- What is Human Resource Management (HRM)?

- Importance of HRM in an Organization

- What are the key Objectives of HRM?

- What are the main functions of HRM?

- Scope of HRM in an Organization

- Role Of HRM in an Organization

- Technology Integration & Future Trends in HRM

- Career Paths In Human Resource Management

- Conclusion

- Frequently Asked Questions (FAQs)

- Simulation Training: Understanding the Concept

- Evolution of Training Methodologies

- Benefits of Simulation Training

- Implementing Simulation Training in Organizations

- Future Simulation Training Trends

- Summing Up

- Frequently Asked Questions

- What do you mean by Performance Appraisal?

- Purpose & Objective of Performance Appraisal

- Types of Performance Appraisal

- Methods of Performance Appraisal: Benefits & Drawbacks

- Understanding the Working of Performance Appraisal

- Benefits of Performance Appraisal with Examples

- Criticisms & Limitations Of Performance Appraisal

- Conclusion

- Frequently Asked Questions (FAQ)

- Job Analysis: Definition & Importance

- Job Analysis: Key Components

- Identifying The Right Moment For Job Analysis

- Navigating Job Analysis Process

- Distinguishing Job Analysis & Evaluation

- Using The Findings Of Job Analysis

- Conclusion

- Frequently Asked Questions (FAQs)

- Deciphering Training & Development

- Difference Between Training, Development & Learning

- Significance Of Training & Development In HRM

- Benefits Of Training & Development For Organizations

- Types & Methods Of Employee Training

- Building Blocks Of Training Programs

- Trends & Innovation In Employee Training

- Strategic Integration With Talent Management

- Addressing Challenges In Training & Development

- Frequently Asked Questions (FAQs)

- Understanding Strategic Human Resource Management

- Scope Of Strategic Human Resource Management

- Creating A Strategic HR Plan In 7 Steps

- Different Approaches To Strategic Human Resource Management

- Importance Of Strategic Human Resource Management

- Characteristics Of Strategic Human Resource Management

- Frequently Asked Questions (FAQs)

- What is Selection Procedure in HRM?

- Stages Of Selection Procedure In HRM

- Making Informed Decisions With Job Offers

- Onboarding Strategies For New Hires

- Best Practices In Selection Procedure

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Human Resource Planning

- Understanding The Essence Of Human Resource Planning

- Key Objectives & Importance Of Human Resource Planning

- Strategic Alignment Of Human Resource Planning

- Core Steps Involved In Human Resource Planning Process

- Analyzing Labor Market Dynamics

- Tools & Techniques For Human Resource Planning

- Common Challenges & Solutions In Human Resource Planning

- Future Trends Influencing Human Resource Planning

- Measuring Success & Progress In Human Resource Planning

- Frequently Asked Questions (FAQs)

- Concept & Purpose Of Job Evaluation

- Overview Of Job Evaluation Methods

- Importance Of Implementing A Job Evaluation System

- Steps To Conduct A Thorough Job Evaluation

- Selecting Appropriate Method For Job Evaluation

- Establishing Job Evaluation Committee

- Advantages & Limitations Of Job Evaluation Techniques

- Maintaining & Updating Job Evaluation Process

- Frequently Asked Questions (FAQs)

- What is Training Needs Analysis?

- Purpose of Training Needs Analysis

- What are the Types of Training Needs Analysis?

- 7 Key Steps to Conduct Training Needs Analysis

- Methods of Data Collection for TNA

- What are the Benefits of Training Needs Analysis?

- Conclusion

- Frequently Asked Questions (FAQ)

- Types of Training Methods

- On-the-Job Training Methods (Learning by Doing)

- Off-the-Job Training Methods (Structured Learning)

- Microlearning & Mobile Learning

- Peer-to-Peer & Self-Directed Learning

- Choosing The Right Method

- Traditional Vs Modern Training Techniques

- Evaluating The Different Types Of Training Methods

- The Future of Training

- Conclusion

- Frequently Asked Questions (FAQs)

- What is Job Design in HRM?

- Methods of Job Design: Key Strategies

- The Impact of Taylorism on Job Design

- Hackman and Oldham Model or the Job Characteristics Model

- Socio-Technical Systems and Job Design

- The Job Design Process: Best Practices

- Things to Keep in Mind for an Effective Job Design Process

- Conclusion

- Frequently Asked Questions (FAQs)

- What is Training?

- What is Development?

- Core Differences Between Training and Development

- Similarities Between Training and Development

- Why This Difference Matters: Strategic Implications

- Importance of Training and Development

- Common Pitfalls of Confusing Training and Development

- Integrating Training and Development for Holistic Growth

- Frequently Asked Questions (FAQs)

- Key Challenges in Human Resource Management

- Addressing HRM Challenges Globally

- Legal and Regulatory Compliance in HRM

- Enhancing Productivity in HRM

- HRM Challenges in India

- Strategic Role of HR Leaders

- Technological Advancements in HRM

- Diversity and Inclusion in the Workplace

- Conclusion

- Frequently Asked Questions

- What do You Mean by Sources of Recruitment?

- Internal Sources of Recruitment

- Advantages & Disadvantages of Internal Sources of Recruitment

- External Sources of Recruitment

- Advantages & Disadvantages of External Sources of Recruitment

- Key Differences Between Internal & External Sources of Recruitment

- Innovative Recruitment Channels in the Digital Era

- Conclusion

- Frequently Asked Questions

- Want to Source Right & Optimize Your Recruitment Process?

- What is Human Capital?

- Human Capital Theory Explained

- Human Capital and Economic Growth

- Measuring Human Capital

- Human Capital Formation

- Human Capital Management Strategies

- Role of Education in Human Capital Formation

- Critiques of Human Capital Theories

- Future of Human Capital in Business

- Conclusion

- Frequently Asked Questions

- What is Wage?

- Types of Wages

- What is Minimum Wage?

- What is EPF Wage?

- What is the Differential Wage Rate?

- What is Real Wage?

- What is a Living Wage?

- Theories of Wages

- Factors That Affect Wages

- How Are Wages Calculated? (Formula to Calculate Wage)

- Key Differences Between Wages Vs. Salary

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Training Evaluation

- Understanding Training Evaluation Models

- Different Types Of Training Evaluation Methods

- Importance & Benefits Of Training Evaluation

- Formative Vs Summative Training Evaluation

- Creating An Effective Training Evaluation In Simple Steps

- Strategies For Employee Training Evaluation

- CIPP & Kaufman's Models In Training Evaluation

- Measuring & Analyzing Training Outcomes

- Best Practices For Conducting Training Evaluation

- Frequently Asked Questions (FAQs)

- What is Wage and Salary Administration in HRM?

- Importance of Wage and Salary Administration

- Objectives Of Wage & Salary Administration

- Principles Of Wage & Salary Administration

- Factors Influencing Wage & Salary Levels

- Frequently Asked Questions (FAQ)

- Meaning Of HR Professional

- Role Of An HR Professional

- Essential Skills Of Successful HR Professionals

- Effective Communication In HR Professionals

- Decision-Making & Problem-Solving In HR Professionals

- Frequently Asked Questions (FAQs)

- Definition & Evolution Of HRMS

- Understanding The Core Functionalities Of HRMS

- Key Features & Components Of HRMS

- Benefits & Importance Of Implementing HRMS

- Security Measures & Data Protection In HRMS

- Role Of Artificial Intelligence In HRMS

- Choosing The Right HRMS For Your Organization

- Frequently Asked Questions (FAQs)

- Definition Of Job Characteristics Model

- Hackman And Oldham Job Characteristics Model

- Five Core Job Characteristics Model Explained

- Psychological States & Work Outcomes in JCM

- Autonomy & Role In Job Satisfaction

- Task Significance

- Impact Of Feedback On Job Performance

- Factors Influencing The JCM's Effectiveness

- Practical Implications For SEO Content Writing

- Frequently Asked Questions (FAQs)

- Definition Of Executive Compensation

- Basics Of Executive Compensation

- Key Components Of Executive Compensation

- Purpose Of Compensation Packages

- Role Of Executive Compensation

- Types & Structures Of Executive Compensation Plan

- Short, Medium & Long-Term Compensation

- Trends & Regulations

- Best Practices For Executive Compensation

- Corporate Strategy & Governance

- Controversies & Criticisms

- Frequently Asked Questions (FAQs)

- Defining Employee Relations

- Importance Of Employee Relations Management

- Strategies For Effective Employee Relations

- Role Of An Employee Relations Specialist

- Resolving Workplace Disputes & Conflicts

- Addressing Wage Concerns & Policy Clarification

- Legal Compliance & Employee Relations Management

- Frequently Asked Questions (FAQs)

- What is International Human Resource Management?

- Objectives of International HRM

- Functions of International HRM

- Models of International HRM

- Strategies For Effective IHRM Implementation

- Key Differences Between IHRM and Domestic HRM

- Challenges in International HRM

- Frequently Asked Questions (FAQs)

- Importance Of Executive Development In HRM

- Methods Of Executive Development

- Objectives Of Executive Development

- Importance & Benefits Of Individualized Development Programs

- Frequently Asked Questions (FAQs)

- Defining Personnel Management & Objectives

- Key Functions Of Personnel Management

- Roles & Duties Of A Personnel Manager

- Personnel Management Vs. HRM

- Approaches & Policies In Personnel Management

- Manpower Planning, Recruitment & Selection Processes

- Training & Development Within Personnel Management

- Analysing Current Trends In Personnel Management

- Frequently Asked Questions (FAQs)

- What do you mean by Job Evaluation?

- What Are the Importance of Job Evaluation Methods?

- Best 7 Job Evaluation Methods in HRM

- Role Of Market Pricing In Job Evaluation

- Advantages & Disadvantages Of Job Evaluation Methods

- Career Progression, Legal Considerations & Compliance

- Best Practices For Job Evaluations

- Conclusion

- Frequently Asked Questions (FAQs)

- What is Personnel Management (PM)?

- What is Human Resource Management (HRM)?

- Similarities Between Personnel Management & HR Management

- Elaboration on Key Evolutionary Shifts

- Emerging Trends in Modern Human Resource Management

- Frequently Asked Questions (FAQs)

- Introduction to Kirkpatrick Model

- Origin & Evolution of the Kirkpatrick Model

- Importance of the Kirkpatrick Model

- Implementing the Kirkpatrick Model Training Evaluation

- Measuring Reaction: The First Level of Evaluation

- Assessing Learning: The Second Level Explained

- Evaluating Behavior Change: The Third Level of Impact

- Analyzing Results: The Fourth Level of Training Effectiveness

- Balancing Limitations in the Kirkpatrick Model

- Final Remarks

- Frequently Asked Questions (FAQs)

- Exploring The Concept Of Salary

- Key Differences Between Wages And Salary

- Types Of Wages & Their Impact on Earnings

- Varieties Of Salary Structures

- Advantages Of Earning Wages

- Benefits Of Receiving A Salary

- Legal Distinctions In Wage & Salary

- Overtime Compensation In Wage & Salary

- Frequently Asked Questions (FAQs)

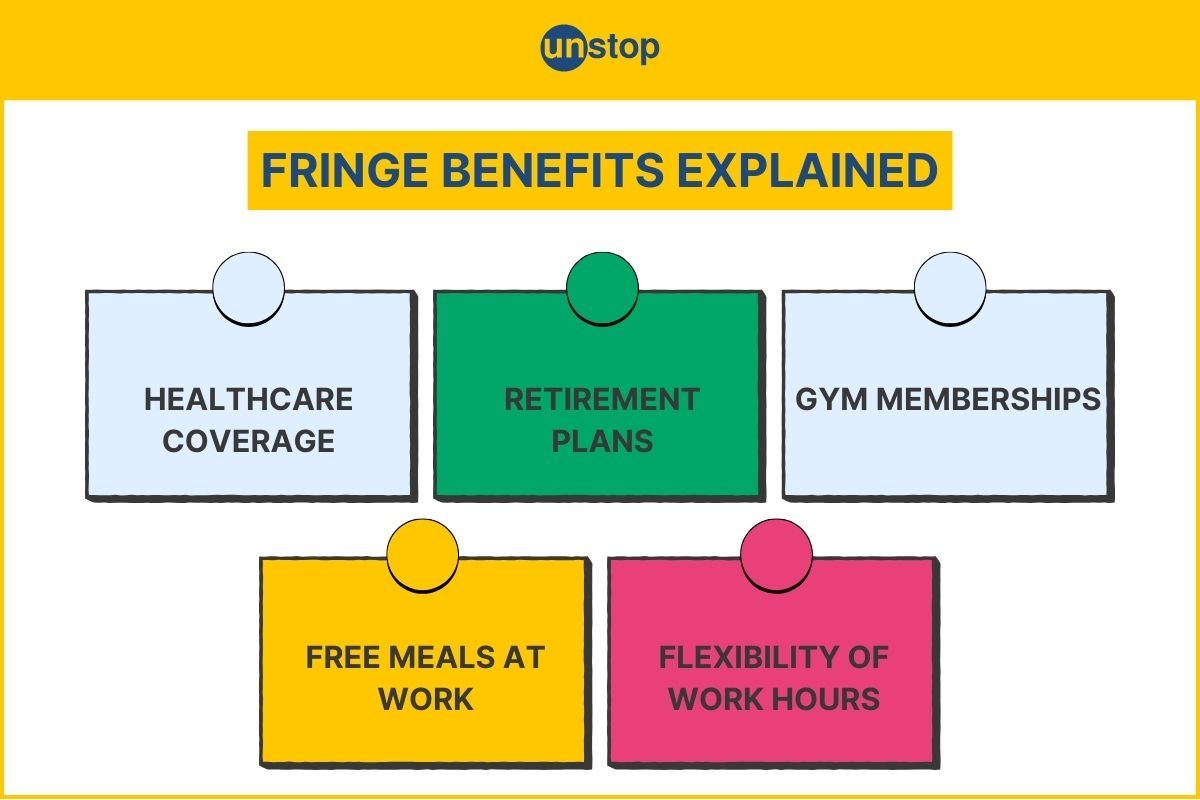

- Fringe Benefits Meaning & Objectives

- Examples & Types Of Fringe Benefits

- Necessity Of Fringe Benefits By Law

- Tax Implications For Various Fringe Benefits

- Valuing & Calculating Fringe Benefits

- Role Of Cafeteria Plans In Fringe Benefits

- Impact Of Fringe Benefits On Employees

- Business Impact Of Fringe Benefits

- Considerations In Offering Fringe Benefits

- Conclusion

- Frequently Asked Questions (FAQs)

- What Is HR Compliance & Importance

- Key Elements Of An HR Compliance Checklist

- Managing HR Compliance In The Workplace

- Conducting An Effective HR Compliance Audit

- Overcoming Challenges In HR Compliance

- Automation For Streamlined HR Compliance

- Best Practices For Enforcing HR Compliance

- Long-term Data Governance In HR Compliance

- Frequently Asked Questions (FAQs)

- What is Recruitment Process In HRM?

- 5 Essential Stages of Recruitment & Selection Process

- Identifying Vacancies & Crafting Effective Job Descriptions

- Job Portals, Social Media & Technology in Recruitment

- Internal Vs External Sources of Recruitment

- Strategies for effective Recruitment in HRM

- Psychometric Tests used in Recruitment

- Conclusion

- Frequently Asked Questions (FAQs)

Fringe Benefits In HRM | Definition, Types & Tax Implications

Fringe benefits play a pivotal role in attracting and retaining top talent. These additional perks beyond salary, such as health insurance, flexible work hours, and retirement plans, significantly impact an employee's decision to join or stay with a company.

This article delves into the significance of fringe benefits in today's competitive job market and explores how they contribute to overall job satisfaction and employee well-being.

Fringe Benefits Meaning & Objectives

Before we go further, let us study the definition of fringe benefits and their role in the workplace:

Fringe Benefits Meaning

Fringe benefits refer to non-monetary compensation provided to employees and their regular wages. Fringe benefits are extra rewards given to employees to make their total compensation better and encourage them to stay with the company.

Objectives of Fringe Benefits

Employers offer fringe benefits as a way to improve employee satisfaction and well-being. Employers give extra benefits to make a good work environment and keep employees happy and motivated.

Offering fringe benefits also contributes to boosting employee morale and productivity. Employees who feel valued through such offerings are more likely to be engaged and committed in their organizational roles.

Furthermore, by providing attractive fringe benefits, companies can gain a competitive edge in recruitment efforts by standing out as desirable employers with comprehensive compensation packages.

Examples & Types Of Fringe Benefits

Let us study the types of fringe benefits with examples:

Common Types of Fringe Benefits

Fringe benefits, often known as "perks" or "employee benefits," are additional compensations provided to employees on top of their regular salaries. These benefits not only enhance the overall compensation package but also contribute to employee satisfaction and retention. Here's a closer look at some of the most common types of fringe benefits offered by employers:

- Health Insurance: Perhaps the most valued fringe benefit, health insurance covers or significantly reduces the cost of medical treatments for employees. This may include vision and dental coverage as well.

- Retirement Plans: To help employees prepare for their retirement, many employers offer retirement plans such as 401(k) plans in the United States. Often, employers will match a portion of the employee's contributions, further incentivizing participation.

- Paid Time Off (PTO): This includes vacation days, sick leave, and personal days. Offering paid time off allows employees to rest and recharge, leading to increased productivity and job satisfaction.

- Life and Disability Insurance: These insurances provide financial protection to employees in case of unforeseen life events, ensuring peace of mind for them and their families.

- Flexible Working Hours: Allowing employees to adjust their working hours or work from home provides them with a better work-life balance, making this a highly appreciated benefit.

- Tuition Assistance: Employers may offer to cover the cost of further education or professional development courses, encouraging continuous learning and advancement within the field.

- Employee Discounts: Discounts on products or services from the employer or partnered organizations can be a direct financial benefit to employees.

- Wellness Programs: From gym memberships to mental health support, wellness programs aim to improve the overall health and well-being of employees.

- Childcare Assistance: Some organizations offer onsite childcare, subsidies, or assistance in finding childcare services, which is a significant benefit for working parents.

- Transportation Benefits: This can range from company-provided transportation to subsidies for public transit or parking, easing the daily commute for employees.

By offering a comprehensive package of fringe benefits, employers can attract top talent, reduce turnover rates, and foster a motivated, healthy, and productive workforce.

Necessity Of Fringe Benefits By Law

Let us study what necessitates the role of fringe benefits:

Legal Requirements

Employers must provide certain fringe benefits to their employees as required by law. These benefits include social security, unemployment, work injuries, and time off for family or medical reasons. Failing to meet these legal obligations may lead to penalties or legal consequences.

Ensuring compliance with labor laws related to fringe benefits is crucial for maintaining a positive employer-employee relationship.

Employers show they care about their employees' welfare and build trust and loyalty by offering the required benefits.

Impact On Employer-Employee Relationships

The provision of fringe benefits has a significant impact on employer-employee relationships. For instance, offering free meals or breakfast at work fulfills legal requirements and enhances employee satisfaction and morale.

Similarly, providing opportunities for training and development not only meets legal obligations but also demonstrates an investment in employees' growth and career advancement.

Pros

- Compliance with labor laws fosters a positive work environment.

- Providing mandated fringe benefits can lead to higher employee retention rates.

Cons

- Failure to abide by the legal requirements may result in financial penalties.

- Non-compliance can damage an employer's reputation and employee trust.

Tax Implications For Various Fringe Benefits

From a tax perspective, fringe benefits can be categorized as taxable or non-taxable benefits.

For example, employer-provided health insurance is usually considered non-taxable for employees. However, benefits such as using a company car for personal reasons or having life insurance paid by the employer usually need to be taxed.

It's important to understand that while some benefits can be excluded from an employee's total income and not subject to income tax withholding, others may require the employer to report and withhold taxes in a specific manner.

Importance Of Considering Tax Consequences

Considering the tax consequences when offering fringe benefits is essential for employers and employees. Employers need to understand how providing different types of fringe benefits impacts their overall compensation costs and potential tax liabilities.

Similarly, employees should be aware of any potential tax obligations associated with receiving certain fringe benefits to avoid unexpected financial burdens at year-end.

Furthermore, knowing the tax implications allows both parties to make informed decisions regarding which fringe benefits will best suit their needs while minimizing any adverse effects on their finances come tax time.

Valuing & Calculating Fringe Benefits

Let us study the methods for valuing and calculating fringe benefits:

Methods For Valuing

Employers can value fringe benefits in various ways, depending on the type of benefit. For example, they might determine the value of a company car by considering its annual lease value. Health insurance benefits are typically valued at their actual cost to the employer.

Other extra benefits, like meals and lodging, may have a value based on what they would cost if you bought them.

Valuing fringe benefits accurately is crucial for financial reporting purposes as it ensures that companies comply with accounting standards and provide transparent information to stakeholders.

Calculation Process

The calculation process for determining the value of fringe benefits involves assessing each benefit's specific characteristics and applying the appropriate valuation method. This often requires collaboration between HR professionals, finance teams, and tax experts to ensure accuracy.

Accurately valuing fringe benefits also enables employers to make informed decisions about compensation packages, attract top talent, and maintain employee satisfaction.

Role Of Cafeteria Plans In Fringe Benefits

Let us study the role of cafeteria plans in fringe benefits:

Definition & Purpose

Cafeteria plans, which are also referred to as flexible benefits plans or Section 125 plans, give employees the option to choose from a range of fringe benefits.

This allows them to customize their benefit packages based on their individual needs. By offering cafeteria plans, employers aim to attract and retain talent by providing a diverse range of benefits catering to their workforce's unique requirements. For instance, an employee who requires extensive healthcare coverage may opt for comprehensive medical insurance through the cafeteria plan.

Cafeteria plans enhance employee satisfaction and engagement by empowering them with the freedom to select benefits that align with their lifestyle and priorities.

Flexibility For Employees

The flexibility provided by cafeteria plans is advantageous for employees as it gives them control over allocating a portion of their compensation towards specific benefits.

This can make employees feel more satisfied and motivated with their jobs because they will feel appreciated when they can customize their benefits to fit their own situations.

Employers need not worry about being overwhelmed with administrative tasks when implementing cafeteria plans because these are typically managed through automated systems or third-party administrators.

Impact Of Fringe Benefits On Employees

Let us look at some of the impacts of fringe benefits on employees:

Employee Motivation

Fringe benefits, such as flexible work hours and healthcare coverage, play a crucial role in motivating employees. Good employees are more likely to feel valued and inspired when they receive attractive fringe benefits.

Allowing employees to work from home can make them happier and more motivated. Also, giving them extra benefits like health programs and chances to learn new skills shows that the company cares about their well-being and wants them to grow.

Employee Retention

Attractive fringe benefit packages directly impact employee retention rates. By offering appealing perks such as bonuses or paid time off, organizations create a supportive culture that encourages staff members to remain with the company for the long term.

These incentives are a powerful retention tool that makes employees feel appreciated and valued beyond their salaries. It's important for bosses to grasp how extra work perks can keep workers happy and hardworking.

By recognizing what truly matters to their staff members and tailoring fringe benefit offerings accordingly, companies can ensure sustained motivation and job satisfaction among their valuable team members.

Business Impact Of Fringe Benefits

Let us also study the impact of fringe benefits on business:

Effectiveness & ROI

The effectiveness and return on investment (ROI) of offering fringe benefits can be measured through employee surveys, retention rates, and recruitment costs.

For instance, if a company offers flexible work hours as a fringe benefit, it can measure its effectiveness by evaluating how it contributes to employee satisfaction and work-life balance.

Employees who feel valued through these benefits are more likely to be engaged in their work. This engagement often translates into higher productivity levels and improved performance.

Consideration Of Business Metrics

When evaluating the business impact of fringe benefits, organizations need to consider various business metrics such as cost savings from reduced turnover, enhanced talent acquisition due to competitive benefits packages, and improved employer branding, leading to better customer satisfaction.

These metrics provide tangible evidence of how fringe benefits contribute to employee well-being and directly affect the company's bottom line.

Considerations In Offering Fringe Benefits

Let us study some of the important considerations while offering fringe benefits to employees:

Unique Considerations

Small businesses often face unique challenges when providing fringe benefits. Limited resources and workforce can make it difficult to administer complex benefit programs.

Small businesses may not have HR departments or enough money to offer extensive benefits like big companies. They have to think hard about which benefits will really help their employees without costing too much.

Small businesses must navigate legal requirements and compliance issues when offering fringe benefits. They must ensure that their benefit offerings align with state and federal regulations, which can be daunting without specialized expertise or legal counsel.

Customization Options

One advantage for small businesses is the ability to customize fringe benefit packages based on their employees' diverse needs. While large companies may offer standard benefits such as gym memberships or cafeteria meals, smaller organizations can tailor their offerings more closely to what matters most to their workforce.

For example, a tech startup might prioritize offering generous remote work policies and professional development opportunities through training programs, recognizing that its employees highly value these.

On the other hand, a restaurant business might focus on providing complimentary meals during shifts as part of its fringe benefit package.

Conclusion

Understanding the various types and legal implications of fringe benefits is crucial for both employers and employees. It ensures compliance with tax laws and impacts employee motivation and overall business performance.

Valuing and measuring the impact of fringe benefits provides insights into their effectiveness, guiding strategic decisions in offering competitive employment packages.

Time For A Short Quiz

Frequently Asked Questions (FAQs)

Q1. What are fringe benefits?

Fringe benefits refer to extra perks that employees receive on top of their usual pay. These may come in non-monetary forms and are meant to supplement their regular wages or salaries. These can include health insurance, retirement plans, childcare assistance, and other perks.

Q2. Why are fringe benefits important for employees?

Fringe benefits are crucial in attracting and retaining top talent. They contribute to employee satisfaction, overall well-being, and work-life balance.

Q3. How do employers calculate the value of fringe benefits?

Employers typically calculate the value of fringe benefits by considering the cost incurred for providing these benefits and any associated tax implications.

Q4. Are all fringe benefits subject to taxation?

The tax treatment of fringe benefits varies depending on the type of benefit offered. Some may be taxable, while others could be exempt from certain taxes.

Q5. What is a cafeteria plan about fringe benefits?

A cafeteria plan allows employees to select from a menu of different benefit options, such as health insurance or dependent care assistance, using pre-tax dollars deducted from their paychecks.

Suggested Reads:

- On-the-Job Training vs Simulations: A Comparative Analysis

- Gamified Recruitment For Engaging And Assessing Top Talent

- Employee Skill Gap Analysis: What Is It & How To Conduct It?

- How Simulations Help In Developing Economics Skills Among Students & Employees?

- Upskill And Reskill: The Learning Approaches Shaping Professional Development Today

Instinctively, I fall for nature, music, humor, reading, writing, listening, traveling, observing, learning, unlearning, friendship, exercise, etc., all these from the cradle to the grave- that's ME! It's my irrefutable belief in the uniqueness of all. I'll vehemently defend your right to be your best while I expect the same from you!

Login to continue reading

And access exclusive content, personalized recommendations, and career-boosting opportunities.

Subscribe

to our newsletter

Comments

Add comment