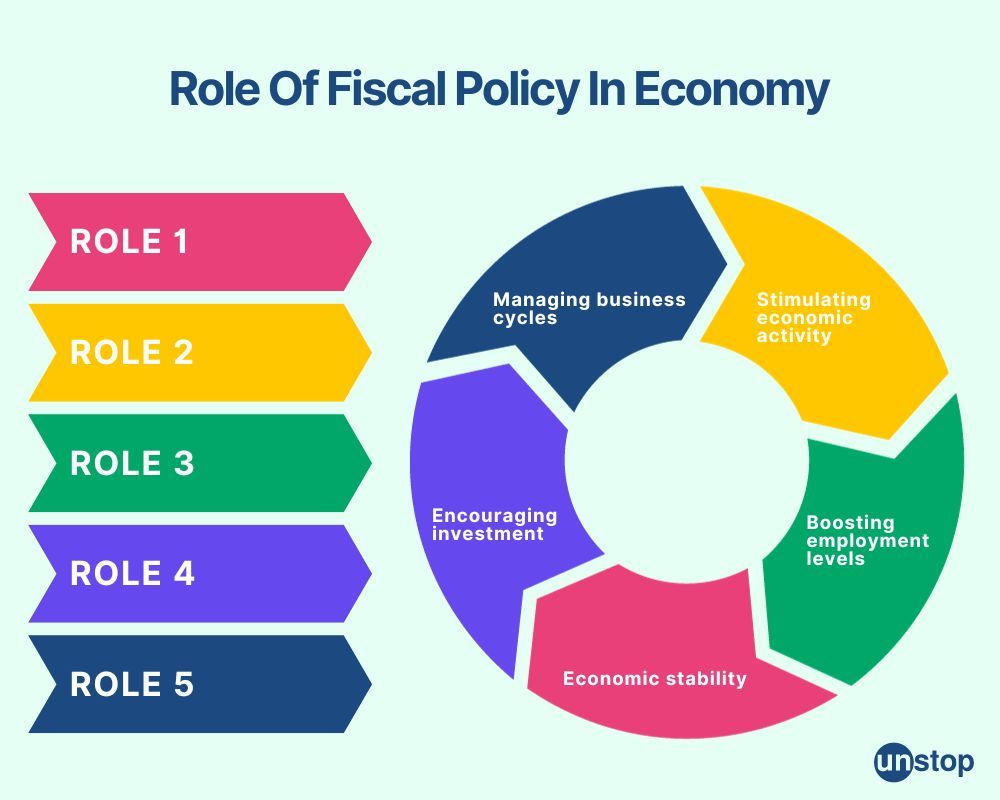

Importance of Fiscal Policy in the Economy

Fiscal policy plays a vital role in shaping the economic conditions of a country. By adjusting tax rates and government spending, it impacts economic stability and growth.

Economic Stability

One of the key objectives of fiscal policy is to maintain price stability within an economy. Through measures such as adjusting tax rates and government spending, policymakers aim to prevent excessive inflation or deflation. When prices remain stable, businesses and consumers make better-informed decisions about their investment policy and purchasing power.

Stimulating Economic Activity

Fiscal policy has the power to stimulate or slow down economic activity depending on the prevailing economic conditions. During times of recession or low growth, governments may implement expansionary fiscal policies to boost demand and encourage business investment. This could involve reducing taxes or increasing government spending on infrastructure projects, which in turn creates jobs and stimulates economic growth.

Boosting Employment Levels

Unemployment levels are closely tied to fiscal policies implemented by governments. By increasing government spending on job creation programs or providing incentives for businesses to hire more workers, fiscal policy can help reduce unemployment rates. Conversely, during periods of high inflation or overstimulation in the economy, policymakers may adopt contractionary fiscal policies that aim to control inflation but might also result in temporary job losses.

Encouraging Investment

The implementation of favourable fiscal policies can have a positive impact on business investment decisions. When tax rates are lowered for businesses or when governments provide incentives for investment through subsidies or grants, it encourages companies to expand their operations and invest in new projects. This increased investment leads to job creation, technological advancements, and overall economic growth.

Managing Business Cycles

Business cycles are the fluctuations in economic activity characterized by periods of expansion followed by contractions. Fiscal policy plays a crucial role in managing these cycles. During periods of economic downturn, expansionary fiscal policies can help stimulate demand and lift the economy out of recession. Conversely, during times of excessive growth, contractionary fiscal policies can help prevent overheating and inflation.

Types Of Fiscal Policies

Fiscal policy is broadly categorized into three main types based on the goals the government is trying to achieve: expansionary fiscal policy, contractionary fiscal policy and mixed fiscal policy. Each type is used under different economic conditions to influence the level of economic activity.

Expansionary Fiscal Policies

Expansionary fiscal policies are designed to stimulate economic growth during periods of recession or slow economic activity. The primary objective is to increase aggregate demand and boost consumer spending. This is achieved through two main approaches:

Drawbacks of Expansionary Fiscal Policy

Inflation Risk: Increased government spending without proper control measures can lead to excessive aggregate demand in the economy, potentially causing inflation.

Budget Deficit: Implementing expansionary fiscal policies often requires increased government borrowing or reduced revenue from taxes. This can result in budget deficits if not managed effectively.

Contractionary Fiscal Policies

Contractionary fiscal policies are employed when there is a need to control inflation or address excessive aggregate demand that could lead to an overheated economy. During periods of high inflation or excessive aggregate demand, governments may opt to cut spending in various sectors. By reducing government expenditure, they aim to decrease the overall demand in the economy.

Another approach is to raise taxes on individuals and businesses. Higher tax rates reduce disposable income, which can help curb excessive spending and dampen inflationary pressures. Contractionary fiscal policies are often used as a means of reigning in an overheated economy or controlling inflation.

Drawbacks of Contractionary Fiscal Policy

Economic Slowdown: The reduction in government spending and increased taxes may lead to decreased consumer spending and business investment, potentially resulting in an economic slowdown.

Unemployment: Contractionary fiscal policies can have adverse effects on employment levels, as reduced government spending may lead to job losses in certain sectors.

Mixed Fiscal Policies

Mixed fiscal policies refer to a combination of different approaches and measures taken by the government to manage the economy. These policies typically involve a mix of both expansionary and contractionary fiscal measures to achieve desired economic outcomes. Mixed fiscal policies recognize that there is no one-size-fits-all approach and that a combination of expansionary and contractionary measures may be necessary depending on the prevailing economic conditions.

The effectiveness of mixed fiscal policies depends on various factors, including the timing, magnitude, and duration of the measures implemented. It is important for policymakers to carefully assess the economic situation and make informed decisions to strike the right balance between expansionary and contractionary measures. Additionally, coordination with other macroeconomic policies, such as monetary policy, is crucial to ensure a cohesive and effective approach to economic management.

Tools Of Fiscal Policy

The tools of fiscal policy are the mechanisms that governments use to influence economic activity through changes in spending and taxation. These tools are primarily used to achieve macroeconomic objectives such as stimulating economic growth, controlling inflation, and managing public debt. The main tools of fiscal policy are:

Government Spending

Public Expenditure: This includes spending on infrastructure, healthcare, education, defence, and other public services. When the government increases its spendings, it can stimulate economic activity by creating jobs and boosting demand for goods and services.

Transfer Payments: Payments made to individuals or groups, such as unemployment benefits, pensions, and social welfare programs. These transfers can support household income and consumption, especially during economic downturns.

Taxation

Income Taxes: Adjustments to personal and corporate income tax rates can influence disposable income and business profitability. Lower taxes can increase consumer spending and investment, while higher taxes can help control inflation and reduce deficits.

Consumption Taxes: Taxes on goods and services, such as sales tax or value-added tax (VAT). Changes in consumption taxes can affect consumer behaviour and overall demand in the economy.

Corporate Taxes: Adjustments to corporate tax rates can influence business investment decisions and economic activity

Public Debt Management

Government Borrowing: Issuing government bonds and other debt instruments to finance spending. Managing the level of public debt and the cost of borrowing is crucial for maintaining fiscal stability and avoiding excessive deficits.

Subsidies and Grants

Subsidies: Financial assistance provided to businesses or individuals to support specific industries or activities, such as agriculture or renewable energy. Subsidies can encourage production and consumption in targeted areas.

Grants: Funds given to individuals, organizations, or local governments to support various projects or programs. Grants can promote economic development and address specific needs.

Automatic Stabilizers

Unemployment Insurance: Programs that automatically provide financial support to individuals who lose their jobs. Automatic stabilizers help stabilize the economy by maintaining consumer spending during economic downturns.

Progressive Taxation: Tax systems that automatically adjust with income levels. Higher-income individuals pay a larger proportion of their income in taxes, which helps moderate economic fluctuations.

Fiscal Policy Vs Monetary Policy

Governments and central banks use fiscal policy and monetary policy as two key tools to influence economic conditions. While they both aim to achieve stability and promote growth, they operate through different mechanisms. Let's explore the differences between fiscal policy vs monetary policy as listed in the table:

|

Fiscal Policy |

Monetary Policy |

|

Implemented by the government |

Implemented by the central bank |

|

Involves a change in government spending and taxation |

Involves a change in interest rates and money supply |

|

Aims to influence aggregate demand and stabilize the economy |

Aims to control inflation and promote economic growth |

|

Examples include increasing government spending during a recession or decreasing taxes to stimulate consumer spending |

Examples include raising interest rates to reduce inflation or lowering interest rates to encourage borrowing and investment. |

|

Effects are generally long-term. |

Effects are generally short-term. |

|

Can be more politically influenced |

Can be more independent and less politically influenced |

|

It can be slower to implement and have a delayed impact |

It can be implemented relatively quickly and have an immediate impact |

|

This can lead to budget deficits or surpluses |

Can affect the money supply and financial markets |

|

Can directly affect income distribution through changes in taxation |

Can indirectly affect income distribution through changes in interest rates and credit availability |

Conclusion

In conclusion, fiscal policy is a crucial tool for governments to manage the economy, balancing the goals of economic growth, employment, and price stability. By adjusting government spending and taxation, fiscal policy can either stimulate the economy during downturns or cool it down during periods of inflation. While powerful, it requires careful implementation to avoid unintended consequences like excessive debt or inflation.

Ultimately, effective fiscal policy helps create a stable economic environment that supports long-term prosperity. To ensure a comprehensive understanding of fiscal policy's impact on the economy, it is crucial to consider its relationship with monetary policy as well.

Quiz Time! See if you can answer the following questions correctly.

Frequently Asked Questions (FAQs)

1. What is the government fiscal policy?

Fiscal policy of the government refers to the use of taxation and spending which influence the economy. It involves decisions on how much money the government should collect in taxes and how it should spend those funds. Fiscal policy aims to stabilize the economy, promote growth, and control inflation.

2. How does fiscal policy affect the economy?

Fiscal policy has a direct impact on the economy. An increase in spending or a reduction in taxes stimulates economic activity by putting more money in people's pockets. This can lead to increased consumer spending, business investments, and job creation. Conversely, when the government cuts spending or raises taxes, it can slow down economic growth.

3. Who determines fiscal policy?

In most countries, fiscal policy is determined by the government's executive branch, usually under the guidance of the finance ministry or treasury department. The decision-making process involves policymakers analyzing economic indicators and making choices that align with their goals for economic stability and growth.

4. What are expansionary and contractionary fiscal policies?

Expansionary fiscal policies involve increasing government spending or reducing taxes to boost economic activity during times of recession or slow growth. This approach aims to stimulate demand and increase employment.

Contractionary fiscal policies involve decreasing government spending or raising taxes to cool down an overheating economy experiencing high inflation rates. This strategy helps reduce excessive demand and prevent an unsustainable rise in prices.

5. Can fiscal policy be used as a tool for income redistribution?

Yes, fiscal policy can be utilized as a tool for income redistribution. Governments can implement progressive tax systems where higher-income individuals pay a larger percentage of their earnings in taxes compared to lower-income individuals. The revenue generated from these progressive tax structures can then be used for social welfare programs and initiatives aimed at reducing income inequality.

Suggested Reads:

- What Is Elastic Demand?: Understanding Its Factors & Types With Examples

- What Is Monopoly? Definition, Features, Types, Impact & Antitrust Laws

- What Is Demand Forecasting, Benefits & Methods Explained

- Engel's Law Explained: How Income Impacts Your Grocery Bill

- Marginal Utility Explained: From Evolution To Current Use

Instinctively, I fall for nature, music, humor, reading, writing, listening, traveling, observing, learning, unlearning, friendship, exercise, etc., all these from the cradle to the grave- that's ME! It's my irrefutable belief in the uniqueness of all. I'll vehemently defend your right to be your best while I expect the same from you!

Login to continue reading

And access exclusive content, personalized recommendations, and career-boosting opportunities.

Subscribe

to our newsletter

Comments

Add comment