- Step 1: The Groundwork

- Step 2: The Three Sections

- Step 3: Practice Makes Improvement

- The Secret Ingredient

- Understanding Basics Of Number Series

- Types Of Number Series Reasoning Questions

- Addition & Multiplication In Number Series

- Square & Cube-Based Number Series Patterns

- Missing Terms & Arranging Sequences

- Tricks & Tips For Solving Number Series

- Selected Number Series Questions With Solutions

- Frequently Asked Questions (FAQs)

- Must Know Terminologies in Blood Relation Questions

- Basic Approaches to Solve Blood Relation Questions

- Types Of Blood Relation Questions

- Tips For Solving Blood Relation Questions

- Multiple Choice Questions (MCQs) with Detailed Explanation

- Conclusion

- Frequently Asked Questions (FAQs)

- Letter Series In Logical Reasoning

- Types Of Letter Series Patterns

- Tips For Solving Letter Series Reasoning

- Best Practice Question Samples With Answers

- Conclusion

- Frequently Asked Questions (FAQs)

- Basics of Problems On Age-Related Questions

- Formula to Solve Problems on Ages-Related Questions

- Types of Age-Related Questions & Examples

- Tips & Tricks for Solving Ages Problems

- Best MCQs on Problems on ages with solved answers

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition of Calendar

- Understanding Days of the Week

- What is a Leap Year?

- Concept of Odd Days in a Century

- Tips For Solving Calendar Reasoning Questions

- Best Calendar Reasoning Questions with Answers (MCQs)

- Frequently Asked Questions (FAQs)

- Basic Concepts of Clock

- Structure of a Clock

- Angle Equilavalence in Clock

- Tips For Solving Clock Questions

- Selected Clock Questions & Answers (MCQs)

- Conclusion

- Frequently Asked Questions (FAQs)

- Understanding The Concept Of Direction Sense

- Tips For Effective Problem-Solving In Direction Sense

- Practical Test Practice Questions And Answers

- Conclusion

- Frequently Asked Questions (FAQs)

- Importance Of Dice Reasoning

- Dice Numbers In Dice Reasoning

- Classification Of Dice

- Constructed Vs Deconstructed Dice

- Tricks & Tips For Solving Dice Problems

- Practice MCQs With Detailed Answers

- Conclusion

- Frequently Asked Questions (FAQs)

- Alphanumeric Series Defined

- Alphanumeric Series In Reasoning Tests

- Tips & Strategies For Solving Alphanumeric Series

- Practice Sample Questions With Detailed Answers

- Conclusion

- Frequently Asked Questions (FAQs)

- Concept Of Mirror Image Reasoning Explained

- Important Terms In Mirror Image Reasoning

- Types Of Mirror Images

- Identifying Correct Mirror Image

- Finding Clock's Mirror Image

- Tips To Solve Mirror Images

- Selected Practice Questions With Answers

- Conclusion

- Frequently Asked Questions (FAQs)

- Concept & Overview Of Input-Output

- Input-Output In Competitive Exams

- Types Of Input-Output Problems

- Strategies, Tips & Tricks For Solving Reasoning Questions

- Selected Practice Questions With Answers

- Conclusion

- Frequently Asked Questions (FAQs)

- Importance Of Finding The Odd One Out

- Tricks And Tips

- How to Find The Odd One Out?

- Solved MCQs with Detailed Explanation

- Conclusion

- Frequently Asked Questions (FAQs)

- Understanding Key Concepts

- Exploring Different Ranking Types

- Formula And Application Of Order And Ranking

- Tips For Solving Order & Ranking

- Selected Practice Questions And Answers

- Conclusion

- Frequently Asked Questions (FAQs)

- Importance Of Pipes & Cistern Aptitude

- Key Terminologies used in Pipes and Cisterns

- Pipes and Cisterns Formula with Examples

- Pipes and Cisterns Shortcut Tricks

- Tips For Solving Pipes & Cistern Problems

- Selected Questions & Answers For Practice (MCQs)

- Conclusion

- Frequently Asked Questions (FAQs)

- Key Concept in Boats and Streams

- Formulas Of Boats & Streams

- Distance & Time Formula

- Tips For Solving Boats & Streams Questions

- Selected Practice Questions With Answers (MCQs)

- Conclusion

- Frequently Asked Questions (FAQs)

- Concept of Mixture and Alligation

- Types Of Alligation Questions

- Formula for Solving Mixture & Alligation

- Tips For Solving Mixture And Alligation

- Selected Questions With Answers For Practice

- Conclusion

- Frequently Asked Questions (FAQs)

- Concepts and Definitions Related to Time and Work

- Important Time And Work Formulas

- Tricks and Tips to Solve Time & Work Questions

- Time And Work MCQs with Detailed Solution

- Conclusion

- Frequently Asked Questions (FAQs)

- What is Harmonic Progression(HP)?

- Formula to find the nth Term in Harmonic Progression

- Formula to find the Sum of the nth Term in HP

- What is Harmonic Mean?

- Harmonic Progression Solved Best MCQs

- Conclusion

- Frequently Asked Questions (FAQs)

- What is Mensuration in Maths?

- What are 2D figures in Mensuration?

- What are 3D figures in Mensuartion?

- Basic Terminologies In Mensuration

- Basic 2D Formulas in Mensuration

- Basic 3D Formulas in Mensuration

- 2D vs 3D in Mensuration

- Solved Questions With Solutions (MCQs)

- Conclusion

- Frequently Asked Questions (FAQs)

- Relationship Between Time, Speed And Distance

- Conversion Units Time, Speed And Distance

- Average & Relative Speed: Two Trains Moving in the same or opposite direction

- Solved MCQs on Time, Speed And Distance

- Conclusion

- Frequently Asked Questions (FAQs)

- What is Simplification in Maths?

- BODMAS Rule in Simplification Explained

- Simplification & Approximation Relation

- Key Terms in Simplification

- Examples Of Simplification Techniques

- Simplification Questions With Solved Answers (MCQs)

- Conclusion

- Frequently Asked Questions (FAQs)

- Height And Distance Important Terms

- Right Angled Triangle In Trigonometry

- Trigonometric Ratios

- Solved Examples For Better Understanding

- Height And Distance Applications In Trigonometry

- Height And Distance Practice Questions & Answers

- Conclusion

- Frequently Asked Questions (FAQs)

- Defining Interest Types

- Simple Interest Vs. Compound Interest

- Selected Solved Questions & Answers

- Conclusion

- Frequently Asked Questions (FAQs)

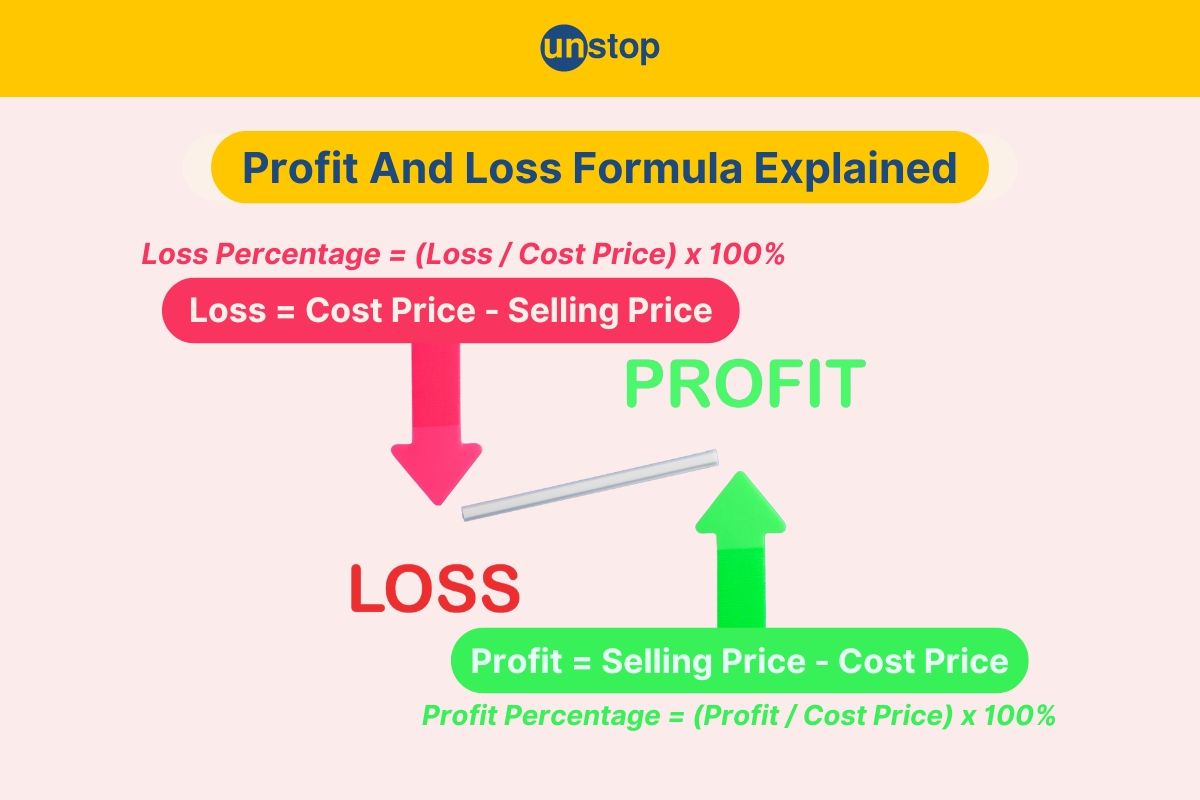

- Basic Concepts Of Profit And Loss

- Determining Selling Price

- Calculating Discounts

- Formulas For Calculating Profit And Loss

- Examples Of Profit And Loss

- Profit & Loss Questions With Detailed Solution

- Conclusion

- Frequently Asked Questions (FAQs)

- Defining Angle Of Elevation

- Key Terms Used In Angle Of Elevation

- Angle of Elevation Formula with Example

- Angle of Elevation vs. Angle of Depression

- Angle of Elevation MCQs with Answers

- Conclusion

- Frequently Asked Questions (FAQs)

- Defining HCF And LCM

- Calculation Methods Of HCF And LCM

- HCF By Prime Factorization Method

- LCM By Prime Factorization Method

- Difference Between HCF And LCM

- HCF & LCM Practice Questions With Answers

- Conclusion

- Frequently Asked Questions (FAQs)

- What is fraction and decimal?

- Understanding Decimal Fraction

- Place Value in Decimal Fraction

- Mathematical Operations with Decimal Fraction

- Practice with Solved Examples

- Summary

- Frequently Asked Questions

- All About Decimals

- All About Fractions

- How to Convert a Decimal into Fraction

- Simple vs Recurring Decimals

- Converting Recurring Decimals to Fractions

- Conversion Charts

- Practice Questions (With Solutions)

- Closing Thoughts

- Frequently Asked Questions

- What is Arithmetic Mean?

- Arithmetic Mean Formula- Ungroup Data & Group Data

- Merits of Arithmetic Mean

- Demerits of Arithmetic Mean

- Alternatives to Arithmetic Mean

- What is the Weighted Arithmetic Mean?

- Arithmetic vs. Geometric Mean

- Arithmetic Mean Application in Statistical Analysis

- Arithmetic Mean Practice Questions with Explanation

- Frequently Asked Questions

- What is Geometric Progression?

- Key Properties of Geometric Progression

- General Form Of Geometric Progression

- General Term or the Nth Term of Geometric Progression

- The sum of nth Terms of GP

- Types Of Geometric Progression

- Solved Questions and Answers of GP

- Conclusion

- Frequently Asked Questions (FAQs)

- Average in Maths

- Average Formula in Maths

- Differentiating Types of Average

- How to Calculate Average of Negative Numbers?

- Practical Applications of Averages

- Average Questions For Practice

- Frequently Asked Questions

- What is Simple Interest in Maths?

- Simple Interest Formula Explained

- Simple Interest Formula for Years, Months & Days

- Simple Interest Examples & Practice Questions

- Conclusion

- Frequently Asked Questions (FAQs)

- Defining Mathematical Ratios

- Understanding Proportions Fundamentals

- Differentiating Ratios from Proportions

- Ratio and Proportion Formulas

- Properties of Ratio and Proportion

- How to Solve Ratio and Proportion Problems

- Ratio and Proportion Problems (With Solutions)

- Summary

- Frequently Asked Questions

- What is Number in Maths?

- Types of Numbers With Example

- Real vs Complex Numbers Explored

- Basic Operations on Numbers

- Practice Questions (With Solutions)

- Frequently Asked Questions

- What is Arithmetic Progression (AP) in Maths?

- Important Terminologies in Arithmetic Progression

- Basic Terms in Arithmetic Progression

- General Form Of Arithmetic Progression Series

- Types Of Arithmetic Progression

- Solved Questions With Explanation (MCQs)

- Conclusion

- Frequently Asked Questions (FAQs)

- Understanding Basic Concept

- Importance Of Train Problems In Aptitude

- Tips To Solve Train Problems

- Selected Practice Questions & Answers

- Conclusion

- Frequently Asked Questions (FAQs)

- Definition Of Mode

- Calculating Mode For Ungrouped Data

- Calculating Mode For Grouped Data

- Bimodal, Trimodal & Multimodal Distributions

- Comparing Mean, Median & Mode

- Selected Practice Questions With Answers

- Conclusion

- Frequently Asked Questions (FAQs)

- Important Concept In Races And Games

- Calculating Time, Speed & Distance

- Importance Of Races And Games Problems

- Sample Practice Questions With Answers

- Conclusion

- Frequently Asked Questions (FAQs)

- Types Of Partnership

- Formula For Partnership Questions

- Tips To Solve Partnership Aptitude Questions

- Selected Partnership Questions (Practice MCQs)

- Conclusion

- Frequently Asked Questions (FAQs)

Profit And Loss: Basic Concepts, Formulas, Questions & Answers

Understanding the concept of profit and loss is essential whether you're preparing for a competitive exam or simply looking to improve your quantitative aptitude skills. Mastering the basic concepts and formulas and practising with questions can help you excel in this area of the exam.

Don't let the complexity of the problems overwhelm you; instead, use them as opportunities to enhance your problem-solving abilities and excel in the exam.

Basic Concepts Of Profit And Loss

Profit and loss are fundamental concepts in business and finance, representing the difference between the amount earned from selling goods (revenue) and the amount spent to produce or acquire them.

Profit And Loss Relationship

If the cost price is less than the selling price, then a profit is made. Conversely, if the cost price is higher than the selling price, a loss occurs. Understanding this relationship is crucial for effective financial management.

Cost Price & Selling Price

The cost price refers to the amount a business pays to purchase or produce an item, while the selling price is the value at which it is sold. The interest between these two values determines whether a profit or loss is incurred.

Marked Price

Marked price, also known as market price, is the initial value assigned to a product before any discounts are applied. It serves as a reference point for both sellers and buyers, indicating the value of the item without considering any reductions.

Determining Selling Price

The selling price is derived from the cost price of an item with additional considerations such as operating expenses and desired profit margin. By adding these factors to the cost price, businesses arrive at a selling price that ensures they cover all costs and generate income.

For example, if a product's cost price is ₹50 and the business aims for a 20% profit margin, the selling price would be calculated by adding the margin to the cost: ₹50 + (₹50 x 0.20) = ₹60. This ensures that after covering costs, including production and operational expenses, the business makes a profit on each sale.

Calculating Discounts

To determine the discount percentage, one must understand how it relates to both marked and selling prices. The formula for calculating discount percentages based on these prices is straightforward:

Discount % = ((Marked Price - Selling Price) / Marked Price) x 100

For instance, if an item's marked price is ₹100 and it is sold for ₹80, the discount percentage would be (₹100 - ₹80) / ₹100) x 100 = 20%. This calculation shows how much of a reduction in price was offered to customers.

Formulas For Calculating Profit And Loss

Let us study the formulas for calculating profit and loss:

Profit Formula

To calculate overall profit, subtract the cost price from the selling price. The formula is:

Profit = Selling Price - Cost Price

Loss Formula

To determine a loss, subtract the selling price from the cost price:

The formula is:

Loss = Cost Price - Selling Price

Net Profit Calculation

The net profit can be found by deducting all expenses from the total revenue generated. The formula is:

Net Profit = Total Revenue - Total Expenses

Profit Percentage Calculation

Calculating profit percentage involves dividing the profit by the cost price and then multiplying by 100%:

Profit Percentage = (Profit / Cost Price) x 100%

For example, let us say that an item is bought for ₹50 and sold for ₹70. Using the profit formula: ₹70 - ₹50 = ₹20 (profit).

Calculating profit percentage: (₹20 / ₹50) x 100% = 40%

Loss Percentage Calculation

Similarly, to find the loss percentage, divide the loss by the cost price and multiply by 100%:

Loss Percentage = (Loss / Cost Price) x 100%

For example, let us say that a product costing ₹80 is sold for $60. Applying the loss formula: ₹80 - ₹60 = ₹20 (loss). Determining loss percentage: (₹20 / ₹80) x 100% = 25%

Click here to enhance further and upskill your quantitative aptitude related to profit and loss right away!

Examples Of Profit And Loss

Let us consider some examples of profit and loss:

Profit Scenarios

Imagine a small bakery that sells fresh bread daily. Each loaf costs ₹5 to make, including ingredients and labour. If the bakery sells 100 loaves in a day, its total revenue would be ₹500 (100 loaves x ₹5 each). However, if the daily expenditures amount to ₹300, the bakery's profit for that day would be ₹200 (₹500 - ₹300).

Let's consider another example in the tech industry. A software company develops an app that generates revenue through in-app purchases. If the company earns ₹10,000 in revenue monthly but incurs expenses of ₹7,000 (including development costs and salaries), its monthly profit would be ₹3,000.

Loss Scenarios

Picture a clothing store that faces declining sales due to changing fashion trends. If the store's monthly revenue drops to ₹3,000 while its fixed costs remain at ₹5,000, it will incur a monthly loss of ₹2,000.

In another scenario, a restaurant invests in renovating its space to attract more customers but fails to see an increase in revenue. If the renovation costs amount to ₹15,000 and the monthly revenue remains stagnant at ₹8,000 while operating expenses total ₹10,000, the restaurant will experience a significant loss of ₹7,000 for that month.

Profit & Loss Questions With Detailed Solution

Provided below are some selected questions with detailed answers for you to practice and enhance your quantitative aptitude skills:

Question 1. A company sells a product at ₹50 per unit. The fixed costs are ₹10,000, and variable costs per unit are ₹20. If the company sells 500 units, what will be its profit?

A) ₹5,000

B) ₹10,000

C) ₹15,000

D) ₹20,000

Solution: A) ₹5,000

Explanation: Total Revenue = Selling price per unit×Number of units sold = ₹50×500 = ₹25,000

Total Costs = Fixed Costs + Variable Costs = ₹10,000 + (₹20×500) = ₹20,000

Profit = Total Revenue - Total Costs = ₹25,000 - ₹20,000 = ₹5,000

Therefore, the company's profit from selling 500 units is ₹5,000.

Question 2. A bookstore sells each textbook for₹30. The fixed costs of operating the bookstore are ₹1,000, and the variable costs per textbook are ₹10. If the bookstore sells 200 textbooks, what will be its profit?

A) ₹2,000

B) ₹3,000

C) ₹4,000

D) ₹5,000

Solution: B) ₹3,000

Explanation: Total Revenue: ₹30 per textbook×200 textbooks = ₹6,000

Total Costs: ₹1,000 (Fixed) + (₹10 per textbook×200 textbooks) = ₹3,000

Profit: Total Revenue - Total Costs = ₹6,000 - ₹3,000 = ₹3,000

Hence, the company's profit from selling 200 textbooks is ₹3,000.

Question 3. A bakery sells cakes for ₹20 each. The fixed costs of running the bakery are ₹500, and the variable costs per cake are ₹15. If the bakery sells 30 cakes, but due to a production error, 10 cakes are damaged and unsellable, what will be its loss?

A) ₹50

B) ₹150

C) ₹200

D) ₹250

Solution: C) ₹200

Explanation: Total Revenue: ₹20×30 = ₹600

Total Costs: Fixed costs (₹500) + Variable costs (₹15×30) = ₹950

Loss: Only 20 cakes are sold due to damage, yielding a revenue of ₹400.

Loss = Total Costs (₹950) - Revenue from sold cakes (₹400) = ₹550

However, the loss incurred only accounts for the damage, which is ₹200.

Therefore, the bakery incurs a loss of ₹200.

Question 4: A toy store sells each toy for ₹10. The fixed costs of operating the store are ₹200, and the variable costs per toy are ₹5. If the store sells 50 toys, what will be its profit?

A) ₹100

B) ₹50

C)₹200

D) ₹250

Solution: B) ₹50

Total Revenue: ₹10 per toy×50 toys =₹500

Total Costs: Fixed costs (₹200) + Variable costs (₹5 per toy×50 toys) = ₹450

Profit: Total Revenue (₹500) - Total Costs (₹450) = ₹50

Therefore, the store's profit from selling 50 toys is ₹50.

Question 5. A company sells widgets for ₹20 each. The cost price of each widget is ₹15. If the company sold 100 widgets, what is its profit?

A) ₹500

B) ₹750

C) ₹1,000

D) ₹1,250

Solution: A) ₹500

Explanation: Profit per Widget: Selling Price - Cost Price = 20 - 15 = ₹5

Total Profit: Profit per Widget×Number of Widgets Sold = 5×100 = ₹500

Therefore, the company's profit from selling 100 widgets is ₹500.

Question 6: A textile shop sells sarees for ₹2000 each. The shop incurs a cost price of ₹1500 for each saree. If the shop sells 50 sarees, but due to a quality issue, 10 sarees are returned by customers, each fetching a refund of ₹1500, what is the net profit of the shop?

A) ₹25,000

B) ₹30,000

C) ₹35,000

D) ₹40,000

Solution: C) ₹35,000

Explanation: Total Revenue: Selling price per saree×Number of sarees sold = ₹2000×50 = ₹1,00,000

Total Costs: Cost price per saree * Number of sarees sold = ₹1500×50 = ₹75,000

Refunds: Number of returned sarees * Refund per saree = 10×₹1500 = ₹15,000

Net Profit: Total Revenue - Total Costs - Refunds = ₹1,00,000 - ₹75,000 - ₹15,000 = ₹10,000

Therefore, the net profit of the shop is ₹10,000. However, since the question asks for the net profit after refunds, we need to subtract the refund amount from the calculated profit:

Net Profit = ₹10,000 - ₹15,000 = -₹5,000

However, this implies a loss. Thus, the correct answer should be:

Net Loss = ₹5,000

Since this option is not provided, the closest answer would be the one without considering the refunds:

(Note: It's important to recognize that the refunds significantly impact the profit/loss scenario.)

Question 7: A jewellery store sells gold bangles for ₹30,000 each. The cost price of each gold bangle is ₹25,000. With a sudden rise in demand, the store decides to offer a discount of 10% on the selling price. If the store manages to sell 20 gold bangles, what is its net profit?

A) ₹1,00,000

B) ₹1,50,000

C) ₹40,000

D) ₹2,50,000

Solution: C) ₹40,000

Explanation: Selling Price after Discount: ₹30,000 - 10% = ₹30,000 - ₹3,000 = ₹27,000 per bangle

Total Revenue: Selling price per bangle * Number of bangles sold = ₹27,000×20 = ₹5,40,000

Total Costs: Cost price per bangle * Number of bangles sold = ₹25,000×20 = ₹5,00,000

Net Profit: Total Revenue - Total Costs = ₹5,40,000 - ₹5,00,000 = ₹40,000

Therefore, the net profit of the jewellery store is ₹40,000.

Question 8: A grocery store sells basmati rice for ₹120 per kilogram with a 15% profit margin, while it sells pulses for ₹80 per kilogram with a 20% profit margin. If the store sells 50 kilograms of basmati rice and 80 kilograms of pulses and incurs fixed costs of ₹5000, what is the overall profit or loss of the store?

A) ₹600

B) ₹800

C) ₹2820

D) ₹1200

Solution: C) ₹2,820

Explanation: Basmati rice profit per kilogram = 15% of ₹120 = ₹18

Total profit from selling 50 kilograms of basmati rice = ₹18×50 = ₹900

Pulses profit per kilogram = 20% of ₹80 = ₹16

Total profit from selling 80 kilograms of pulses = ₹16×80 = ₹1,280

Total Profit: Adding profits from basmati rice and pulses = ₹900 + ₹1,280 = ₹2,180

Subtracting the fixed costs of ₹5,000 from the total profit = ₹2,180 - ₹5,000 = -₹2,820. Therefore, the store incurs an overall loss of ₹2,820.

Question 9: A bookstore sells each novel for ₹200. The cost price of each novel is ₹150. If the store sells 50 novels, what is its overall profit?

A) ₹2,000

B) ₹2,500

C) ₹3,000

D) ₹3,500

Solution: B) ₹2,500

Explanation: Profit per Novel: Selling price - Cost price = ₹200 - ₹150 = ₹50

Total Profit: Profit per novel×Number of novels sold = ₹50×50 = ₹2,500

Therefore, the overall profit of the store is ₹2,500.

Question 10: In a class of 50 students, 70% passed the math exam, and 80% passed the science exam. If 60% of the students passed both exams, how many students passed exactly one exam?

A) 8

B) 10

C) 12

D) 15

Solution: D) 15

Explanation: Students who Passed Math: 70% of 50 = 0.70×50 = 35

Students who Passed Science: 80% of 50 = 0.80×50 = 40

Students who Passed Both Exams: 60% of 50 = 0.60×50 = 30

Students who Passed Exactly One Exam: Total students who passed math + Total students who passed science - Students who passed both exams = 35 + 40 - 30 = 45 - 30 = 15.

Therefore, the number of students who passed exactly one exam is 15.

Conclusion

You've now grasped the fundamentals of profit and loss and mastered the calculations like a pro. By delving into examples and solving problems, you've honed your skills to maximize profits effortlessly.

Engage with practice questions to solidify your understanding and boost your confidence in tackling quantitative aptitude related to profit and loss. Keep practicing, stay curious, and watch your proficiency in profit and loss calculations soar!

Time For A Short Quiz

Frequently Asked Questions (FAQs)

1. What are the basic concepts of profit and loss?

The basic concepts of profit and loss involve revenue exceeding expenses for profit and expenses exceeding revenue for loss. It is a fundamental aspect of understanding the financial performance of a business.

2. How can I calculate profit and loss using formulas?

Formulas for calculating profit and loss key formulas include:

-

Profit = Selling Price - Cost Price

-

Loss = Cost Price - Selling Price

3. Can you provide examples to clarify profit and loss calculations?

Here is an example of profit and loss: If an item costs ₹50 and is sold for ₹70, the profit is $20. Conversely, if it sells for ₹40, the loss incurred is ₹10.

4. How can I practice profit and loss problems effectively?

Regularly practising solved problems and attempting new ones sharpens your skills in profit and loss calculations. This hands-on approach boosts confidence and proficiency in applying mathematical concepts to real-world scenarios.

5. Where is profit and loss mostly used?

Profit and loss problems are mostly used in business settings to analyze financial performance and make strategic decisions. They are also commonly used in educational settings to teach students about financial concepts and calculations.

Suggested reads:

- What Is Mensuration: Formulas With Top Selected Question & Answer

- Harmonic Progression- Formula With Selected Questions & Answers

- Mixture And Alligation: Explained With Selected Question & Answer

- Boats And Streams: Formula, Top Question With Solution (Aptitude)

- Clock Questions: Selected Question & Answer (Aptitude) Explained

Instinctively, I fall for nature, music, humor, reading, writing, listening, traveling, observing, learning, unlearning, friendship, exercise, etc., all these from the cradle to the grave- that's ME! It's my irrefutable belief in the uniqueness of all. I'll vehemently defend your right to be your best while I expect the same from you!

Login to continue reading

And access exclusive content, personalized recommendations, and career-boosting opportunities.

Subscribe

to our newsletter

Comments

Add comment