- Top Employee Onboarding Software

- Why Use Employee Onboarding Software?

- Key Features of Effective Onboarding Software

- How To Choose The Right Onboarding Software?

- Which is the Best Onboarding Software?

- Frequently Asked Questions (FAQs)

- What Is Upskill And Reskill?

- Difference Between Reskilling And Upskilling

- Upskilling for Workplace Advancement

- Reskilling for Career Transformation

- Crafting Successful Upskill and Reskill Strategies

- Upskill And Reskill Strategizing: Things to Keep in Mind

- Measuring the Impact of Skill Development Initiatives

- Frequently Asked Questions

- What’s a Skill Gap?

- Employee Skill Gap Analysis: Why Do We Need It?

- How To Conduct Employee Skill Gap Analysis?

- Addressing Skill Gaps Through Training and Hiring

- Utilizing Skills Gap Analysis for Strategic Planning

- Leveraging Employee Skill Gap Analysis: Things To Keep In Mind

- Frequently Asked Questions

- Transformative Role of AI in Talent Acquisition

- Impact of AI on Business Recruiting

- Overcoming Challenges in AI-Driven Talent Acquisition

- Starting with AI in Talent Acquisition

- Future Landscape of AI in Talent Acquisition

- Frequently Asked Questions

- HR In The Hot Seat - Challenges With Evolving Workforce

- Mastering Effective HR Management: Tips For Overcoming Challenges

- Summing Up

- The Future of HR: Key Trends for 2024

- Skill-Based Hiring

- Prioritizing Employee Experience, Engagement & Well-being

- AI-Empowered Workforce Evolution and Its Impact

- Taking Diversity, Equity, and Inclusion Beyond Mandates

- Hybrid and Remote Work

- Embracing the Gig Economy and Blended Workforce

- Transparent HR Practices

- Climate Change Adaptation in HR Practices

- Leveraging HR Analytics for Data-Driven Decisions

- Continuous Learning & Development to Improve Productivity

- The Office Buzz in 2024

- Bottom Line - HR Operating Model Needs A Shift

- Importance and Impact of Recognizing Employee Birthdays

- Professional Birthday Wishes for Employees (All Experience Levels)

- Personalized Birthday Wishes for Employees in Different Roles

- Fun Birthday Wishes for Employees (with Templates)

- Birthday Wishes for Remote Employees

- Heartfelt Birthday Wishes for Employees

- Belated Birthday Wishes for Employees

- Simple & Sweet Birthday Wishes for Employees

- Celebrating Employee Birthdays: Ideas and Traditions

- Tips and Ideas for Sending Birthday Wishes to Employees

- Closing Thoughts

- Frequently Asked Questions

- What Is An Employee Referral?

- Benefits of Implementing Employee Referral Programs

- Setting Up an Effective Employee Referral Program

- Employee Referral Email

- Employee Referral Scheme

- Overcoming Challenges of Employee Referrals

- Companies with Best Employee Referral Programs

- Employee Referral Programs: Best Practices

- Closing Thoughts

- Frequently Asked Questions (FAQs)

- Importance of Team Building Activities

- Types of Team Building Activities

- Outdoor Team Building Activities for Employees

- Indoor Team Building Activities for Employees

- Easy Team Building Activities for Remote Employees

- Team Building Activities For New Employees (Icebreakers)

- Fun Team Building Activities for Different Goals

- To Boost Communication and Collaboration

- To Reduce Stress Levels and Promote Well-being

- Aligning Team Purpose and Values with Strategic Activities

- Final Remarks

- Frequently Asked Questions

- Importance of Employee Appreciation Quotes

- Work Appreciation Quotes for Employees

- Employee Appreciation Quotes for Hard Work Recognition

- Employee Appreciation Quotes for Teamwork and Collaboration

- Appreciation Quotes for Celebrating Employee Anniversaries and Milestones

- Employee Appreciation Quotes for Strong Work Ethics

- Employee Appreciation Quotes for Project & Goal Completion

- Employee Appreciation Quotes for Quality of Work

- Employee Appreciation Quotes for Creativity and Innovation

- Appreciation Quotes for Managers

- Peer-to-Peer Employee Appreciation Quotes

- Appreciation Quotes for Employees Leaving the Company

- Employee Appreciation Quotes for Thoughtful Gestures

- Funny Employee Appreciation Quotes

- Short Employee Appreciation Quotes

- Employee Appreciation Quotes for Different Roles

- Employee Appreciation Quotes for Senior Leadership

- Creative Ways to Use Employee Appreciation Quotes

- Summary

- Frequently Asked Questions (FAQs)

- What is Employee Satisfaction?

- Importance of Employee Satisfaction

- Objectives of Employee Satisfaction

- Employee Satisfaction vs. Employee Engagement

- Key Reasons for Employee Dissatisfaction

- Strategies for Improving Employee Satisfaction

- Ways to Measure Employee Satisfaction

- Best Practices for High Employee Satisfaction

- Final Remarks

- Frequently Asked Questions (FAQs)

- How to Craft Effective Employee Appraisal Comments

- Key Areas to Focus in Performance Review

- Comments On Hard Work & Dedication

- Assessing Interpersonal Skills

- Evaluating the Ability to Collaborate & Work in Teams

- Gauging Punctuality

- Commenting on Communication Style

- Reviewing Time Management and Productivity

- Leadership in Performance Appraisals

- Assessing Creativity & Innovation

- Evaluating Problem-Solving Abilities

- Recognizing Flexibility and Dependability in Reviews

- Employee Appraisal Comments for Different Roles

- Summary

- Frequently Asked Questions (FAQs)

- Employee Grievance Meaning

- Importance of Employee Grievance Process

- Types of Workplace Grievances

- Reasons for Employee Grievances

- Employee Grievance Procedure

- Steps in the Employee Grievance Handling Process

- Employee Grievance Form Example

- Final Remarks

- Frequently Asked Questions (FAQs)

- What is Company Culture?

- Importance of Company Culture

- Types of Company Culture

- Factors Contributing to Organizational Culture

- Assessing & Developing Corporate Culture

- Company Culture - It’s not just Perks or Feels

- Good Company Culture Examples

- Developing Company Culture: Best Practices

- Closing Thoughts

- Frequently Asked Questions (FAQs)

- What is Employee Empowerment?

- Benefits of Empowering Employees

- Employee Empowerment vs. Micromanagement

- Strategies for Effective Employee Empowerment

- Role of Managers in Fostering Empowerment

- Organizational Structure Supporting Empowerment

- Overcoming Barriers to Employee Empowerment

- Frequently Asked Questions (FAQs)

- What is Employer Branding?

- Importance of Employer Branding Strategy

- How to Build an Employer Branding Strategy?

- Strategies for Building a Strong Employer Brand

- How to Measure and Boost Your Employer Branding Success?

- Examples of Strong Employer Brand Strategy

- Best Practices for an Effective Employer Branding Strategy

- Closing Thoughts

- Frequently Asked Questions (FAQs)

- What are Employee Wellness Programs?

- Importance of Employee Wellness Programs

- Examples of Employee Wellness Programs

- Real-Life Examples of Corporate Wellness Programs

- Strategies for Encouraging Participation

- Supporting Diverse Employee Needs

- Creating Comprehensive Wellness Programs

- Measuring the Impact on Business and Employees

- Closing Thoughts

- Frequently Asked Questions (FAQs)

- What is Talent Management?

- Developing a Winning Talent Management Strategy

- Models and Frameworks

- Tips for Framing Effective Talent Management Strategy

- Looking Ahead: Recent Trends in Talent Management

- Frequently Asked Questions

- Role of AI in HR: Addressing Common Challenges

- Artificial Intelligence in HR Processes

- AI Tools for HR Functions

- How to Adopt AI in HR?

- Addressing Challenges of AI in HR

- Ethical and Responsible AI Use

- The Future of AI in HR

- Closing Thoughts

- Frequently Asked Questions

- What is Performance Management?

- Elements of Effective Performance Management

- Performance Management Cycle

- Differentiating Performance Management

- Benefits of Performance Management With Examples

- Challenges faced in Performance Management and their Solutions

- Future Trends in Performance Management

- Frequently Asked Questions

- Changing Role of HRM

- Changing Role Of HR Manager

- Technology and the Changing Role of HRM

- The Rise of AI and Machine Learning in HR

- Mobile Technology's Impact on HR Practices

- The Significance of People Analytics in HR

- Navigating the Future of HR Technology

- Final Remarks

- Frequently Asked Questions

- Compensation Management Meaning

- Compensation Types

- Breaking Down The Compensation Management Process

- HR Software for Compensation Management

- Current Trends in Compensation Management

- Frequently Asked Questions

- Defining Flexible Work Arrangements

- Flexible Working: Advantages for Businesses

- Challenges of Flexible Work Arrangements

- Crafting Flexible Working Practices

- Types Of Flexible Work Arrangements

- Comparing Flexible Work Arrangements

- Real-Life Examples of Flexible Work Arrangements

- Final Remarks

- Frequently Asked Questions

- Conflict Resolution Meaning

- Conflict Origins

- Tried & Tested Conflict Resolution Strategies

- Methods of Conflict Management at Workplaces

- Conflict Resolution Strategies: Top Management Tips

- Summary

- Frequently Asked Questions

- Career Development Meaning

- Career Development Plan for Employees

- Career Development in HRM: Growth Ideas For Employees

- Issues in Career Development and Their Solutions

- Closing Thoughts

- Frequently Asked Questions

- Understanding Compensation

- Exploring Benefits

- Difference between Compensation and Benefits

- Compensation & Benefits Structure

- Final Remarks

- Frequently Asked Questions

- Defining Recruitment in HR Practices

- Exploring Talent Acquisition in HR

- Understanding Talent Acquisition vs Recruitment

- When to Recruit or Acquire Talent

- Talent Acquisition vs Recruitment: Responsibilities

- From Recruitment To Talent Acquisition

- Closing Thoughts

- Frequently Asked Questions

- Work Culture Meaning

- Types of Work Cultures

- Components of Culture

- Best Work Culture Examples Set By Top Companies

- Creating a Positive Work Culture

- Closing Thoughts

- Frequently Asked Questions

- Defining Learning vs Development

- Importance of Learning and Development

- L&D Activities for Employees

- Choosing the Right L&D Activities

- Crafting an Effective L&D Strategies

- Aligning L&D Strategy with Business Goals

- Designing Engaging Learning Journeys

- Learning and Development Process: KPIs

- ROI in Learning and Development

- Emerging Trends in L&D

- Closing Thoughts

- Frequently Asked Questions

- What Is Leadership Development?

- Key Skills for Leaders

- How To Develop Leadership Skills in Organizations?

- What Is A Leadership Development Program?

- How To Develop A Leadership Development Program?

- Example of A Leadership Development Plan

- Benefits of Leadership Development Training

- Frequently Asked Questions

- Defining Diversity Training

- Importance of Diversity Training

- What are the Types of Diversity?

- Types of Diversity Training Methods

- Diversity Training Activities

- Choosing A Diversity Training Program

- How to Implement Diversity Initiatives

- Best Diversity Training Programs (Real-Life Examples)

- Improving the Effectiveness of Diversity Training

- Tracking and Evaluating the Results of DE&I Training Efforts

- Essential Elements for Successful Diversity Training

- Closing Thoughts

- Frequently Asked Questions

- Defining Occupational Health & Safety

- Evolution of Workplace Health and Safety

- Identifying Common Workplace Hazards

- Global Impact on Occupational Health & Safety

- Managing Employee Health and Safety Risks

- Occupational Health and Safety Problems

- Future of Occupational Health and Safety

- Frequently Asked Questions

- Employee Orientation Defined

- Employee Onboarding Explained

- Orientation and Onboarding: Understanding the Difference

- Importance of Orientation and Onboarding

- Crafting Comprehensive Integration Strategies

- Quick Tips for Orientation and Onboarding

- Frequently Asked Questions

- What is HR Metrics?

- Importance of HR Metrics

- HR Metrics Examples in Recruitment

- HR Metrics Examples in Employee Retention

- HR Metrics Examples in Revenue

- Other Common HR Metrics

- Soft HR Metrics Example

- HR Metrics Formula

- Utilizing HR Metrics Effectively

- Future of HR Metrics

- Summary

- Frequently Asked Questions

- Defining Decision Making Process

- Key Concepts In Decision Making

- Decision Making & Problem Solving

- Tips For Improving Decision Making Skills

- Selected Practice Questions & Answers

- Conclusion

- Frequently Asked Questions (FAQs)

- A case(s) of miscommunication

- The devil is in the (resume) details

- One for the complaints!

- What is an Exit Interview?

- Benefits of Exit Interviews to an Organization

- How to Conduct Exit Interviews?

- Exit Interview: Sample Questions to Ask

- Overcoming Challenges of Exit Interviews

- Exit Interviews: Best Practices

- Closing Thoughts

- Frequently Asked Questions

- Technology in the Workplace

- Benefits of Tech Integration

- Technology in the Workplace: Key Functions

- How Technology Normalized Remote Work

- Workplace Technology: Top Tools and Software

- Steps for Effective Technology Implementation

- Overcoming Tech Implementation Challenges

- Ethical Considerations in Tech Use

- Keeping Pace with Tech Trends

- Closing Thoughts

- Frequently Asked Questions

- What is Ethical Leadership?

- Principles of Ethical Leadership

- Difference between Ethics and Integrity

- Importance of Ethical Leadership

- Ethical Leadership in Practice

- Overcoming Challenges

- Frequently Asked Questions

- Embracing Change Management

- Mastering People Analytics

- Enhancing Stakeholder Relationships

- Navigating Diversity, Equity & Inclusion

- Upholding Ethics and Data Privacy

- Developing Critical Thinking

- Advancing Negotiation Techniques

- Fostering Inter-departmental Collaboration

- Building Resilience in HR

- Frequently Asked Questions

- What is Mental Health?

- Benefits of a Mentally Healthy Workforce

- Prioritising Mental Health: Creating a Culture of Support

- Final Remarks

- Frequently Asked Questions

- Gen Z vs Millennials - What is the difference?

- Retain and Engage Gen Z Employees: Need and Strategies

- Strategies to Retain and Engage Gen Z Employees

- Rethinking Requirements

- Final Remarks

- Frequently Asked Questions

- Understanding Millennial Leadership Needs

- Key Leadership Skills for Millennials

- How To Develop Millennial Into Leaders

- Additional Strategies to Develop Leaders

- Learning Preferences of Millennials

- Benefits of Investing in Millennial Leaders

- Closing Thoughts

- Frequently Asked Questions

- Understanding Fluff

- Examples of Interview Fluff

- Identifying Interview Fluff

- Addressing Interview Fluff

- Seeing Through the Fluff

- Frequently Asked Questions

- What is the Gender Pay Gap?

- Is the Gender Pay Gap Real?

- Factors Affecting the Gender Pay Gap

- How Age Impacts Women’s Earnings

- The ‘Motherhood Penalty’

- Education's Role in Wage Differences

- Racial and Ethnic Disparities in Pay

- Closing the Gender Gap

- Frequently Asked Questions

- Top Weirdest Late-To-The-Office Excuses

- The Fine Art of Balancing Wit and Wisdom in HR

- Understanding Social Media Recruiting

- Crafting Your Social Media Recruitment Strategy

- Implementing Your Strategy Effectively

- Popular Platforms for Recruitment

- Navigating the Downsides of Social Media Recruiting

- Measuring Success and Adjusting Strategy

- Summary

- Frequently Asked Questions

- Who Is A High Potential (HIPO) Employee?

- Characteristics of A High Potential (HIPO) Employee

- High Potential Employee Identification

- Grooming High Potential Employees

- Why High Potential Employees Leave

- How Do You Retain High Potential Employees?

- High Potential Employee Development: Best Practices

- Closing Thoughts

- Frequently Asked Questions

- What is Digital Fluency?

- Why Digital Fluency Matters?

- Difference between Digital Literacy and Digital Fluency

- Key Components of Digital Fluency

- Achieving Digital Fluency

- Overcoming Challenges

- Future of Workforce Digital Fluency

- Frequently Asked Questions

- What is Loud Quitting?

- Pros and Cons of Loud Quitting

- Reasons Behind the Trend

- Analyzing the Impact

- How HR Can Navigate the Loud Quitting Uproar

- Preventive Strategies

- Closing Thoughts

- Frequently Asked Questions

- Defining Emotional Intelligence in HR

- Why Emotional Intelligence Matters for HR Leaders

- How To Build Emotional Intelligence in HR

- Integrating EQ into HR Practices

- Impact of EQ on Company Culture

- Emotional Intelligence in HR: Major Challenges

- Final Remarks

- Frequently Asked Questions

- Understanding Internal Job Posting

- Internal Job Posting: Pros and Cons

- The Internal Job Posting Process

- Writing Effective Ads for Internal Job Posting

- Strategies for Success of Internal Job Posting

- Summary

- Frequently Asked Questions

- Understanding Workplace Bias

- Common Types of Bias in HR

- Closing Thoughts

- Frequently Asked Questions

- What is a Dry Promotion?

- Dry Promotion: Pros and Cons for Companies

- Impact of Dry Promotion on Employee Retention

- Preventing Talent Loss After Dry Promotions

- Closing Thoughts

- Frequently Asked Questions

- What Is A Stay Interview?

- Importance Of Stay Interviews

- Benefits And Challenges Of Stay Interviews

- Planning And Conducting Stay Interviews

- Stay Interviews: 20 Sample Questions To Ask

- Best Practices For Effective Stay Interviews

- Summary

- Frequently Asked Questions

- Who Is A Boomerang Employee?

- Reasons For Returning

- Benefits Of Hiring Boomerang Employees

- Challenges Of Rehiring

- Interviewing Boomerang Candidates: Sample Questions

- Enhancing The Hiring Process

- Making Informed Decisions

- Final Remarks

- Frequently Asked Questions

- Talent Pipeline Meaning

- Significance of Talent Pipelines

- Advantages of a Talent Pipeline

- Building a Talent Pipeline

- Maintaining a Talent Pipeline

- Attracting Top Talent

- Implementing the Strategy

- Frequently Asked Questions

- What is Micromanagement?

- Recognizing Micromanagement

- Leadership versus Micromanagement

- Keeping Micromanagement in Check

- Beyond Micromanagement

- Summing Up

- Frequently Asked Questions

- Recognizing Signs Of A Bad Hire

- Understanding The Impact On Teams

- Dealing With A Bad Hire

- Preventing Future Bad Hires

- Closing Thoughts

- Frequently Asked Questions

- Defining Neurodiversity

- Importance of Neurodiversity in the Workplace

- Moving Towards Inclusive Environments

- Final Remarks

- Frequently Asked Questions

- Understanding the Generation Gap

- Multigenerational Workforce: Debunking Stereotypes

- Strategies for Bridging the Gap

- Benefits of a Multigenerational Workforce

- Final Remarks

- Frequently Asked Questions

- Defining Productivity Theatre: All Show, No Go

- 5 Key Drivers of Fake Productivity

- Solutions to Combat Productivity Theatre

- Summary

- Frequently Asked Questions

- Defining Grumpy Staying

- Why do Grumpy Stayers not Leave?

- Recognizing the Signs

- Exploring the Causes

- Understanding the Impact

- Addressing the Issue

- Taking Action: Addressing Grumpiness with Empathy

- After the Conversation

- When Grumpy Staying Continues

- Closing Thoughts

- Frequently Asked Questions

- The Rationale Behind Office Peacocking

- Impact on Company Culture

- Impact on Employees

- Case Studies: Examples of Office Peacocking

- The Downside: Potential Pitfalls of Office Peacocking

- Practical Tips for Implementing Office Peacocking

- Frequently Asked Questions

- 13 Common Mistakes Young Managers Make

- Strategies To Avoid Mistakes (Individual Growth)

- How Young Managers Can Boost Teamwork

- Learning From Errors

- Summary

- Frequently Asked Questions

- Understanding Great Regret - What causes the shift shock?

- Impact of Great Regret

- How can HR help make the situation better?

- Closing Thoughts

- Frequently Asked Questions

- Understanding the HR Budget

- Key Components of an HR Budget

- Preparing an HR Budget Step-by-Step

- Importance of HR Budgeting in Management

- Final Remarks

- Frequently Asked Questions

- What are Pre-Employment Assessments?

- Importance of Pre-Employment Testing

- Types of Pre-Employment Assessments

- 15 Tips for Creating Effective Pre-Employment Assessments

- Closing Thoughts

- Frequently Asked Questions

- Exploring the Productivity Paradox

- Understanding the Impact of Solow Paradox

- Productivity Paradox: Why it Matters for Recruiters & HRs

- Identifying Causes and Challenges

- Strategies for Enhancing Productivity

- AI & the Modern-Day Productivity Paradox

- Beyond Technology: Building a Productive Workforce

- Summary

- Frequently Asked Questions

- Understanding the Great Reshuffle 2.0

- Preparing Leaders for the Change

- HR’s Role in Handling Great Reshuffling 2.0

- The Way Ahead

- Frequently Asked Questions

- Definition Of Managerial Grid

- Managerial Grid Theory Explained

- Application Of Managerial Grid

- Criticisms And Limitations

- Evolution And Contemporary Perspectives

- Integrating Managerial Grid With Other Models

- Practical Steps For Implementing Managerial Grid

- Conclusion

- Frequently Asked Questions

- Understanding Skills Taxonomy

- Why do we Need Skills Taxonomy?

- Benefits of Skills Taxonomy

- Components of Skills Taxonomy

- Building a Skills Taxonomy: A Step-by-Step Guide

- Skill Taxonomies vs Intelligence Tools

- Closing Thoughts

- Frequently Asked Questions

- Definition Of Team Building

- Stages Of Team Development

- Top 10 Strategies For Effective Team Building

- Team Building Activities

- Best Practices For Effective Team Building

- Setting Team Building Objectives

- Challenges In Team Building

- Conclusion

- Frequently Asked Questions (FAQs)

- Defining Job Shadowing

- Unpacking the Benefits

- Setting Up the Experience

- Job Shadowing vs Internship

- Dos and Don'ts for HR Professionals

- Closing Thoughts

- Frequently Asked Questions

- Employee Journey Mapping: Meaning & Importance

- Stages of the Employee Journey

- Steps for Effective Mapping

- Employee Journey Map: Where does it begin?

- Employee Journey Map: Template

- Best Practices & Tips

- Summary

- Frequently Asked Questions

- Why are Performance Appraisals needed?

- Evolution of Performance Management

- Modern Performance Practices

- Benefits of Modern Performance Appraisals

- The Future

- Frequently Asked Questions

- Is Experience the Sole Indicator of Success?

- Why Hire Inexperienced Talent?: Key Advantages

- Skills to Look For in Inexperienced Talent

- Challenges and Considerations in Hiring Inexperienced Talent

- Final Remarks

- Frequently Asked Questions

- What is a Company Retreat?

- Company Retreat Ideas: Team-Building & Exploration

- Relaxation and Celebration

- Planning Your Retreat: Things to Keep in Mind

- Closing Thoughts

- Frequently Asked Questions

- Understanding HR Forecasting

- HR Forecasting Key Concepts

- Steps for Implementing HR Forecasting

- Common HR Forecasting Methods

- Closing Thoughts

- Frequently Asked Questions

- What is ESG?

- HR and ESG - Why Care?

- ESG in HR Strategy

- Challenges for HR

- Future of ESG in HR

- Frequently Asked Questions

- Defining the Great Betrayal

- Reasons for Its Spread

- Impact on Workers

- Impact on Corporations

- Rebuilding Trust & Valuing Employees

- Closing Thoughts

- Frequently Asked Questions

- Importance of Clear Expectations

- Setting Expectations Early

- Communicating Expectations Effectively

- Differentiating Expectations

- Reviewing and Adjusting Expectations

- Summing Up

- Frequently Asked Questions

- Understanding KRA Frameworks And Models

- KRAs vs KPAs and KPIs

- Monitoring and Tracking KRAs

- KRAs in Various Roles

- Impact of KRA Frameworks and Models on Organizational Success

- Frequently Asked Questions

- Where: The Place of Work

- When: The Time of Work

- How Much Work: Alternate Employment Models

- Who Does the Work: Intelligence

- Designing Organizations with the Four Dimensions of Work

- Summing Up

- Simplifying Processes: The Foundation of Efficiency

- Reducing Unnecessary Meetings: Reclaiming Valuable Time

- Building Strong Accountabilities: Ensuring Responsibility

- Role of HR in Addressing Inefficiencies

- Continuous Improvement: A Commitment to Excellence

- Leadership's Role in Driving Efficiency

- Conclusion: A Holistic Approach to Efficiency

- Understanding Financial Freedom

- Benefits of Empowering Employees Financially

- Empowering Employees Through Financial Literacy

- Financial Topics That Need Attention Based On Career Stage

- Summing Up

- Frequently Asked Questions

- Defining Employee Voice

- Benefits of Amplifying Employee Voice

- Strategies and Tools

- Encouraging Participation

- Closing Thoughts

- Frequently Asked Questions

- Appraisal Blues: Signs of Unhappy Employees

- Addressing Unhappiness Post-Appraisal

- Non-Monetary Solutions for Dissatisfied Employees

- Summing Up

- Frequently Asked Questions

- Women in the Middle Eastern Workforce

- Importance of DEIB

- Role of HR in Building Inclusive Workplaces for Women

- Measuring Inclusion Progress: Key Metrics

- Closing Thoughts

- Frequently Asked Questions

- Preparing for the Conversation

- Conducting the Conversation

- Best Practices for the Talk

- After the Conversation

- Helping Employees Grow

- Frequently Asked Questions

- Understanding HR Exhaustion

- Factors Leading To HR burnout

- Impact Of HR Burnout

- Strategies To Prevent And Manage HR Burnout

- Role Of Technology In Preventing Burnout

- Celebrating HR Successes

- Summary

- Frequently Asked Questions

- Common Mistakes When Hiring Young Talent

- Building Connections with Candidates

- Summary

- Frequently Asked Questions

- Walking a mile in the employee’s shoes

- Conducting Humane Layoffs

- Remote Layoffs Management

- Supporting Laid-off Workers

- Managing the Aftermath

- Wrapping Up

- Frequently Asked Questions

- Importance of Shortening Time-to-Hire

- Shortening Hiring Time: Pre-Application Stage

- Reducing Hiring Time: Application Stage

- Hacks to Shorten Hiring Time: Interview Stage

- Reducing Hiring Time: Offer Stage

- 5 Other Important Hacks & Strategies

- Final Remarks

- Frequently Asked Questions

"Money Matters" – Empowering Employees To Achieve Financial Well-Being

Forget company merchandise and free food coupons– the real perk your employees crave is financial freedom. By fostering a workplace culture that prioritizes financial education and resources, companies can help our team members achieve their personal financial goals, reduce stress, and enhance their productivity and satisfaction at work. This article dives into practical strategies to help employees take control of their finances. Let’s get started.

Understanding Financial Freedom

When it comes to employees’ financial freedom, it becomes a critical component of overall workplace health. Financial freedom for employees can have different meanings depending on individual goals and circumstances. For some, financial freedom might simply be feeling secure and meeting their needs. For others, it might involve early retirement or the ability to pursue entrepreneurial ventures. At the core, it's a feeling of control and empowerment over one's financial situation.

What is Financial Wellbeing and Financial Empowerment?

Financial well-being is the state of having control over your day-to-day and month-to-month finances, being able to absorb a financial shock, feeling secure about your financial future, and making choices that allow you to enjoy life. It encompasses the ability to meet current and ongoing financial obligations, manage unexpected expenses, and achieve long-term financial goals.

Financial empowerment, on the other hand, is the process of gaining the knowledge, skills, confidence, and access to resources necessary to make informed financial decisions. It involves understanding how to manage money effectively, leveraging financial tools and services, and having the confidence to take control of one's financial situation. Empowerment leads to greater financial independence and stability, enabling individuals to navigate their financial journey with confidence and resilience.

Together, financial well-being and financial empowerment contribute to a holistic sense of financial health, where individuals not only survive but thrive financially, making choices that align with their values and aspirations.

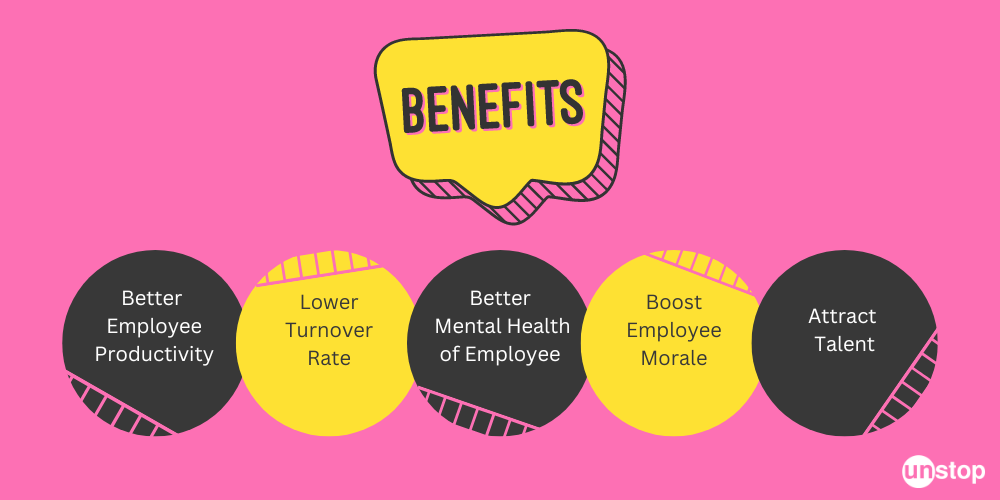

Benefits of Empowering Employees Financially

Enhancing Employee Productivity

Financial stress can be a significant distraction, leading to decreased productivity and increased absenteeism. When employees are preoccupied with financial worries, their focus and efficiency at work suffer. By supporting financial well-being, employers can help mitigate these distractions, fostering a more engaged and productive workforce.

Reducing Turnover Rates

High turnover rates are costly for any organization. Employees who feel financially secure are more likely to stay with their current employer, reducing the costs associated with recruiting and training new staff. Financial well-being initiatives can build loyalty and encourage long-term commitment, benefiting both employees and the company.

Improving Mental Health

Financial insecurity is closely linked to mental health issues such as anxiety and depression. Employers who prioritize financial well-being can alleviate some of these stressors, contributing to a healthier, more resilient workforce. This not only improves individual well-being but also creates a more positive and supportive workplace culture.

Boosting Employee Morale

When employees feel that their employer genuinely cares about their financial health, it can significantly boost morale. Programs like financial education workshops, retirement planning assistance, and emergency savings funds demonstrate a company's commitment to its employees' overall well-being. This can lead to higher job satisfaction and a stronger sense of community within the workplace.

Attracting Top Talent

In a competitive job market, offering comprehensive financial well-being programs can be a powerful tool for attracting top talent. Prospective employees are increasingly looking for employers who provide more than just a salary; they seek holistic benefits that support their long-term financial goals. Companies that recognize and address this trend are better positioned to attract and retain high-calibre professionals.

Empowering Employees Through Financial Literacy

Empowering employees through financial literacy is not just a benevolent act but a strategic business move that can lead to increased productivity, reduced stress, and higher employee retention. Here are several steps companies can take to foster financial literacy among their workforce:

- Offer Financial Education Workshops: Host regular workshops covering essential topics such as budgeting, saving, investing, and debt management. These sessions can be led by financial experts and tailored to different levels of financial knowledge.

- Provide Access to Financial Advisors: Partner with financial advisory firms to offer employees one-on-one consultations. This personalized guidance can help employees create tailored financial plans and address specific concerns.

- Incorporate Financial Wellness Programs: Integrate comprehensive financial wellness programs into your employee benefits package. These programs can include online courses, webinars, and interactive tools that employees can access at their convenience.

- Utilize Technology and Apps: Leverage financial planning apps and software that can help employees track their expenses, set financial goals, and monitor their progress. Providing access to these tools can make financial management more accessible and less intimidating.

- Encourage Retirement Planning: Educate employees about the importance of retirement planning and offer resources to help them understand their options. They can be encouraged to engage in personal financial planning to ensure a comfortable retirement. This includes investing in a diverse portfolio of assets such as mutual funds, stocks, real estate, fixed deposits, etc.

- Create a Supportive Culture: Build an environment where discussing financial matters is encouraged rather than stigmatized. This can be achieved through open communication channels and regular check-ins on financial well-being.

- Incentivize Participation: Motivate employees to engage in financial literacy programs by offering incentives such as bonuses, gift cards, or additional paid time off for completing courses or attending workshops.

- Regularly Update Resources: Financial markets and regulations are constantly evolving. Ensure that the educational materials and resources you provide are regularly updated to reflect the latest information and best practices.

By implementing these steps, companies can empower their employees with the knowledge and tools needed to achieve financial stability and success, ultimately benefiting both the individual and the organization as a whole.

What is Early Wage Access? Early wage access, or EWA, lets employees claim a portion of their already-earned wages before the official payday. This helps manage unexpected bills, reduces dependence on expensive payday loans, and gives them more control over their finances. By easing financial stress, EWA can be a stepping stone towards achieving financial freedom.

Financial Topics That Need Attention Based On Career Stage

Onboarding

- Understanding your pay package: Breakdown of salary, benefits explanation (health insurance, paid time off), budgeting basics.

- Company retirement plan: Introduction to company-sponsored retirement plans, enrollment process, and contribution strategies.

- Emergency savings: Importance of building an emergency fund, setting savings goals, different savings account options.

Mid-career (3-5 years)

- Debt management: Strategies to pay off student loans, credit card debt, and other personal loans.

- Building wealth: Investment basics, understanding risk tolerance, asset allocation strategies.

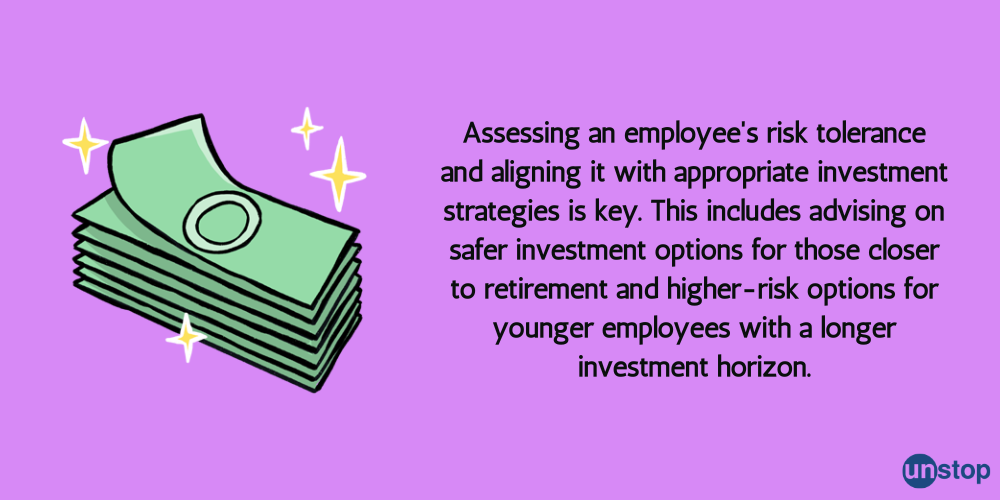

- Life insurance: Need for life insurance, different types (term vs. whole life), choosing the right coverage amount.

Seniority (5+ years)

- Estate planning: Creating a will and power of attorney, beneficiary designations for retirement accounts.

- Retirement planning: Evaluating retirement goals and risk tolerance, adjusting investment strategies closer to retirement.

- Long-term care planning: Exploring options for long-term care needs, cost considerations.

Apart from these, companies can also facilitate:

- Financial wellness programs: Offering workshops on budgeting, debt management, and financial planning.

- Financial advisor access: Providing access to financial advisors for personalized guidance (on-site or virtual).

- Student loan repayment assistance: Offering programs to help employees pay off student loan debt.

The above topics cater to the needs of employees at different stages of their careers. Companies can thus frame and personalize their initiatives around these for the maximum benefit of the employees.

Summing Up

Empowering your employees towards financial freedom is a smart business strategy. By providing the tools, education, and resources necessary for financial well-being, you are investing in the foundation of a more engaged, motivated, and productive workforce. This, in turn, enhances their focus at work, as they are less distracted by financial worries. By offering financial wellness programs, such as workshops on budgeting, retirement planning, debt management, and investment education, employers can provide valuable guidance that helps employees make informed financial decisions.

Furthermore, companies that prioritize financial well-being can also enhance their reputation as an employer of choice, attracting top talent who are seeking supportive and progressive workplaces. In essence, investing in employees' financial health is a win-win strategy that promotes long-term success for both the employees and the organization. It cultivates a resilient workforce capable of driving the company forward while ensuring that employees enjoy a higher quality of life and peace of mind with financial security.

Frequently Asked Questions

Q1. What is financial well-being?

Financial well-being is the state of having control over your finances, being able to meet expenses, saving for future goals, and feeling secure about your financial future.

Q2. How can financial literacy empower employees?

Education equips employees with knowledge about budgeting, saving, investing, and managing debt. This understanding helps them make informed financial decisions.

Q3. What are some strategies for financial empowerment?

Strategies include offering financial literacy programs, providing access to financial advisors, and encouraging savings through employer-sponsored retirement plans.

Q4. How can employers support their employees' financial journey?

Employers can support this by offering resources like financial counselling, workshops, and tools for budgeting and planning. They can also provide benefits that promote financial health.

Q5. Can workplace initiatives really impact employees' financial health?

Yes, workplace initiatives like financial wellness programs have been shown to reduce stress and improve overall financial security among employees.

Suggested Reads:

As a biotechnologist-turned-writer, I love turning complex ideas into meaningful stories that inform and inspire. Outside of writing, I enjoy cooking, reading, and travelling, each giving me fresh perspectives and inspiration for my work.

Login to continue reading

And access exclusive content, personalized recommendations, and career-boosting opportunities.

Subscribe

to our newsletter

Blogs you need to hog!

Organize Hackathons: The Ultimate Playbook With Past Case Studies

What is Campus Recruitment? How To Tap The Untapped Talent?

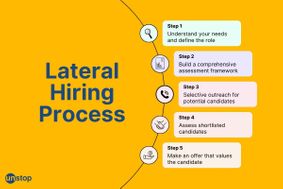

Lateral Hiring: A Complete Guide To The Process, Its Benefits, Challenges & Best Practices

Comments

Add comment